Der er valgfeber i US, skriver Nordea i en analyse. Banken mener, at en demokratisk valgsejr vil styrke de europæiske aktier i forhold til de amerikanske. Joe Biden ligger foran Trump i de afgørende swing-stater. Vinder Trump, vil der herske usikkerhed over hele linjen. Det afgørende bliver dog, om Demokraterne vinder begge kamre i Kongressen.

US: Election fever

The stakes are high and the result is far from clear in the US November elections. A decisive Democratic victory would probably hit the USD and support European assets, while another Trump term would be full of uncertainties.

- US elections are fraught with much more uncertainty than suggested by the rather clear poll numbers.

- A Biden victory would drive EUR/USD higher, while his tax plans could cause some concerns amidst equity investors.

- A second term for Trump would be full of uncertainties – lack of Congressional support would probably constrain his domestic plans significantly .

- Equity markets tend to perform after the election-related uncertainty eases.

- The risks of prolonged uncertainty over the election outcome are real, and could dent financial market confidence.

- Filling the vacant Supreme Court seat worsened relations between the Republicans and Democrats further.

- US-China trade war will continue no matter who wins.

Another lockdown or striving to keep the economy open, escalating trade war or more negotiations, more deregulation or worrying tax hikes? These are just some of the issues that distinguish the two presidential candidates, sitting president Donald Trump and the Democrat contender Joe Biden.

Also the balance of Congress is important, as the president can only do so much without the support of both chambers of Congress. The election on 3 November will be extremely interesting, and the stakes are much higher than in a normal election year.

We think the race is much closer than the polls imply, and even if a Biden victory is the most likely outcome, such a scenario is far from a given. If Biden wins and the Democrats also take control of the Senate (the House is very likely to remain in Democratic hands in any case), we could expect to see European assets outperforming US ones and a higher EUR/USD.

Biden in the lead, but a lot can still happen …

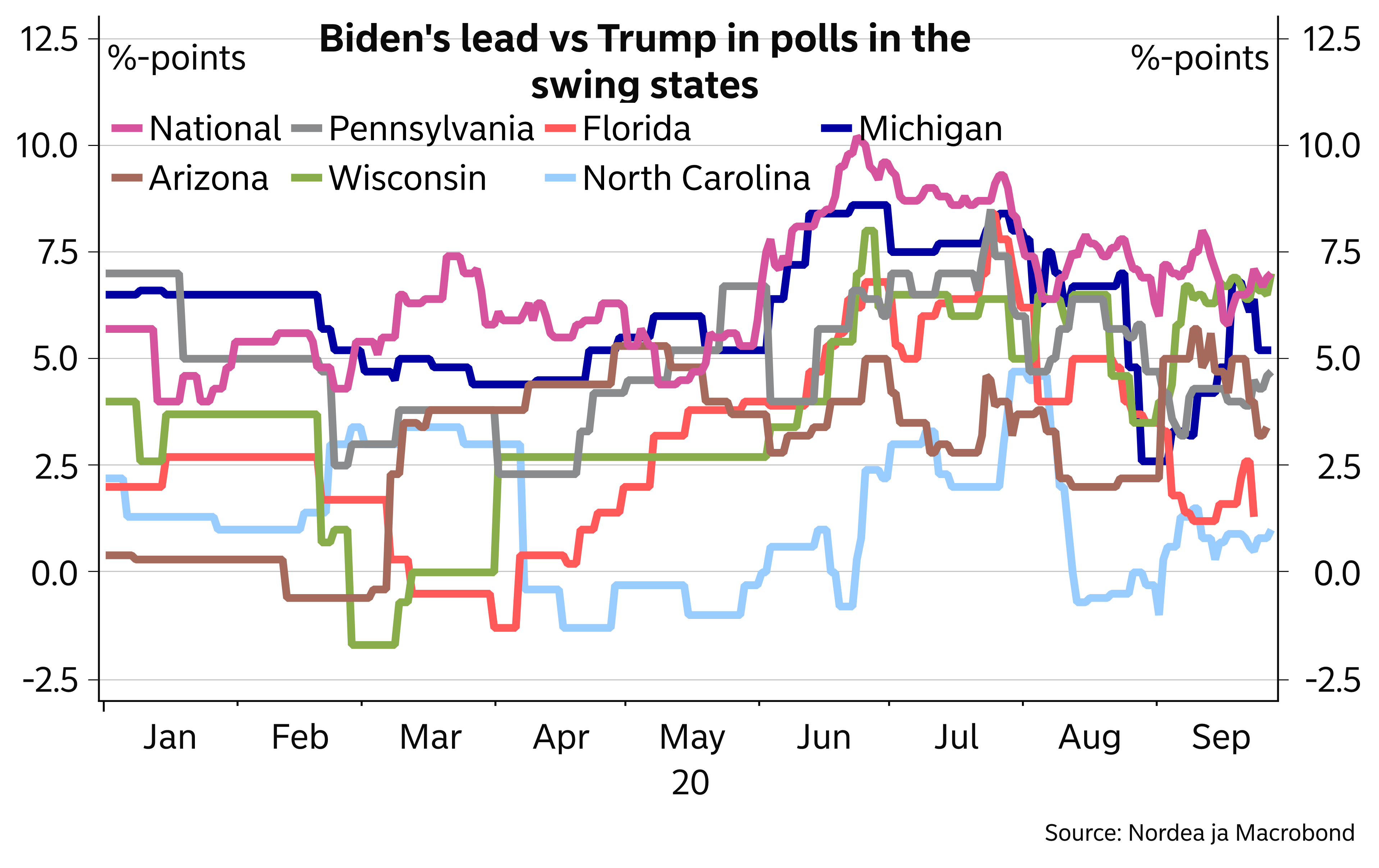

Biden is clearly ahead in the national polls, but the election is not decided by the national vote. A good reminder of this is the 2016 election, where Clinton got almost 3 million votes more than Trump nationally but lost the electoral college after Trump prevailed in the important swing states. The polls in the swing states are much closer than the national ones, even if Biden is ahead in those as well.

Some models, such as that of the popular FiveThirtyEight, give Biden almost an 80% chance of winning. However, the election is more than a month away and a lot can still happen. We think that the betting market odds, giving Biden an edge but only with around 54% probability, better reflect the real odds.

Biden’s lead is narrower in the swing states compared to nationally

The House of Representatives is all but certain to remain in Democratic hands, but the fate of the Senate is more uncertain. Each state has two seats in the 100-seat Senate irrespective of their size, and only 35 of those seats are up for grabs this year. Republicans currently have a 53-47 majority, but 23 Republicans will have to defend their seats this year vs only 12 Democrats.

RealClearPolitics expects 46 seats to be relatively safely in Democratic hands and an equal 46 in Republican ones, while 8 seats are what they call toss-ups, i.e. close races. Betting markets, in turn, give the Democrats around 55% odds of having a majority in both chambers after the November vote.

The Democrats thus have a good shot to take both chambers of Congress and the White House, and that outcome is the single most likely scenario. However, there are other scenarios with high probabilities as well.

Biden’s trade policies would lift EUR/USD

We have identified three scenarios, to which we attach notable probabilities. The most likely one (with around 40% probability) is a Biden victory and Democrats winning a majority in the Senate (and retaining the House, which we expect in all the three scenarios).

In this scenario, Biden and the Democrats would probably introduce a sizable fiscal easing package in early 2021, assuming the economy would still be significantly burdened by Covid-19.

He would seek to increase investments in the housing market, social security and health care. And he would seek to reverse some of the tax cuts implemented by Trump, and also reverse some of his deregulation agenda, especially with regards to the climate agenda.

The tax hike aspects of Biden’s agenda could put some pressure on equity markets. Even if the tax hikes are mainly targeted towards higher-income taxpayers, his plans would include higher corporate, dividend and capital gains taxes, which could scare equity investors to some extent. In the short run, however, sizable fiscal stimulus could offset such concerns.

In trade policy, while Biden and the Democrats will retain a harsh stance towards China, the stance towards the EU should ease. Biden is likely to try to heal relations with the EU and team up with the EU in the fight against China.

He would most likely also be much more predictable in his foreign-policy decisions compared to Trump. As a result, a Biden presidency would lead to a more stable global trade environment, which would support a weaker USD and a clearly higher EUR/USD. European assets should perform vs US ones. The longer-term outlook for interest rates would not change materially, but a sizable fiscal stimulus package could steepen the yield curve in the short term.

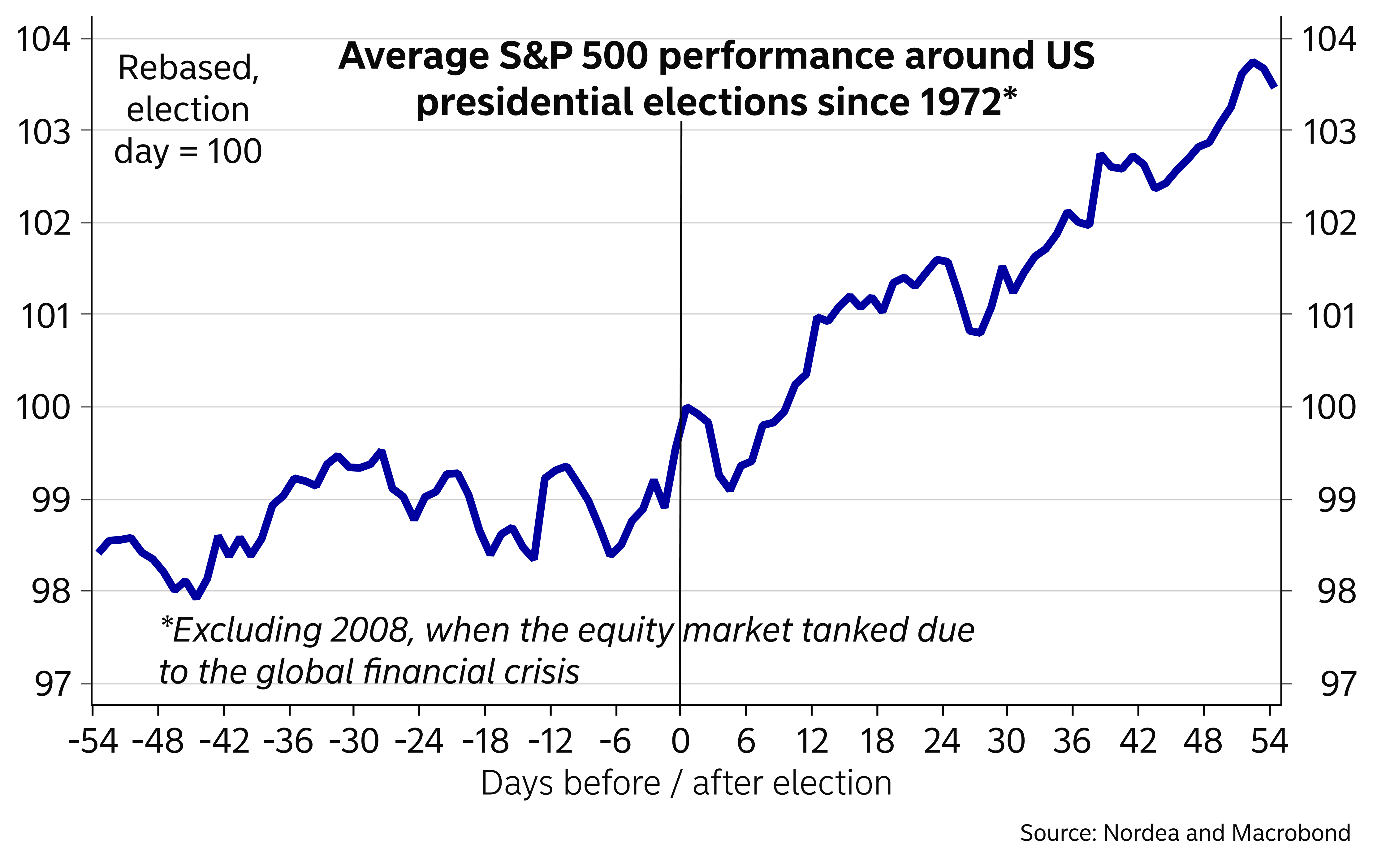

Equity markets normally perform after the election uncertainty passes

Uncertainty tends to prevail ahead of US presidential elections, and on average, US equities have not performed that well ahead of the vote. In the period after the elections, when the uncertainty has been lifted, US equities have rallied.

As the uncertainties are even larger than usually this time, the case for equity underperformance ahead of the vote is strong, while a clear result in early November would open the door higher for equities again.

Equity markets tend to perform after the election uncertainty recedes

What if there is no clear result?

Financial markets have become accustomed to the election result being clear on the evening of the vote. True, in 2000 it took over a month until the Supreme Court stopped a recount in Florida and effectively determined the winner, but even then Al Gore quickly accepted the decision. This time Trump has refused to say he would honour the results and admit defeat, even if the vote count pointed that way.

US-China trade war will continue no matter who wins

The Sino-US relationship has worsened dramatically this year. Covid-19 has intensified the blame game between the two countries and China’s rise as a military and technology superpower as well as its human rights policies and environmental impact are considered serious problems by the US. According to a survey by the Pew Research Center, a record of 73% of Americans had a negative view on China in March and an aggressive China policy has bipartisan support in the US Congress.

This all suggests that the post-election rhetoric on China is not expected to soften, even if Biden is expected to move in to the White House. Overall, the US Congress has also played a very active role in tightening China policies this year and that will continue no matter the composition of the new Congress. Thus, we do not expect Biden to unwind the existing tariffs on imports from China and the flow of new restrictions on China and on Chinese companies will continue.