Den danske inflation steg til 2,2 pct. i september. Det er det højeste niveau siden november 2012. Det ligger langt under inflationen i Europa generelt. Nordea venter, at inflationen bliver højere i de næste måneder, bl.a. på grund af stigende fødevarepriser, men også mange service-priser ventes at stige på grund af mangel på arbejdskraft i servicesektoren. Men for hele året venter Nordea en inflation på 1,6 pct., og for de næste to år på under 2 pct.

Danish inflation climbing even higher

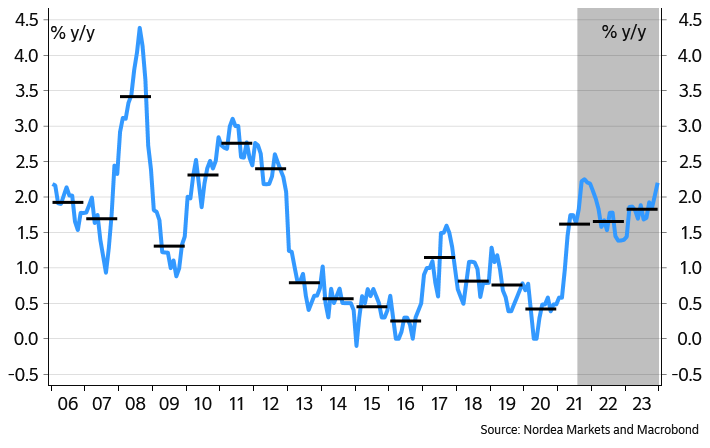

In September Danish inflation climbed to 2.2% y/y. This is the highest level since November 2012. Part of the increase is clearly driven by temporary factors, but there are also signs of a more permanent upward shift in Danish inflation

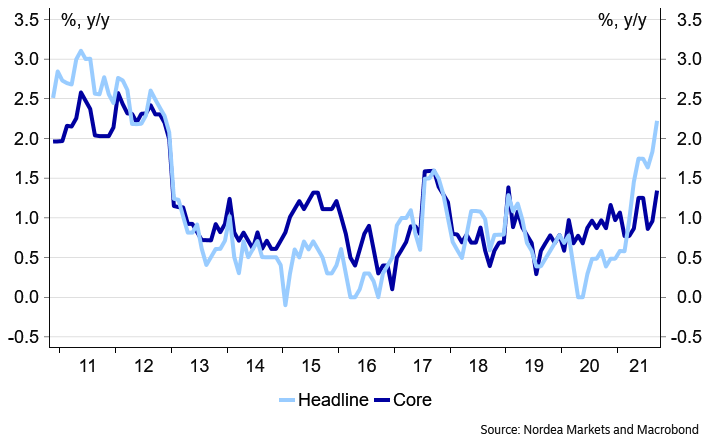

Measured year-over-year the Danish headline CPI increased by 2.2% in September, up from 1.8% in August. Core inflation, excluding energy and non-processed food, was up to 1.3% in September compared to 1.0% in the previous month. This was the highest level since January 2019.

Chart 1: Headline and core inflation

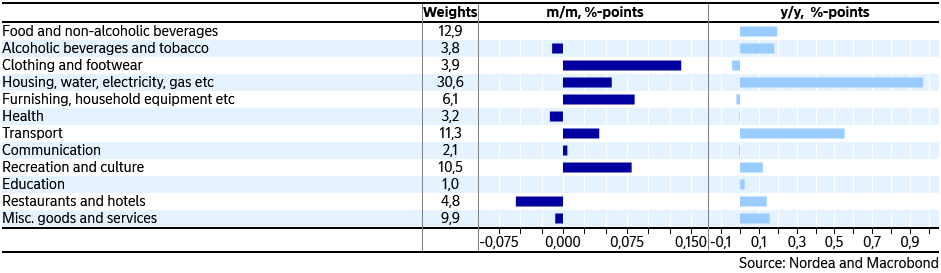

In September the annual change in the consumer price index was mainly lifted by the effects of higher prices on gasoline (0.43% point), electricity (0.36%-point) and rents for housing (0.29%-point) In total this caused housing to make a significant positive contribution to the annual inflation numbers in September of close to 1.0% point. On the other hand, the base effects from last year’s large tax increase on tobacco continued to decline.

Table 1: Contribution to headline inflation in September, m/m and y/y

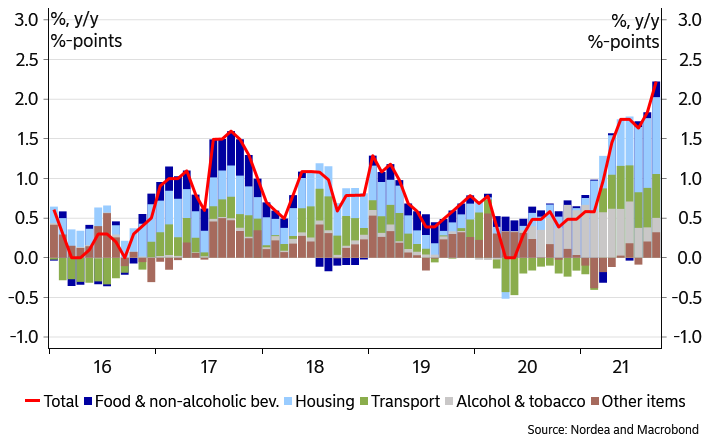

Chart 2: Contribution to CPI

Higher inflation is here to stay

Looking forward, we expect Danish inflation to stay at elevated levels during the rest of the year. This is expected even though base effects from last year’s large tax increase on tobacco is about to disappear. Instead, this is expected to be replaced by higher prices energy which will lift both Housing and Transport.

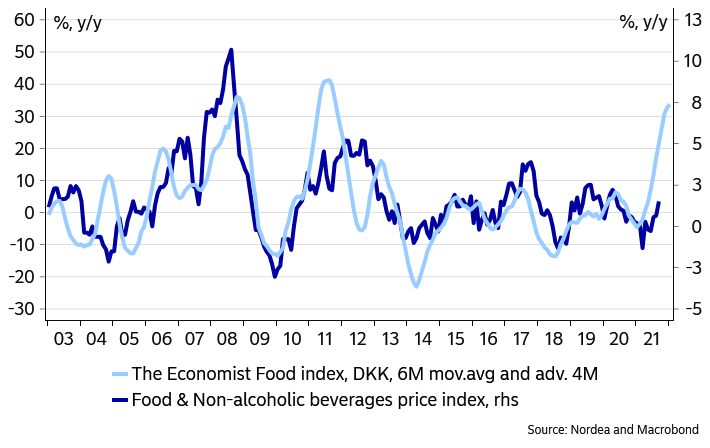

In addition, global food prices have increased sharply over the past year. Historically this has been a very good leading indicator for the development in Danish food prices, which together with non-alcoholic beverages account for almost 13% of the consumer price index. Due to this we expect higher food prices to contribute around 0.5% point later this year.

Chart 3: Higher food prices ahead

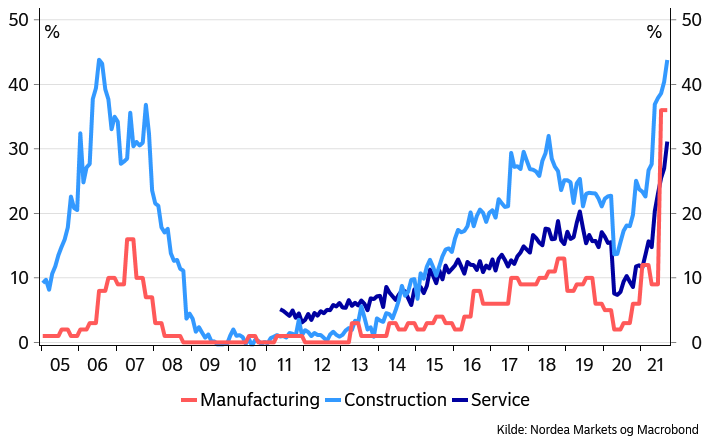

Also prices on many services are expected to increase at a faster pace. According to the latest data from the labour market, the lack of labour supply is at a record high – both measured by number of vacancies and by the number of companies stating that production is limited due to shortage of labour force. This squeeze at the labour market is likely to trigger upward pressure on nominal wages, which again could give rise to higher price increases especially in the services sector as companies will try to pass on the higher wage costs to consumers.

Chart 4: Shortage on manpower

In total we expect an average inflation rate in 2021 of 1.6% Next year this is expected to increase to 1.7% and 1.8% in 2023. In a long-term perspective this is still a relatively low level but compared to the period from 2013 to 2020 it is markedly higher.