Nordea mener, der er en reel risiko for, at Brexit-aftalen bryder sammen – eller rettere, at EU og UK tvinges til at vende tilbage til forhandlingsbordet. Det kan føre til fald i pundet, og det kan udskyde Bank of Englands plaer om at hæve renten. Affæren bunder i, at Boris Johnson leger med tanken om at bruge artikel 16 i Brexit-aftalen for at undgå check af handelen mellem UK og Nordirland. Årsagen til affæren er, at handelen mellem Irland og Nordirland er steget dramatisk siden briternes udtræden af EU, mens handelen mellem Nordirland og UK er gået tilbage. Ender det med en handelskrig mellem EU og UK, bliver det et ekstremt hårdt slag for UK, der slet ikke har oplevet den fremgang med en voksende global handel, som Boris Johnson påstod. UK har ikke fået en nævneværdig stigning i handelen med landene uden for EU, mens handelen med EU er gået tilbage.

GBP: Oh god, not again! The Brexit deal in chance of collapse..

Here we go again. Brexit-risks are back in the limelight as Boris Johnson considers invoking Article 16 in the Northern Irish protocol, which will throw the parties back at the negotiations table. This is a digital risk event for the GBP and BoE.

Highlights:

– A triggering of Article 16 is now our base case, which will likely lead the BoE towards fewer hikes than priced

– EUR/GBP is probably headed towards higher levels, if Brexit risks are reintroduced (we target 0.88)

While negotiations on the Northern Ireland protocol are deadlocked, diplomats are now expecting Boris Johnson to trigger Article 16 within weeks. Under the terms of the post-Brexit trade agreement, Northern Ireland was kept part of EUs single market for goods to avoid a need for checks along the Irish land border as goods enter EU. This means that products moving from Britain to Northern Ireland are subject to checks and controls, which according to the British government is damaging trade and supply lines. The European Commission has offered to simplify these a great deal, but Britain insists on a total rewrite of the protocol to remove most checks and controls.

The “nuclear option” Article 16 allows either part – Britain and EU – to suspend any part of the agreement that is causing economic, societal and environmental damage or trade diversion. The British government says this condition is clearly met, entitling it to invoke Article 16.

Data prints from August 2021 from the Irish Central Statistics Office reveal that exports from the Republic of Ireland to Northern Ireland had gone up 43% since Britain left the EU, whilst goods flowing in the opposite direction had gone up 77%. In contrast, 50% of Northern Irish businesses have said that the Protocol has had a negative impact on business with the rest of the United Kingdom. This trade diversion forms the context for why Britain are (probably) ready to invoke Article 16.

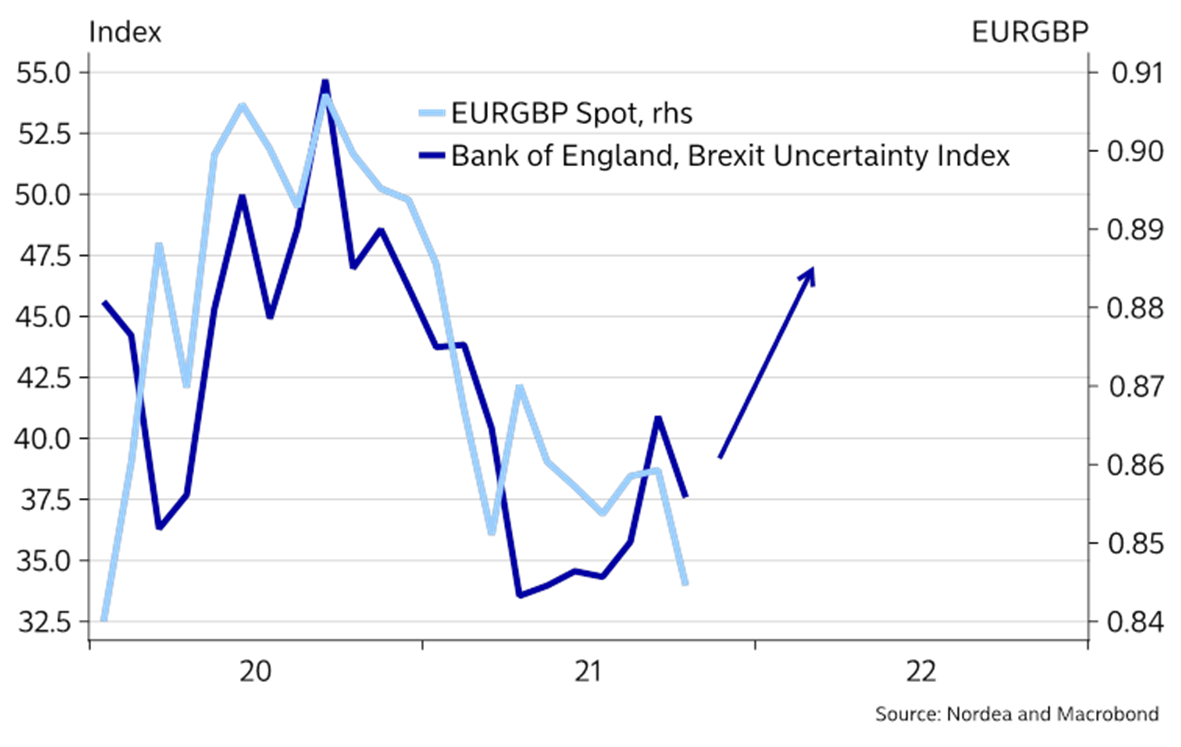

Chart 1. Renewed Brexit uncertainty to lead EURGBP higher?

Negotiations drags on, if BoJo triggers the “Nuclear Option”

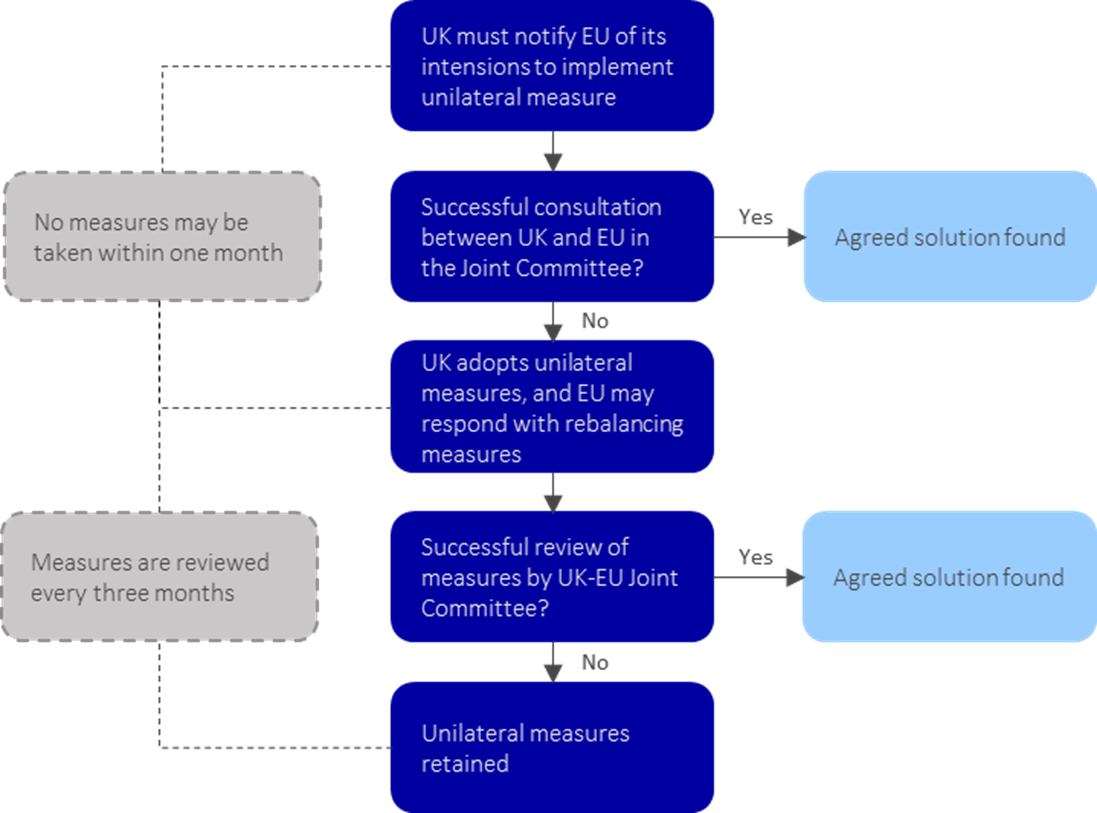

If Boris Johnson invokes Article 16, both parties should enter negotiations to find a solution and no measures can be implemented during the initial one-month negotiating period. Should negotiations fail, then Britain can adopt “unilateral measures” that will be reviewed every three month.

In practice, this could mean Britain stopping checks on goods that are being sent across the Irish Sea or on a more severe note, suspending further parts of the agreement like product standards, customs checks or VAT rules. Depending on the scenario, EU can take different “rebalancing measures”. This will most likely result in lengthy court proceedings. However, if Britain overrides the provisions on customs and the single market, the EU would respond more forcefully.

Chart 2. The process for triggering Article 16 of the Northern Ireland protocol

No-deal Brexit back on the table if Article 16 is triggered

According to Irish foreign minister, Simon Coveney, EU would might react by terminating the total Brexit trade deal, but we have obviously heard a lot of similar empty threats from the EU before. In case of a termination, a 12 month “transition period” will be seen to allow the two parts to negotiate.

This may seem familiar as it recreates a dynamic seen in the negotiations over the withdrawal treaty and the subsequent trade deal, which we have earlier described as a “prisoners dilemma”. In case that the EU suspends the deal, exporters in Britain would lose their tariff free access to the single market for goods and one would expect Britain to strike back by putting costs on EU goods. This would make British goods more expensive and much less competitive in the European single market, which is a bigger issue for the UK than the EU on a net/net basis.

It would be impossible for Britain to win such a trade war. Besides exporters, British consumers would also face rising costs. As an example, a 2017 analysis for the Institute of Fiscal Studies showed that around 30% of food consumed by households is imported with 70% of this coming from EU member states. Overall, consumers will be affected by the potential “no-deal” disruptions like supply bottlenecks and rising energy costs, increasing the cost of living. Another aspect is whether a termination of the trade deal could end up impacting Britain’s reputation. It could torpedo Britain’s credibility as a trade partner as it seeks to enter trade deals across the world.

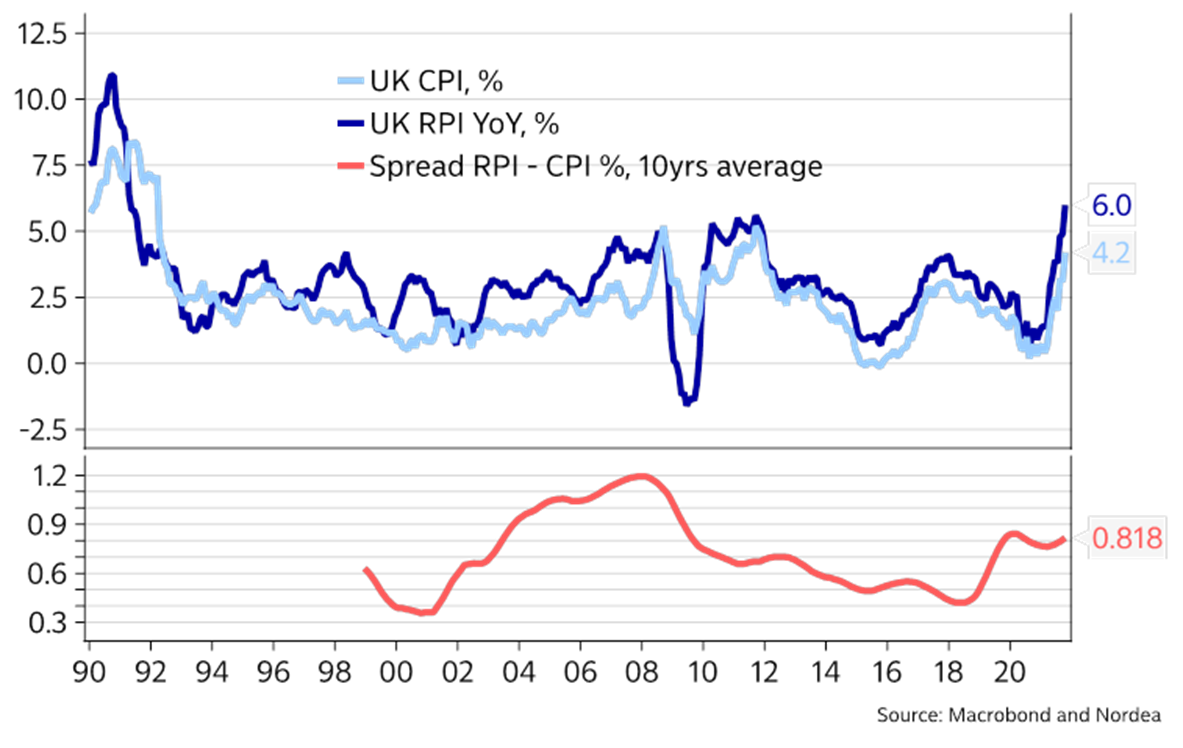

Chart 3. Inflation is moving up FAST in the UK, but is it good inflation?

Failure on Article 16 will hit rural Ireland and Britain hard

For all markets including agriculture that don’t perform well during times of uncertainty, a triggering of Article 16 is likely bad news. The triggering of the article in itself won’t be an issue, it is the outcome of the negotiation that will determinate what happens.

If the EU withdraws from the trade deal, it would mean full tariffs on Irish agricultural exports to Britain and likewise full tariffs on cross border trade on the island of Ireland. Alternatively, the EU could initiate rebalancing measures like applying targeted tariff against Britain on sensitive products such as cars, whisky or fish.

This is similar to what we saw, when EU put a 56% tariff on Harley-Davidson bikes imported from the US with other countries imposing taxes on products that mattered in Trump-supporting states. Both scenarios would be bad for Britain’s fragile economy. Nonetheless when it comes to Brexit, experience has shown that politics trump economics. With Boris Johnson’s dipping popularity, he may find it too politically attractive to fight EU ahead of the 2023 election and a new fight against the EU may come in politically handy when new unpopular lockdowns are likely to be implemented during this winter.

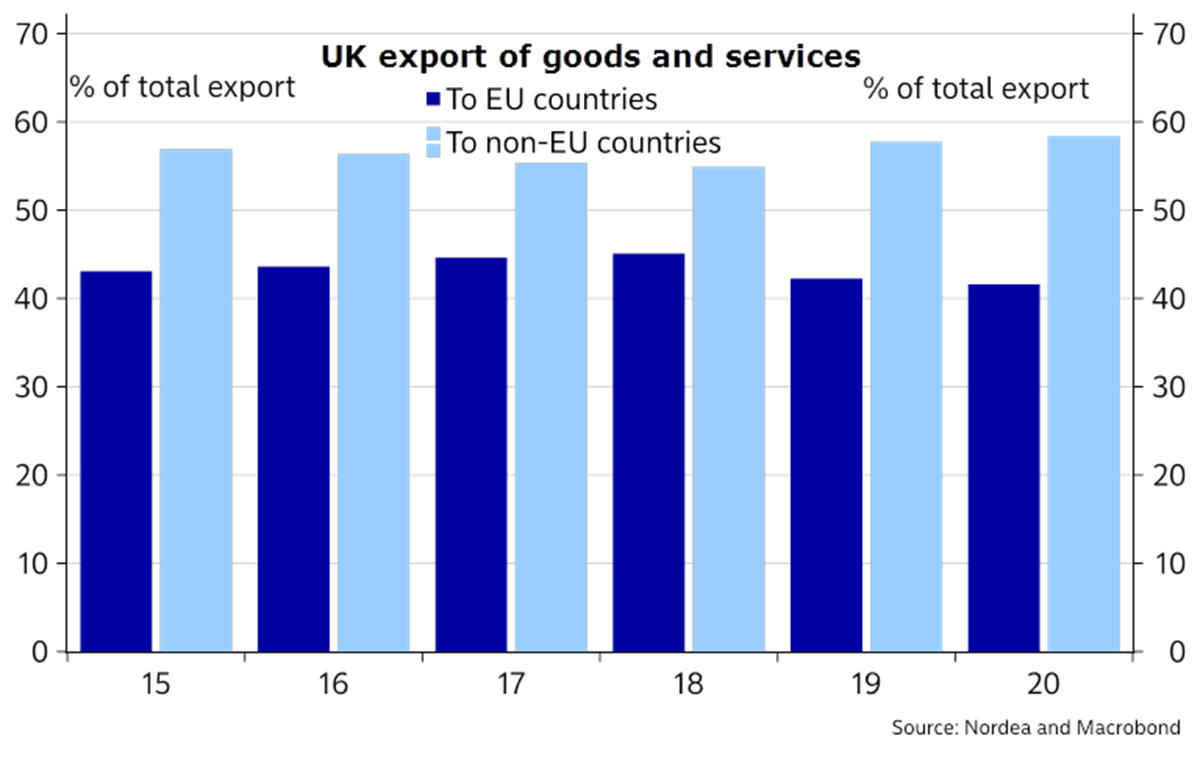

Chart 4. UK exports to the EU have slowed a bit, but still make up around 40% of all exports

What could Article 16 mean for GBP and BoE?

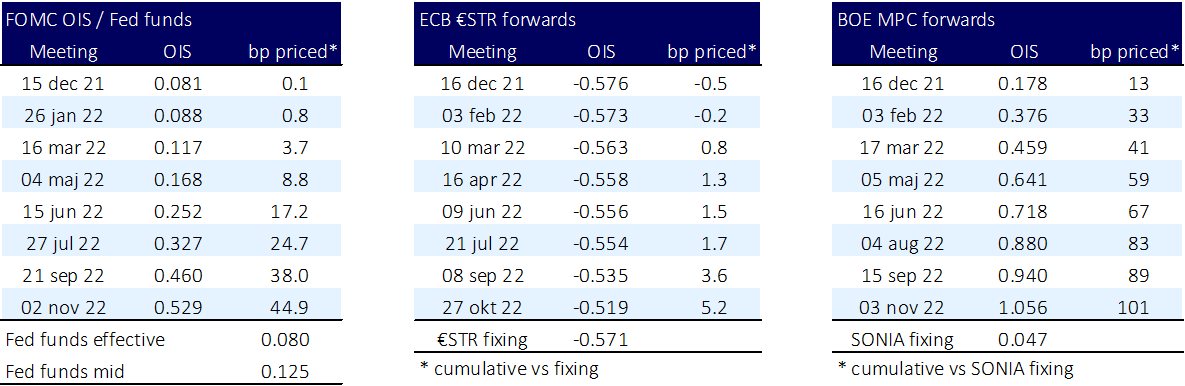

We judge that EUR/GBP is headed back towards 0.88 should the Brexit-uncertainty be re-introduced and it will likely also at least partly wreak havoc with Bank of Englands hiking plans.

Just exactly a year ago (before the trade deal was signed between the EU and UK) Bank of England decided to increase the QE program as a consequence of the uncertainty around Brexit as they wrote that “The outlook for the economy remains unusually uncertain. It depends on the evolution of the pandemic and measures taken to protect public health, as well as the nature of, and transition to, the new trading arrangements between the European Union and the United Kingdom. It also depends on the responses of households, businesses and financial markets to these developments.”

We continue to forecast two hikes (2x 25 bps) from Bank of England during 2022, and we expect them to refrain from hiking in December should the triggering of Article 16 happen before then, which we consider to be the base case now.