I en omfattende analyse af ECBs afvikling af centralbankens enorme opkøbsprogram skriver Nordea, at ECB kan reducere sin balance hurtigere end den amerikanske centralbank, Fed. Inden udgangen af næste år kan ECB reducere sin balance med 1400 milliarder euro, mens Nordea venter, at Fed vil reducere balancen med 1700 milliarder dollar – men ECB kan måske reducere sin balance hurtigere end Fed. Opkøbsprogrammerne har været et kerneelement i den ekstremt lave rente de seneste år. ECB ventes i næste måned at hæve renten. Nordea venter en rentestigning på 25 basispunkter, men vil ikke udelukke, at ECB kan hæve renten med 50 basispunkter, fordi høgene i centralbanken presser på. Nordea har også set på sammensætningen af inflationen i USA, og den viser, at boligudgifter er det element, der har presset inflationen mest i vejret i de seneste måneder.

Week Ahead: Could the ECB balance sheet contraction outpace the Fed?

The Eurosystem balance sheet could contract at a faster pace compared to the Fed over the next year. The repricing of the ECB outlook is not complete either.

“It is premature at this stage to discuss how the ECB’s balance sheet policies – in particular the reinvestment of the maturing stock of assets purchased under the PEPP and the APP – will interact with the process of interest rate normalisation. For the time being, our policy interest rates will act as the marginal tool for adjusting the policy stance.” – Christine Lagarde, ECB President on 23 May

Even though the pressure on the ECB to act has risen considerably lately, active balance sheet policies are unlikely to come into play any time soon. The current ECB forward guidance states that the reinvestments in the Pandemic Emergency Purchase Programme (PEPP) will continue at least until the end of 2024, while the central bank has pledged to continue reinvestments under the Asset Purchase Programme (APP) for an extended period of time past the date of the first rate hike.

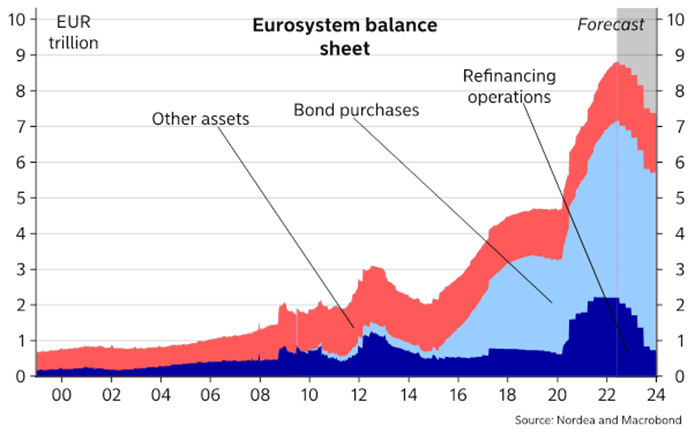

However, that does not mean that the Eurosystem balance sheet will stay constant, far from. The ECB has more than EUR 2000bn of refinancing operations to banks outstanding, and repayments in these operations are likely to pick up as early as later this month. Still a while ago it looked like there would be considerable interest in repaying a big chunk of the refinancing operations early, but given that the ECB is now set to hike rates several times this year, holding on to the Targeted Longer-Term Refinancing Operations (TLTROs) has become more attractive, even though the special conditions (a borrowing rate of as low as -1%) are set the expire at the end of this month.

As a result, the repayments in the TLTROs are likely to pick up in earnest only in the summer 2023, when the largest TLTRO, with currently more than EUR 1200bn outstanding, will mature. And while some of the maturing TLTROs will no doubt be rolled over to new ECB operations, the bulk will most likely be repaid. As a result, due to the repayment of the TLTROs, we expect the ECB balance sheet to contract by more than EUR 1400bn by the end of next year.

Eurosystem excess liquidity, measured by the usage of the ECB’s deposit facility and the excess reserves of the banking system less the reserves exempted from the negative deposit rate, total around EUR 3500bn. Further, true excess liquidity will decline by less than implied by the TLTRO repayments, as a rise in the ECB’s deposit rate out of negative territory will make tiering redundant and the currently exempted reserves (of the order of EUR 1000bn) will count towards true excess liquidity again.

As a result, we do not expect the decline in excess liquidity described above to have any major impact on EUR overnight rates, while also Euribor rates may stay relatively close to the €STR swap curve.

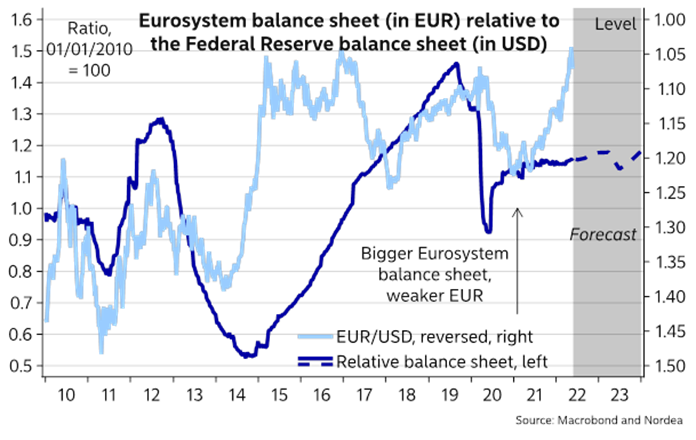

However, even the passive Eurosystem balance sheet contraction may have more impact on the FX market. The EUR 1400bn contraction estimated to take place in the Eurosystem balance sheet until the end of next year is actually not that much behind the Fed, whose balance sheet is set to contract by around USD 1700bn by the end of 2023, assuming it follows the path it has set for its balance sheet contraction. In fact, by the middle of next year, the ECB balance sheet could actually have contracted at a faster pace compared to the Fed.

While relative balance sheet developments have not been a major driver of FX markets lately, as interest rate expectations have taken a bigger role, if anything, relative balance sheet development between the Eurosystem and the Federal Reserve could actually be slightly supportive of the EUR vs the USD over the next year rather than the opposite, despite most headlines concentrating on the Fed’s quantitative tightening.

It remains to be seen, though, whether the markets distinguish between the causes of the balance sheet contraction, with the Fed actively determining the moves in its balance sheet, while the ECB’s balance sheet developments will be more determined by the decisions of banks regarding their borrowing from the central bank.

Chart1: Eurosystem balance sheet set to contract significantly in the coming year

Chart 2: Eurosystem balance sheet actually likely to contract faster than that of the Federal Reserve one over the next year

ECB repricing not complete yet

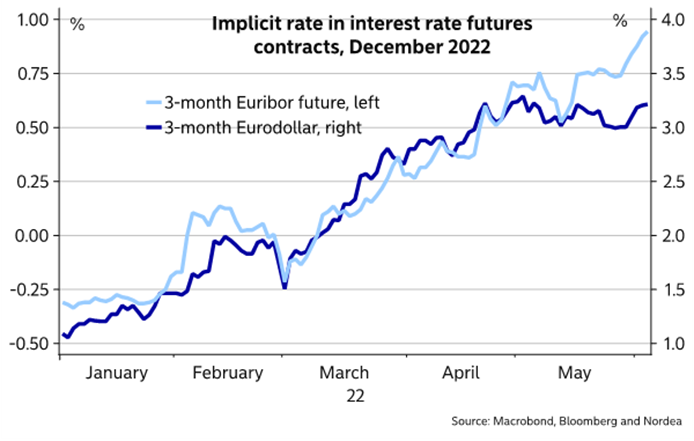

After the Fed hiked rates by 50bp in early May and Powell signalled that a couple of more such moves were to be expected, the market pricing for the next couple of meetings has stabilised close to such guidance. It seems the Fed is currently largely happy with the current market pricing and further Fed commentary has not led to big swings in market pricing any more.

The same is not true for the ECB. Even after President Lagarde and Chief Economist Lane both made clear that 25bp rate hikes are the preferred way for the ECB to proceed in July and September, markets have paid more attention to some of the more hawkish Governing Council members that have wanted to keep the option open for a 50bp move as early as at the July meeting.

Chart 3: ECB pricing turned increasingly aggressive even if Fed pricing has plateaued

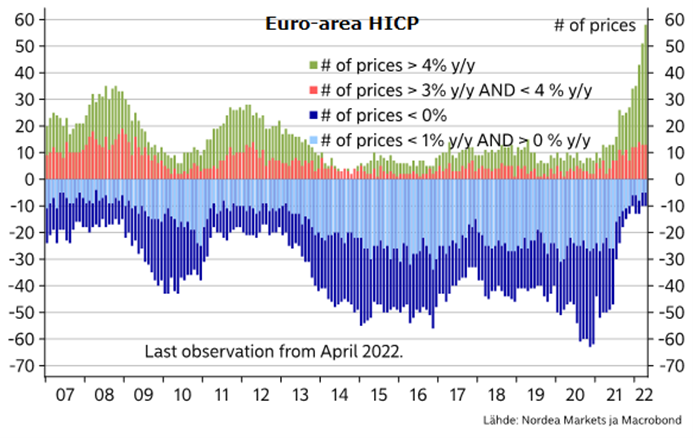

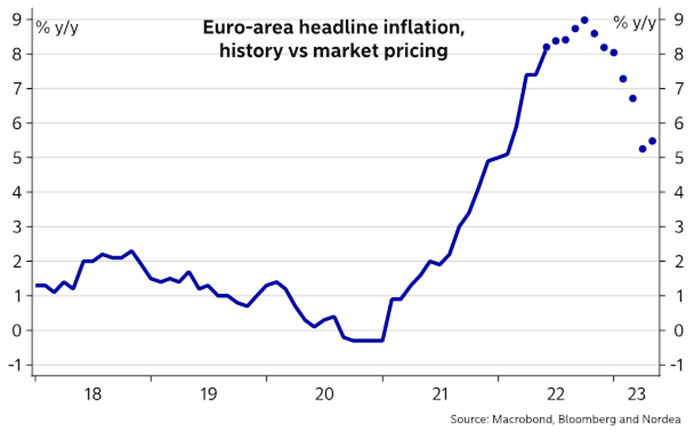

The hawks have become more vocal as inflation data has continued to surprise to the upside. Euro-area inflation accelerated to above 8% in May compared to the ECB’s Q2 forecast of 5.6% from March. Core inflation hit records as well with a 3.8% reading, well above the ECB’s 2% inflation target, while price pressures have become more widely spread both among sectors and geographically.

We think that the ECB will not completely rule out a 50bp hike in July at its meeting on 9 June, and such a message coming with staff forecasts which will likely show that inflation is already slightly above 2% at the end of the forecast horizon in late 2024 could easily lead to further hawkish market moves.

However, looking at eventual outcomes, we continue to find a 50bp move in July unlikely, not least as it would be a huge loss of credibility for Lagarde and the entire ECB. It is not common for Lagarde to give such clear signals between meetings, and she clearly indicated that the ECB would start to normalise monetary policy gradually, but that it was harder to say what would happen from the autumn onwards. So she basically opened the door for the ECB to ditch its pledge to gradualism, but not quite yet. A deviation from that path as early as July would imply that Lagarde is not in control and her signals should not be trusted.

True, the ECB is in a data dependent mode and a lot can still happen before the July meeting. Nevertheless, if inflation data continues to surprise to the upside and inflation expectations creep higher, the odds of a 50bp rate hike look much higher for the September meeting compared to July. If market pricing is right, Euro-area inflation will continue to rise and hit 9% y/y in September, so even if the ECB should not be guided by the current inflation level, further increases also in realised inflation will add pressure on the ECB to show it is serious about making sure price stability is achieved in the medium term. On ECB pricing, the market is now pricing in around 125bp of higher overnight rates by the end of the year, implying expectations of at least one 50bp hike in the four meetings remaining after next week.

Our own baseline ECB forecast still sees the central bank hiking in 25bp increments, albeit with risks to the upside for this year. Still, especially the EUR market is currently driven more by high inflation and its implications for central banks rather than signs of slowing growth. In this environment, ECB pricing could continue to increase, lifting longer yields as well as giving some support for the EUR in the near term.

EUR/USD has risen over the past few weeks on the back of improved risk sentiment, some hopes that the Fed could take a break in raising rates in the autumn – unlikely to happen – and higher ECB vs Fed interest rate expectations amidst high Euro-area inflation and hawkish statements from some ECB members. Looking ahead until year-end, we still believe that the USD will hold the advantage given the rife uncertainty about global economic development and financial markets.

Chart 4: Price increases becoming increasingly broad-based

Chart 5: Euro-area inflation unlikely to have peaked yet

What is most important in the week ahead

This week features the much awaited ECB meeting (Thursday) and important US CPI inflation figures (Friday). Besides that we will follow the US University of Michigan Consumer Confidence survey (Friday) and policy meetings in Australia (Monday), Poland (Tuesday), and Russia (Friday). We will also pay close attention to Norwegian inflation figures (Friday) and Chinese PMI figures (Monday), which are poised to show a rebound from the reopening after Covid lockdowns.

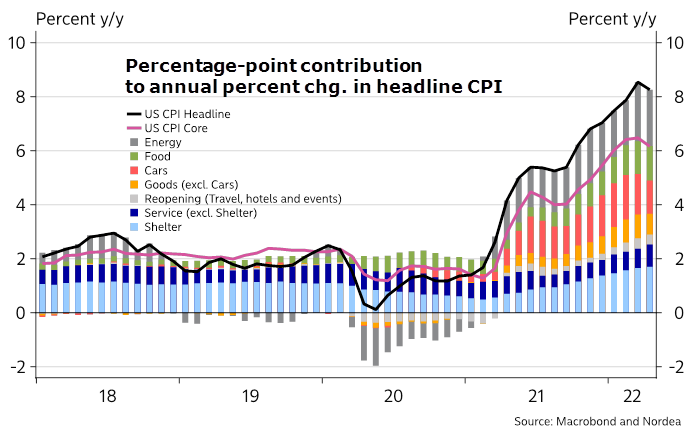

In the US, CPI inflation figures will display stubbornly high prices. Headline inflation is likely to stay flat printing at 8.3% y/y (consensus: 8.2%), while core inflation will fall towards 6.1% y/y (consensus: 5.9%) with a slight risk to the downside.

The primary driver of headline inflation will be energy prices, which are poised to show a large contribution to year-on-year headline CPI on the back of a 9% gasoline price increase in May. Another contributing factor will be service inflation, which has accelerated on a month-on-month basis and will start contributing more and more to the year-on-year numbers. Today’s inflation problem began as a surge in goods prices during the pandemic, but it has now turned into sticky and broad-based service inflation, which really highlights the Fed’s delay in withdrawing accommodative policy.

Chart 6: US inflation to show a slow descent ahead

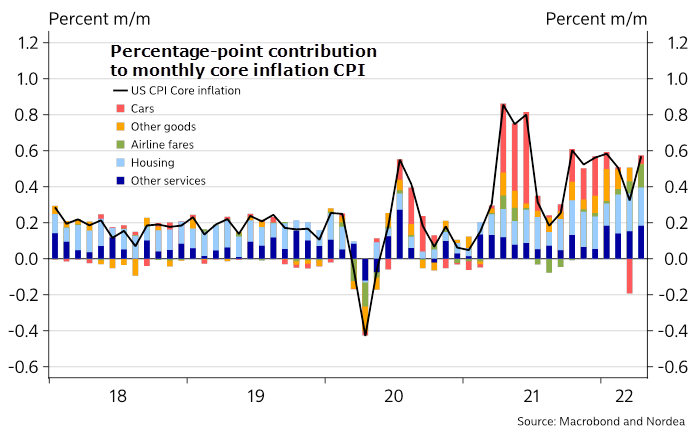

Looking into monthly core inflation growth, we have seen a large pickup in stickier services categories. In May housing components will rise in a similar fashion as in April and other services prices will do the same as economic data displays a strong real consumption on the heels of high wages and large savings. Airline fares will moderate compared to April as jet fuels have fallen, but on the other hand, high-frequent data shows high demand for travelling. Goods inflation will fall on a year-on-year basis but it is still a matter of base effects.

Chart 7: Housing an important component driving US core inflation

What the Fed really needs to happen is deflating goods prices and service inflation not to accelerate further. Looking ahead, service inflation is almost surely going to rise in the next months, which will keep the Fed on a hawkish trajectory raising interest rates by 50bp at the next two meetings.

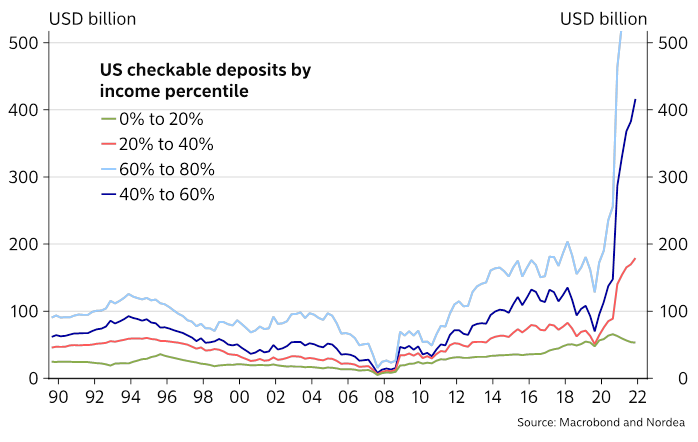

Turning to consumers, the University of Michigan consumer sentiment will reveal a downbeat sentiment, primarily impacted by higher consumer prices. The UoM survey has fallen to historical lows which have primarily only been seen during recessions, but the deviation from hard economic data is staggering. Real Final Sales to Private Domestic Purchasers is up 3.9% QoQ Annualised for Q1 and the job market remain historically hot. Time will tell how long households can weather high inflation. Real wages are still negative, but households exhibit exceptional fundamentals with large excess savings and net worth, which are likely to be a buffer against headwinds in the coming months.

Chart 8: High US savings are a notable buffer against economic headwinds

Lastly, looking into Norwegian inflation, we see May core inflation at 3.2% y/y while Norges Bank expects 2.6%. If we are right, the inflation figures will contribute to an upward revision of the rate path in June, but we still believe that Norges Bank will stick to its plan of one hike per quarter.