Nordeas cheføkonom, Helge. J. Pedersen, skriver, at centralbankerne overalt er ved at lette foden fra speederen, men det går ikke nær så hurtigt i ECB som i USA, omend der er enkelte ECB-rådsmedlemmer, der mener, at ECB skal være hurtigere til at reagere mod den høje inflation. Men den korte rente vil fortsat være negativ, også i Danmark, mens de lange renter ventes at følge den internationale tendens: opad. For Danmark betyder det, at pengepolitikken snart bør justeres, men det kan Danmark blot ikke gøre på grund af fastkurspolitikken. Danmark følger nøje ECB-renterne. Derfor får finanspolitikken den altafgørende betydning for at afværge en overophedning, som der er risiko for på arbejdsmarkedet.

Chief Economist’s Corner: Central banks ease off the accelerator

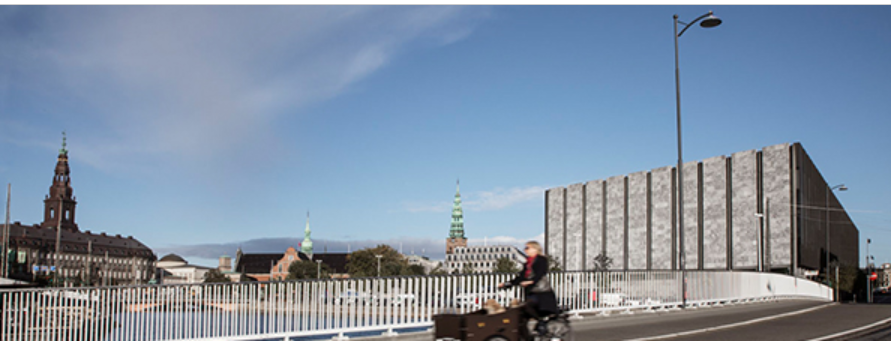

Chief Economist, Nordea, Helge J. Pedersen: High inflation makes central banks worldwide sharpen their tone and tighten monetary policy – but not in Denmark.

The Danish economy is in great shape and the removal of the last COVID-19 restrictions has provided an extra boost here in the cold and dark winter months. But although everyday life is about to return to normal in Denmark, it will probably be a while before the rest of the world is ready to reopen. And when it finally happens, it will not be a global big bang, but a gradual reopening at varying speed from country to country and from continent to continent.

The same is true of monetary policy. Several central banks have already started hiking their policy rates on the back of solid economic growth coupled with skyrocketing inflation – some will soon follow suit while others will wait a while longer.

Obviously, financial markets are focusing on the two large central banks, the Federal Reserve (Fed) in the US and the ECB in the Euro area. These two central banks have historically acted in very different ways. The Fed is known as an active central bank, keeping abreast of developments, attentive to market reactions and quick to act. The ECB, on the other hand, is reactive and rarely influenced by the markets’ response to its monetary policy decisions.

So it’s no surprise that it is the Fed which is now ready to tighten monetary policy aggressively to counter the surge in inflation. Fed chief Jerome Powell has already hinted that the Fed will embark on a hiking cycle as early as in March – soon to be followed by a reduction of its huge bond holdings. That’s the main reason why markets reacted so sharply to the December FOMC minutes, sending yields higher and equities down – a pattern which has continued after the January meeting.

Inflation has also risen sharply in the Euro area. But unlike their Fed counterparts, the heads of the European central banks have not been in a hurry to announce imminent monetary policy shifts. At the latest meeting in December, ECB President Christine Lagarde admittedly confirmed that the long-planned rollback of the Pandemic Emergency Purchase Programme in March will go ahead.

But in return the bank will buy more government bonds and other securities under its ordinary asset purchase programme at least until October this year. Monetary policy rates will not be raised until the end of 2023 at the earliest. All else equal, this is a policy mix that will result in a steeper European yield curve going forward.

However, lately the ECB has started to ventilate concerns about inflation taking hold at a level beyond the 2% target if the green transition drives prices higher than estimated so far. For instance if new carbon taxes cause a steady increase in energy prices and inflation expectations among consumers and businesses.

This is what German-born Isabel Schnabel, member of the ECB’s Executive Board, said in a speech in early January at a virtual meeting of the American Finance Association. If so, the ECB may have to stop turning a blind eye to the high inflation level and react by tightening monetary policy faster and more aggressively than previously assumed.

But generally short rates are expected to stay in negative territory for a long time yet – also in Denmark as the Danish central bank tracks the ECB to maintain its fixed exchange rate regime. However, long yields will follow the international trend, moving further up as central banks worldwide tighten their monetary policy stance. This could impact the equity market as well as the housing market, which has risen exorbitantly in recent years.

Denmark is currently in a situation where monetary policy should in my view be normalised sooner rather than later. But the situation cannot be helped. The fixed exchange rate regime is set in stone and maintaining it is also the best thing to do for the Danish economy in the long run.

But it means that fiscal policy to a growing extent will have to be the all-important counter-cyclical instrument. Especially as the Danish labour market is currently very much at risk of overheating. Only time will show if the heralded tightening in the 2022 budget and measures to boost the supply of labour will suffice to prevent an overheating.