Nordea skriver i en analyse af inflationens virkninger, at der på samme tid både er inflation og deflation. Banken hæfter sig ved, at den helt store risiko er, hvor meget forbruget og boligpriserne vil falde. Aktiemarkederne er faldet kraftigt siden nytår, og inflationen er blevet så vedholdende, at ingen længere taler om et midlertidigt fænomen. Energi- og fødevarepriserne er steget dramatisk, og nu kommer er den afgørende periode, begyndende med data i denne uge fra USA: Hvornår begynder forbruget at falde, og hvornår kommer der fald i boligmarkedet?

Uddrag fra Nordea:

Week Ahead: Inflation and deflation at the same time

It’s all about inflation. No, not when it comes to asset prices. There are good reasons to be concerned about price increases of goods and services. But at the same time, there is also reason to be concerned about price decreases of financial assets.

“It looks increasingly unlikely that the disinflationary dynamics of the past decade will return” – ECB President Christine Lagarde (this week)

Transitory deflation in asset prices?

Inflation data out this week was another piece of evidence that inflation pressures are firm and a return to central banks’ long-term inflation target will take time. No central banker uses the word transitory any longer when it comes to inflation. At least not when it comes to price increases of goods and services.

When it comes to financial assets, it’s all about (sharp) price decreases, that is, deflation. Equity and bond prices have plummeted this year and especially the recent sell-off in American equites is worrying. US technology shares have been in a bear market for some time now (down more than 20% from the top in the last 52 weeks), and Wednesday this week the Nasdaq closed down 29% from the top last November. And the S&P 500 closed down by 18% from the highs of early January this year. Hence, the S&P 500 is heading into a bear market as well.

For several years there were no price pressures when it came to goods and services while asset prises only knew one way, and that was higher. Now everything has turned upside down.

Let’s hope deflation in asset prices turns out to be transitory. That will not be the case for price increases of goods and services.

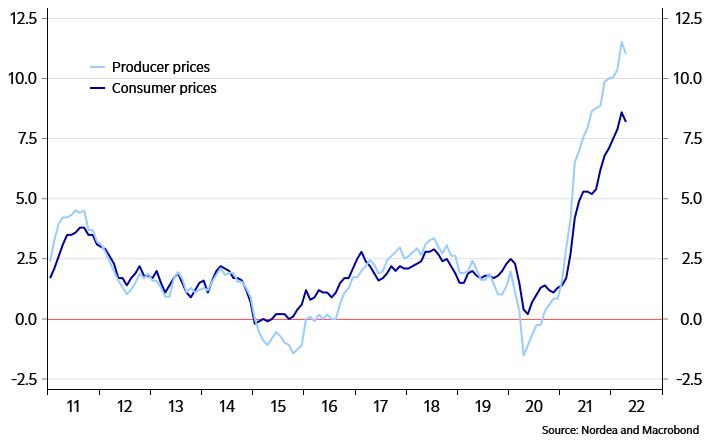

Chart 1. US inflation stays elevated, % y/y

Higher commodity prices, wages and interest rates all weigh heavily on costs, and there is little doubt that companies will try to pass the buck on to consumers and might succeed in doing so as long as labour markets stay tight in Europe and North America.

Energy prices stay elevated and will probably do so as long as there is no positive development in the war in Ukraine. But metal prices have begun to move lower as demand from China slows. However, food prices continue to rise and that is a big concern as there is no quick fix to the imbalance between demand and supply when it comes to the agricultural sector. One can only fear that the situation will get worse.

The FAO’s world food price index has increased by almost 20% since the beginning of the year. Wheat prices are up by 50% and soybeans by 33%. Wheat production in Ukraine will not only be hit hard this year, it will also be the case for next year. And food prices would be heading for the perfect storm if weather conditions suddenly were to take a turn for the worse.

Chart 2.FAO world food price index

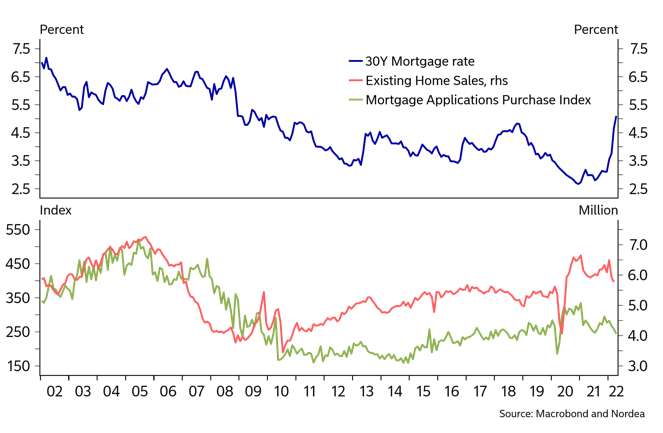

Another area to be concerned about is the housing market. If suddenly property prices were to drop, it would deal a severe blow to consumer sentiment and consumption. We’ll pay attention to housing data from the US next week.

What’s most important in the week ahead

This week features a fresh batch of economic data from the US and the UK. In the US we will pay close attention to the Philly Fed manufacturing survey (Thursday), retail sales data (Tuesday) and housing market data through existing home sales (Thursday) and mortgage applications (Wednesday). In the UK this week offers labour market data and inflation data, which will be central for the Bank of England’s policy path.

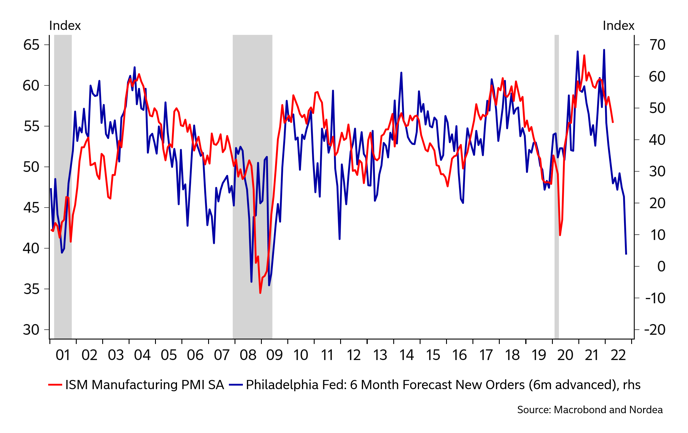

In the US we will get new sentiment figures from the Philly Fed manufacturing index, which has shown a material slowdown in the expectational component. The development adds to a large pile of evidence pointing to a contraction in the manufacturing industry, which is weighed down by poor consumer sentiment and shortages of input materials and labour. Recently, growth has deteriorated materially, impacted by financial conditions and renewed supply-chain disruptions as China struggles with its zero-covid strategy, which all add to a worrying outlook.

Chart 5. Philly Fed points to severe ISM contraction

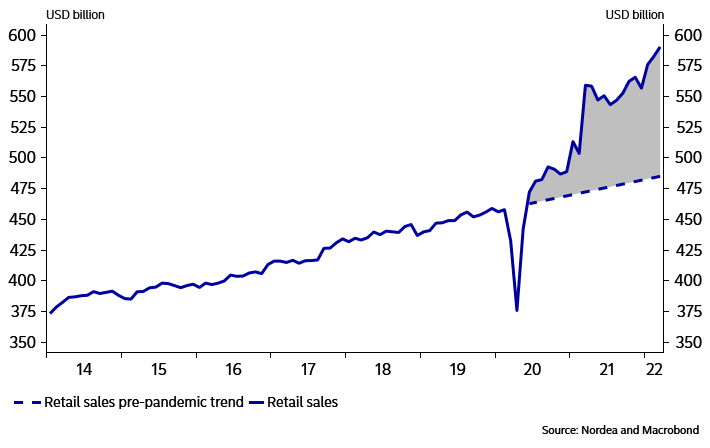

Turning to US consumption, we look for retail sales to moderate towards more trend-like growth. US households are faced with alarmingly high inflation and dwindling stimulus boosts from policy. Even so, consumption has managed to stay on trend also in real terms, which underscores the strength of households’ financials. Looking ahead, eroding purchasing power and spending of savings should weigh on demand, which is supported by the pick-up in credit during Q1 2022.

Chart 6. Retail spending remains strong

While consumption is surprisingly strong, there are already signs that higher rates are hurting the US housing market, the more interest rate-sensitive part of the economy. The average US 30-year fixed-rate mortgage rate has risen to 5.1% from 3.2% since the start of the year. This is negatively impacting home sales and will likely dampen the great housing boom. Looking ahead, it will be key to follow the health of the property market, which is the largest contributing factor to household wealth and therefore consumers’ behaviour.