Den danske inflation ligger betydeligt under niveauet i eurozonen. Den faldt i december til 3,1 pct., og det var fra et højt niveau på 3,4 pct. i november, det højeste siden 2008. Kerneinflationen, dvs. fraregnet energi, blev på 1,5 pct. Den samlede inflation (head line) er steget ekstremt kraftigt det seneste halve år. Den danske inflation ligger næsten 2 procentpoint under euro-inflationen. Det er den største forskel i 20 år. Nordea vurderer, at euro-inflationen vil falde mere end den danske inflation i det nye år.

Danish inflation: fall from a high level

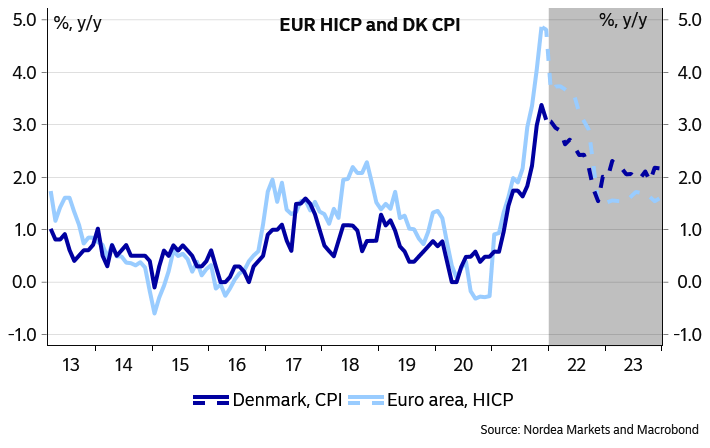

In December Danish inflation moved lower after hitting the highest level since 2008 in the previous month. Currently Danish inflation is significantly below inflation in the Euro area. However, this gap is likely to close later this year.

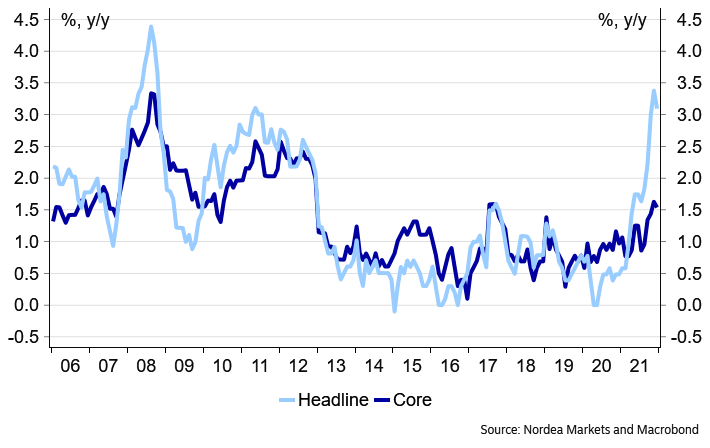

Measured year over year, Danish headline CPI increased by 3.1% in December, down from 3.4% in November. Core inflation, excluding energy and non-processed food, stood at 1.5% compared to 1.6% the previous month.

Chart 1: Headline and core inflation

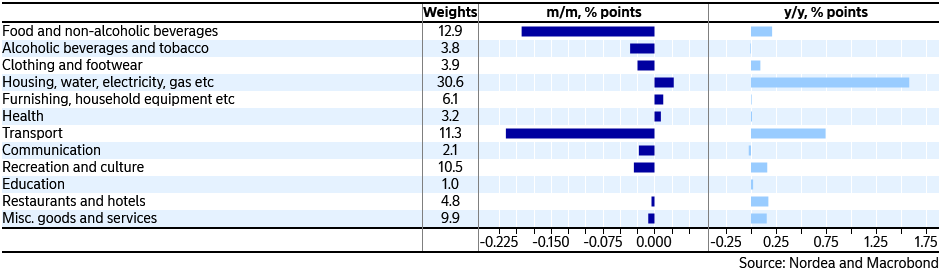

Lower prices of Food and Transport compared to last month

Compared to November, the CPI fell by 0.5%. This drop was mainly caused by falling prices of Transport (-0.21% point) and Food (0.19% point). The fall in prices of food in December is most likely related to the fierce price competition in the weeks ahead of Christmas.

Table 2: Contribution to headline inflation in December, m/m and y/y

Higher energy prices the main driver of the elevated inflation

In December the annual change in the consumer price index was mainly lifted by the effects of higher prices of energy. Electricity made a positive contribution of 0.75% point, gasoline 0.51% point and natural gas 0.38% point. In total this caused the housing component to make a contribution of 1.6% points and the transport component to add 0.7% point to the annual inflation numbers.

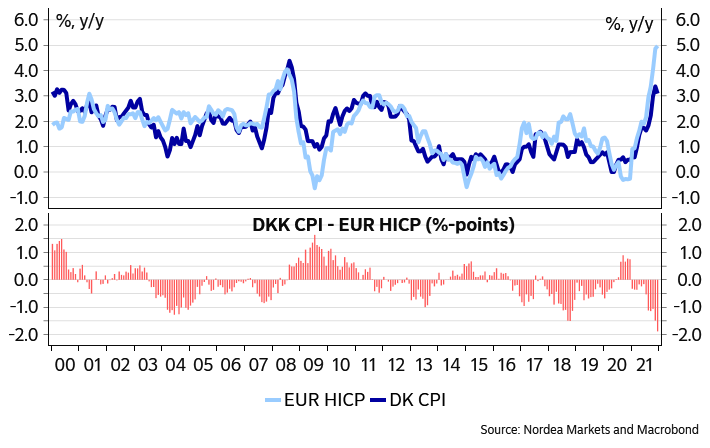

Danish inflation much below the Euro area

In December, the difference in the annual change in DK CPI against EUR HICP was 1.9% points. This is the largest spread in more than 20 years.

Chart 2: DK CPI and EUR HICP

There are two main reasons why the spread in inflation between Denmark and the Euro area is currently unusually large:

1. Base effects from the temporary VAT cut in Germany last year. In the second half of 2020 the Germany government lowered the standard VAT rate from 19% to 16% and reduced the VAT rate from 7% to 5%. According to our estimates the base effects from this are currently lifting EUR HICP inflation by around 0.5% point. Starting from the beginning of 2022, this base effect will no longer be present in the EUR annual inflation numbers.

2. Higher weights of energy in the Euro area. In the Danish CPI, rents for housing account for 22.1% of the overall index. As imputed rentals are not included in EUR HICP, the housing component is much smaller in the Euro area. The relatively low weight of rents leaves more room for other components like energy for housing and transport rents in the Euro area compared to Denmark. Due to the larger weights there is a clear positive correlation between higher prices of energy and the spread between EUR HICP and DKK CPI

Assuming unchanged prices going forward, the positive base effects from energy will start to fade in coming months. This will likely take both DKK and EUR inflation somewhat lower – but given the larger weight this effect will be most evident in the Euro area. Due to this, we expect Euro area inflation to fall more decisively in 2022.