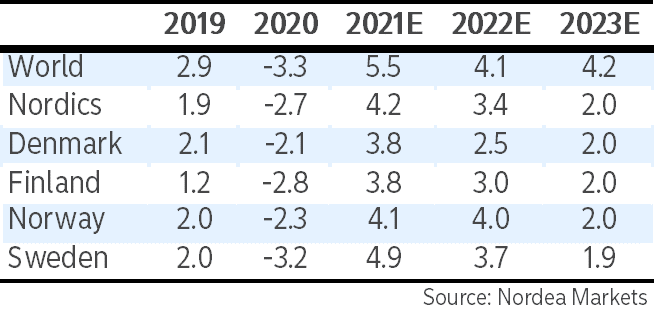

Ganske vist hærger pandemien stadig, og inflationen er røget i vejret. Men de nordiske lande hører til de lande, der er kommet bedst gennem krisen. Da krisen toppede i 2020, havde Norden en mindre minusvækst end verden som helhed. De havde en vækst sidste år på 4,2 pct. mod en global vækst på 5,5 pct. Sverige klarede sig bedst i Norden. I år vil den nordiske vækst falde til 3,4 pct., vurderer Nordea, og Danmark vil ligger et godt stykke under gennemsnittet med 2,5 pct. Næste år venter Nordea, at alle nordiske lande vil ryge ned på en vækst på 2 pct. Danmark er kommet tæt på fuld kapacitet, og huspriserne vil stige mindre end hidtil, vurderer banken.

Nordea Economic Outlook: Heating up

The new Economic Outlook is out now!

The pandemic continues to rage, but the global economic outlook remains benign. After a solid 5.5 percent growth in 2021 we expect global growth to land at 4.1 percent this year and 4.2 percent in 2023. says Helge Pedersen, Nordea Group Chief Economist. New resistant variants of the virus, increasing geopolitical tensions and high inflation pose the greatest risks to the growth prospects

The Nordic countries are among those that, measured on all parameters, have fared best through the pandemic and the economic outlook remains solid.

The Danish economy is now operating close to capacity. The shortage of available resources makes it difficult to boost activity without generating higher wages and higher prices. After a period of high turnover and sharp price rises, the housing market is now moving into a new phase. Here the combination of higher financing costs and existing regulations is expected to slow the increase in selling prices.

The Finnish economy has almost fully recovered from the recession caused by the coronavirus and is currently in an upswing, however, the spread of the Omicron variant will dampen economic growth in the first quarter of the year. The service sector will continue its recovery later this year although elevated inflation is chipping away at consumers’ spending power. Investments are expected to pick up on the back of high demand in the manufacturing sector, residential construction growth and the green transition.

The recovery of the Norwegian economy last year was the fastest and strongest in history. Over the year, Norway went from plenty of idle resources and high unemployment to capacity and labour shortages. Omicron seems to be just a bump on the road and growth looks set to remain solid going forward. Price and wage growth is picking up and Norges Bank will continue its quarterly rate hikes well into next year. Both housing prices and the NOK rate should remain largely stable.

In Sweden is labour demand at a record-high and unemployment will continue down to the lowest level in over a decade. As current supply issues are expected to ease, conditions are in place for another solid year for household consumption and exports. Despite exceptionally benign financial conditions and increasing signs of overheating, inflation looks set to fall below the 2% target later this year. This, in turn, will prompt the Riksbank to leave the repo rate unchanged at zero until at least the end of 2023.