Den danske inflation lå stabilt i februar på 0,6 pct., men Nordea har analyseret de underliggende dynamikker bag tallene, og de tyder på en højere inflation i de kommende måneder. På grund af pandemien mangler der data, og derfor har Danmarks Statistik foretaget skøn. Hvis man skubber dem til side, har inflationen været 0,9 pct. Som følge af stigende huslejer samt højere oliepriser og fødevarepriser, venter Nordea en inflation i år på 1 pct. – den højeste siden 2017. I 2020 var den på 0,4 pct.

Uddrag fra Nordea:

Danish inflation: Moving towards a higher level

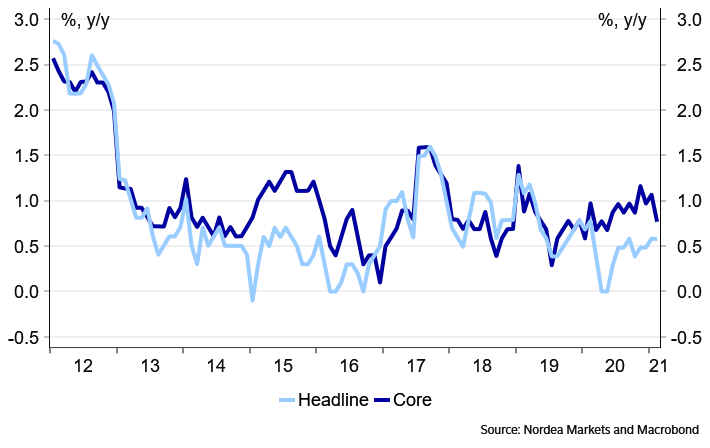

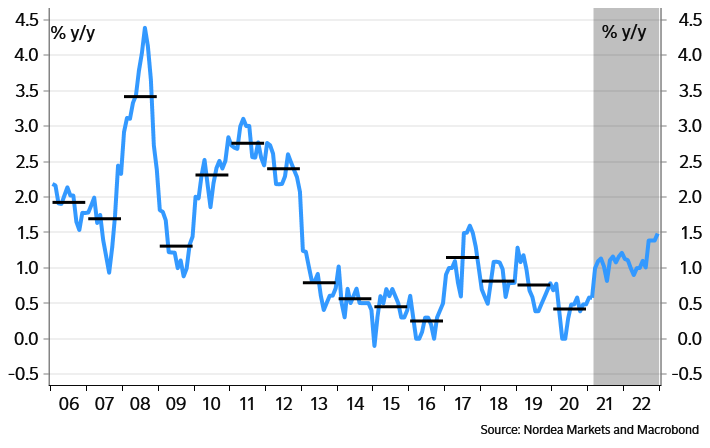

In February Danish inflation stayed unchanged at 0.6%. However, underlying dynamics point to higher inflation in coming months.

Measured year-over-year the Danish CPI increased by 0.6% in February, unchanged compared to last month. However, it should be noted that due to the coronavirus around 15% of the data in the consumer price index is not based on actual observations but instead estimated by Statistics Denmark. If these estimations are not included in the calculations, the annual inflation rate was 0.9%.

Chart 1: Headline and core inflation

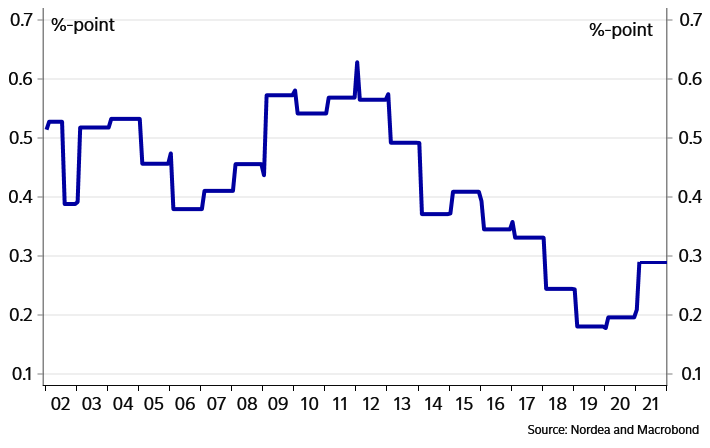

Higher rents – but still below the historical average

In February the annual update of the rents survey was released. In the composition of the Danish inflation index, actual rents paid by tenants carry a weight of 8.6%. The assumption is that rents paid by tenants equal the rental value of owner-occupied dwellings. As the calculated rental value of owner-occupied dwellings carries a weight of 13.5%, this implies an aggregate rent weighting of 22.1% in the overall inflation index.

In the updated survey rents increased by 1.3%. This was higher compared to last year (1.0%), but still significantly lower compared to the historical average of 2.3%. This implies that rents for housing made a positive contribution of 0.29% point to the annual inflation numbers in February (compared to 0.20% point last month). As data on rents are only updated once a year this higher contribution will remain in place until next year.

Chart 2: Contribution from rents to annual inflation

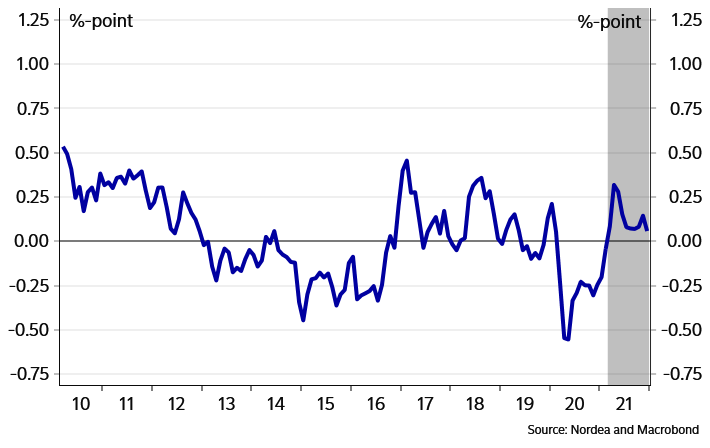

Higher contribution from gasoline and food ahead

Starting next month the sharp increases in gasoline prices will contribute with positive base effects to the year-over-year inflation numbers. Assuming unchanged oil prices measured in DKK this effect will peak in April with a positive contribution of around 0.3% point.

Chart 3: Contribution from oil price

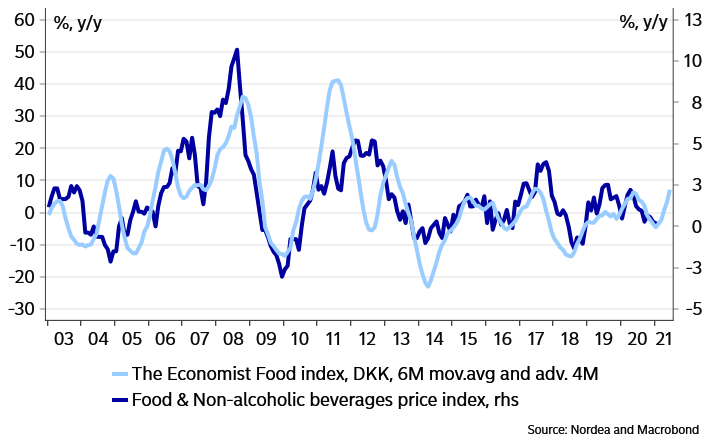

Also, food prices are expected to pick up speed going forward as a consequence of the recent surge in many commodity prices. As food and non-alcoholic beverages account for 12.9% of the overall consumer price index even relatively small price increases will have a large effect on overall inflation numbers.

Chart 4: Higher food prices ahead

Due to the larger contribution from rents, higher gasoline prices, the ongoing positive base effects from the large increase in cigarette prices and the expected increase in food prices we expect Danish inflation to move gradually higher during the course of the year. On average we expect this to yield an average inflation of 1.0% in 2021 – the highest level since 2017 and up from 0.4% in 2020.