ECB er kommet under øget pres for at bremse euroens stigning. Euroen ligger omkring 1,20 over for dollaren. Der kan ventes en indikation fra ECB på det næste centralbankmøde. Problemet er, at en fortsat stigning af euroen strammer de finansielle betingelser og trykker inflationen endnu mere.

ECB Watch – Preview: Under pressure

The ECB is under pressure to prevent further strengthening of the EUR with core inflation already at record-lows. We expect Lagarde to bring promises of more policy easing to next week’s ECB meeting, if not concrete easing measures.

- Risks tilted towards further easing measures already next week, or at least promises of more easing measures to come.

- Stronger euro lead to tighter financial conditions and will push core inflation forecasts lower.

- PEPP is not the only game in town – the ECB still has several tools at its disposal.

- Market easing expectations have risen lately, but more action already next week could still lead to a dovish market reaction.

Three reasons the ECB is under pressure

Three key issues are adding pressure on the ECB to ease monetary policy further or at least make strong commitments in that direction when the Governing Council meets next week:

- Lowest core inflation on record in August

- EUR/USD touching 1.20

- Average Inflation Targeting at the Fed

In June, when the ECB expanded and extended the Pandemic Emergency Purchase Program (PEPP), ECB Chief Economist Lane called it a “proportionate response to the substantial downward revision of the economic and inflation outlooks and the significant deterioration in financial conditions.”

Substantial and significant are perhaps too strong words to describe the current situation, but it is noteworthy that financial conditions have tightened since the June PEPP expansion – mostly because of the stronger EUR – and core inflation has fallen to a record low.

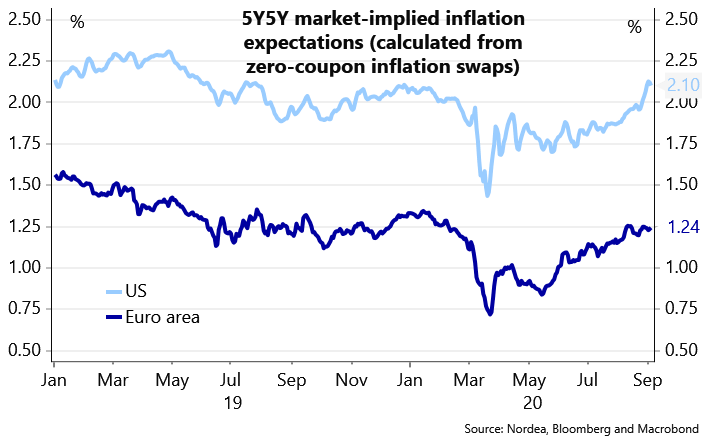

Moreover, the Fed just introduced Average Inflation Targeting (AIT), which has helped boost market-implied inflation expectations in the US, while the improvement seen in the Euro area from the March lows has stalled.

Rebound in inflation expectations has stalled in the Euro area

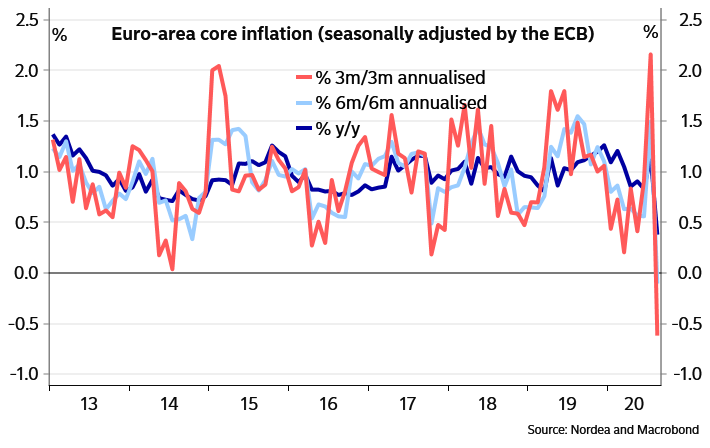

We attribute most of the drop in core inflation in August to a record low of 0.4% y/y to temporary factors, or more specifically to late summer sales in France and Italy. However, we believe this factor will pull core inflation lower in September too before normalising in October. Moreover, services prices showed weakness in August as well, which should be a much bigger concern in Frankfurt even if the Flash August inflation numbers probably haven’t been taken fully into the staff projections.

Stronger euro taking the inflation forecast down – again

The September staff macroeconomic projections are likely to show larger moves inside the inflation projections than in the growth outlook.

The June growth projections were already pessimistic enough to take into account the negative impact of the corona crisis. Actually, the decline in Q2 2020 was slightly smaller than foreseen in the ECB projections and we will most likely see an upward revision in the 2020 GDP forecast from -8.7% to somewhere between -7 and -8%.

On the other hand, the rebound is likely to be smaller as well. That implies that the 2021 projection will be lower than +5.2% foreseen in June.

Regarding the outlook further out, we do not expect that the ECB has changed its general view on a gradual recovery path.

The corona virus will keep hindering recovery in many sectors such as tourism and it will take time before the Euro-area economies are back to the pre-crisis levels. In the June projections, this was implicitly viewed to happen in 2023 and the ECB will probably not change that view.

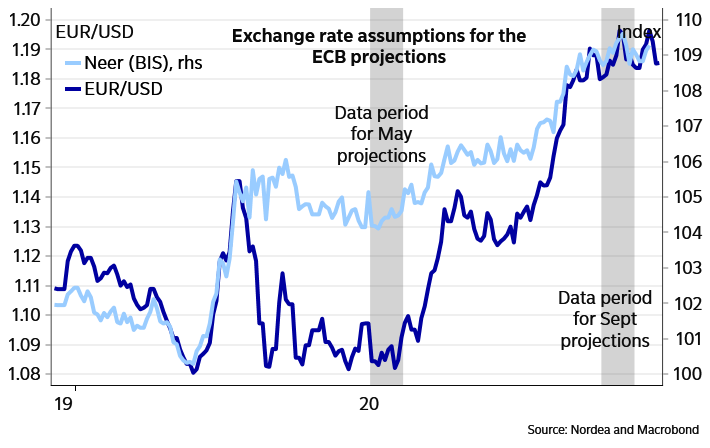

On top of the weak GDP outlook, the stronger euro increases the ECB’s pain regarding the inflation projection.In the June projections, the EURUSD assumption taken from the FX market was at 1.08.

This time, the EURUSD will be close to 1.19. Although the move in NEER has been considerably smaller (around 4%), there will be a significant impact on the Euro-area inflation projections in 2021-2022. Based on the old ECB sensitivity analyses, that could imply around 0.2 %-point less core inflation both in 2021 and 2022.

The headline inflation will see an upward contribution from the higher oil price compared to June. The flatter curve implies less inflation in the coming years, though, although the impact on 2020 forecast will be positive.

Stronger EUR will take core inflation forecasts down

Momentum in core inflation weakened considerably

Tighter financial conditions

Financial conditions have tightened since the expansion and extension of the PEPP at the June meeting, mainly owing to a stronger EUR in trade-weighted terms.

The Fed’s shift to AIT is likely to be followed up on through more new easing measures, which will weaken the USD even further unless the ECB steps up its game. So far, many Governing Council members have attributed the EUR strength to the implementation of the Recovery Fund, while the weaker USD is seen as a good sign too, relating to better global growth expectations.

At the end of the day, however, a stronger EUR and tighter financial conditions will weigh on the staff inflation projections. The June staff projections were based on a EUR/USD assumption of 1.08 compared with a spot rate that is around 10% stronger, prompting a couple of tenths of a percentage point downward revision to the September staff core inflation projections.

Tighter financial conditions since PEPP expansion and extension in June

Easier financial conditions in the US but not so much so in the Euro area