Nordea venter en nedgang i den amerikanske økonomi i 2020 og forventer, at centralbanken sænker renten. En recession er en mulighed, og det bliver finansielle data, som indikerer det.

Uddrag fra Nordea:

In this macro theme, we make the case for a US slowdown in the first half of 2020, prompting the Fed to cut rates. A trigger is needed for the US to fall into recession and so far only financial indicators have sent recession signals.

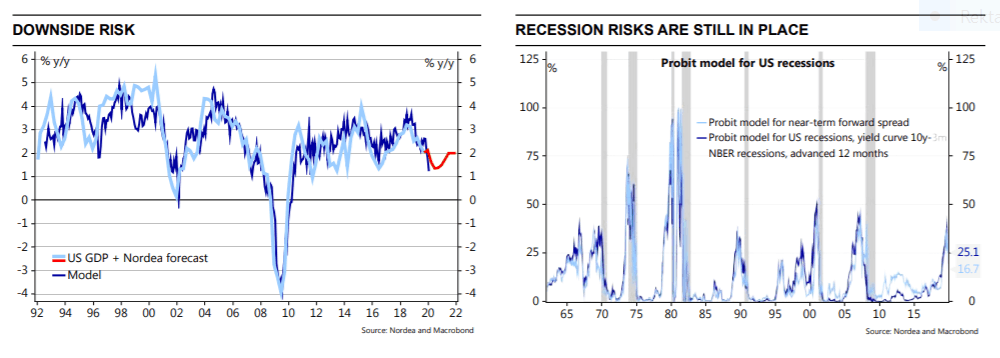

The market narrative of a US economy that has bottomed may prove to be premature. Indeed, leading indicators still point to a slowdown and the yield curve has sent its powerful recession signal. An update of the ‘roadmap to recession’ theme from March confirms that a trigger is needed for the US to fall into recession and recession probability models show that only financial indicators have sent recession signals, so far.

Global manufacturing activity has stabilised in recent months, leading the Fed to conclude that no more rate cuts are likely to be appropriate and, in turn, prompting long-term bond yields to rise on both sides of the Atlantic. However, we do not buy into the ‘nothing to see here’ narrative; we still expect a US slowdown to unfold and occasional recession fears to return, which should in turn lead the Fed to cut rates one more time.

The yield curve sent a strong recession signal earlier this year upon inverting and the most watched key figures are still on the roadmap to recession that we laid down in March. However, we do not see the trigger for a recession yet, which is why we stick to forecasting a slowdown.

On top of our roadmap to recession, we expand our recession analysis by introducing recession probability on different time horizons and based on various leading indicators. In general, we find that financial indicators give better early warning signals of recessions than economic key figures. Overall, we see the risk of a looming recession as significant but not alarmingly high.