Nordea mener, at udstedelsen af danske statsobligationer i dag er udtryk for, at Nationalbanken rider med på bølgen af udstedte statsobligationer. Men de amerikanske T-bonds er dog mere attraktive end DGB22, mener banken, som foretrækker DGB29 ved dagens auktion.

Uddrag fra Nordea:

Danish government bonds remains at semi-core level. We prefer DGB29 at the auction

Danish government bonds have stabilized around Dutch govies. We don’t expect that to change in the near future due to increasing issuance, missing QE and limited liquidity. We prefer the DGB29 at todays auction

Today the Danish Central bank will auction DGB22 and DGB29. This comes on the back of a very large investor interest at last week’s T-bill auction. From that point it makes sense for the Danish Central Bank to ride that wave and offer the DGB22.

The challenges to get the money from all the Corona rescue packages into the economy have left the Net Position much lower than the daily liquidity estimates from the Danish Central Bank. Despite the low Net Position our model for the short rates based on the central bank rates and the size of the Net Position gives that short rates are some 5bp too high. This is in our view a reflection of the large supply of bonds/t-bills in the short end. We find the T-bills more attractive than DGB22.

The main reason for buying Denmark is in our view the uncertainty regarding the sustainability of the Italian debt situation where Denmark could benefit from being safe haven. However the recent positive signals from Germany and France makes it likely that the inevitable is postponed once again leaving the strong credit in Denmark a secondary factor in the overall assessment.

The boxplot over the last one year’s data shows that

- Danish government bonds is one of the few asset classes that haven’t reverted after the Corona stress and the 15bp interest rate hike. We don’t expect that to change in the near future

- Covered bullets spread to govies is at the cheap side in the 3-5 year maturity. The spread is more in the middle of the range in the 1 year maturity

- Callables is in the middle of the range relative to govies and more elevated to swaps (consequence of the low Bund spread)

- Semi-core and peripheral govie spreads have reverted some but is still to the high side

- Bund spread is at very low levels. The Danish spread is at the lowest levels in a very long time

- Credit continue to look relatively elevated

- Bot equity and interest rate volatility remain to the high side

The one chart to rule them all. Boxplots for central timeseries over the last year. Green stars are current level, Red stars are levels at the latest auction 5 May

Spread to swap on 8 year Danish and German government bonds

The missing recovery can also be illustrated by the fact that Danish government bonds continue to trade in line with Holland…

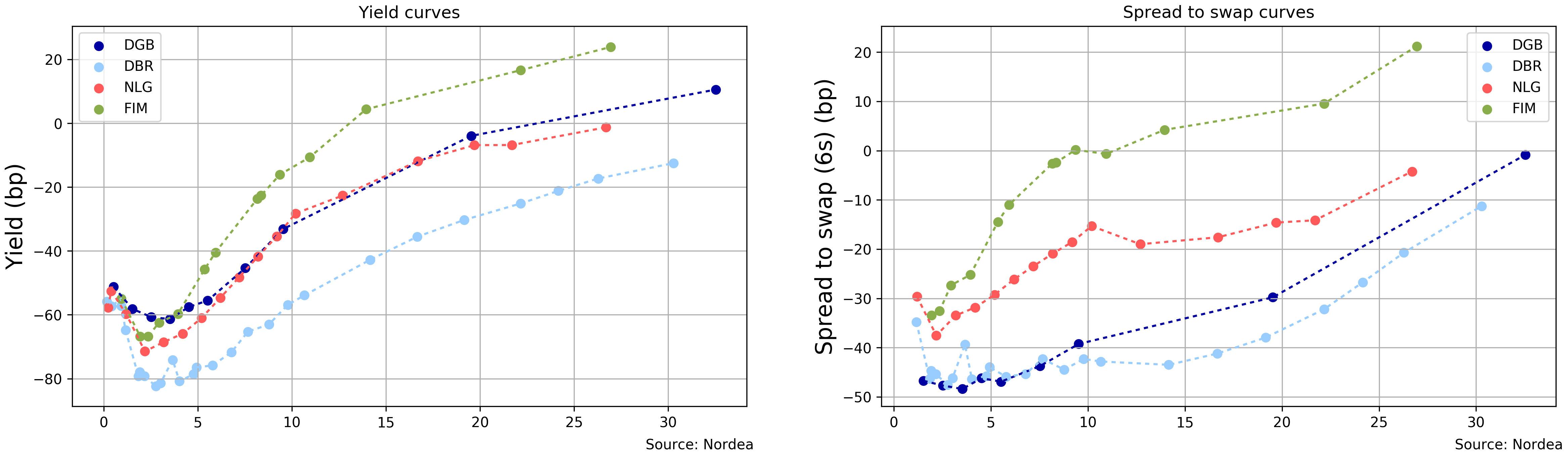

Actual yield curves and spread to swap in Denmark, Germany, Holland and Finland

Yield curves and spread to swap in Denmark, Germany, Holland and Finland at last auction (5 May)

Summing up, at the auction we prefer the DGB29 and we asses that t-bills is more attractive than the DGB22.