Nordea betragter de danske statsobligationer som attraktive. Nationalbanken holder i dag auktion over T-bill 21 og 22. De tre-måneders statsobligationer er kommet på niveau med de svenske og franske. Udenlandske investorer køber normalt to tredjedele af obligationerne. Auktionens forløb vil indikere, om Nationalbanken sænker renten i maj.

Danish T-bills at attractive levels – and an opportunity to bet on a Danish interest rate cut

On Wednesday (April 14th) the Danish Central Bank will auction T-bills 21/II-IV (Jun, Sep and Dec) and T-bill 22/I (Mar). We continue to find the longer dated maturities of decent value and the segment seems even more interesting if betting on a cut.

Last week we argued that an independent Danish rate cut is potentially in play in May or it will go away (here). Due to the dividend season the Danish Krone typically strengthens in May, and thereby put downward pressure on the EURDKK.

This could lead to further FX intervention like we saw in March or in the event that the pressure gets too intense a cut could be brought into play, but it will likely take more than DKK 30bn worth of intervention during May. In our main scenario we expect the Danish central bank to withstand the pressure and thereby keep the deposit rate unchanged at -50 bps, however the big test will come next month.

During the last weeks short dated Danish government bonds have performed due to rate-cut expectations. If the Danish central bank eventually chooses to sanction an independent interest rate cut of 10 bps, it will imply a downward pressure towards -60 bps in the short end of the curve and hence support performance in Danish T-bills.

At the previous T-bill auction two weeks ago, issuance ended at DKK 2.76bn and the three longest maturities cleared at -50 bps. All bids for Sep-21 and Dec-21 were accepted while the bid-to-cover ratio for Mar-22 ended at 2.05. Considering the current levels we had expected greater interest in Danish T-bills, and with Easter behind us it will be interesting to see if the auction will gain more attention – in particular from foreign investors who account for approximately 2/3 of the investors in DGTBs.

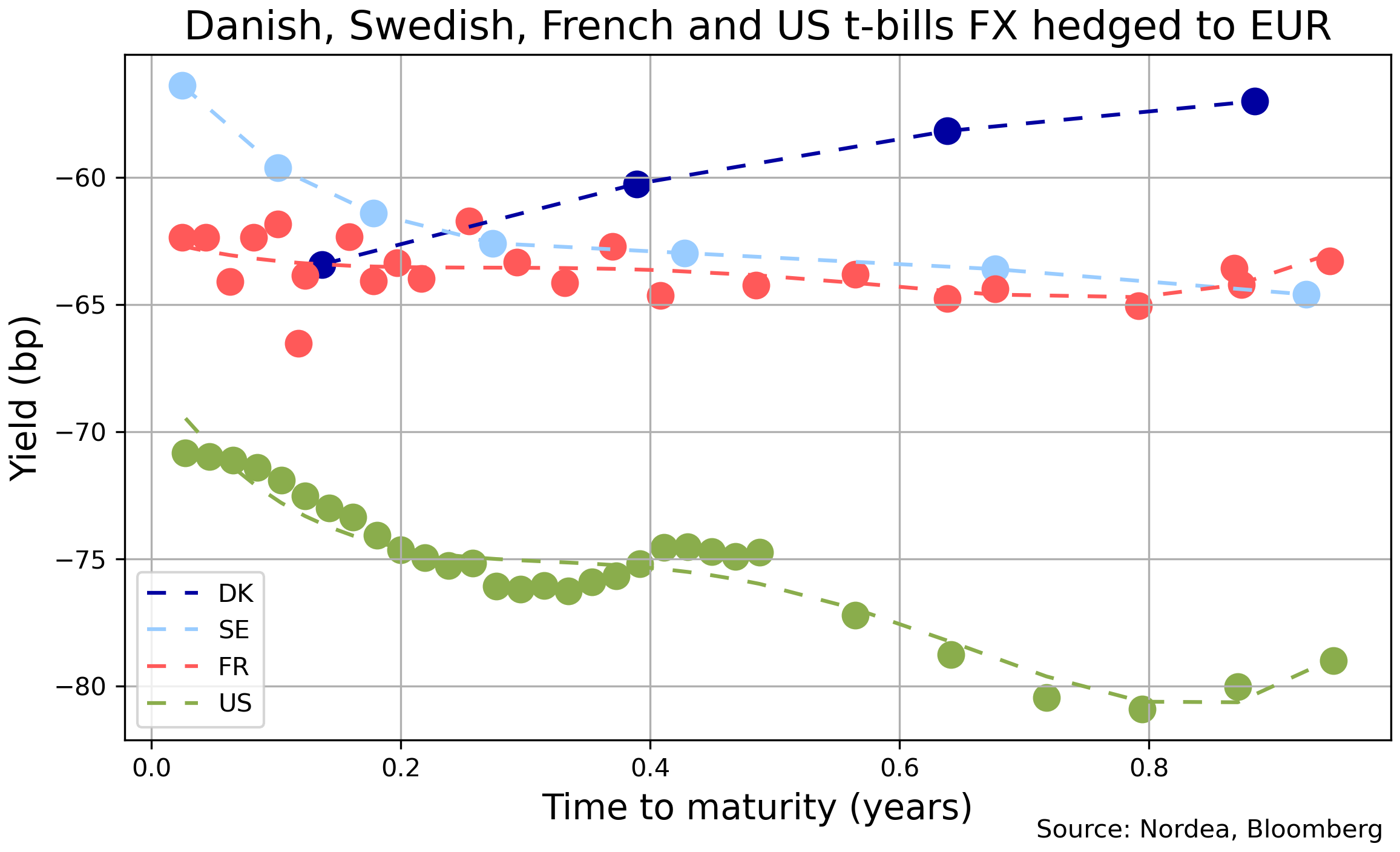

T-bills FX hedged to EUR

Looking forward at the upcoming auction, it is clear from the above chart that longer dated Danish T-bills are looking attractive relative to peers. Assuming clearings at -52 bps Mar-22 offers a pickup of 7.5 bps to France T-bills including the FX hedge, whereas Sep-21 and Dec-21 offer a pickup of roughly 3 and 6 bps respectively. In the very short end Swedish T-bills continue to offer more value, leaving us neutral on Jun-21.

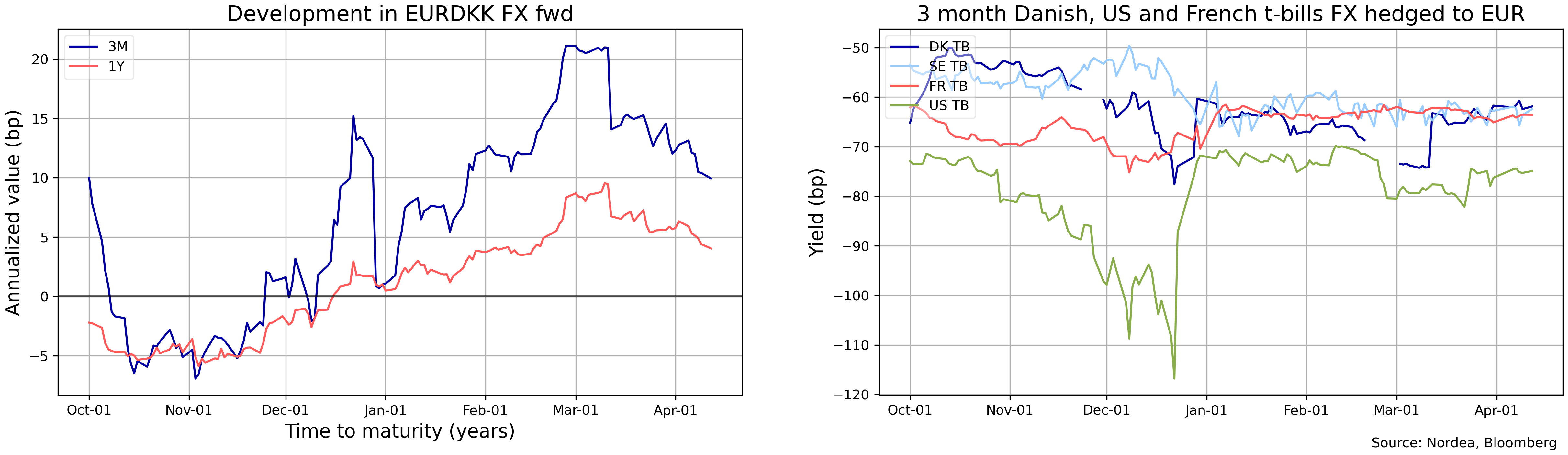

The DKK liquidity has been super tight over the last month and dropped to DKK 75bn in late March. However, the Net Position is now improving and according to our model it will reach DKK 130-135bn over the coming weeks.

This have resulted in a downward pressure on the EURDKK FX fwds and thereby made Danish assets slightly more attractive seen from the view of a EUR investor, which adds to our positive view on Danish T-bills.

Looking at the chart below, we see that the 3 month Danish T-bill is close to par with France and Sweden.