Tale er ikke længere nok. Nu må vi handle, sagde et medlem af ECB’s ledelse, Isabel Schnabel, tidligere i denne uge. Første handlinger bliver at sætte renten i vejret i juli, vurderer Nordea, der venter yderligere to rentestigninger i år og fire næste år, dvs. syv stigninger det næste halvandet år. ECB vil også begynder at rulle sit opkøbsprogram tilbage i juni. Krigen i Ukraine har svækket den europæiske økonomi, og den økonomiske usikkerhed er blevet særdeles høj. Det kan ogå føre til politisk uro, f.eks. på grund af de stærkt stigende priser, skriver Nordea, der har reduceret sin prognose for den økonomiske vækst i eurozonen markant til 3 pct. i år og 1,5 pct. næste år.

New ECB forecast: Time to act

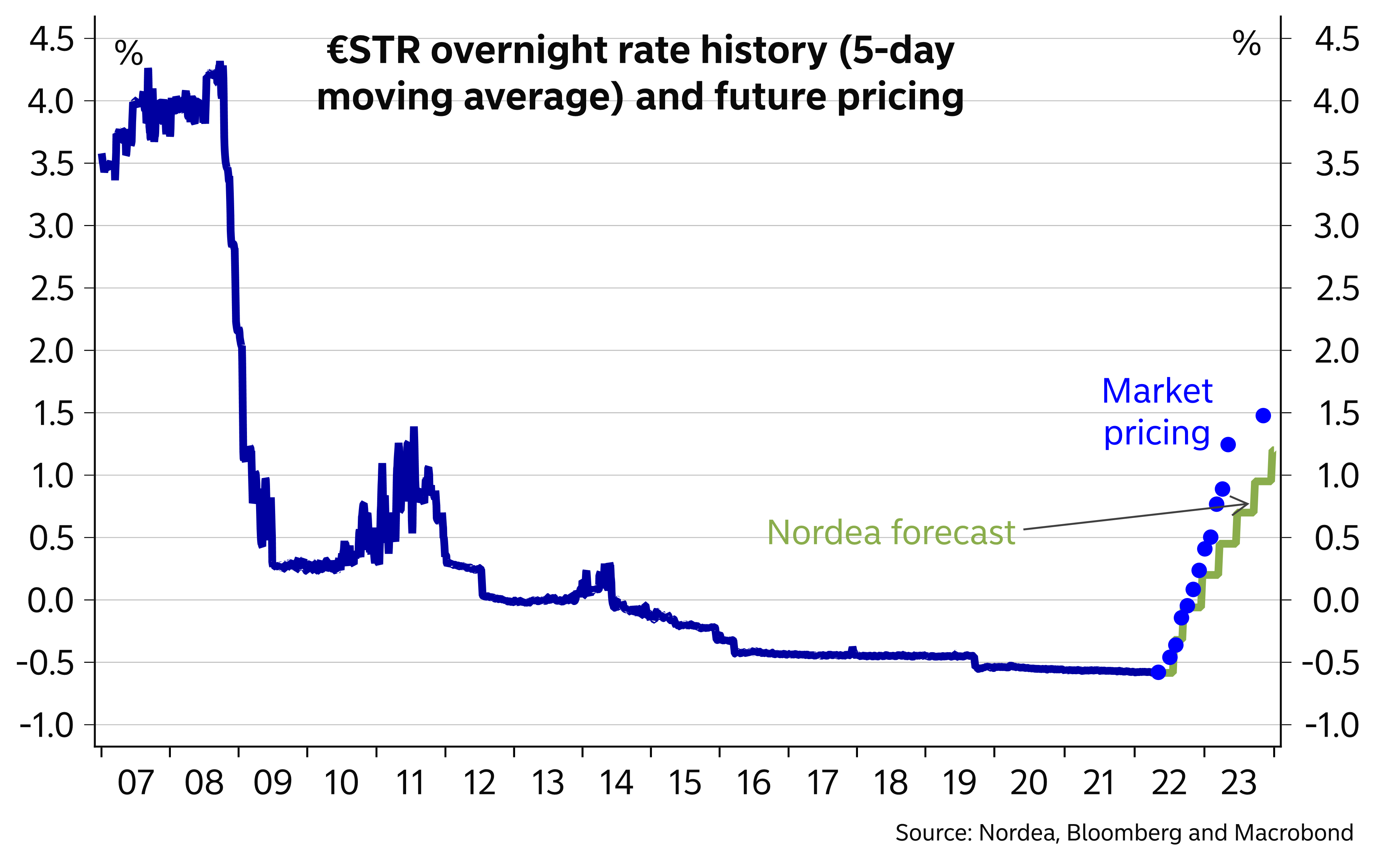

The ECB’s signals have strongly favoured a rate hike already in July. We think the economy will keep growing despite the high uncertainty, with core inflation staying above the ECB’s target and a total of seven ECB rate hikes by the end of 2023.

- We now think the ECB will start its rate hikes already at the July meeting, followed by further moves in September and December this year.

- We see four additional moves in 2023.

- We see a risk that the ECB could hike rates at all four remaining meetings this year, as the financial markets are currently largely pricing in, but going into 2023, the risk picture starts to tilt to the downside.

- The Russian assault on Ukraine has weakened the Euro-area economic outlook and we expect growth to slow to around the potential next year.

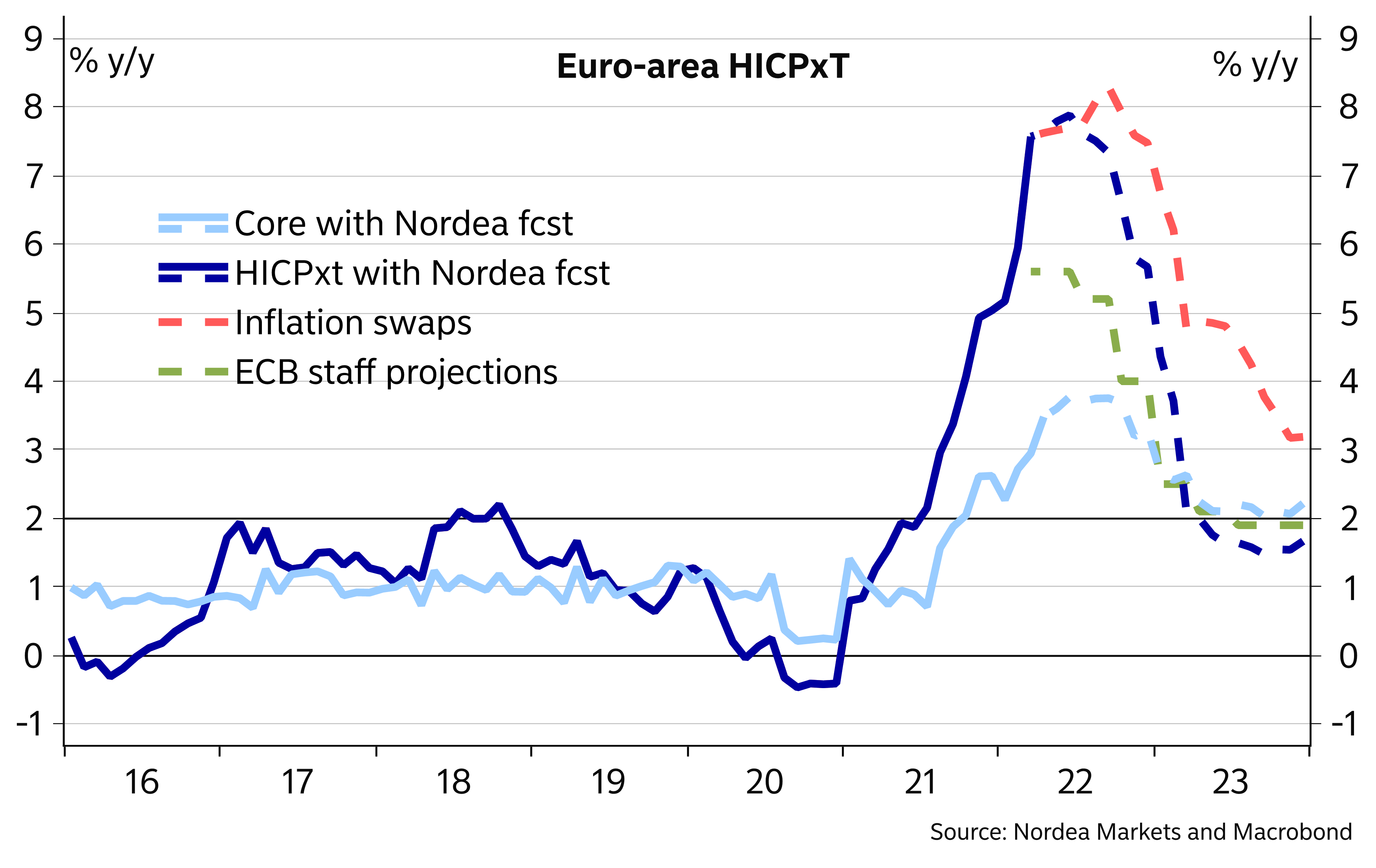

- We see Euro-area core inflation staying above the ECB’s 2% inflation target for practically our entire forecast horizon.

- The uncertainty around the Euro-area economic outlook is exceptionally high. It remains to be seen, how consumers and companies will weather the negative impact of the increased geopolitical risks, high energy and raw material prices and increased challenges in the global supply chains. In some countries, high inflation may also increase domestic political risks.

Talking is no longer enough, we need to act. Those were the words of Isabel Schnabel, member of the ECB’s Executive Board, earlier this week. She added that she thought the ECB could end its net asset purchases already by the end of June, found a July rate increase possible and emphasised that the ECB was still quite far away from neutral interest rates, so there should be plenty of room for rates to increase, before higher rates would slow down the economy more clearly. She added that if the ECB would have to compromise between supporting the economy or tackling inflation, it would choose price stability.

Schnabel’s comments follow a string of other Governing Council members, including President Lagarde, pointing to the possibility of raising rates already at the July meeting. As the ECB has steadfastly held on to its sequencing of ending net purchases first and hiking rates only some time after that, a hike at the 9 June meeting still looks to be out of the question. But a decision to hike in July will effectively be taken at the June meeting, if asset purchases are ended before the July meeting, even if the ECB is unlikely to say that explicitly.

We think that as Schnabel says, the ECB is done talking. And if they are ready to bring forward the end of net asset purchases and the first hike, they are likely planning to do much more than hike rates once or twice, as long as the economic and inflation outlook remain rather robust. Our own updated economic and inflation forecasts (see more below) support a cycle of rate hikes, and we now see a total of seven 25bp rate hikes during our forecast horizon until the end of next year.

We think the ECB will hike in July, September and December this year, followed by quarterly hikes in 2023 (March, June, September, December). The quarterly path would be supported by the schedule of the ECB’s staff forecasts. The ECB usually makes the bigger decisions at meetings when it has new forecasts at its disposal.

Financial markets price in almost four hikes by the end of this year and another four for next year. Given the ECB’s desire to start tightening policy soon and at least to get rid of negative rates rather rapidly, we see risks tilted towards the four hikes that the market is pricing in for this year. However, going into next year, we see risks that the economy will slow down more clearly, which together with falling inflation could persuade the ECB to slow down or even stop its rate hikes. As a result, we see risks tilted to the downside for the rate path we forecast for 2023.

We still see rates rising somewhat more slowly than the market is currently pricing in

The ECB staff forecasts are still likely to maintain the profile of inflation falling to close to the 2% target by the end of the ECB’s forecast horizon. However, the forecasts have been very wrong on the recent inflation developments, as high inflation has proved to be much more violent and persistent than the ECB thought some months ago. Credibility reasons are thus strongly favouring an exit from the very accommodative monetary policy.

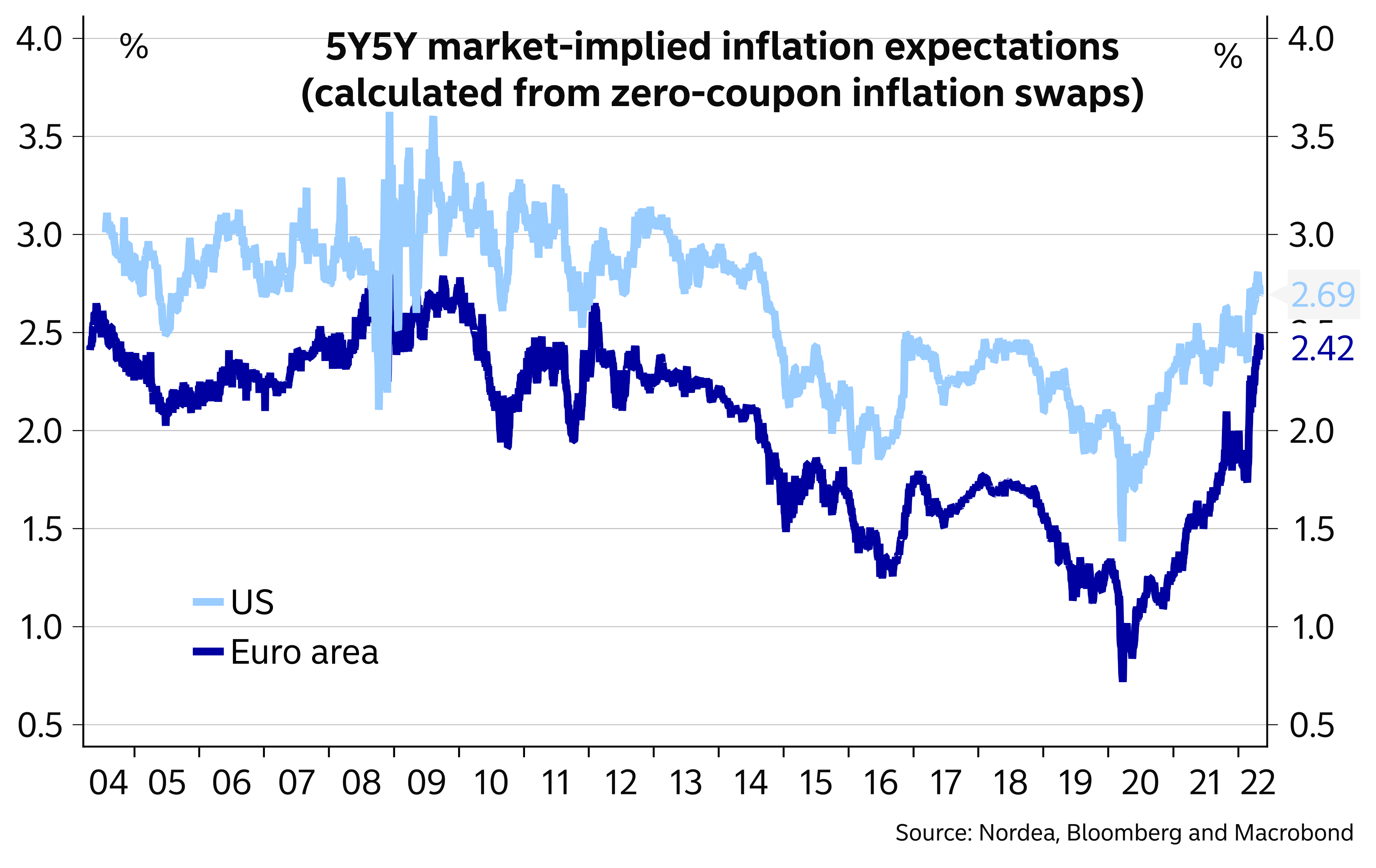

Even if realised wage developments do not support any emergence of a wage-price spiral at this point, the ECB has seen enough upside risks to make it act. In addition, the broad rise in inflation expectations has added pressure on the ECB to act.

Further, the desire to at least normalise policy is strong within the ECB, and the starting level for rates is very low. It should thus not take more than inflation at around the 2% target at the end of the ECB’s forecast horizon to support the case for continued rate hikes. Even if we see risks tilted to the downside going into next year, further upside inflation surprises could keep the ECB hiking at every meeting long into 2023.

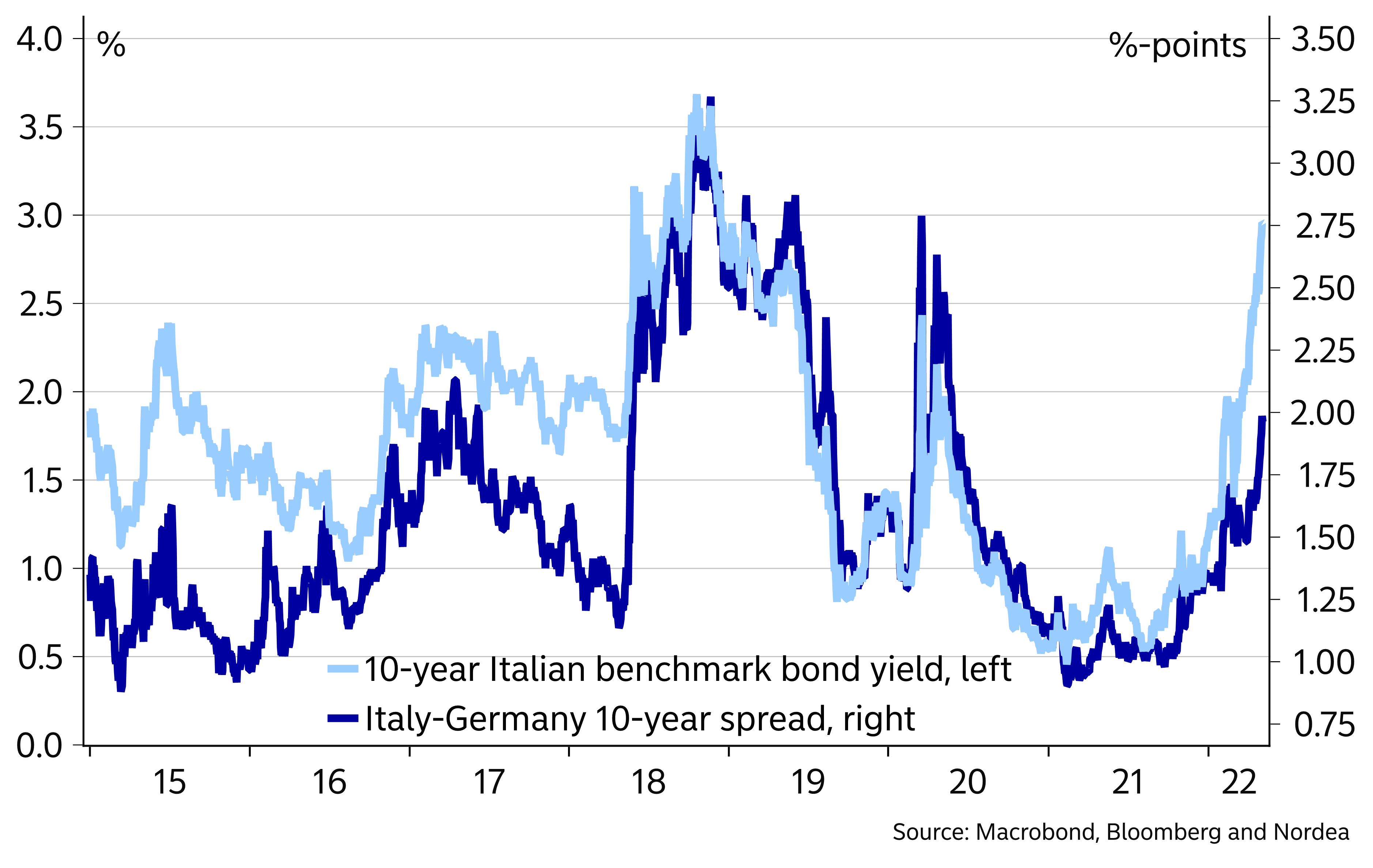

We have argued before that countries such as Italy should be able to handle a gradual rise in interest rates. Whether our new forecast is any more in line with a gradual rise in interest rates is up for debate, and the spread between Italian and German bonds has widened clearly in the past few weeks. The pressure on countries like Italy is thus likely to increase, which poses also some risks to the broader outlook.

We see an increasing chance that the ECB will need to come up with a new tool to tackle the risks of fragmentation at the same time as it continues to hike rates. This tool is likely to take the form of a targeted new bond purchase programme of a limited scale that would not need follow the capital key. However, we think discussions of such a programme are at an early stage, and such a tool is not likely to see the daylight until late this year at the earliest. For now, the ECB is likely to continue to point to the flexibility of its reinvestments under the Pandemic Emergency Purchase Programme (PEPP).

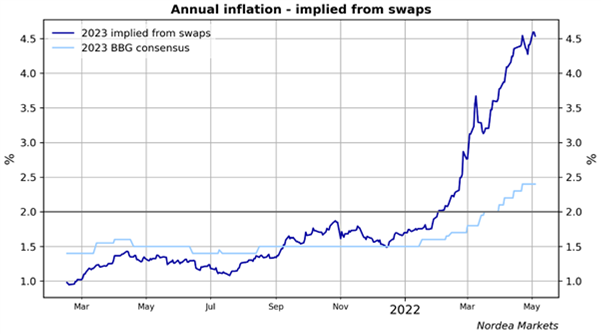

Euro-area inflation expectations have risen rapidly and approach US levels

Italian bond yields surged lately

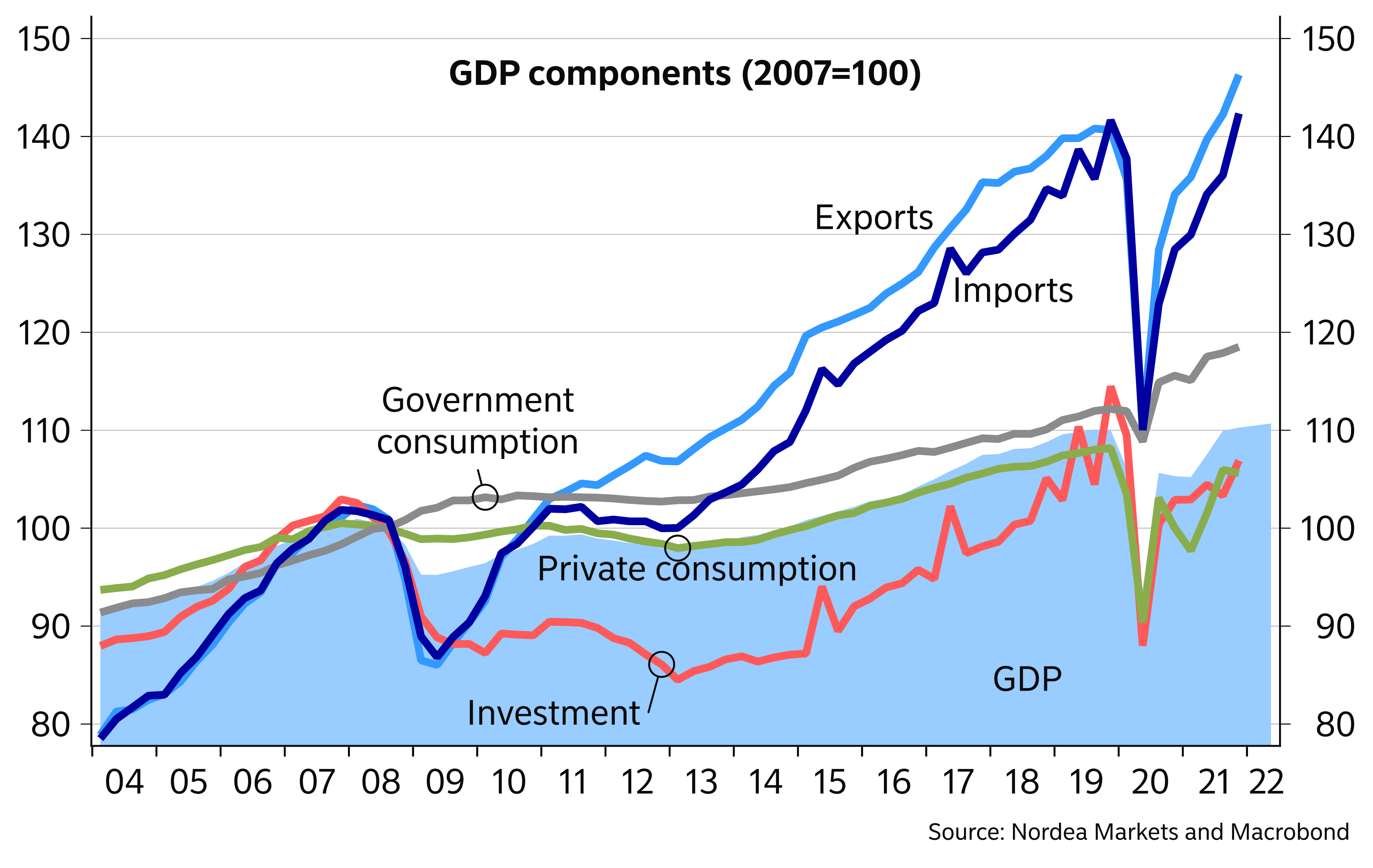

Downside risks to the economic outlook have increased

Russia’s assault to Ukraine has weakened Euro-area growth prospects and we lower our GDP growth forecast for 2022 from 4.0% to 3.0% and for 2023 from 2.5% to 1.5% (old forecast from February can be found here). Given the fact that the exports to Russia form only 0.7% of Euro-area GDP, the biggest negative impact will stem from very high energy prices and the resulting decline in households’ purchasing power. In addition, the increased uncertainty is likely to hurt fixed asset investments.

In 2022, economic growth continues to be supported by the post-pandemic recovery which benefits especially the service sector. However, this rather positive forecast is conditional on an assumption that households are confident enough to spend a part of their excess savings. This is because despite strong labour market development, real income growth will be clearly negative in 2022 due to very high inflation and still moderate wage growth for most of this year. We also expect that fixed investments, which continue to be at low levels after the pandemic, are boosted by the tendency to get rid of Russian energy, the ongoing NGEU projects and lack of labour force. However, a dramatic rise in the raw material prices and long interest rates are likely to slow down the housing construction.

The bigger downward revision to the 2023 growth forecast compared to many other analysts is partly due to our view that high energy prices will hurt consumption during the heating season next winter. This implies that the starting point for next year growth will be rather weak. However, consumption growth is expected to gain some pace along the year, when higher wages and lower inflation will turn real income growth positive, again. The wage increases are expected to accelerate from the autumn onwards to higher levels than seen since the Euro-area debt crisis.

We recognise that there is a very high amount of uncertainty around the Euro-area outlook at the moment and it is very easy to build a GDP profile, which is significantly weaker than our baseline forecast. The decline in household confidence, uncertainty regarding the future developments in the war, rising interest rates, challenges in the global supply chains and a risk of a total ban on Russian energy imports may well imply negative growth numbers both in investment and consumption and take the economic zone into a recession.

Economic growth continues to be supported by consumption and fixed investments

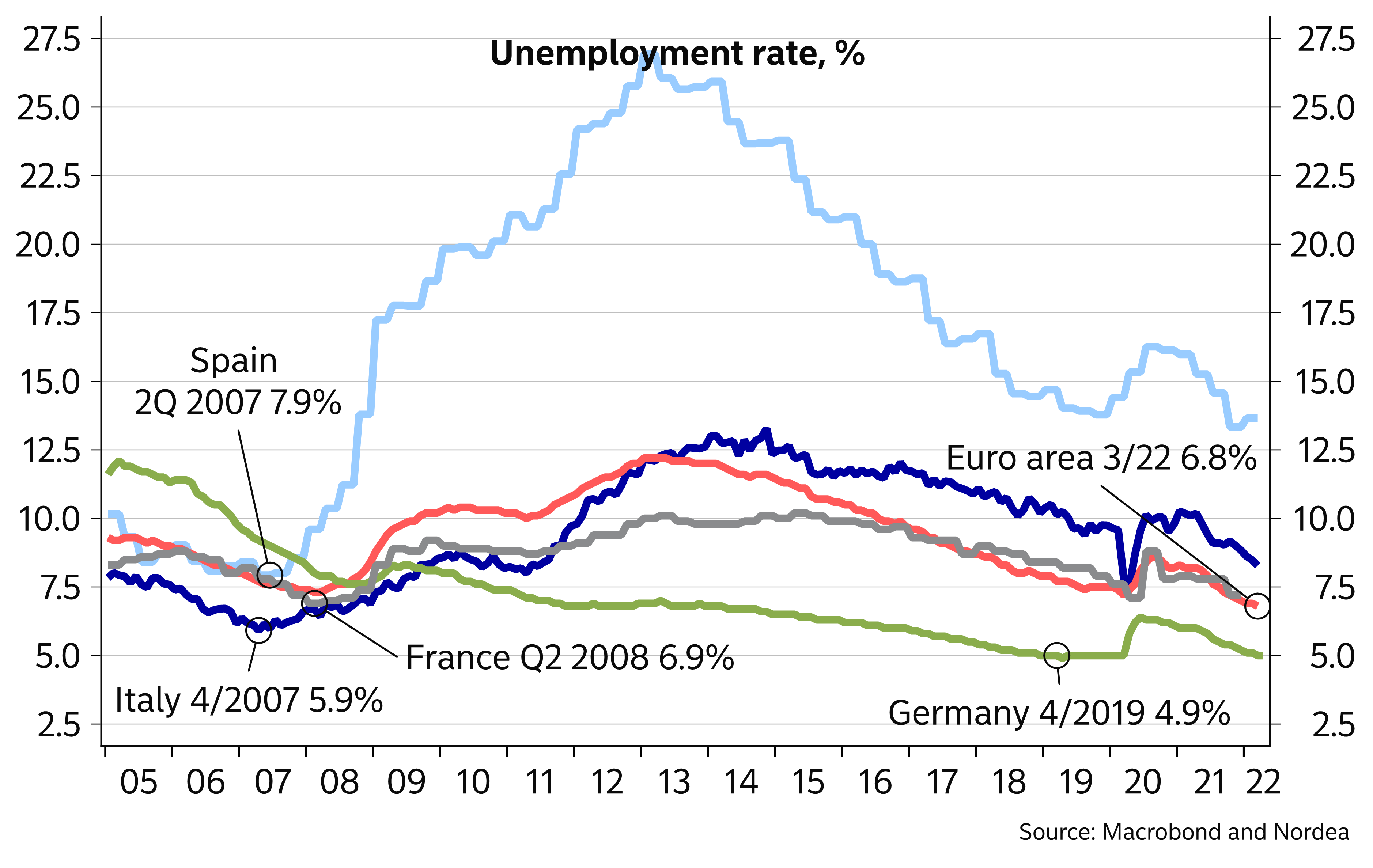

We still see room for improvement in the Southern European labour markets

Mind the gap

During the last year, inflation forecasts for 2022 have been revised higher and higher and analysts and central bankers have been trailing market expectations. It is therefore quite disturbing – and must be for the ECB too – to see the gap between markets and analyst inflation forecasts for 2023.

Markets pricing in much faster inflation than economists are forecasting

Thus, while markets are well above 4%, Bloomberg consensus is 2.4% and the ECB staff projections have 2023 inflation at 2.1%!

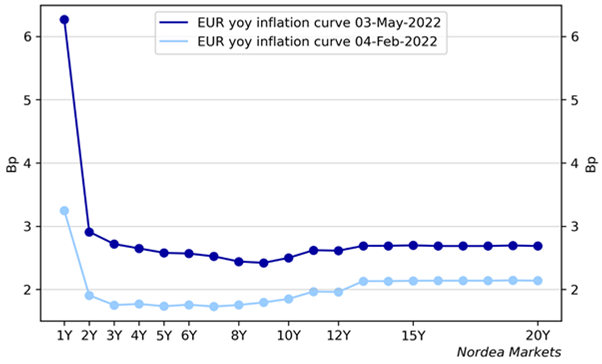

Moreover, inflation expectations further out on the curve have increased to well above the ECB’s target, pointing to at least risks that the current high inflation reading becomes entrenched.

Inflation expectations risen across the board

With that in mind, we are quite humble with regards to our current forecast. Uncertainties are huge and some risks are more structural than business-cycle related, like the need to invest to tackle climate change and reduce dependence on Russian oil and gas, globalisation and companies eagerness to bring production and supply chains closer to home, and the impact of more active fiscal policy to mention a few.

Thus, while our baseline is falling inflation from the last months of the year and onwards to levels that are close to the ECB’s target, we attach relatively high probability to risk scenarios with more structural changes.

Inflation set to fall but uncertainty high

Inflation outlook

We expect inflation to remain around current levels in the coming months before falling from Q4 onwards and base effects to take inflation clearly lower in 2023.

3-6 months:

- Headline: The high levels are not least due to food prices, which we assume will continue rising relatively fast at least the next six months, while we assume the increase in the energy prices to slow down and expect the oil prices to remain close to 100USD/barrel (this expectation is of course conditional on the EU NOT implementing a complete ban on energy imports from Russia) .

- Core: We expect core inflation to remain above 3% y/y in the coming months due to supply chain issues and a gradually tightening labour market.

2023:

- Headline: inflation will be all about base effects going into next year. Energy prices contributed by 3.8%-points of the 7.5% y/y headline inflation in April. In other words, stable energy prices from here will practically lower headline inflation by 3.8%-points y/y one year down the road. Food prices are a major risk factor with clear upside risks for quite some time.

- Core: Higher wage growth is expected to take service prices higher and even if supply bottlenecks are resolved will likely keep core inflation at least 2% y/y and thus much above what we’ve seen for the past decade.

- Current forecasts: 2.1% y/y for headline inflation and 2.3% y/y for core.