Det er Nordeas vurdering, at den seneste tids svækkelse af dollaren er ved at slutte, og at dollaren vil blive styrket i midten af 2021 i forbindelse med, at den amerikanske centrakbank bliver mere “høgeagtig”. Vi kan få en euro-dollar udvikling som i 2017-18, mener Nordea.

Uddrag fra Nordea:

Majors forecasts: EUR/USD to peak relatively soon as Fed could turn “hawkish”

We see EURUSD peaking in the first half of 2021 as the USD yield curve is still alive. The Fed could be tempted to “taper” formally already this year and a hike in 2022 is clearly not out of the question. The ECB will remain accommodative.

Global: A growth “ketchup effect” and (headline) inflation upcoming

The manufacturing sector has already started to perform as a result of lagged effects of 2020 stimulus and low interest rates. If we assume that we are only 4-6 weeks from the seasonal peak in the Covid 19 spread, paired with a successful vaccine roll-out (news are increasingly upbeat), we will argue that most restrictions on the service economy will be gone by mid-April or thereabout and momentum towards fewer restrictions could already begin during March.

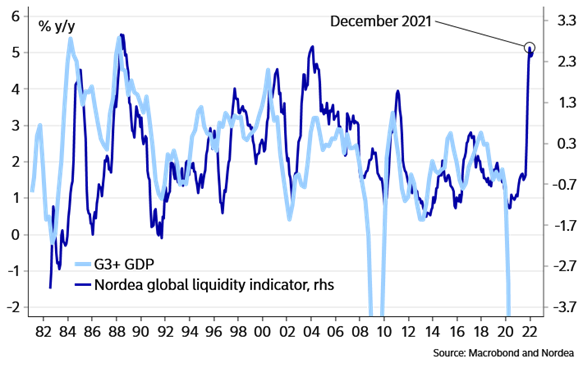

Chart 1. Super strong nominal growth this year as a lagged effect om stimulus from 2020

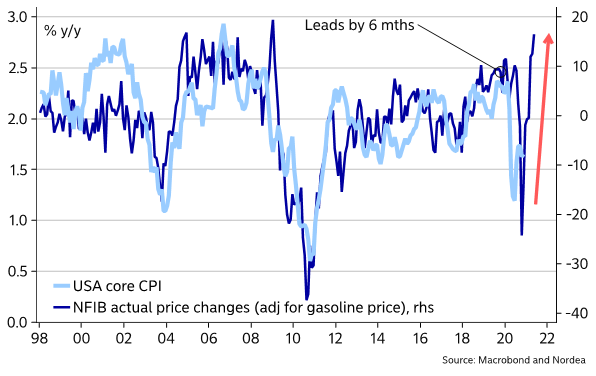

This could lead to a benign economic scenario for the first half of this year with a strong re-opening momentum in the service economy paired with a continued momentum in the interest rate sensitive manufacturing sector. This could lead to a solid nominal growth pace in 2021 and we also see a possible inflation pressure (mostly in the US) following it. Usually, long bond yields tend to pick-up when nominal GDP growth is strong, but the USD curve should be (clearly) most sensitive to this storyline. EUR/USD could consequently peak during the first half of this year because of a wider USD-EUR interest rates spread.

Chart 2. Inflation pressure upcoming in the US?

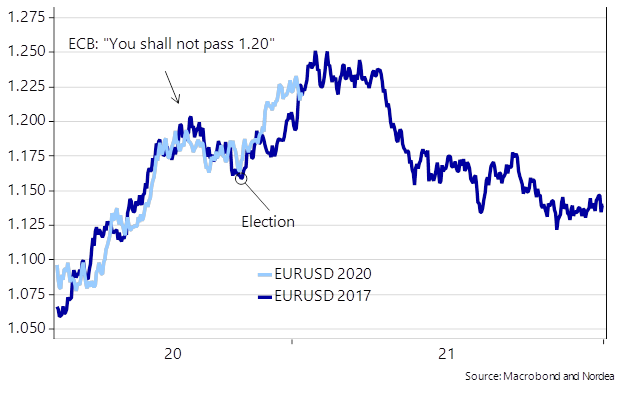

FX: EURUSD to peak in the first half of 2021

We have warned in recent quarters about the risk of a much weaker USD alongside the rebound in the global economy that would follow after the malaise in Q2-2020. The story has unfolded broadly speaking with a weakening USD against EUR, EM and Scandis as we had anticipated.

The consensus surrounding further USD weakness is now striking and most, if not all, expect the USD to weaken further. There are sound arguments behind such a view, most notably the massive double deficit of the United States, but it also seems as if everyone is already positioned for the USD weakness, which could mean that the story is already mostly baked in to market prices.

In 2017/2018, EUR/USD rose towards 1.25 before reversing lower because of the US once again outpacing the Euro area on growth and interest rates.

We are starting to see the contours of a similar develop in to the second half of 2021. A too strong EUR will turn into a slight headache for European exports, while the US looks ripe for a solid economical comeback meanwhile. We accordingly adjust our forecast to reflect this, and expect a peak in EURUSD during first half of 2021 around the 1.25-1.27 area before a reversal longer alongside higher spreads between USD and EUR interest rates.