Med det store kursfald mandag og de lange amerikanske renter på vej mod nul er det værste stadig foran os, skriver Nordea.

Uddrag fra Nordea:

Major forecasts update: Ground zero

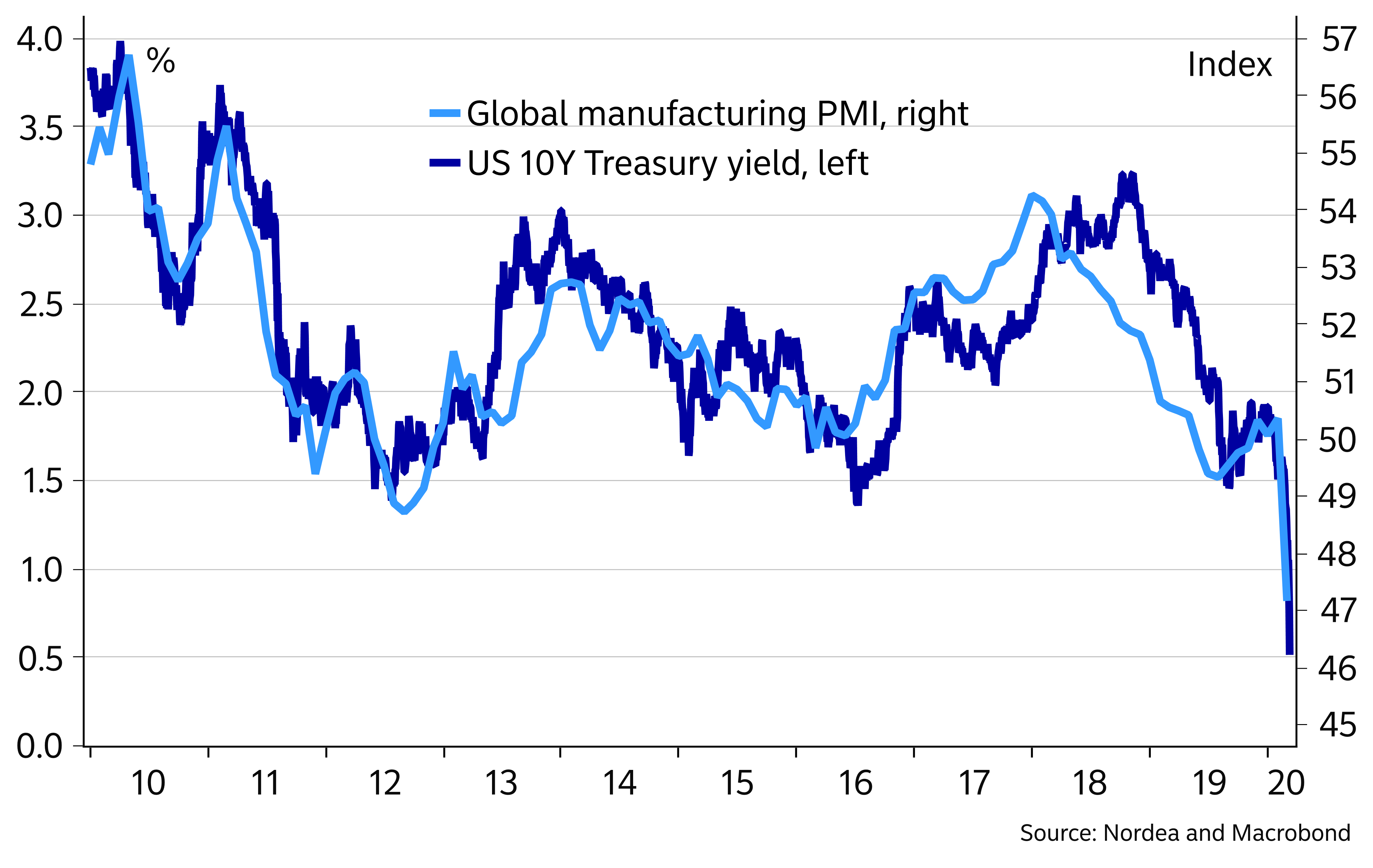

With the market meltdown in full motion, also long US yields are quickly approaching zero. The worst may yet be ahead of us, and the current market environment continues to favour safe havens.

Our main market and central bank views in a nutshell

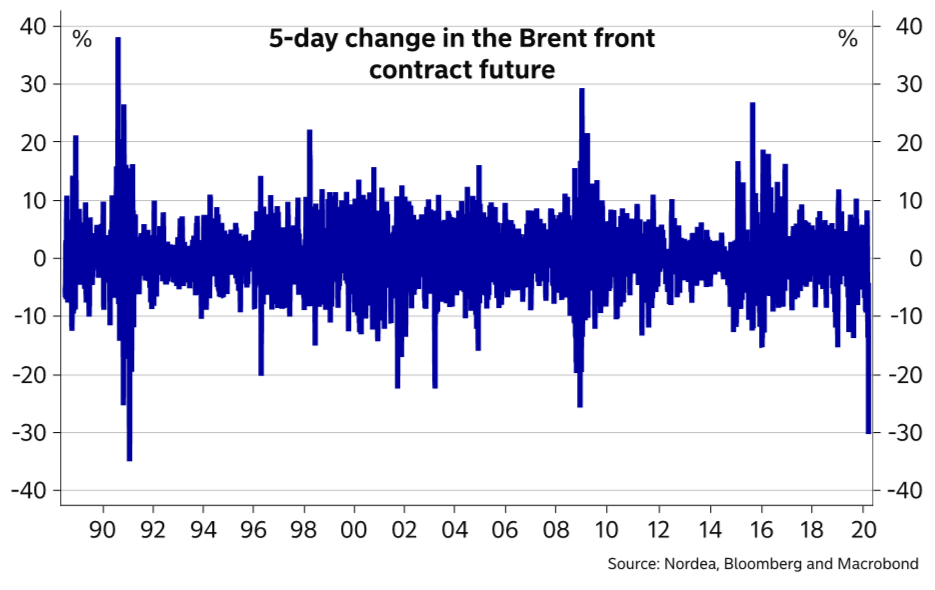

- Great uncertainty continues to prevail in financial markets, with a full-blown oil price war adding to all the question marks concerning the spreading corona virus

- While we have already seen huge moves, which would normally make it tempting to call overshooting, there have been few signs of markets stabilizing

- Monetary and fiscal policy response has only begun

- Bond yields continue to have a downward bias, but further downside is starting to look limited

- The Fed may have re-written the USD playbook materially

The size and rapidity of the current market moves risk making any forecast obsolete in minutes, so one needs to be quite humble in making such calls. Still, it looks increasingly unlikely that the pain and uncertainty felt by financial markets would quickly abate. It appears at least as likely that ever easier central bank policy will be needed to counter the risks facing the global economy.

As if the spreading corona virus was not a big enough unknown, now the plunging oil price amidst what looks like a full-blown price war makes forecasting the global economy an increasingly tricky business. The real impact of the virus is only starting to be visible in economic key figures and while market expectations have no doubt fallen considerably already, the low visibility amidst the spreading disease and the broadening quarantine measures will probably keep the optimists at bay for now.