Nordea har lavet tre scenarier for coronakrisens virkning på dansk økonomi. Den vil give minusvækst på mellem 0,5 og 6 pct. i år, og ledigheden vil kortvarigt stige med mellem 30.000 og 100.000.

Uddrag fra Nordea:

Three scenarios for the Danish economy

The coronavirus outbreak has dramatically changed the outlook for the Danish economy. In this forecast update we attempt to set out 3 scenarios. In all 3 scenarios the economy will be hit by recession, but the depth and the duration differ widely.

At this juncture there is considerable uncertainty about the extent and the duration of the economic downturn resulting from the coronavirus outbreak. In an attempt to describe this uncertainty, we have set out three possible growth trajectories for the global economy. These are described in more detail in our research note The global coronavirus recession. Based on these scenarios we see three possible trajectories for the Danish economy measured by GDP:

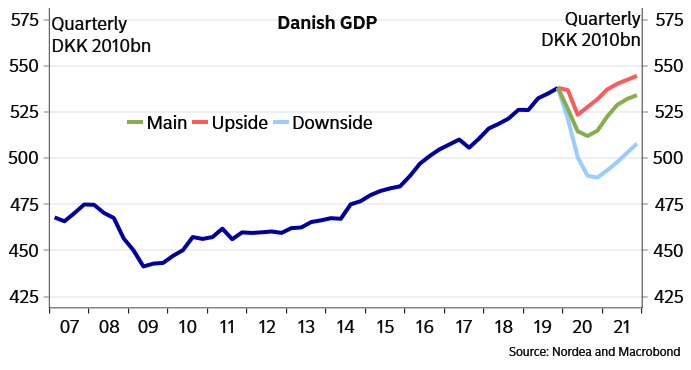

Chart 1. Scenarios for GDP

In all three scenarios the starting point is the large-scale aid packages adopted by the Danish parliament to mitigate the effects of the setback. So far the government has made a commitment to provide subsidies, guarantees and liquidity to the tune of DKK 287bn, equivalent to 12% of GDP. The increase in joblessness is likely to be curbed mainly by the possibility that the corona-hit companies can receive compensation for part of their wage costs and up to 100% of their fixed costs, no matter which of the three scenarios that will unfold.

In general the Danish economy is relatively well positioned to withstand the effects of the coronavirus outbreak. In the run-up to the crisis, employment had increased to an all-time high level and the average wealth of households was at a record high. Also, public finances were rock-solid with a budget surplus last year of 2.4% and an EMU debt of only 34% of GDP. At the same time the current annual balance of payments surplus had increased to over DKK 180bn, chiefly driven by strong growth in exports of pharmaceutical products, agricultural products and green technology – all three categories of goods are traditionally less sensitive to a deceleration in global demand.

This strong foundation does not imply that the Danish economy will not be hard hit by the crisis. But the deceleration in activity will be less pronounced than in many other countries, and generally there is a good chance that the economy can return to the trajectory before the coronavirus crisis.

The three scenarios are described in more detail below.

1. The baseline scenario – the U-turn

Our baseline scenario assumes that GDP growth in the global economy in 2020 will drop by 1% whereas the Euro area will shrink by 5%. In this scenario we expect the Danish economy to be hit by a severe recession in the first two quarters of 2020, with quarterly GDP declines of more than 2%. The deceleration in demand will first and foremost hit the domestic service sector, with exports and investment activity being hit with a minor lag.

The sharp downturn should, however, be relatively short-lived as the gradual opening of the domestic and the international economy in H2 will slowly start to stimulate demand again. For the full year Danish economic activity is set to drop by 3%, but the impact will be spread with a sharp setback in H1 and moderate progress in H2. This progress is set to accelerate going into 2021 when the Danish economy is expected by expand by 2.4%.

Table 1. The baseline scenario

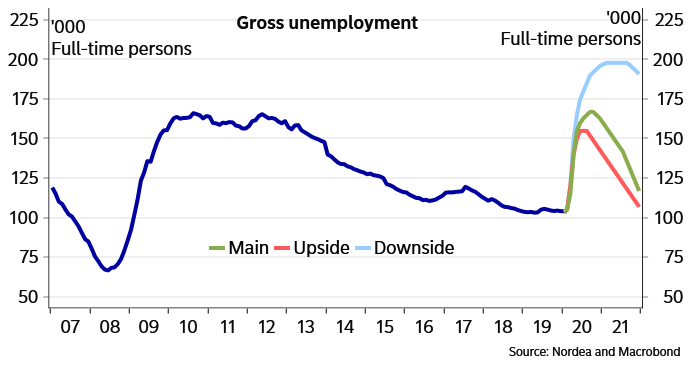

In this scenario unemployment is expected to rise by around 60,000 full-time persons with a peak over the summer. However, the actual decline in employment will likely be much greater. With the government wage compensation scheme, many of the persons who lose their jobs due to the coronavirus crisis will not be registered in the official unemployment data. The government estimates that the wage compensation scheme will cover around 70,000 persons for a period of three months – yet the government has underlined that this estimate is highly uncertain.

Chart 2. Scenarios for unemployment

In the housing market the combination of rising mortgage rates and falling employment is expected to lead to a 5% decline in the average price per square metre for houses in 2020, followed by a minor uptick in 2021.

2. The pessimistic scenario – the L-shaped trajectory

Our baseline scenario assumes that the Danish economy will slowly move back towards the long-term growth pattern in the course of H2 2020 as the negative effects of the virus outbreak dissipate. If this does not happen and the global economy instead moves into a deep recession, the fundamental preconditions for the Danish economy obviously also change. This is the basis of our L-shaped scenario, where global GDP is set to decline by 3.1% in 2020 whereas the Euro area will plunge by no less than 9.3%.

In this scenario the Danish economy will be hit hard by a sharp drop in domestic demand. At the same time exports will be hurt by the large decline in activity among Denmark’s most important trading partners. Overall, this is expected to trigger a GDP decline of 6.1% this year followed by growth around zero in 2021.

Table 2. The L-shaped trajectory

The GDP decline this year will consequently be worse than during the financial crisis in 2009 (-4.9%), and the extended process means that unemployment will continue to rise well into 2021. This effect will be exacerbated as some of the persons who initially received wage compensation will gradually join the ranks of the unemployed as corporate earnings come under pressure. In this scenario unemployment will rise by approximately 100,000 full-time persons (or double the pre-crisis level), and home prices are set to drop by around 10%.

3. The optimistic scenario – the V-shaped trajectory

The third scenario – and the most optimistic one – is based on a small uptick in global GDP of 1% this year followed by a strong rebound of 6.1% in 2021. In this scenario the Danish economy will not avoid a recession in H1. Yet activity will pick up again as early as Q3 as both domestic demand and exports return to the trajectory before the coronavirus crisis. For the full year 2020, this means that the Danish economy will experience a GDP drop of 0.5%; this will make this year the weakest year since 2009, but the downturn will still be relatively limited. In 2021 GDP is set to expand by 2.1%, so the GDP level over the two years as a whole will only be marginally below the level we had expected before the coronavirus crisis.

Table 3. The V-shaped trajectory

In this scenario unemployment is set to rise by around 30,000 full-time persons towards the summer. But as many of them will find employment again in H2, the unemployment rate for the full year should only rise to just under 5% followed by an almost equivalent drop during 2021. Home prices are expected to drop slightly towards the summer followed by renewed increases into the autumn, as the effects of lower interest rates and improving employment again attract buyers into the Danish housing market.