Nordea er sikker i sin seneste vurdering af fremtiden: Det afgørende er stadig inflationen, også selv om den globale vækst falder. Derfor vil renterne også stige. Tropds dette mener Nordea, at amrikansk økonomi er langt stærkere, end tallene og vurderingerne indikerer. Nordea mener, at den finansielle stramning i USA vil blive endnu skrappere – mere end i Europa.

Major forecasts: It’s still about inflation

The global economy continues to lose momentum, but central banks will concentrate on their efforts to rein in inflation. Long yields will rebound to higher levels, while the EUR/USD has more downside left.

Many leading economic indicators have taken a beating, and recession worries have dented central bank expectations and driven long bond yields sharply lower. We argue that despite weakening global growth momentum, central banks continue to be preoccupied with much-too-high inflation and continue to tighten policy. In addition, we believe the US economy is much stronger than many seem to think.

Against this backdrop, we think that

- the Fed will deliver 50bp hikes in September and November, followed by 25bp in December.

- the ECB will hike by 50bp in September and October before moderating to a 25bp rate hike in December.

- the US 10-year Treasury yield will reach 4% next year, while the German 10-year yield will have to settle for 2%.

- EUR/USD is set to fall below parity to bottom at around 0.97 at the turn of the year.

Weaker economy not preventing more central bank tightening

It is clear that the global economy is losing momentum. Given the current headwinds, including little spare capacity, high energy prices and a war in Europe, continued Covid uncertainty and weakening real estate sector in China and elevated inflation, it is virtually unavoidable for the economy to survive unscathed. Further, amidst the current inflation problem, central banks are actively trying to hit the brakes in order to bring inflation down.

We are quite worried about the outlook especially for Europe, which could suffer much more from high energy prices and a shortage of natural gas and enter recession in the second half of the year, and for China, which still has not found a way out of its zero-Covid policies or the problems in the real estate sector.

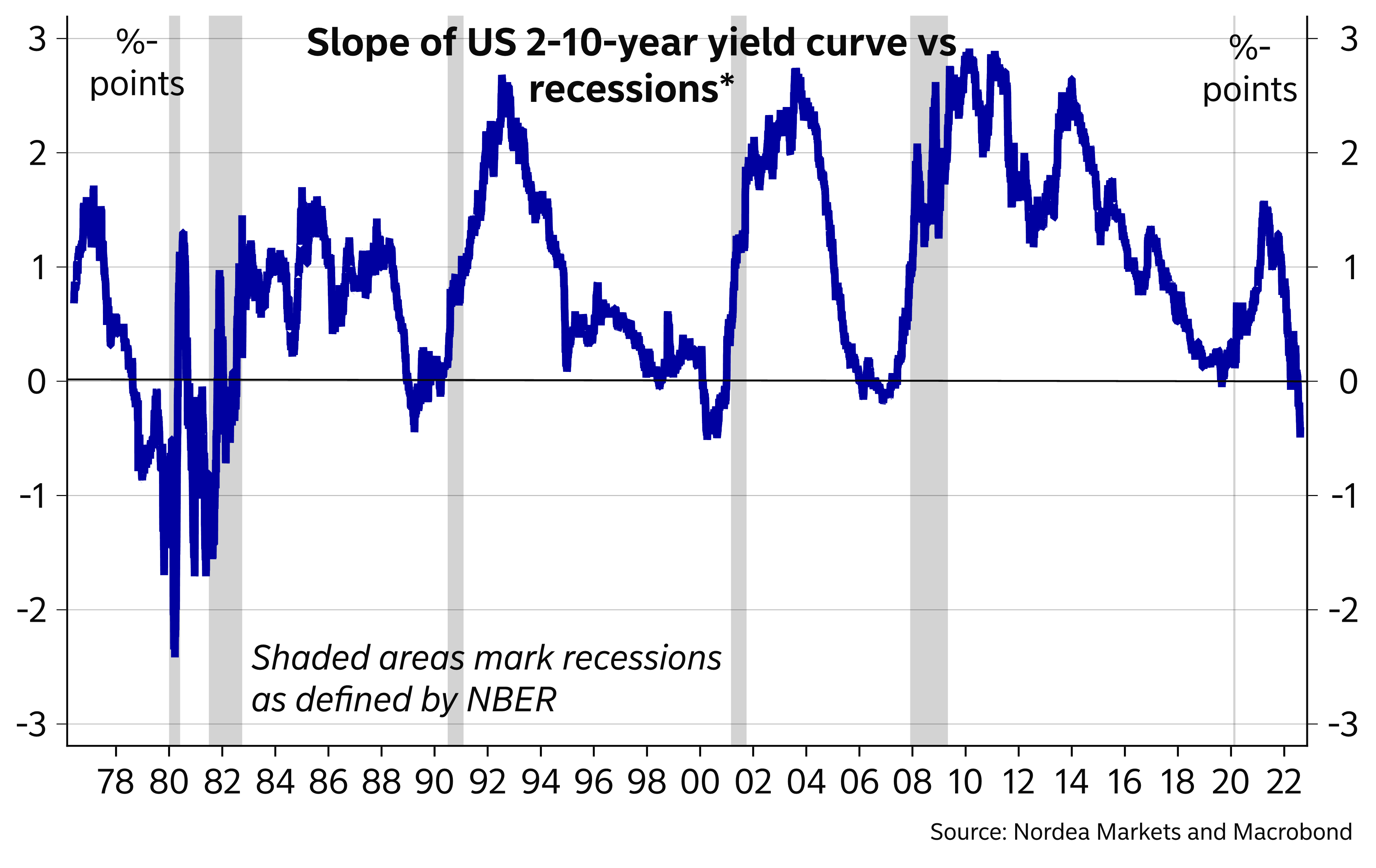

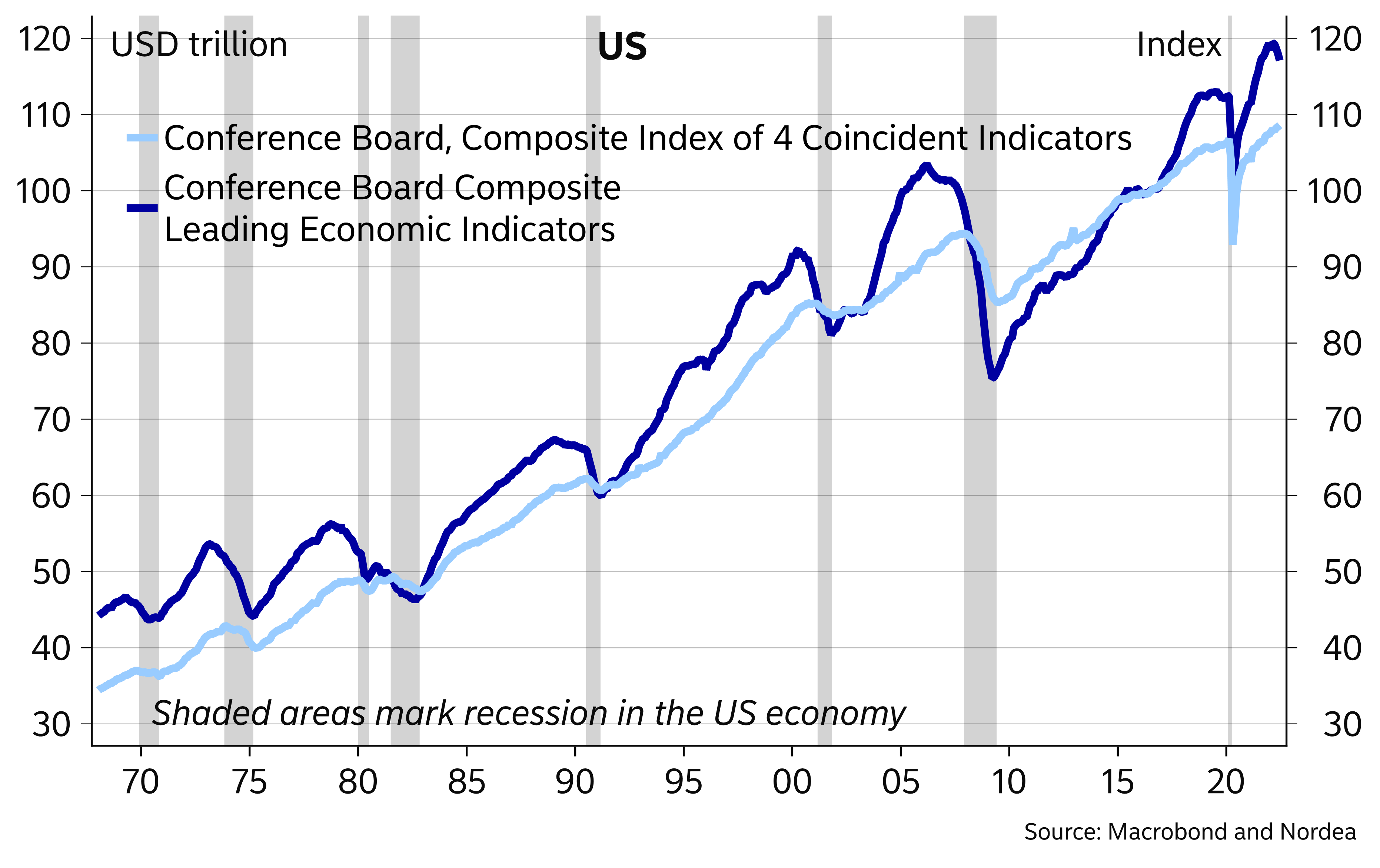

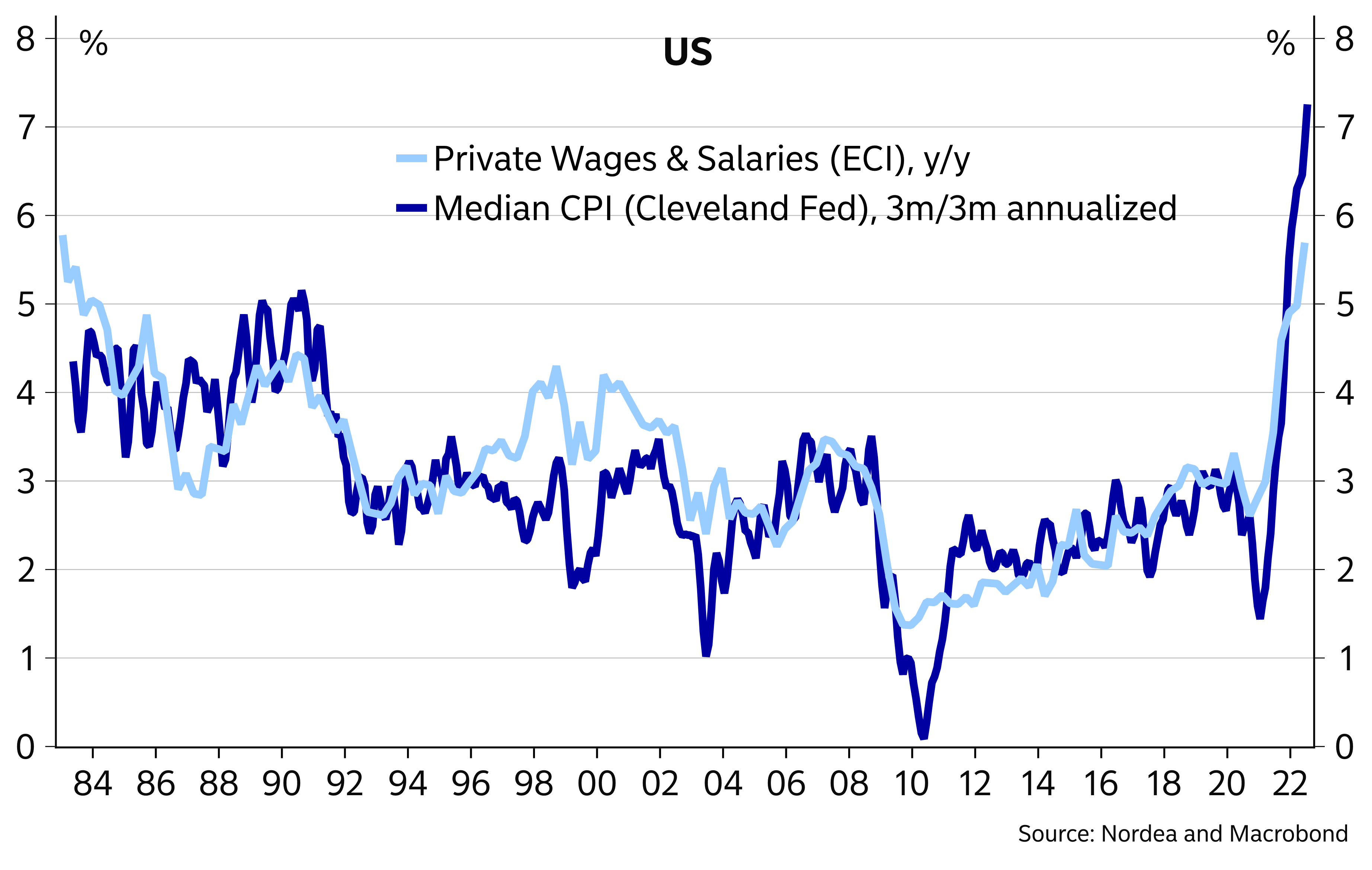

However, we do not think the US economy is on the brink of recession, but the very limited amount of spare capacity implies that growth will continue to slow. True, the inverted yield curve is signalling a recession. Further, many leading indicators have suffered, but much less than one would usually see in a recession. Many indicators of current activity, such as employment, have continued to perform well, while broader financial conditions remain rather easy. Given that a wage-price spiral seems to be ongoing for real in the US, the Fed has plenty more work to do. We expect a 50bp rate hike in September and the fed funds target rate (upper end) to rise to 4.25% early next year.

Yield curve giving clear recession signals

The case for a US recession still rather weak based on economic data

The Fed cannot ease on its inflation worries for a long time

ECB to continue policy normalisation despite severe economic headwinds

The Euro-area economy is in a much more difficult place and a recession over the winter already looks likely. However, one should not make the mistake of concluding that weaker economic performance or even a recession would prevent central banks from tightening policy further.

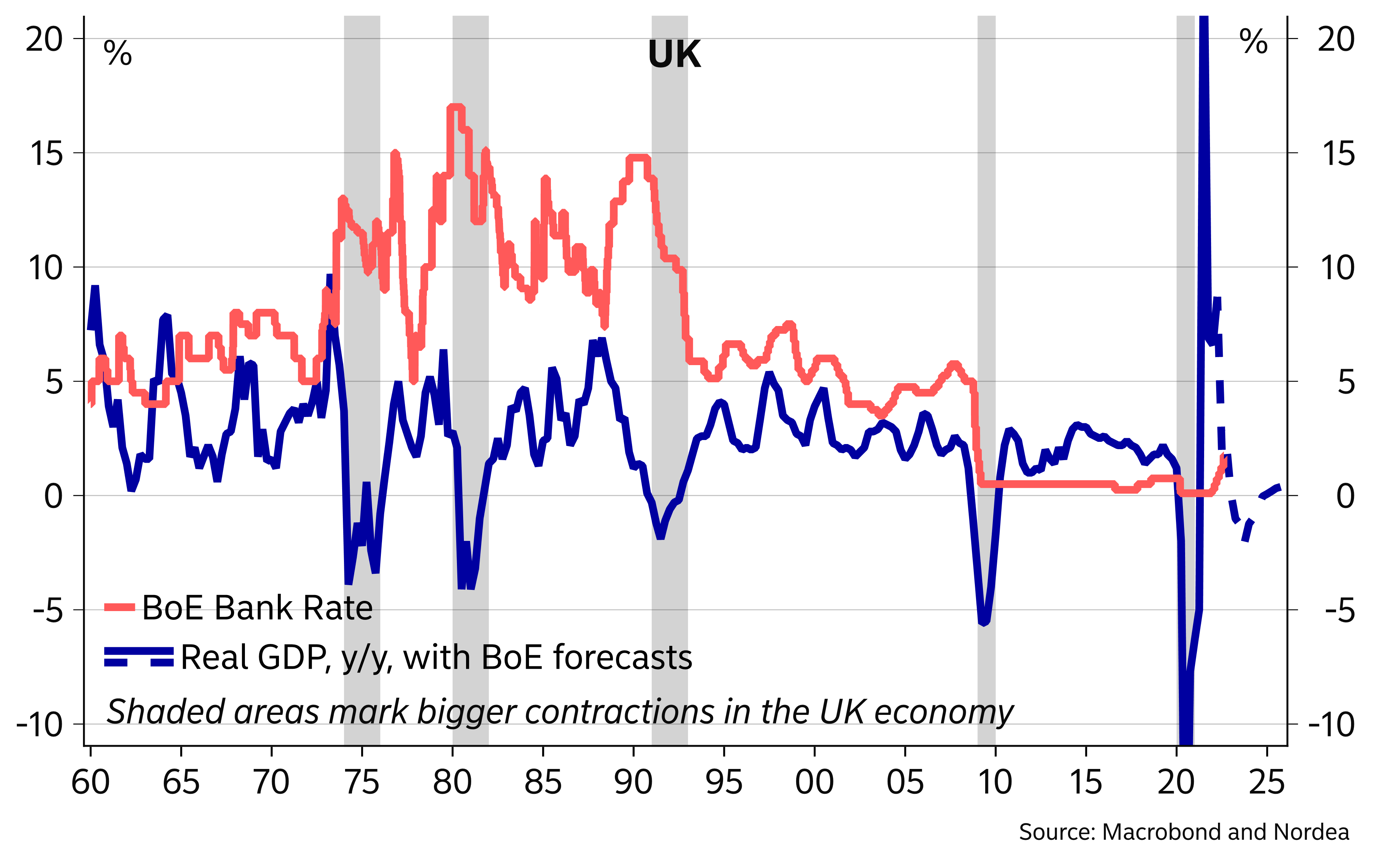

Take the Bank of England. It accelerated the pace of its rate hikes in early August and signalled more would be in store, even as its own forecasts showed the economy hitting a recession lasting almost two years, seeing GDP falling by more than 2% and expecting a very muted recovery after that. The explanation to the stance of the BoE obviously is that given where inflation is at the moment, it may take a recession to bring it down to target.

Bank of England accelerated the pace of its rate hikes even as it is forecasting a notable recession

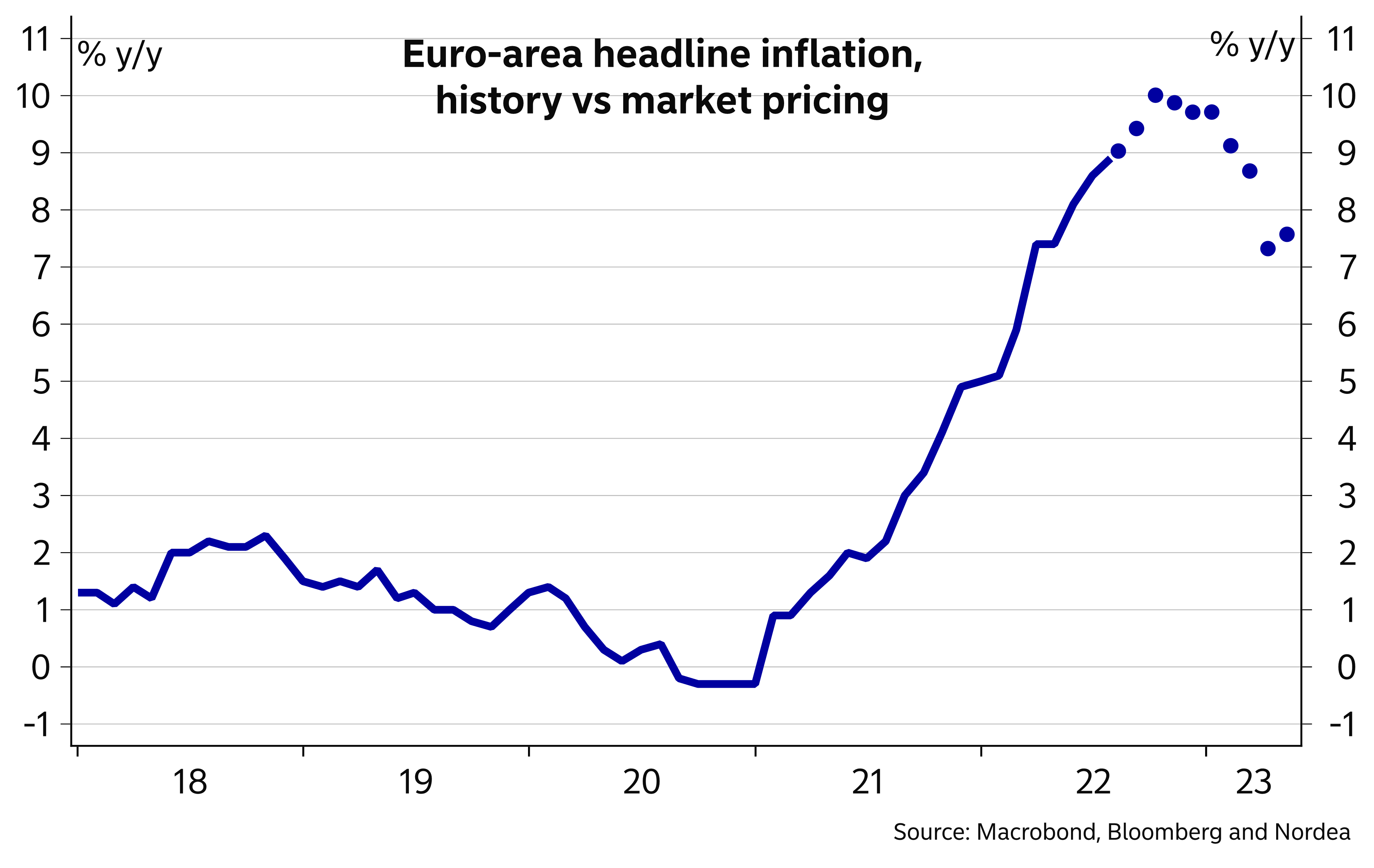

The ECB finds itself in a rather similar position. Hawks have clearly taken over, and after the ECB underestimated the inflation development for a long time, it is now tilted to rather err on the side of tightening too much, even if that means hiking rates on the brink or even in a recession. Naturally, that does not mean that the ECB would totally disregard developments in economic activity. But it is likely to mean that the ECB will not stop hiking rates, until it has seen convincing signs that inflation is on its way down, which will not happen until late this year at the earliest. Overall, Euro-area inflation forecasts contain an exceptional amount of uncertainty at the moment, due to risks in the energy markets and the pass-through mechanism from especially gas prices to consumer prices.

We think the ECB will hike by 50bp both in September and October and by a smaller 25bp in December. At that time, inflation has likely peaked and the economy may already be in a recession, putting the ECB more in a wait-and-see mode. We expect a further 25bp hike in the first half of next year, lifting the ECB’s deposit rate to 1.5%.

Euro-area inflation not about to peak yet

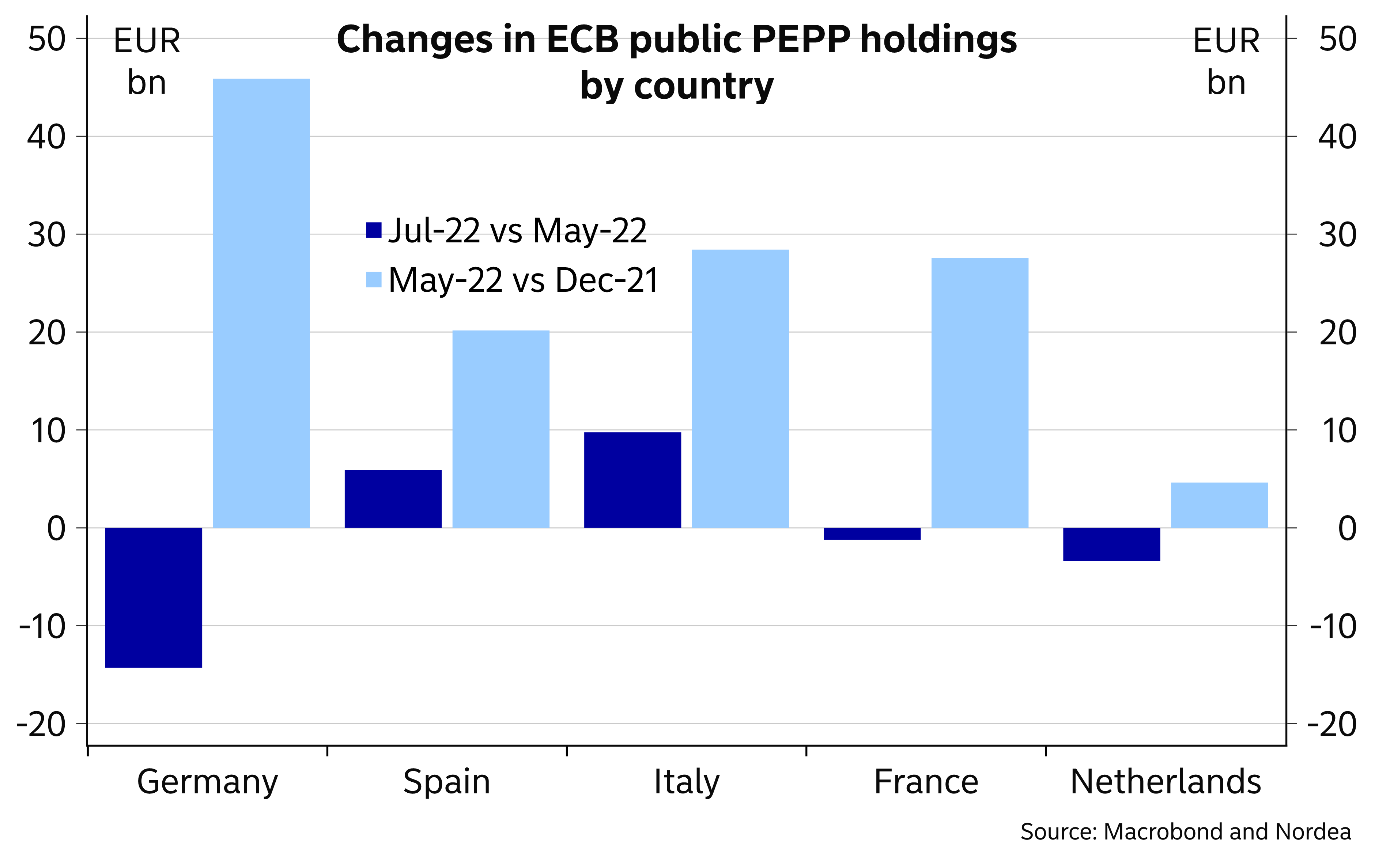

Concerns of how countries like Italy can handle higher rates have receded lately, as interest rate expectations have come down and the ECB has been using the flexibility in its Pandemic Emergency Purchase Programme (PEPP) reinvestments in earnest to use the money coming from eg maturing German bonds to buy Italian bonds. We think the worries towards Italy will make a comeback in the coming months, as the ECB continues to hike rates and Italy will head into uncertain parliamentary elections on 25 September. Still, the threshold for activating the Transmission Protection Instrument (TPI) is probably high and the ECB would very much like to manage by continuing to target PEPP reinvestments into Italian bonds.

ECB started to use the flexibility in its PEPP reinvestments in earnest

US financial conditions needs to tighten much further

US rates have taken a tumble this summer after softer economic data have led investors to believe the Fed will turn around and start cutting rates already early next year. Lower rates have also given a firm bid to equities and in sum, financial conditions have fallen back into easy territory. If things are left as they are, economic activity will not slow enough to bring inflation back down.

The slowing of economic data has been in the cards for a long time. Last year’s above 10% nominal GDP-growth was not going to last. A major part of the slowdown in manufacturing can be attributed to consumers changing their consumptions back to a pre-pandemic pattern, hurting demand for goods. The flipside is solid demand for services. High headline inflation had also dented the purchasing power for many consumers, but with energy and food prices coming down, we expect households to spend more on other items going forward.

The only sector really impacted by the Fed’s actions so far is housing, where much higher mortgage rates have sent activity clearly lower from very elevated levels. Thus far, it looks like other sectors of the economy have few problems employing the workers losing their jobs in the housing industry.

While the Fed has acknowledged that the economy is moving slower, their main (only) problem is still a much too high inflation. They are still telling us (daily for the last two weeks), that in order to get inflation back to 2% they will need to see financial conditions tighter for longer. That means term rates need to go higher and stay there. If the curve continues to stay as inverted as today, this only means Fed funds rate will just go higher to push 10-year rates to where the Fed wants them to be.

After many years where the Fed has eased policy only after the slightest weakness in data, we understand that the market is behaving as it is. The markets are, however, failing to see that this time is different because inflation is now the main worry for the central bank. Between 2008 and early 2020 the Fed was preoccupied with keeping growth above potential.

Previous episodes of curve inversion have happened when the economy has stood on the brink of recession. If the economy does not soon start to slow more clearly, investors will move into the shorter end of the curve and issuers will use the opportunity to lengthen their duration at very attractive yields. This will lead to less inversion. Quantitative tightening (QT) will also mean less demand for US Treasuries going forward. While the Fed started reducing their holdings already in June, the reductions have so far been going at half speed.

In addition, higher tax receipts in April led the Treasury to reduce their issuance over the summer, blunting the impact of QT thus far. When QT moves to full speed in September and the Treasury moves to a normal issuing pattern, the effect will be clearly felt in the market. Just like QE was constantly moving rates lower and flattening the curve, QT will have the exact opposite effect.

The inverted curve also makes US Treasuries much less attractive than many other government markets on a currency-hedged basis. For example, investors can scoop up almost 2% extra buying 10-year Japanese government bonds compared to 10-year US Treasuries at the end of 2022, if forward prices are realised. We have already started to see Japanese investors selling down their holdings of USTs, and there is probably much more to come should history be a guide. Also US investors can benefit, lending out USD in exchange for JPY in the FX swap market and using the proceeds to buy Japanese bonds. Together, we believe these mechanisms should lead to a much less inverted curve, helping the Fed reach its target for tighter financial conditions without having to move the Fed funds much higher than the June dot plot implies.