Nordea har revideret sin prognose for 2020 og 2021 efter at have vurderet forløbet af coronakrisen og nedlukningen af økonomien. Nu vurderes den globale økonomi til at falde dramatisk til minus 2 pct. Kun Kina formår at have en positiv vækst med 1,5 pct. I 2021 ventes væksten at ligge langt over væksten i 2019 med 6 pct. for hele verden. Nordea betegner kursskiftet som en U-udvikling og ikke en V-udvikling, fordi økonomien ligger død i hele 2020.

Uddrag fra Nordea:

The global coronavirus recession ver. 2.0

The Covid-19 pandemic has had a dramatic impact on economic activity. In a new update of our global growth forecasts, we now project the world economy to contract sharply by -2% in 2020.

The Covid-19 pandemic has developed into the most serious global health crisis since the Spanish flu in 1918-19, and the necessary protection measures have a severe impact on economic activity. In a new update of our global growth forecasts, we now project the world economy to contract sharply by -2% in 2020. This is much worse than during the financial crisis and marks even a downward revision of our March forecast by -1% point.

The significant downgrade is due to the fact that we now have more information from key figures and research on the impact of the pandemic to lean to for guidance. For example the OECD has recently concluded in a research note that around 25-30% of all economic activity is impacted by the partial or complete lockdowns in the G7 countries. This means basically that if the lockdowns lasts for just one quarter it could cut off 6-7% of the annual growth in any of these countries.

However, there are still reasons to believe that the recovery will be smoother and stronger than then. Not least because economic policy authorities worldwide have launched relief packages of unprecedented size and scope to counter the negative socioeconomic consequences of the coronavirus outbreak. The swift monetary policy response has helped to stabilise developments in the financial markets and the easing of fiscal policies not least the widespread use of loan guarantees, tax deferrals, work sharing and wage compensation in countries will help the economies to avoid the worst longer term impact of the lockdowns.

Ultimately, the duration of the recession will eventually depend on how long the lockdowns and restrictions will last and what behavioural changes among households and businesses that the pandemic will cause. And while there are already signs of gradual re-openings of the societies in many countries, there are also indications that some restrictions will remain in place for a long time yet. Some even claims that precautionary restrictions will have to remain in place until an effective medical cure or even a COVID-19 vaccine has come into mass production. And this is still likely to take a while.

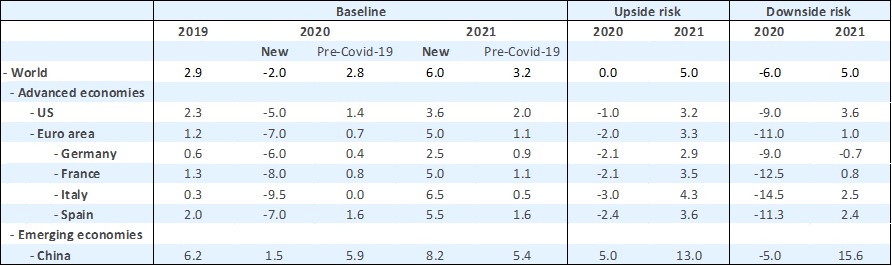

In this research note update, we make assumptions on the degree and extend to which production in various sectors have been shut down in China, the US and the Euro area, followed by assumptions regarding the subsequent recovery. The results are presented in three scenarios for the global economy:

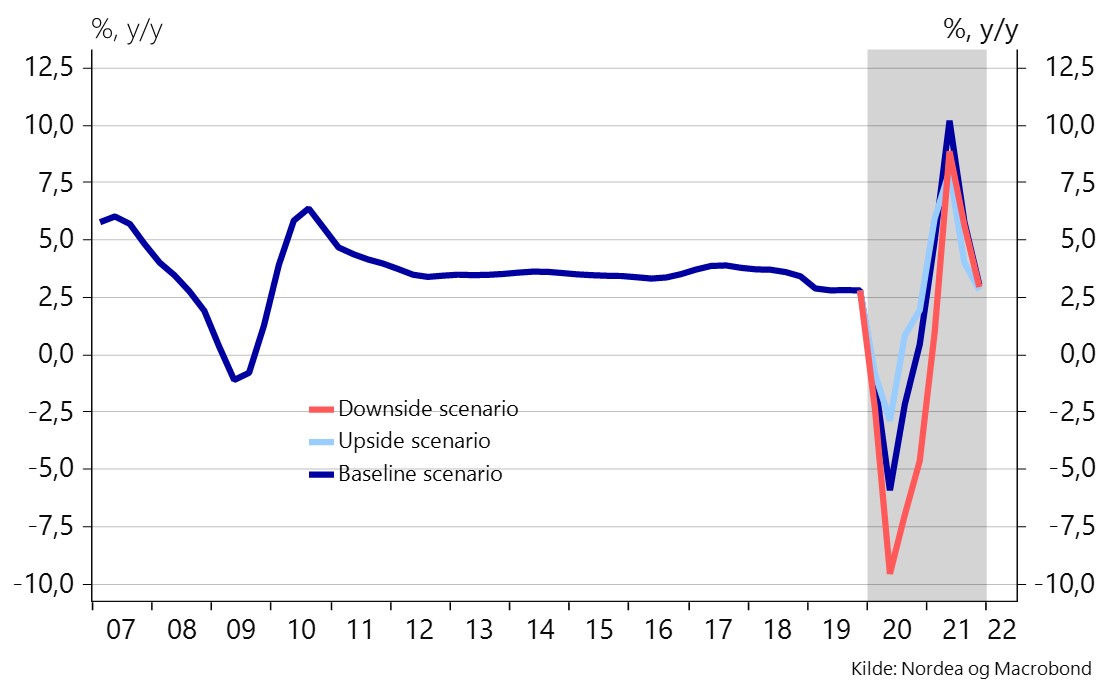

- An U-shaped baseline scenario with a deep shock and some quarters of very low activity before the recovery takes hold;

- An V-shaped upside risk scenario with a faster recovery;

- A L-shaped downside risk scenario, where the downturn will prove lengthy.

Table 1. Growth scenarios

The baseline scenario

The initial shock from the coronavirus to global economic activity will be huge. Extraordinary measures to contain the spread of the virus have had a dramatic impact on economic activity in Q1 and will last throughout the most of Q2, at least. The longer the lock down, the bigger the consequences for the sectors that have been hit the hardest, like tourism, restaurants, hotels. There will be defaults, bankruptcies and unemployment will rise. Households and business will remain cautious.

Never the less, the recovery will be strong once it takes hold. Large-scale fiscal and monetary policy measures have been implemented swiftly and are likely to keep most of the big economies intact, paving the way for most sectors to return to normal activity relatively fast. Pent-up demand is likely to be unleashed after many weeks of lockdown.

We expect global growth to be around -2% in 2020 followed by +6% in 2021 in the U-shaped baseline scenario. In Economic Outlook from late January we expected global growth to come in at 2.8% this year. On back of this we can conclude that the economic costs due to the pandemic is likely to be in the range of 4.5-5% of global GDP (the difference between current forecasts and the pre-Covid-10 outlook). That makes it one of the most economically costly pandemics in history.

The upside risk scenario

The positive risk scenario looks much like the baseline U-shaped scenario, but the recovery is faster, like a V-shape.

The virus outbreak is being contained and the number of critical cases is kept controlled as the containment strategies works and weather conditions improves. The very significant policy easing that has been implemented will provide the economies with a massive boost once the recovery gets started. Many of the crisis facilities that were implemented gradually during the global financial crisis have been in place at the onset of the current crisis, leading to a faster and more decisive policy responses, which bodes well for a fast recovery.

In this scenario we expect global growth to end around 0% in 2020 and 5% in 2021.

The downside risk scenario

Several risks have the potential to make any eventual recovery very gradual and seem more like an L-shape than a U-shape. The virus could come back in a an aggressive second and even third wave, prompting the shutdown to continue for much longer than earlier expected and even much more severe repercussions to the economy. The number of unemployed people rises sharply in line with major defaults and close downs of companies. Consumption and investment activity remains depressed. Real estate prices plummets, credit risks rises further, spreads are widening, and banks will be burdened by bad loans. An outright financial sector crisis will extend the downturn and make the recovery much shallower.

Graph 1. Growth scenarios. Global growth pct. y/y

Read all our Corona related research here: Nordea Markets Corona research