Ifølge Nordea er ledelsen i ECB uenig om, hvordan den stigende inflation og rente skal bekæmpes. ECB holder møde på torsdag. ECB kommer måske ikke med konkrete beslutninger, men det er afgørende, hvordan ECB formulerer sig, selv om der næppe kan ventes konkrete målsætninger.

ECB Watch: What exactly are we monitoring closely?

The ECB will be pressed to clarify what it means by preserving favourable financing conditions and its thoughts about the recent increase in bond yields at its meeting next week. Mere words are unlikely to stop long bond yields from rising further.

- More verbal interventions will be ahead next week, but the ECB is not about to introduce concrete yield or spread targets.

- The ECB is unlikely to be willing to increase the pace of PEPP buying dramatically, and long yields have more upside potential left later this year, as economies re-open and the rebound gathers pace.

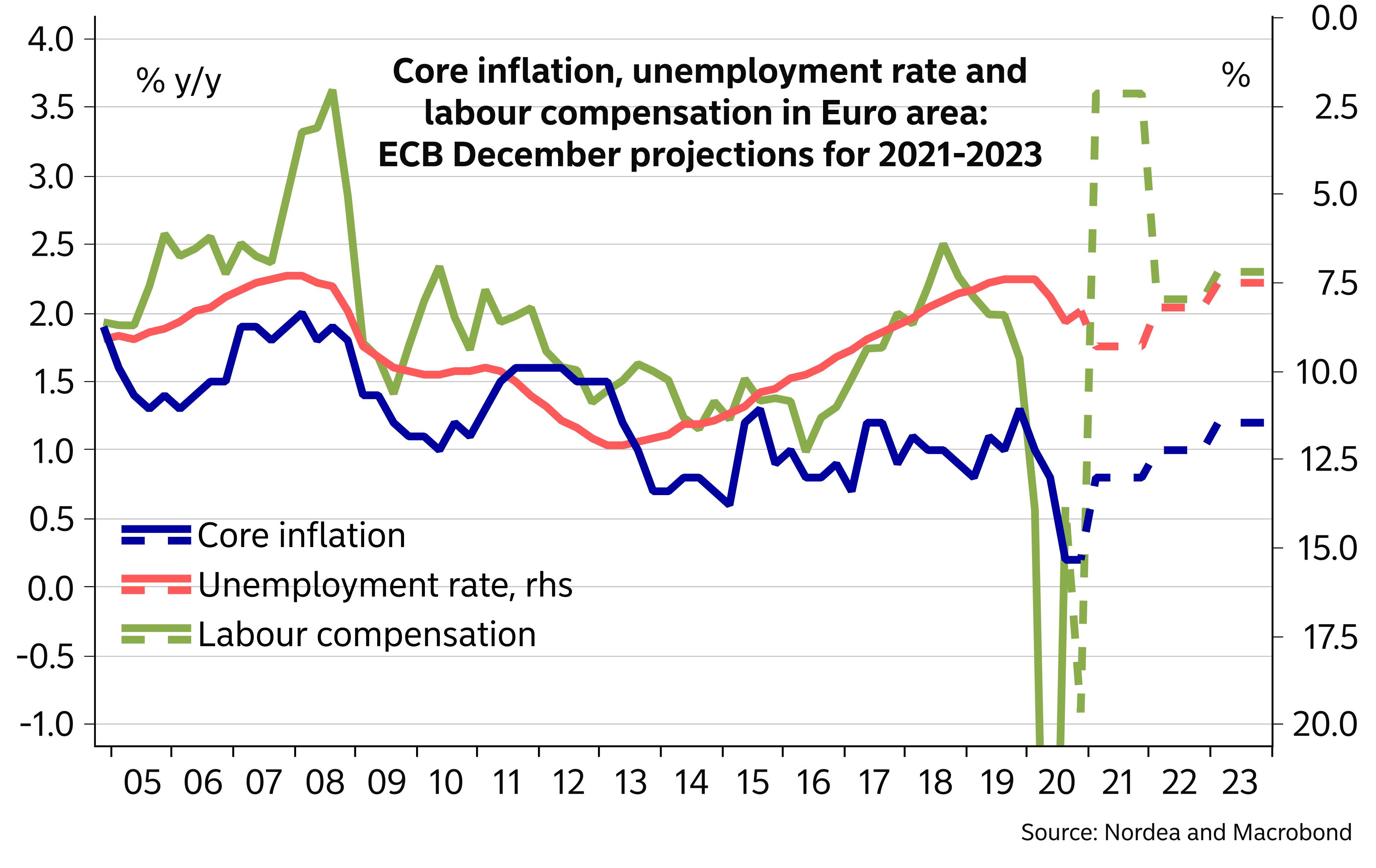

- Both staff growth and inflation forecasts to be revised up, but mainly for the shorter term.

Lagarde and Lane have recently talked about monitoring nominal bond yields, Schnabel referred more to real yields, de Guindos discussed bond spreads and Panetta called for the ECB to increase the volume of bond purchases and seek even lower real yields. In short, not even the Executive Board, let alone the Governing Council, of the ECB agrees on how to respond to the recent rise in longer yields or on what preserving easy financing conditions actually means.

The case for clarifying the ECB’s reaction function regarding rising yields at this week’s monetary policy meeting is thus obvious. However, given the sizable disagreements apparent already at the January meeting, we expect more high level commitments on how the ECB will use the flexibility of the Pandemic Emergency Purchase Programme (PEPP) to prevent any unwarranted tightening in financing conditions, including rapid increases in nominal bond yields. We do not expect the ECB to offer any concrete targets on any financial market variables, leaving the market guessing on what exactly preserving easy financing conditions means.

Such comments may manage to push bond yields down momentarily, but without a significant pick-up in the pace of the bond purchases, of which there are no signs in the latest purchase numbers, the recovering economy and higher US yields will continue to put upward pressure on longer yields.

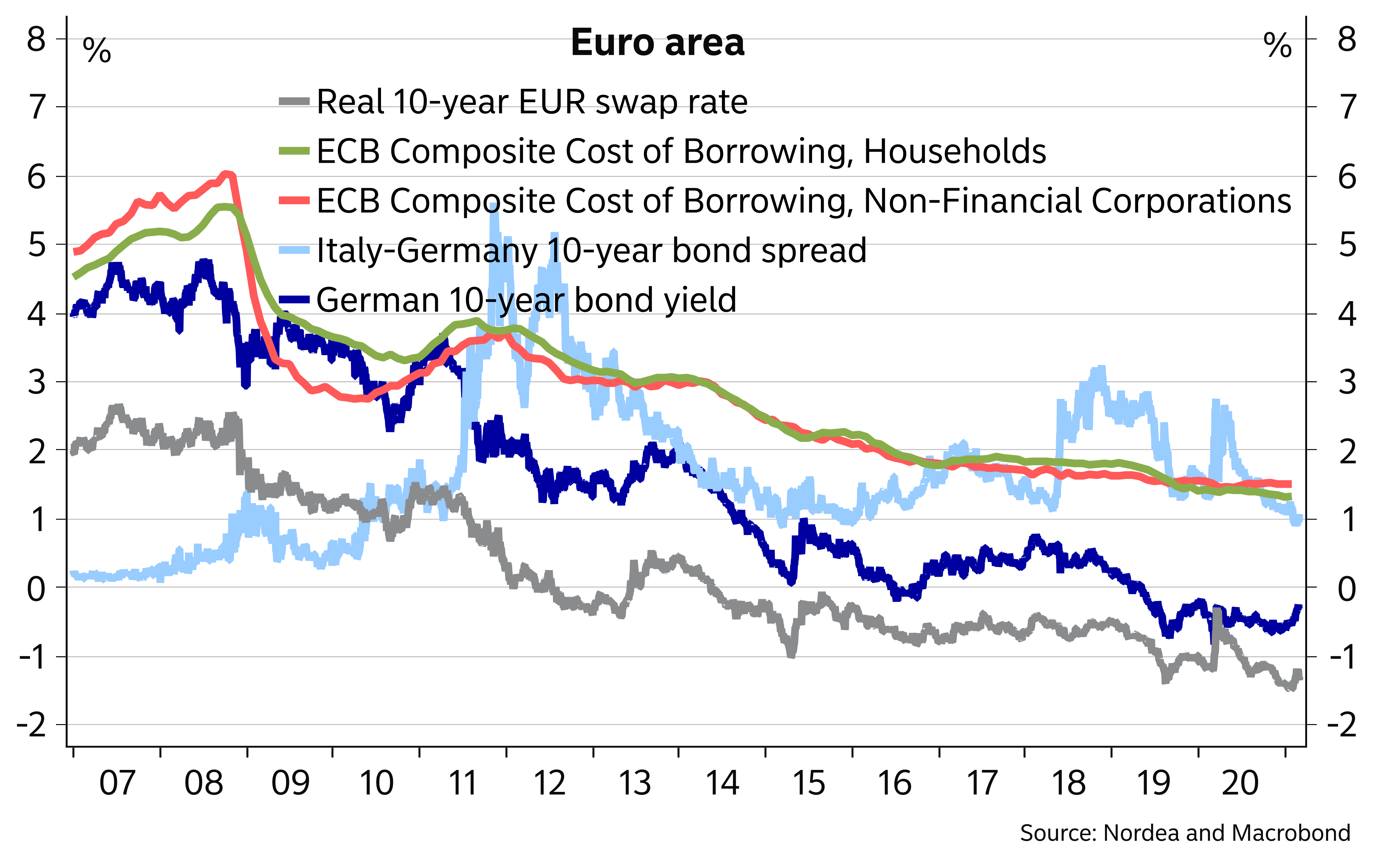

Euro-area financing conditions remain easy

ECB projections – room to be more optimistic

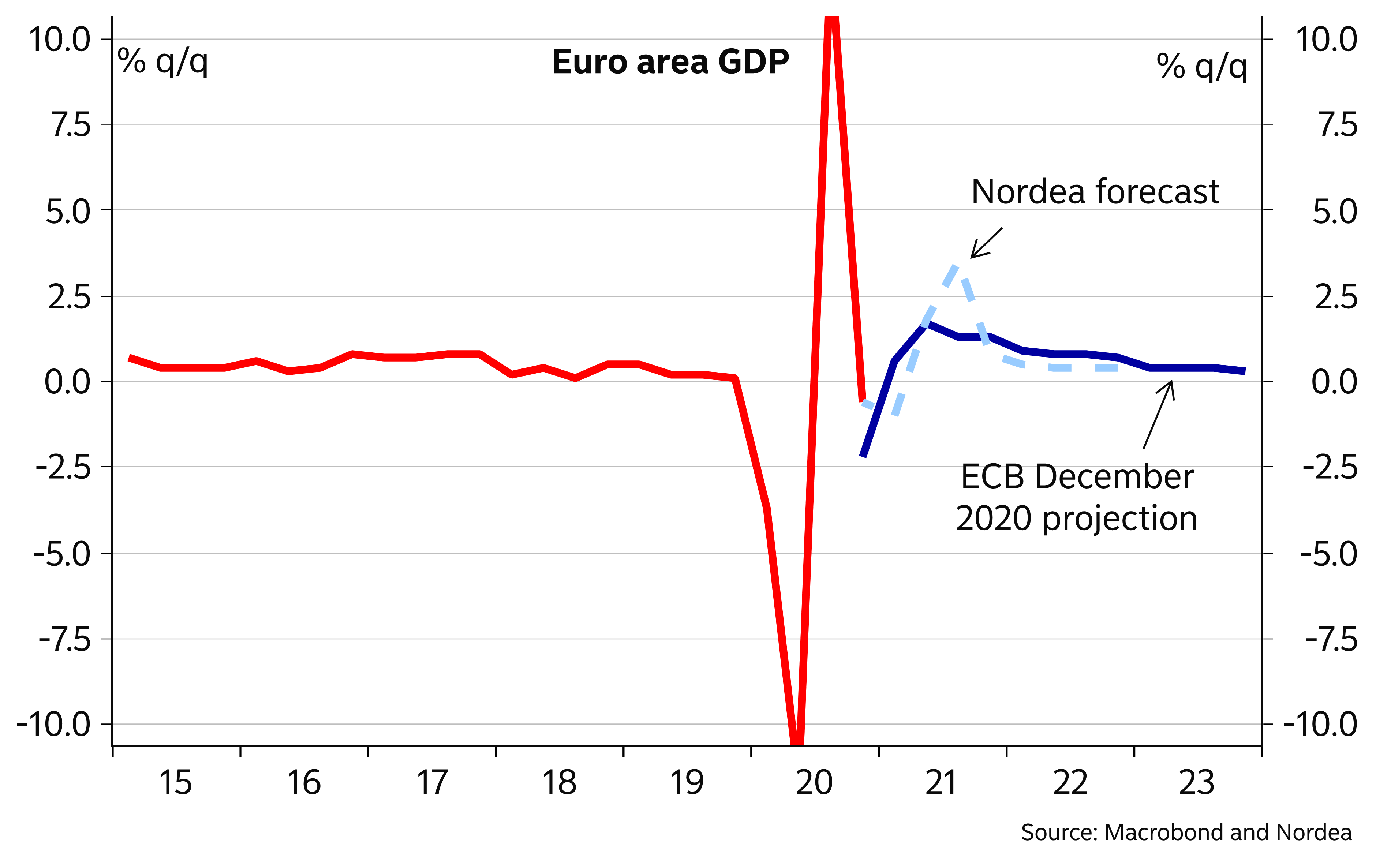

In December, the ECB published rather pessimistic forecasts for both GDP and inflation, and we see room for more optimism in the March projections. Most importantly, even if the lockdowns continue to make the coming weeks challenging, we expect that the ECB will be more optimistic regarding the timetable for vaccinations. In December, the ECB staff assumed that a concomitant relaxation of containment measures is assumed to take place with a broad resolution of the health crisis by early 2022. Now we assume the ECB staff to draw a faster timeline for the recovery and also indicate that the downside risks have somewhat declined due to the vaccines.

In GDP growth numbers, however, the increased optimism will be reflected by only rather modest upward revisions. The forecast for 2021 is likely to rise from 3.9% to slightly above 4% and the 4.2% forecast for 2022 may not change at all, if the ECB continues to see the recovery as a very gradual process. A significant revision to the longer-term growth prospects (2.1% in 2023) would be a surprise as we have not seen any major policy initiatives or structural reforms that would have changed the general economic outlook since December. The EU Recovery Fund and Brexit were taken on board already in the earlier forecast round.

ECB projected in December a very gradual recovery

Regarding inflation, much more important than the growth rates are of course the forecasts for the level of GDP and thus the output gap. Thus, even if annual growth rates will rise only modestly, the inflation projections have more potential to rise given that the starting point for the recovery is stronger than assumed in the December forecast thanks to a better-than-expected GDP development at the end of 2020.