Nordea mener, at ECB bør skele til den amerikanske centralbank, der har blødt op for inflationsmålet – ved at tale om en gennemsnitlig inflation på 2 pct. Det gør det muligt at styrke væksten og de lange renter. ECB’s inflation har siden 2013 været langt under målet på 2 pct. Nordea venter, at ECB næste år vil bruge et “symmetrisk” inflationsmål på 2 pct., og det er meget tæt på den nye amerikanske gennemsnits-definition.

ECB Watch: The real issue

Powell’s AIT is a dovish turn that could be copied by the ECB. Curves could steepen under the right circumstances, but the ECB has the PEPP to prevent premature moves. The Fed and the ECB will keep medium- to longer-term real rates very low for now.

Rates markets are at a crossroads. Will the curve steepen or not? (EUR Rates Flash)

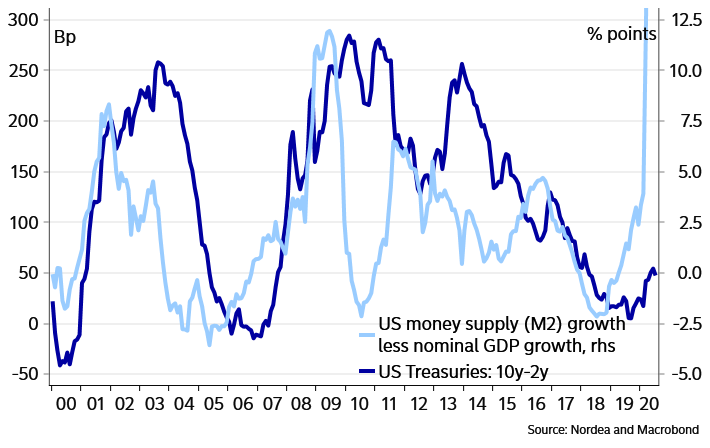

The Average Inflation Targeting (AIT) at the Fed is a dovish shift that should glue short-term policy rates to the floor for years, while pushing up growth and inflation expectations and, in turn, steepen the yield curves.

At the same time, however, the Fed only stopped short of implementing Yield Curve Control (YCC) because the yield curve is not currently a problem. In other words, the Fed will be ready for YCC if the curve steepens too much as was the case during the recovery from the Global Financial Crisis and during the Taper Tantrum.

We believe this is a real issue. At the end of the day, medium- to longer-term real interest rates are what matters to the economy. Therefore, the Fed and the ECB need to lower real interest rates a bit out on the curves even more in order to ease monetary policy further to support the recoveries.

With flat nominal yield curves at very low levels, the most effective way to do that is to push up medium- to longer-term inflation expectations. This is the main reason why Powell introduced AIT at Jackson Hole yesterday.

Nominal yield curves are steepening and could steepen further if either inflation expectations follow suit – keeping medium- to longer-term real interest rates very low – or if the recovery is expected to pick up a lot of speed, say when a vaccine is ready for mass production or if governments step up fiscal easing.

If the nominal curves steepen prematurely, ie ahead of a pickup in inflation and growth expectations, we believe the Fed will be ready to implement YCC, locking in the front-end of the curve. Actually, we still believe the Fed will opt for YCC during the recovery (Fed Preview: From stabilization to accommodation) to prevent a taper tantrum.

Chart 1. Steepening, the Fed and the recovery

ECB to follow suit

The ECB is not as far with its Strategy Review as the Fed. The current timeline says that a conclusion is likely around the middle of next year, but part of the conclusions can of course be moved forward, if necessary.

The ECB’s problem is similar to the Fed’s, just bigger: Inflation has practically been below its target since 2013 and market-based medium-term inflation expectations are miles away from the inflation target. Moreover, most of the nominal yield curve is already at negative levels.

That means two things: 1) the ECB will be even less willing to accept premature steepening and 2) the ECB should be even more inclined to opt for policies aimed at lowering medium- to longer-term real interest rates.

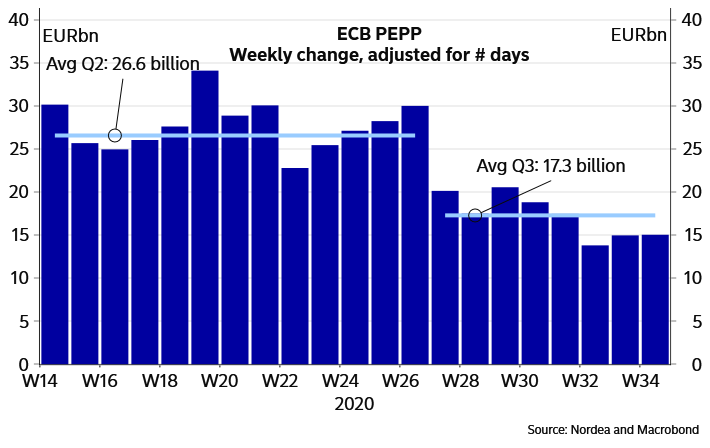

The Pandemic Emergency Purchase Programme (PEPP) serves both purposes. Therefore, it will be very easy for the ECB to increase the weekly PEPP pace should curves steepen too much. If that is not enough or if inflation does not pick up, the envelope can be increased and the programme extended.

In fact, we believe the PEPP has created an ECB inflation put (ECB Watch: The inflation put). We also believe the ECB will opt for a EUR 500bn increase at the December meeting.

Chart 2. ECB PEPP pace

The ECB is widely expected to change its target to a symmetric 2% target when concluding its Strategy Review (ECB Watch: Thoughts on the Strategy Review).

There is not a long way from opting for a symmetric target to saying that symmetric means 2% on average, which is basically as soft as the Fed’s AIT. And with the Fed having paved the way, we believe it is now likely that the ECB opts for some version of AIT too.

Some spill-overs from the USD curve to the EUR curve is likely. A dovish Fed is good news for the Euro area and makes it more likely that we get a more dovish ECB too. However, we believe the ECB will be even less likely to accept premature steepening and it has the tools to prevent it. Therefore, steepening is likely, but at a modest pace unless inflation and growth expectations pick up speed.

Powell’s two key points from Jackson Hole (Week Ahead: No Jackson Hole in One)

- The Fed aims at 2% inflation on average. It’s a very soft form of Average Inflation Targeting (AIT) without any type of commitment but should still imply that policy will not be tightened before inflation has averaged 2% over a year or two.

- The Fed aims to reduce shortfalls of employment from maximum employment, ie asymmetric. Powell basically killed the Philips curve by saying that employment can be its maximum level without causing inflation. Again, the implication is that the Fed can be dovish for longer. Strong employment growth will not lead to tightening unless it brings inflation.

Link to Fed’s updated long-run goals