Mens EU-landene var hurtige til at godkende en gigantisk genopbygningsfond for at stimulere økonomien under pandemien, så går det trægt med at få penge ud og arbejde, fremgår det af en analyse, som Nordea har lavet. I det første halvår af 2022 venter EU-kommissionen, at der bliver udstedt 50 milliarder euro fra fonden – det er væsentligt mindre end de 71 milliarder euro, der blev udstedt fra juni til oktober i år.

Bond Watch: Slower financing for the recovery

The EU will borrow only EUR 50bn in bonds in the first half of 2022, less than expected. The benign near-term issuance outlook together with further ECB support should continue to support EU bonds early in 2022.

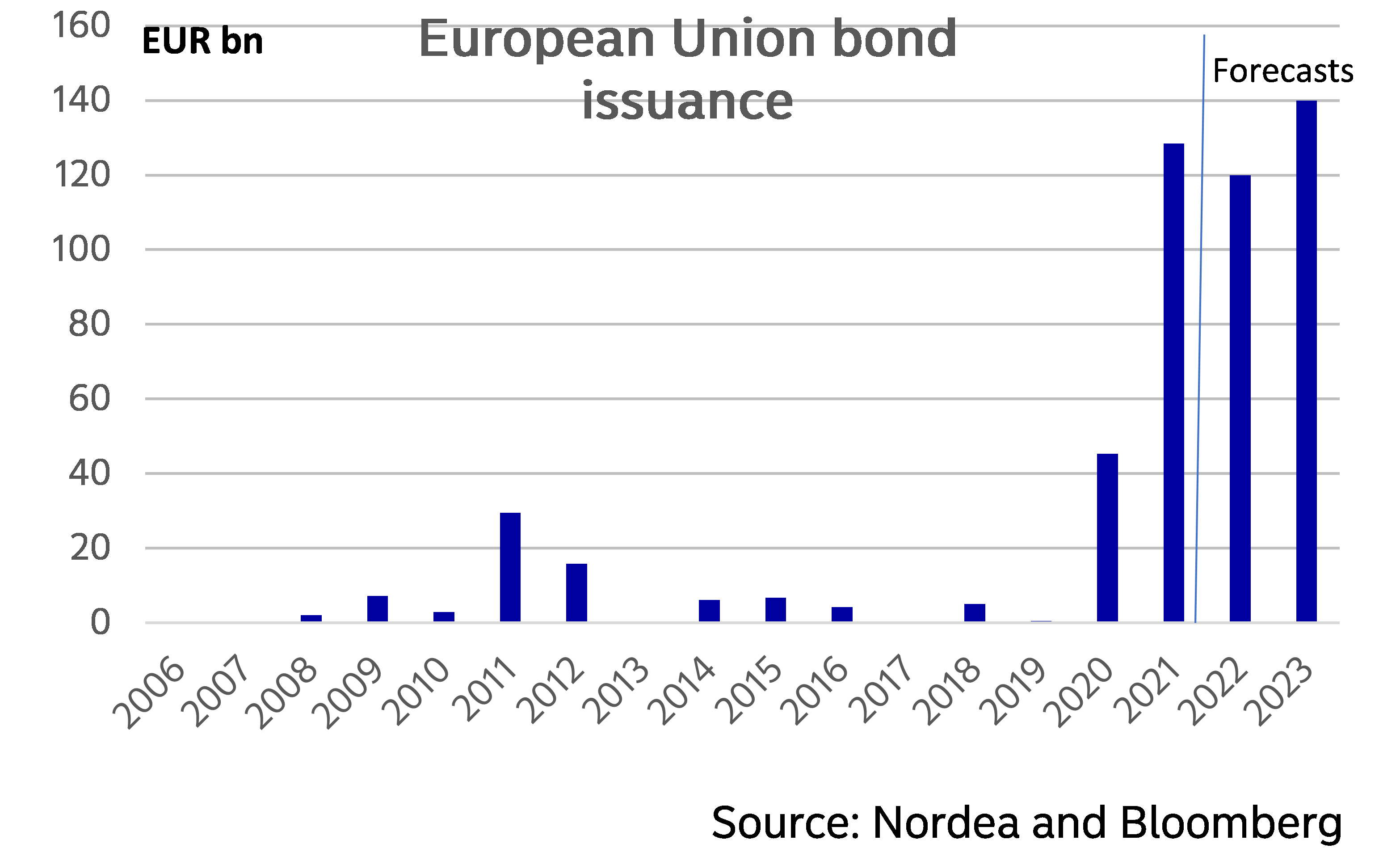

- The EU to issue only EUR 50bn of bonds to finance the NGEU programme in H1 2021, and issuance in 2022 as a whole is likely to fall compared to this year.

- First syndication will take place only in February.

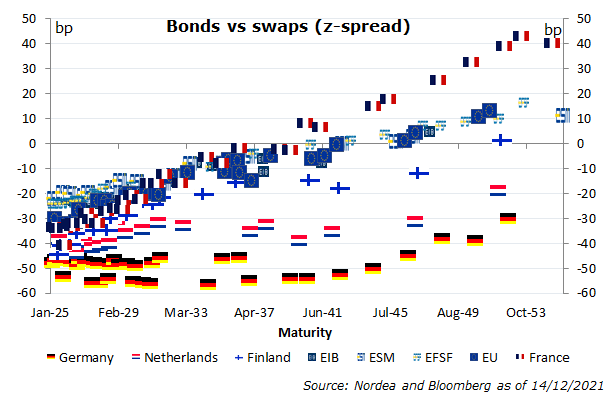

- We see further performance potential left in EU bonds, especially in the very long end.

The European Commission released the European Union funding plan for the first half of 2022. The plan foresees the issuance of EUR 50bn of long-term EU bonds during the first six months of 2022, a clearly slower pace compared to the EUR 71bn issued between June and October of this year.

The funding plan is based on the expected payment needs in the NextGenerationEU (NGEU) programme. Already this year’s original long-term funding target of EUR 80bn was revised lower to EUR 71bn in late October, implying that the distribution of money from the NGEU programme is taking more time than originally thought.

The funding plan does note that since the main part of the NGEU, the Recovery and Resilience Facility, is a performance-based instrument with payments conditional on the completion of targets set in the national recovery and resilience plans, the precise funding needs could yet change. More likely this means that the risks are skewed towards even smaller issuance volumes, if EU countries fail to meet the targets set in their plans on time. Even if the NGEU funding needs are likely to be somewhat larger in the second half of next year, the EU issuance volumes as a whole are set to fall next year compared to this year.

The first bond syndication takes place only on the week starting 7 February, while the first bond auctions will be held on 24 January. This means that the issuance pressure on EU bonds is very limited in January, when the general issuance pressure is traditionally very high.

In addition to the NGEU, the funding need for the other programmes totals an estimated EUR 5.5bn in the first half of 2022.

EU issuance now set to fall next year

Still performance potential left

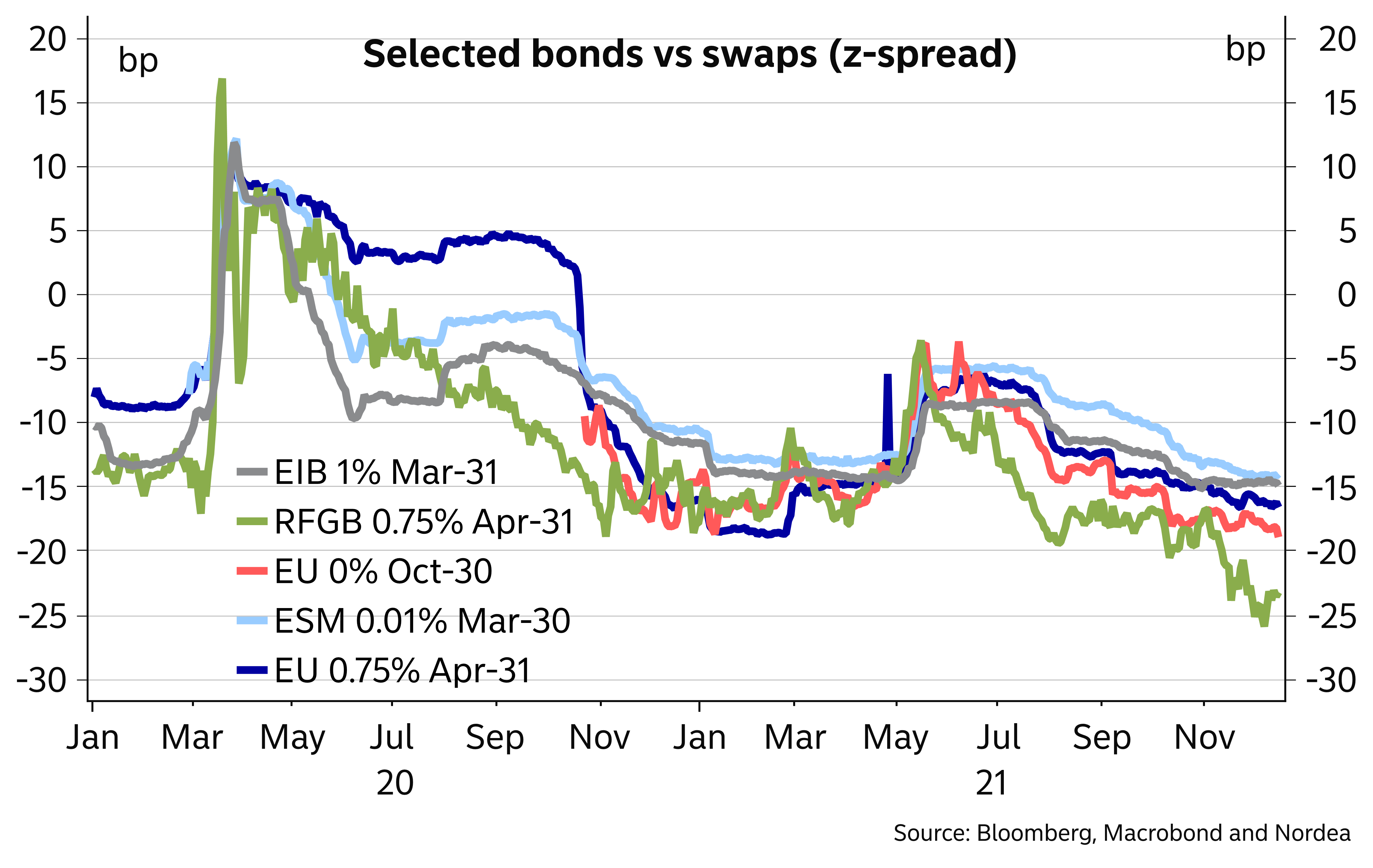

EU bonds are establishing their place as the supranational that is trading the tightest in the EUR bond markets, especially in shorter maturities. In the 2-7-year sector, the bonds offer pick-up over France, while longer out they trade clearly below French levels. In the very longer maturities, EU bonds do not stand out vs the other supranationals.

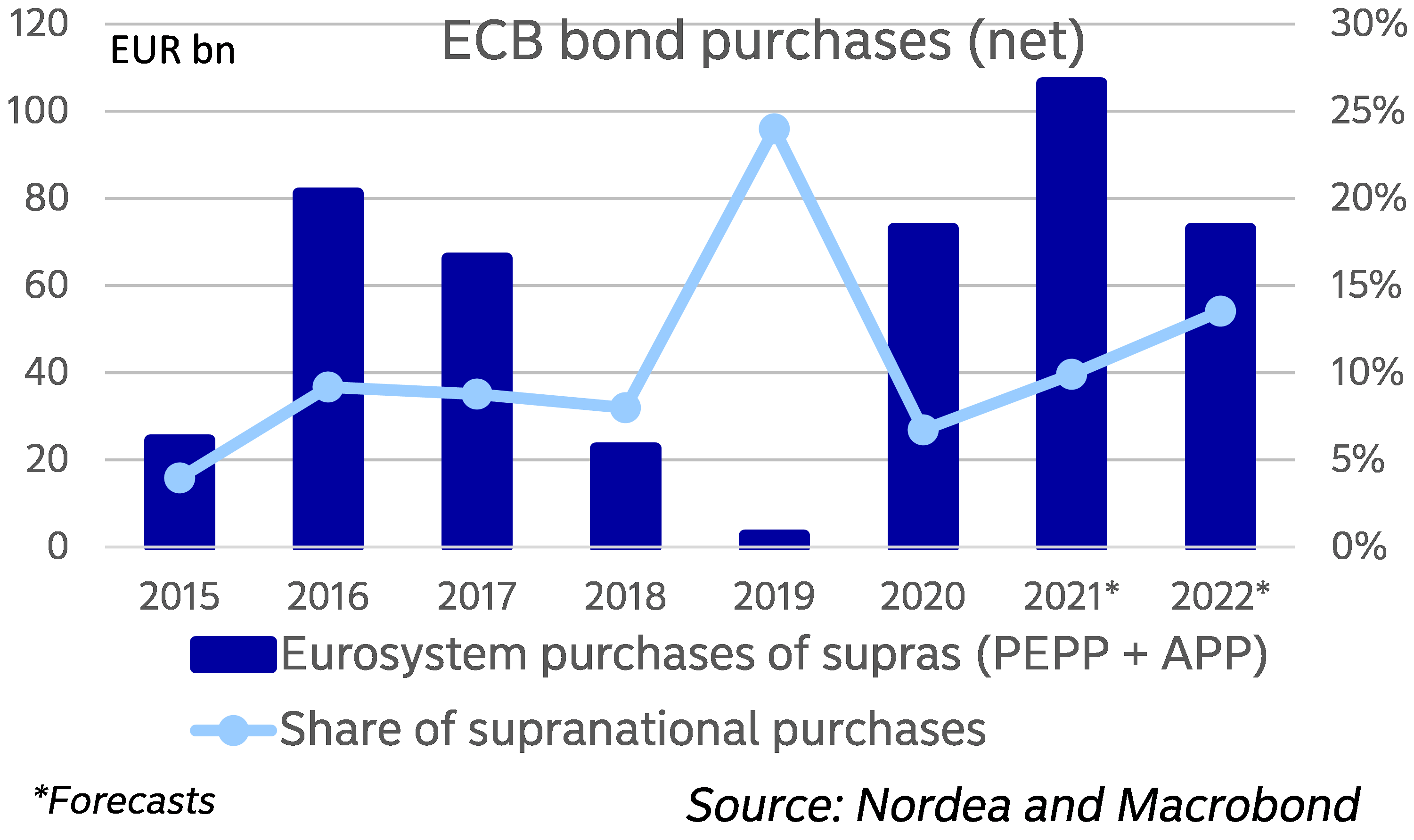

Given the benign near-term issuance outlook, we see more performance potential in EU bonds. Further support should come from ECB purchases in relative terms. Even if the ECB it set to decrease the pace of its net purchases, the central bank is likely to prioritize EU bonds in its purchases, at least to some extent.