Den amerikanske centralbank vil stramme pengepolitikken endnu mere end hidtil forventet, skriver Nordea, der hæfter sig ved, at selv moderate medlemmer af centralbankens ledelse nu taler om at stramme kursen i år. Nordea tror dog, det er galmandsværk at komme med præcise prognoser for, hvornår renten vil toppe. Men markedet venter en rentestigning på 0,45 pct. på centralbankens møde i maj, og stigningen vil sammenlagt være på 2,15 pct. ved årets slutning, lyder de generelle vurderinger på markeddet. Man kan ikke udelukke, at renten stiger med 3 pct. i løbet af det første år med rentestigninger, og det er historisk usædvanligt, skriver Nordea. Det er også usædvanligt, at rentekurven skifter så hurtigt i en periode med rentestigninger, og det indikerer risikoen for recession.

Week Ahead: Repricing recession risks

The Fed is set to take US rates higher quickly. Rapid interest rate rises increase the risk of recession, but it would be almost absurd to think the market could accurately time the peak in interest rates this early in the tightening cycle.

“I expect the combined effect of rate increases and balance sheet reduction to bring the stance of policy to a more neutral position later this year, with the full extent of additional tightening over time dependent on how the outlook for inflation and employment evolves.” – Lael Brainard, Fed Governor on 5 April 2022

That also the traditionally more dovish Fed governors, such as Lael Brainard, have started talking about the need bring monetary policy to a neutral setting quickly, i.e. later this year, is a strong signal that the Fed means business. Monetary policy is set to tighten much more rapidly than seemed likely just a few months back, and that will probably mean bigger 50bp hikes at least at the next few meetings.

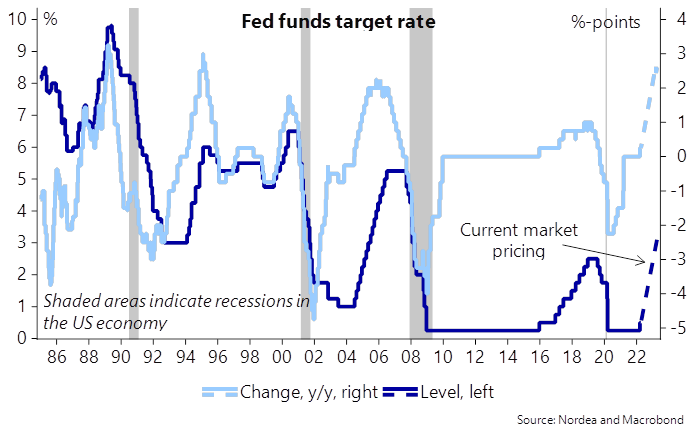

The market is currently pricing in more than 45bp of rate hikes for the May meeting, a cumulative of more than 90bp by the June meeting and a total of around 215bp by the end of the year. The pricing for the terminal fed funds rate has climbed to over 3%, clearly above the Fed’s estimate of the long-run or neutral level of 2.4%.

An increase in the fed funds rate of almost 3 percentage points over just around a year would not be unprecedented, but it would be a fast increase in rates also historically seen.

Chart 1. Markets are pricing in a rapid increase in interest rates also historically seen

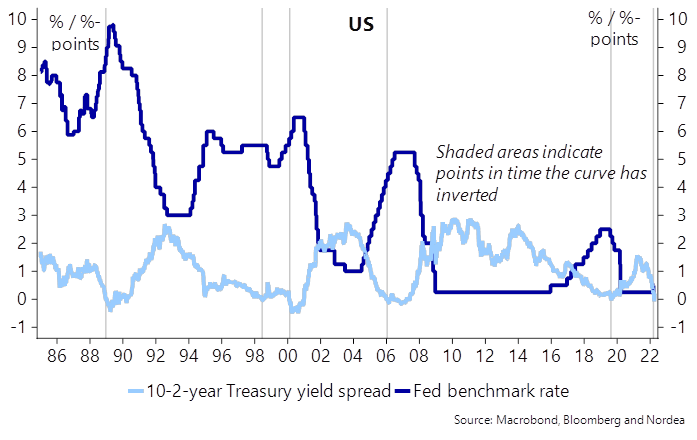

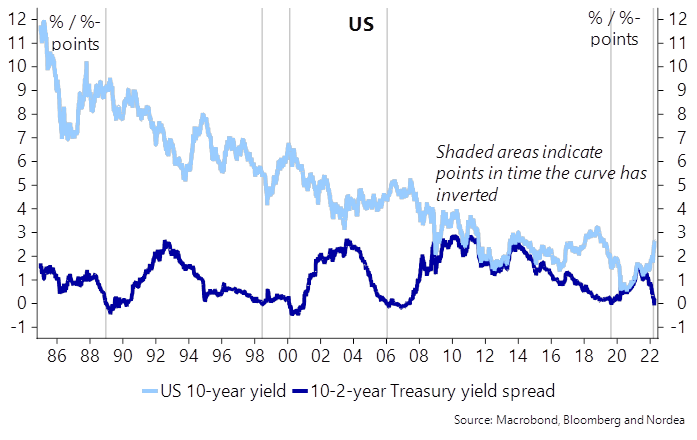

The rapid rise in interest rates is likely also the reason why the market expects rates to start to fall soon after reaching their peak. The 2-10-year yield curve already briefly inverted last month, and given that the inversion of the yield curve has been a rather good leading indicator of US recessions, both in terms of accuracy and lead time (though with some variability as to how fast after an inversion a recession has followed) , such signals should not be disregarded.

However, there are several reasons that might weaken the recession signal this time. Normally the yield curve inverts well into a Fed tightening cycle, usually towards the end of the tightening cycle. This time the inversion took place after just one Fed interest rate hike.

Chart 2. Curve inverted exceptionally early in the tightening cycle

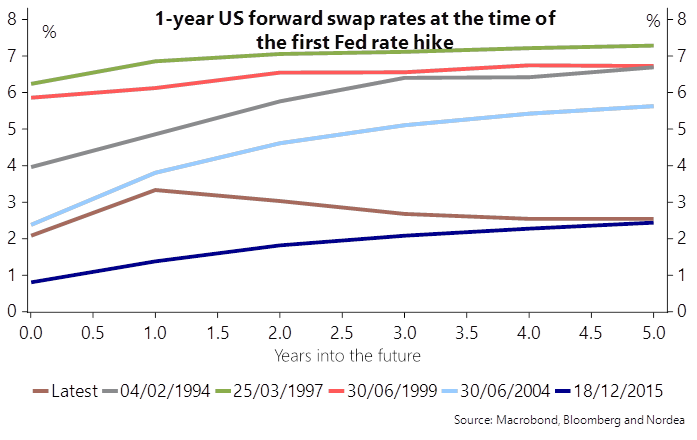

Second, the shape of the curve over the next few years looks quite odd. Usually, the curve flattens gradually after the fastest pace of rate hikes, indicating rising risk premia. This time, the curve indicates falling rates soon after the peak. Such a path looks very possible in reality, as the Fed has turned from raising rates to cutting them rather soon also before. However, it is odd to think that the market would be able to time the peak in rates this accurately at the start of the rate hiking cycle and price in a clear fall in rates soon after. Considering the vast amount of uncertainty currently prevailing, one should not have a particularly strong conviction that the market is able to price in the peak in rates and accurately.

Chart 3. It is quite exceptional for the forward curve to invert already after the first Fed rate hike

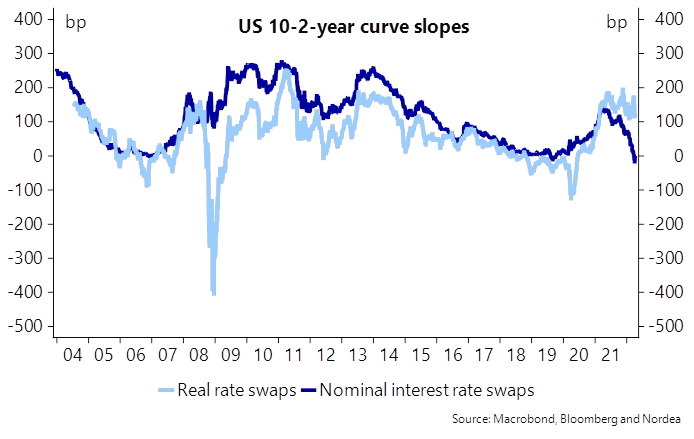

Third, the 10-2-year curve inversion is totally driven by inflation expectations, which imply much higher inflation in the near term and much lower further out. If looking at real interest rates, which should tell us more about the economic outlook, the 10-2-year curve still has plenty of steepness left.

Chart 4. The 10-2-year real rate curve not close to inverting

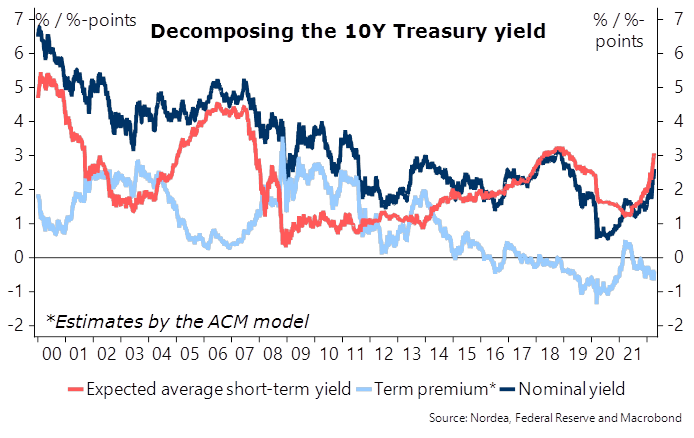

Finally, the Fed’s bond purchases have had a big impact on the curve, and as the idea of those purchases is to depress the term premium, i.e. lower long term rates, the curve should be flatter now than without such purchases.

Chart 5. Long yields would presumably be higher and the curve steeper, if the Fed had not depressed the term premium with its bond purchases

In conclusion, while we have heard the arguments of this time is different many times before, as the curve has inverted and a recession has subsequently followed, we would at least take the curve signals with a bit more than a pinch of salt this time.

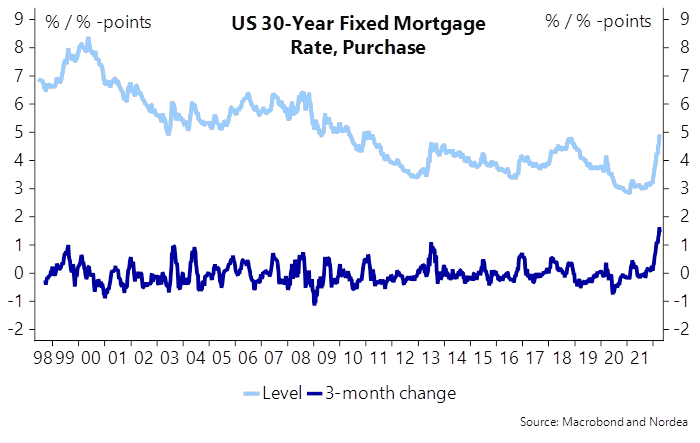

However, recession risks should not be downplayed. High energy prices are burdening the outlook for consumption and the daunting inflation situation could easily force the Fed to tighten monetary policy aggressively enough to eventually push the economy in a recession. Further, long yields have increased rapidly as well, and the housing market will certainly feel pressure after long mortgage rates have already risen by more than 1.5 percentage points in just over three months. Despite these headwinds, it would be premature to conclude a recession would be looming this early in the tightening cycle.

Chart 6. Also mortgage rates have risen rapidly

If the market would genuinely be pricing in looming recession risks, then long rates should be close to peaking. We do not buy into that and see more upside potential in longer US yields, supported also by the Fed’s quantitative tightening efforts, due to start in the coming months.