I juli steg den danske inflation til 8,7 pct. – det højeste niveau siden 1983. Også kerneinflationen steg. En lavere inflation er sandsynlig senere på året, men den vil stadig være høj, vurderer Nordea. Det er fødevarer og energi, der har presset inflationen op. De to faktudgør mere end 50 pct. af inflationen.

Uddrag fra Nordea:

Danish inflation climbing even higher

In July, Danish inflation increased to 8.7%, the highest level since 1983. Also core inflation increased further. Lower headline inflation is expected later in the year, but the level will still be high.

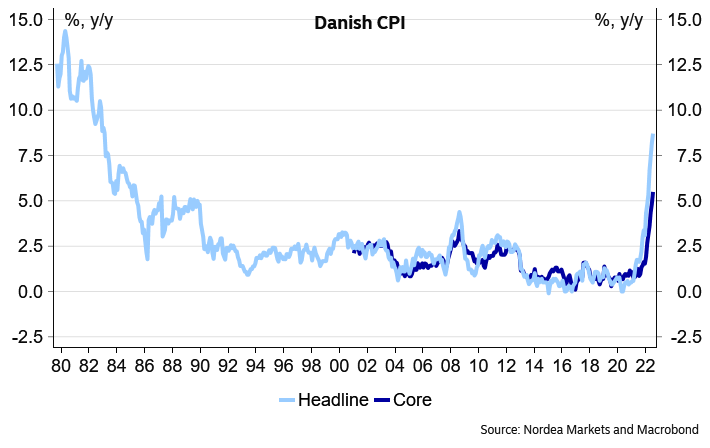

Measured year-over-year, Danish headline CPI increased by 8.7% in July, up from 8.2% in June. Core inflation, excluding energy and non-processed food, stood at 5.5% compared to 4.8% the previous month.

Chart 1: Headline and core inflation

Sharply higher prices on energy and food

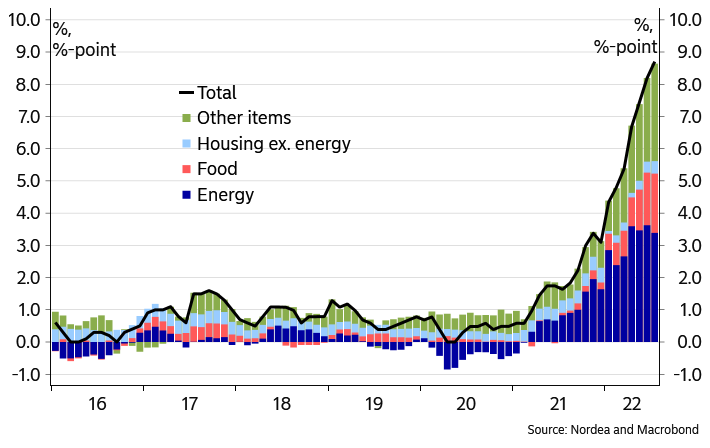

In July, the annual change in the consumer price index was yet again mainly lifted by the effects of higher prices of food and energy. Food made a positive contribution of 1.74%-point, electricity 1.35% point and gasoline 0.94% point. In total, food and energy contributed with more than 50% to the overall headline inflation.

Chart 2: Contribution to headline inflation

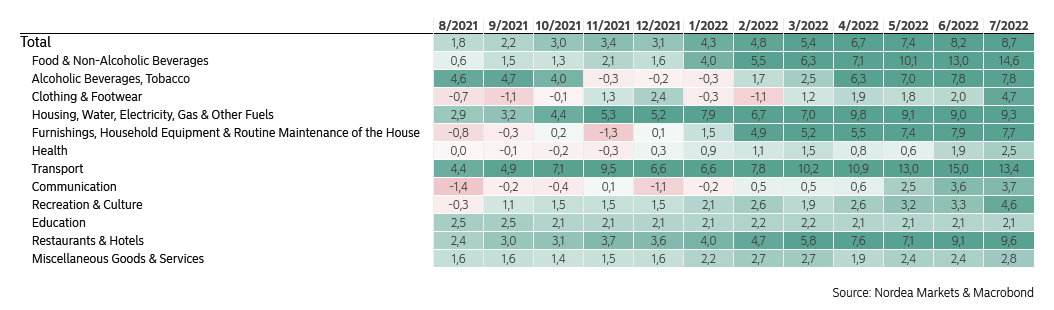

Table 1: Headline inflation, y/y

Price increases are becoming more widespread

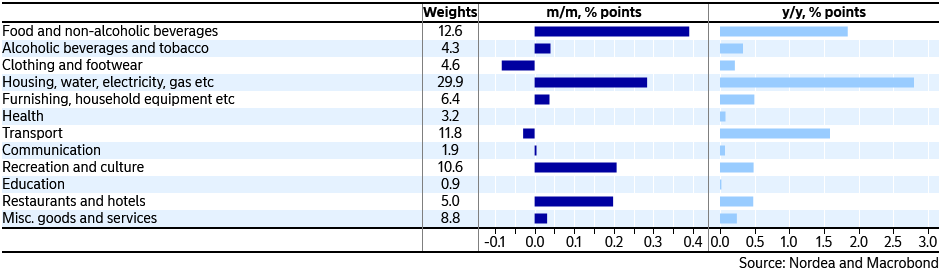

Measured month-over-month higher food prices made the largest contribution (0.39%-point) to the overall increase of 1.1%. But prices also increased on Recreation & culture and Restaurants & hotels. To us, this is a clear signal that inflation is becoming more widespread in the Danish economy.

Table 2: Contribution to inflation in July, m/m and y/y

Lower in the autumn

Short term Danish inflation will stay elevated, due to very high price increases on food and natural gas. However, during autumn the base effects from oil prices is likely to getting smaller which is expected to take the headline inflation lower. Despite the prospect of lower energy inflation, prices of many other goods and services are expected to increase at a faster pace. Many companies are expected to pass on the higher energy costs to consumers. So even though Danish inflation is likely to be close to the peak, the level will remain significant higher than before the pandemic.