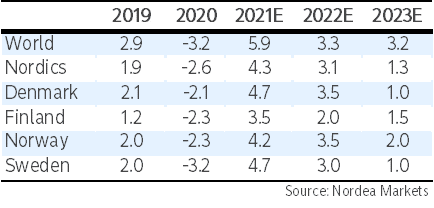

De nordiske lande klarer sig i år bedre end de fleste vestlige industrilande, fremgår det af Nordeas Economic Outlook. De får i år en vækst på globalt niveau, og det er Norge, Danmark og Sverige, der sikrer det høje niveau, mens Finland får et kraftigt dyk. Men landene er under pres, og væksten vil falde særdeles kraftigt i det nye år til omkring 1 pct., vurderer Nordea. Mens den globale vækst i år ventes at blive på 3,3 pct., venter Nordea, at væksten i Norden bliver på 3,1 pct. Danmark, og Norge vil ligge i top med 3,5 pct., Sverige ventes at få en vækst på 3 pct., mens Finland kun får 2 pct., og det sidste skyldes et dramatisk fald i samhandelen med Rusland som følge af Ukraine-krigen. Det er krigen samt covid-udbruddet i Kina, som får væksten i Norden til at blive lavere end sidste år og til at falde dramatisk næste år.

Nordea Economic Outlook: Under Pressure

The war in Ukraine and new COVID-related shutdowns in China have dramatically worsened the outlook for the world economy this year. Against this background, we have downgraded the growth estimate for the world economy this year from 4.1% in January to now 3.3%. In 2023, we expect a further slowdown in global growth to 3.2%. Geopolitics, high inflation and new resistant COVID-19 variants pose the greatest risks to growth prospects.

The Nordic economies will also be affected by the war in Ukraine. However, they all benefit from having had a strong starting point before the war, when the risk of overheating was the common Nordic economic narrative. Finland will be affected the most, Norway the least.

The Danish economy is well positioned to withstand the new challenges. As the slowdown started while activity was high, it may at best prove to be a welcome cooling of the economy. But the uncertainty is high, and a more pronounced slowdown cannot be ruled out. One question is how resilient the housing market is to the rising interest rates and the fall in households’ purchasing power.

In Finland, the collapse of exports to Russia, higher energy prices and shortages in materials will have a negative impact on growth. Yet export prices of raw materials and commodities produced in Finland have shot up, keeping Finland’s terms of trade unchanged. Savings accumulated by households will help sustain private consumption despite a fall in real incomes.

Economic activity in Norway is now at a very high level. Competition for labour and high inflation are pushing up wages, while the war in Ukraine intensifies the inflationary pressure. With an economy under pressure and rising price and wage growth, Norges Bank will continue its quarterly rate hikes until end-2023. Housing prices look set to remain fairly stable, but we would not rule out a small decline.

The Swedish economy is strong but entering a phase of subdued growth as high inflation and rapid rate hikes slow activity. The higher interest rates pose a test for households, with falling housing prices and stagnating consumption. We expect home prices will start to fall in H2, while the labour market will improve further before levelling out next year.