Nordea mener, der bliver lidt mere opmærksomhed om ECBs rådsmøde i morgen, torsdag. Hidtil var der forventing om et kedeligt møde uden nyheder, men det stigende inflationspres kan få høgene i ECB til at udtrykke mere bekymring om inflationen. Derfor venter Nordea klarere signaler fra Lagarde, omend Nordea fortsat venter en due-agtig tone fra hendes side. Først i december ventes egentlige beslutninger, også om at afslutte PEPP-opkøbsprogrammet næste år.

ECB Watch: Unwarranted expectations

The October ECB meeting was supposed to be a boring one, but given risen market expectations, now the ECB needs to emphasise its forward guidance. We expect a slightly dovish market reaction to the ECB’s message on Thursday.

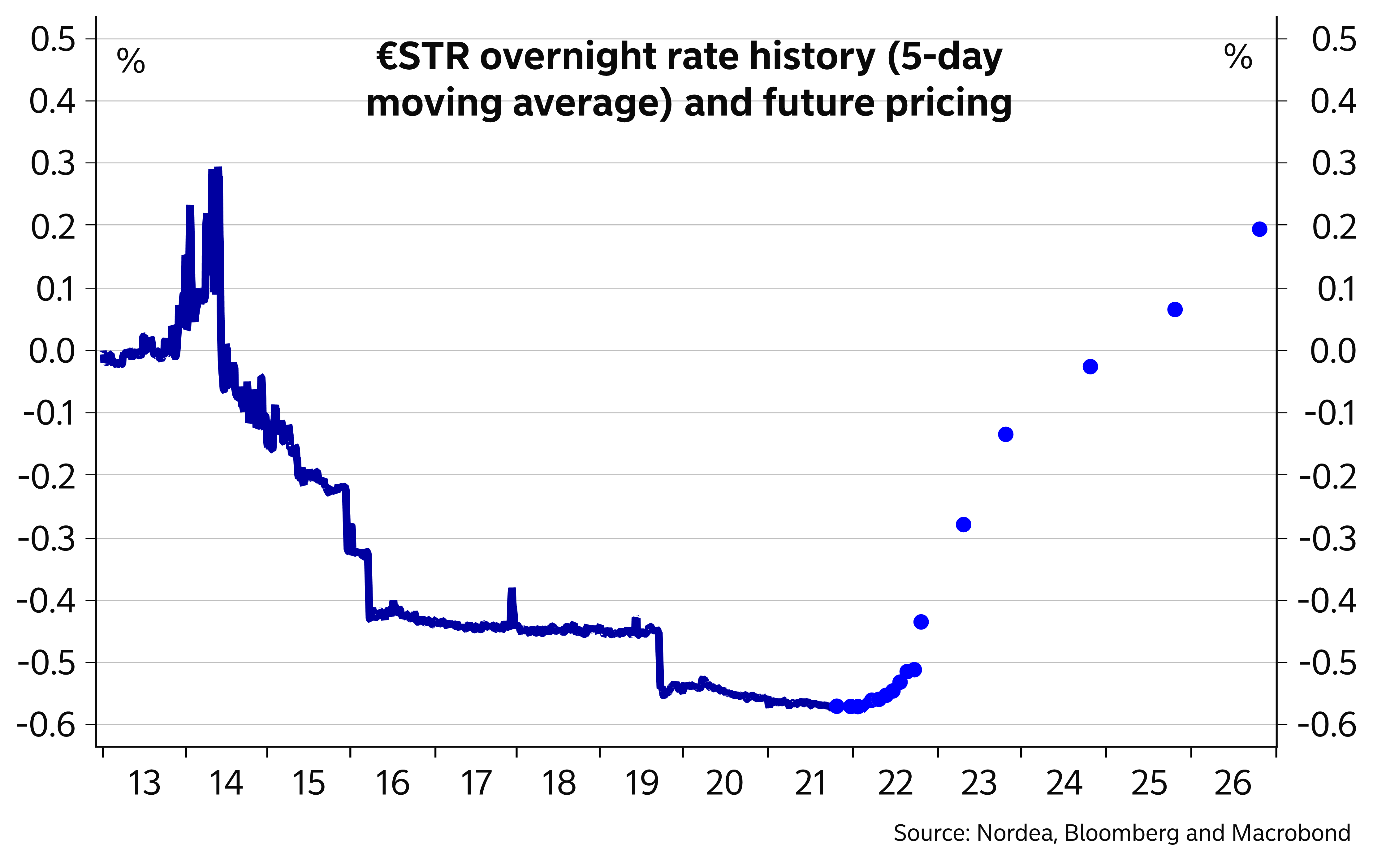

- Financial markets have started to price in clear risks of rate hikes starting already next year also in the Euro area.

- Previous ECB comments have failed to change market pricing much, and we expect Lagarde to try to emphasise the ECB’s dovish guidance on rates.

- Rapidly rising inflation expectations may already worry the more hawkish Governing Council members.

- Short-end pricing may correct somewhat lower on Thursday, but in the bigger picture global inflation worries still have room to escalate.

With the ECB making clear that the next important monetary policy decisions will be taken at the December meeting, the ECB’s October meeting threatened to be an uninteresting one. However, the recent increase in EUR rates and the pricing of higher short rates as early as next year have already prompted a verbal response from the ECB, and more will be in store at this week’s monetary policy meeting.

Chief Economist Lane, for example, commented that the markets may not have fully absorbed the ECB’s forward guidance on rates, as it was hard to reconcile the market pricing with the ECB’s clear guidance.

Such comments have failed to shift market expectations much. In fact, the €STR curve is pricing around a 10bp higher overnight rate on a 1-year horizon and close to a 15bp move by the end of next year. Given that the ECB has practically ruled out further rate cuts and the current global inflation worries, it does make sense for the short end of the EUR curve to tilt towards upside risks.

Nevertheless, it still seems rather far-fetched that the ECB will move its benchmark rates as early as next year, and Lagarde will probably seek to tone down current market pricing. Whether she will succeed better than Mr Lane in his comments is another matter.

Given the large moves seen and the likely dovish comments from Lagarde, we see risks tilted towards a correction lower in the pricing of the short end on Thursday, at least as an initial response. The ECB has been very clear that it will prevent unwarranted tightening of financing conditions, so further pricing of interest rate hikes in the short end of the curve would not be in the ECB’s interests.

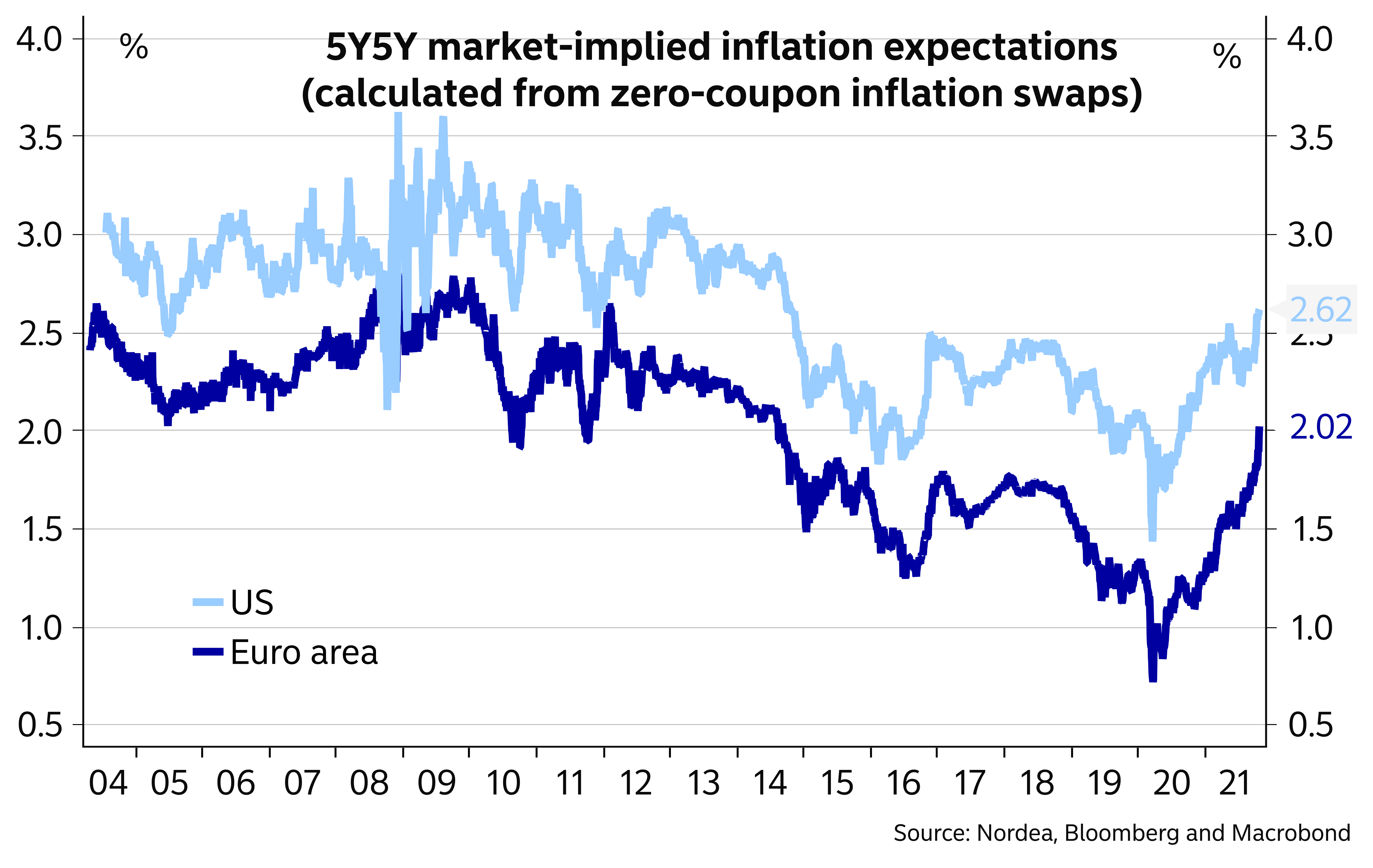

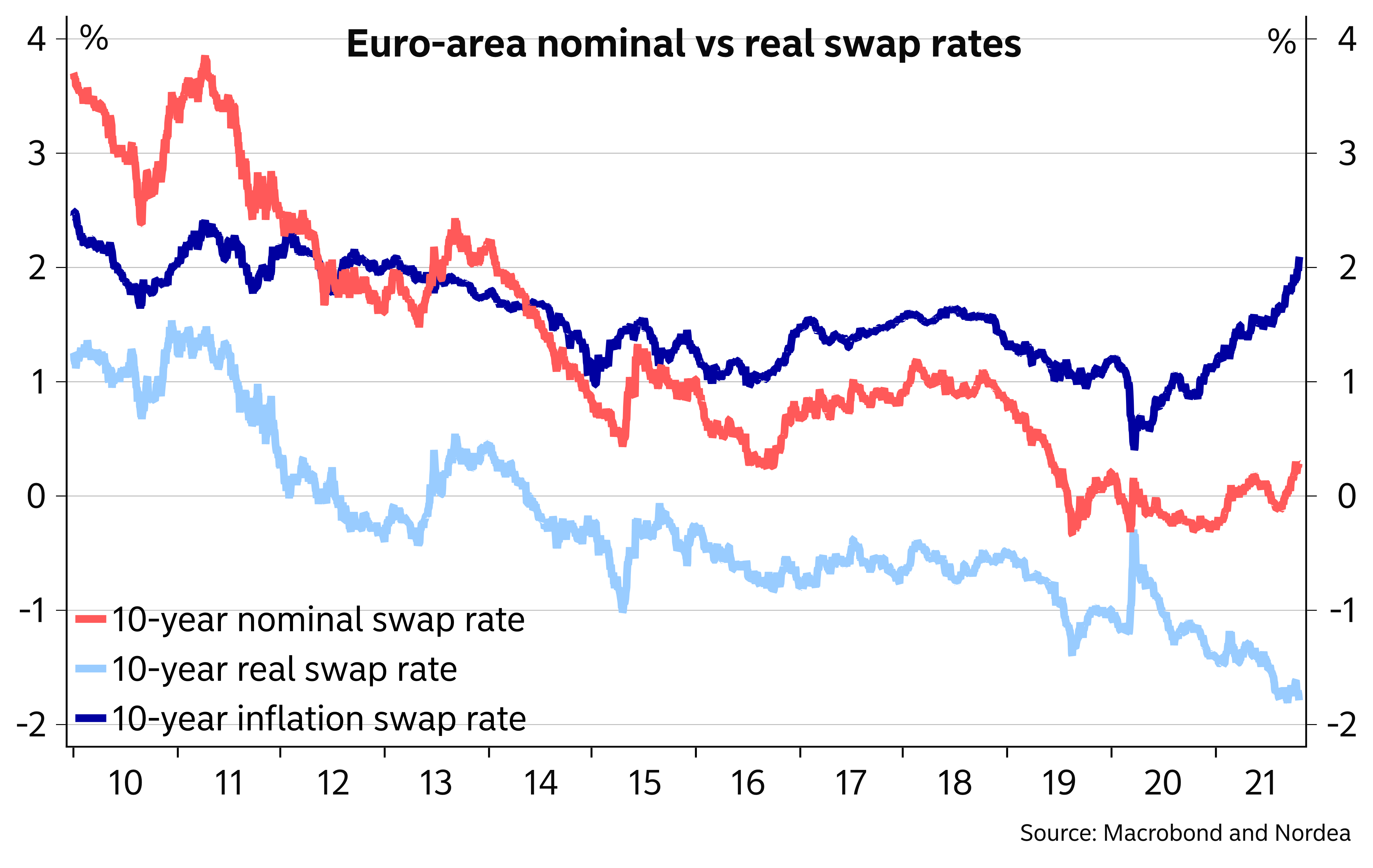

The recent developments in inflation expectations are interesting as well. That the recent rise in longer nominal rates has continued to be driven by higher inflation expectations, while real yields have stayed deeply negative, should ease the ECB’s concern about tightening financing conditions. However, the market-implied 5-year inflation expectation starting in 5 years has now hit 2% for the first time since 2014.

As this measure includes a risk premium component, one could easily argue that it is not yet fully in line with the ECB’s symmetric 2% inflation target. However, given that the measure is now near the ECB’s target and the rapidity of the move, some of the more hawkish Governing Council members may already become more worried about the inflation outlook.

While we expect such views to be reflected more in the October meeting monetary policy account rather than in Thursday’s statement or press conference, there is a chance that some of those thoughts will feature already on Thursday and may dominate the message in the eyes of the financial markets.

Nevertheless, we still find a slightly dovish market response the most likely on Thursday. Looking into the December meeting, we expect a decision to end the Pandemic Emergency Purchase Programme (PEPP) in Q1 next year along with a boost to the Asset Purchase Programme (APP). Global developments will probably keep the market focused on inflation for now, which should keep upward pressure on EUR yields as well beyond this week’s ECB meeting.