Der er tegn på, at den globale økonomi mister kraft i de kommende måneder, skriver Nordea. Men Europa klarer sig bedre igennem og kan måske få en næsten lige så kraftigt vækst som USA. ECB vil få lettere end Fed ved at forklare, at den stigende inflation kun er et overgangsfænomen, da stigende europæiske energipriser kan forklares som en konsekvens af omstillingen til en grøn økonomi.

What #Euroboom?

Talks of a #Euroboom have intensified after strong numbers and a spike in inflation. It will be easier for the ECB to explain away inflation as “transitory”, than it is for the Fed. Credit impulse data suggest that the global economy is slowing!

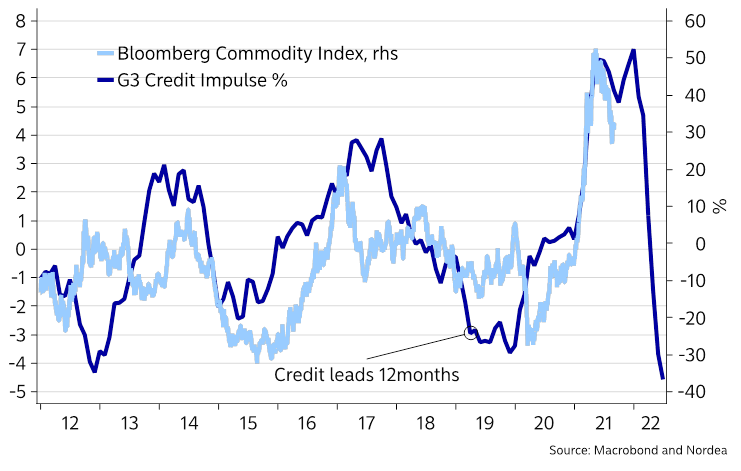

The Fed, or the ECB for that matter, risk tightening into a slowing economy as the global credit impulse (credit created as % of GDP) is worsening across all jurisdictions. The impulse has not looked this bad since 2008, which is a signal that the economy will start to lose momentum globally in to 2022.

When the global credit impulse fades, it tends to i) flatten the yield curve, ii) strengthen the USD, iii) take the steam of out commodities and iii) provide tailwinds for interest rate sensitive stocks, but there is a decent chance of a yield curve steepening through September and October due to i) an anticipated Fed tapering pushback until November, ii) Issuance picking up and iii) Positive data seasonality in the US.

We lean towards steeper curves for now, which could leave us waiting a bid for performance in our short EUR/USD proxy trades such as the long USD/SEK. It is on the other hand good news for the relative vaccine/tourism-trade in long MXN vs. THB or PHP.

Chart 4. The credit impulse looks very lacklustre.. Tightening into a slowing economic momentum?

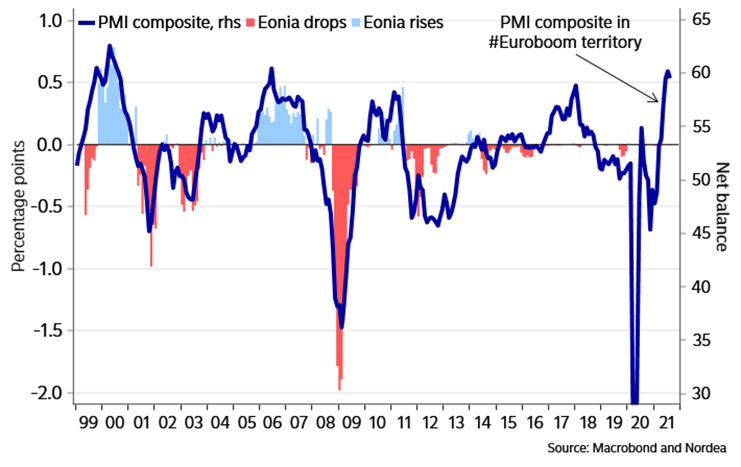

Following strong readings out of the Euro-area there’s not only talk of the possibility that ECB might “taper” before the Fed, but also of a new #Euroboom. As for the former point, the so-called tapering, we would argue that a technical adjustment to a purchase pace is not a real taper – unless the implied endpoint for the size of the central bank’s balance sheet changes, which is not yet the case.

Chart 5. PMI composite at Euroboom levels

And for the latter point, the #Euroboom, we would like to remind our readers that the last time we saw #Euroboom trending on social media and in the Bloomberg terminal, it almost ended in tears. Back then, EUR/USD was propelled for a while by the China-led global reflation, but as China’s credit cycle turned, so did the EUR/USD (which after reaching 1.25+ early 2018 eventually dipped to 1.12 in 2018, and 1.09 in 2019).

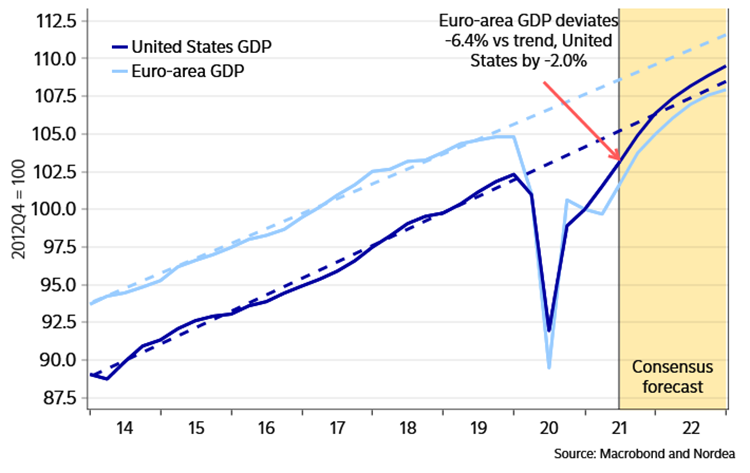

That said, it’s not impossible that Euro-area GDP growth manages to “outperform” US GDP growth in coming quarters. If that scenario unfolds, the main reason is the difference in output gaps. US GDP was only 2% below trend in Q2, 2021 compared to a whopping 6.4% below trend for Euro-area GDP.

Chart 7. Euro-area very far behind in its economic recovery

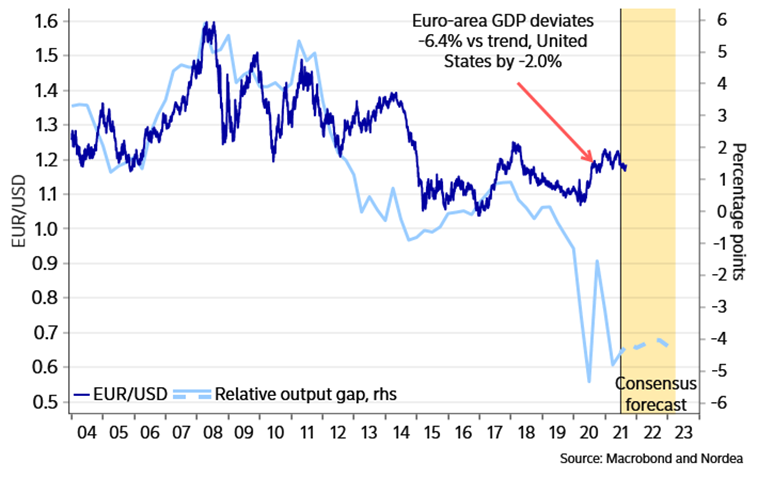

Relative growth may thus become a positive driver for EUR/USD, but from a statistical perspective output gaps are much more important. And this makes sense if we assume that central bank policy is a key driver of currencies. The correlation between the relative output gap (as defined in the above chart) and EUR/USD is 0.7, which compares quite favourable to the pair’s correlation with relative growth (-0.1).

Chart 8. Relative output gaps point south

Finally, we would argue that exploding deficits and surging public debt in 2020 might have been enough to cause a mega spread widening and perhaps a new debt crisis, if not for the ECB’s aggressive action. A sufficiently hawkish move by the ECB could thus perhaps cause growing risk premiums in EUR assets, which could end up being a net negative for the EUR.

If Powell and the Fed find it straightforward to explain most of the US inflation spike away as “transitory”, then it will be even easier for the ECB to do so. Electricity prices are surging in the Euro area and while electricity is obviously an important part of a consumer basket, rising prices can comfortably be contributed to a necessary green energy policy shift.