Den svenske nationalbank, Riksbank, var i går mere høgeagtig end ventet. Repo-renten blev hævet med 25 basispunkter til 0,25 pct., og desuden signaliserede Riksbank flere rentestigninger i resten af året. Det fik Nordea til at ændre sin forudsigelse. Banken venter yderligere tre rentestigninger i år til 1 pct. ved årets udgang. Nordea vurderer, at det er en rigtig beslutning fra Riksbanks side, fordi inflationen er blevet forværret – som overalt i Vesten. Riksbank har også sænket sin vækstprognose. Både Riksbank og Nordea venter en vækst i 2023 på under 2 pct.

Riksbank review: Hitting the brakes

Today’s message from the Riksbank was more hawkish than expected. The repo rate was hiked and the bank signals several rate hikes this year. We change our forecast and now see three additional rate hikes this year, bringing the rate to 1% year-end.

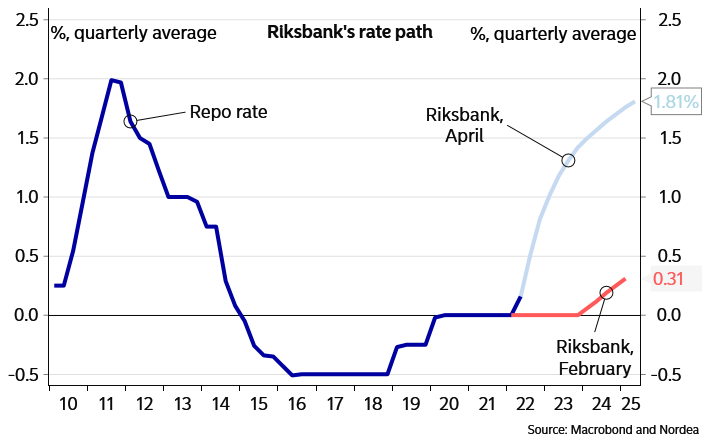

The Riksbank hiked the repo rate by 25bp to 0.25%. There was a lot of uncertainty ahead of today’s rate decision. Our main scenario was that the Riksbank would stay on hold, but we saw a rather high probability of a rate hike.

The rate path was revised upwards massively. The rate path has a 100% probability for 25bp rate hike in June, 100% for an additional 25bp rate hikes in September, and more than 90% for a repo rate at 1.00% in November. The rate path is frontloaded, with many hikes near-term but levelling out as from 2023. The press release also says 2-3 additional rate hikes this year.

As for the balance sheet, bond purchases are to be halved from H2 this year to SEK 18bn per quarter, staring in Q3. The bank’s previous forecast was to keep the balance sheet unchanged throughout 2022.

The Executive Board was unanimous in its decisions.

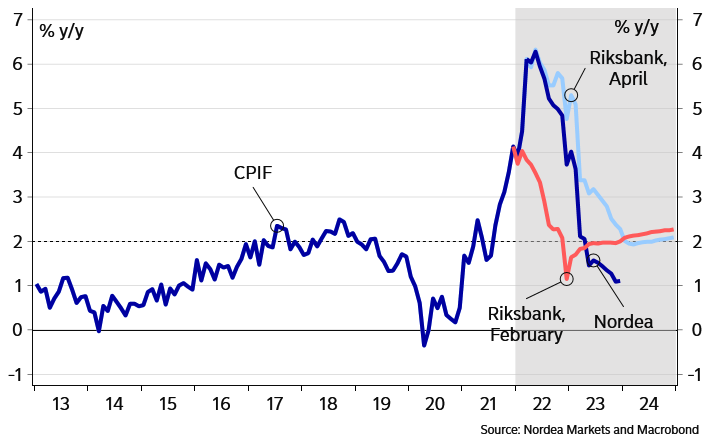

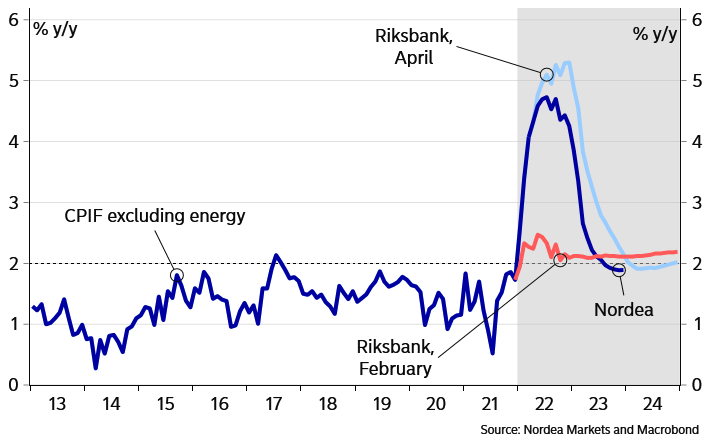

The Riksbank’s inflation forecast is higher than our view. We nevertheless see the bank’s forecast as reasonable as we see upside risks to our forecast. The GDP forecast was revised down with reference to the war in Ukraine, as expected.

As expected, a theme in the report is that the bank will do what it takes to bring down inflation. The Riksbank states that the ”…task of monetary policy is to stabilise inflation close to 2 per cent and the Riksbank will do what is required to achieve this. In this scenario, a considerably tightening is required to bring inflation back to target.”

All in all, the Riksbank is hitting the brakes and a bit harder than we had expected. The bank is taken by surprise by the upsurge in inflation and will take decisive action in the near-term to bring it down. Rate hikes in June are a done deal, and we will probably see rate hikes in September and November as well . Thus, we change our forecast and now see three additional rate hikes this year, meaning a total of four rate hikes this year and a repo rate at 1.0% by year-end 2022 (our previous call was in total 3 rate hikes in 2022). Longer out, we expect economic activity and inflation to slow enough for the Riksbank to leave the repo rate unchanged during 2023. This is to some extent supported by the Riksbank’s rate path as it levels out already from next year.

Nordea’s Economic Outlook is due out on Wednesday 11 May.