ECB står over for en særdeles vanskelig opgave på sit møde i denne uge, vurderer Nordea. Banken mener, at ECB vil forstærke sin afvikling af obligationskøbene, altså foretage en vis stramning af pengepolitikken, men samtidig holde sig fra rentestigninger. Det er den stigende inflation som følge af Ukraine-krigen, der skaber bekymring for rentestigninger. Økonomien kan være på vej ind i stagflation. Nordea venter, at inflationen vil stige til 5 pct. i år.

ECB Watch: The price of flexibility

The ECB has very hard decisions to make, but to keep its options open, it will likely decide in favour of a faster taper of its net asset purchases this week. The wish to normalize policy is strong within the Governing Council.

- Amidst all the uncertainty, we expect the ECB to opt for flexibility by deciding to accelerate the taper of its asset purchases and remove the link between the end of net purchases and the first rate hike

- Financial markets have started to price in higher stagflation risks, not an easy cocktail for a central bank

- Rate hikes remain on the horizon, even if the uncertainty regarding their timing has increased

- Staff forecasts are full of uncertainty, but will likely show downward revisions to growth and upward revisions to inflation

- February monetary policy account emphasized the strong desire to normalize policy

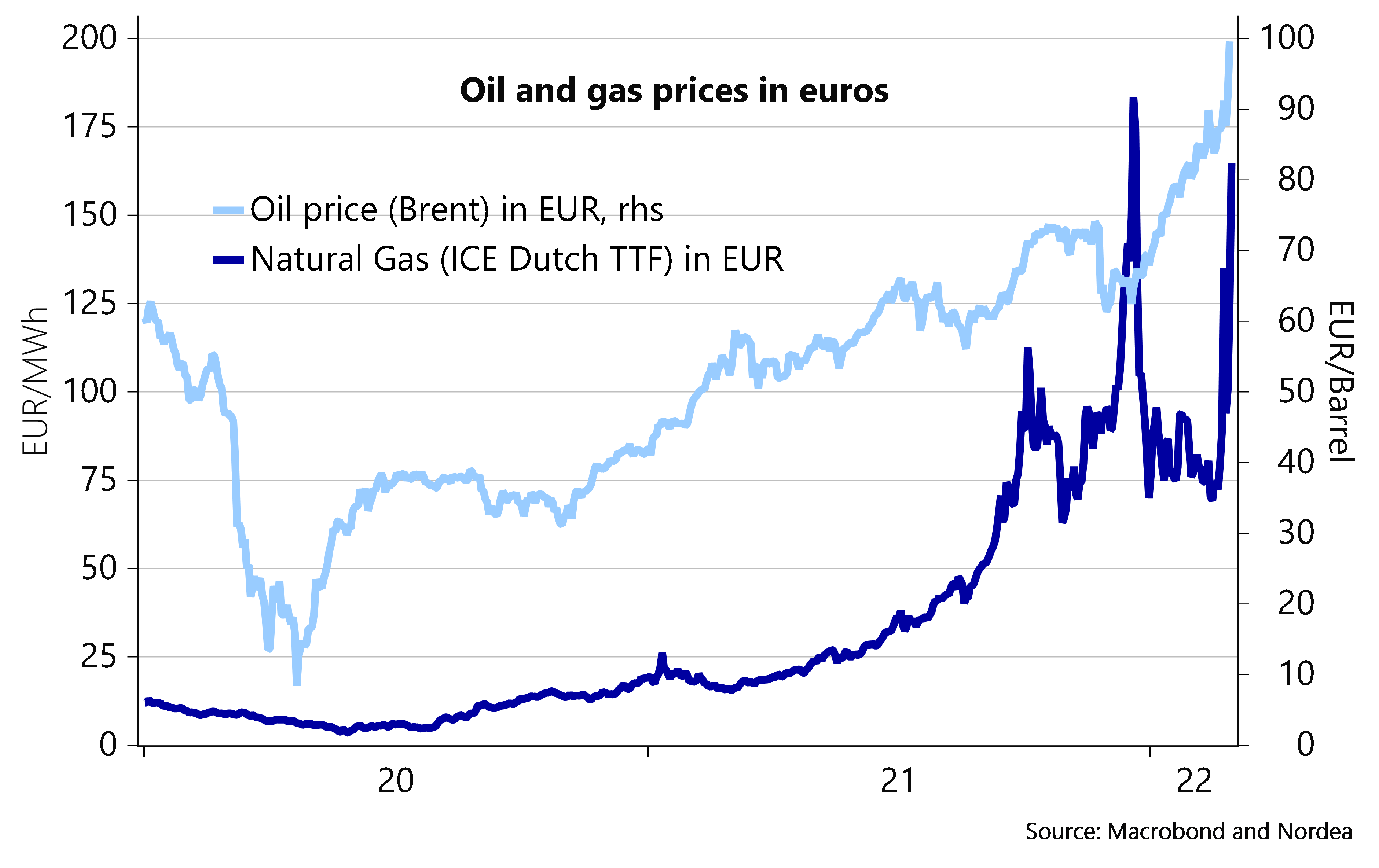

The ECB finds itself between a rock and a hard place,when it meets on 10 March. The Russian raid on Ukraine has made the economic outlook considerably more uncertain. At the same time, it has pushed energy prices steeply higher, meaning that inflation will rise much further in the near term and likely stay at higher levels for longer than the ECB thought only a few weeks ago.

Normally, a central bank would disregard the inflationary impact of a spike in energy prices stemming from a supply shock, as it would have a dampening impact on consumption and with that the economy of energy-importing countries, which should actually push inflation lower in the medium term.

This time, however, the ECB is also struggling with its credibility, as it has been severely underestimating inflation for more than a year, saw broadening underlying inflationary pressures before the Russian attack and also the labour market had started to show signs of tightness. The risk of second-round effects had thus increased, at least prior to the Russian attack.

It remains clear that if the increased uncertainty and higher energy prices delivered a major and longer-lasting blow to the Euro-area economy, the ECB would continue its easy policies for longer. But the uncertainty about the impact remains large, and many Governing Council members have become quite worried about the inflation situation. Most speeches of Governing Council members since the Russian attack have suggested, that even if the risk of another delay has increased, the direction remains towards a normalization of the ECB’s policies.

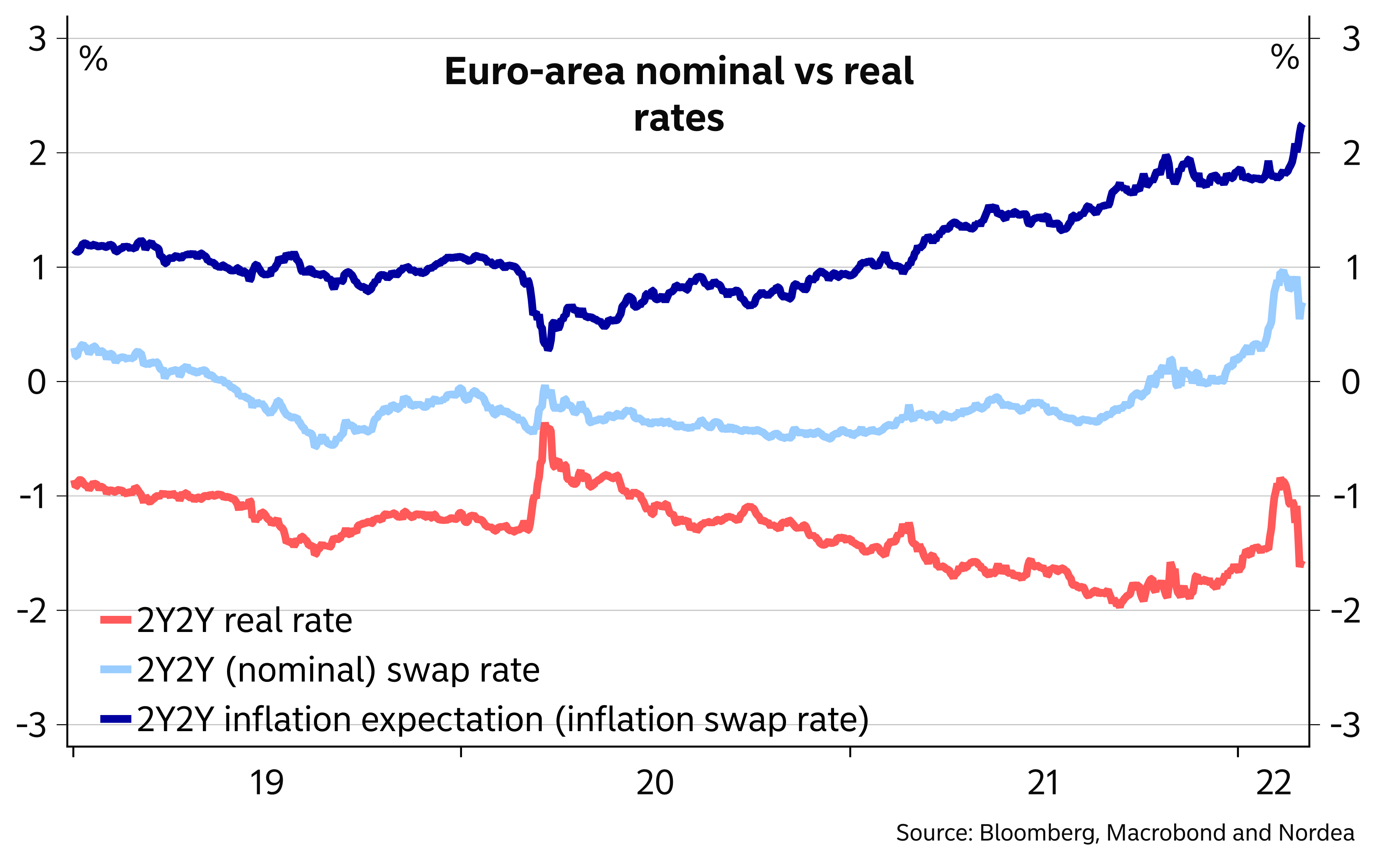

Even financial markets have had difficulties making up their mind. Real yields have slumped, indicating a deteriorated economic outlook. But inflation expectations, even in the medium term, have jumped and now remain clearly above the ECB’s 2% target. The market is thus pricing in increasing risks of stagflation – the combination of weak economy and high inflation.

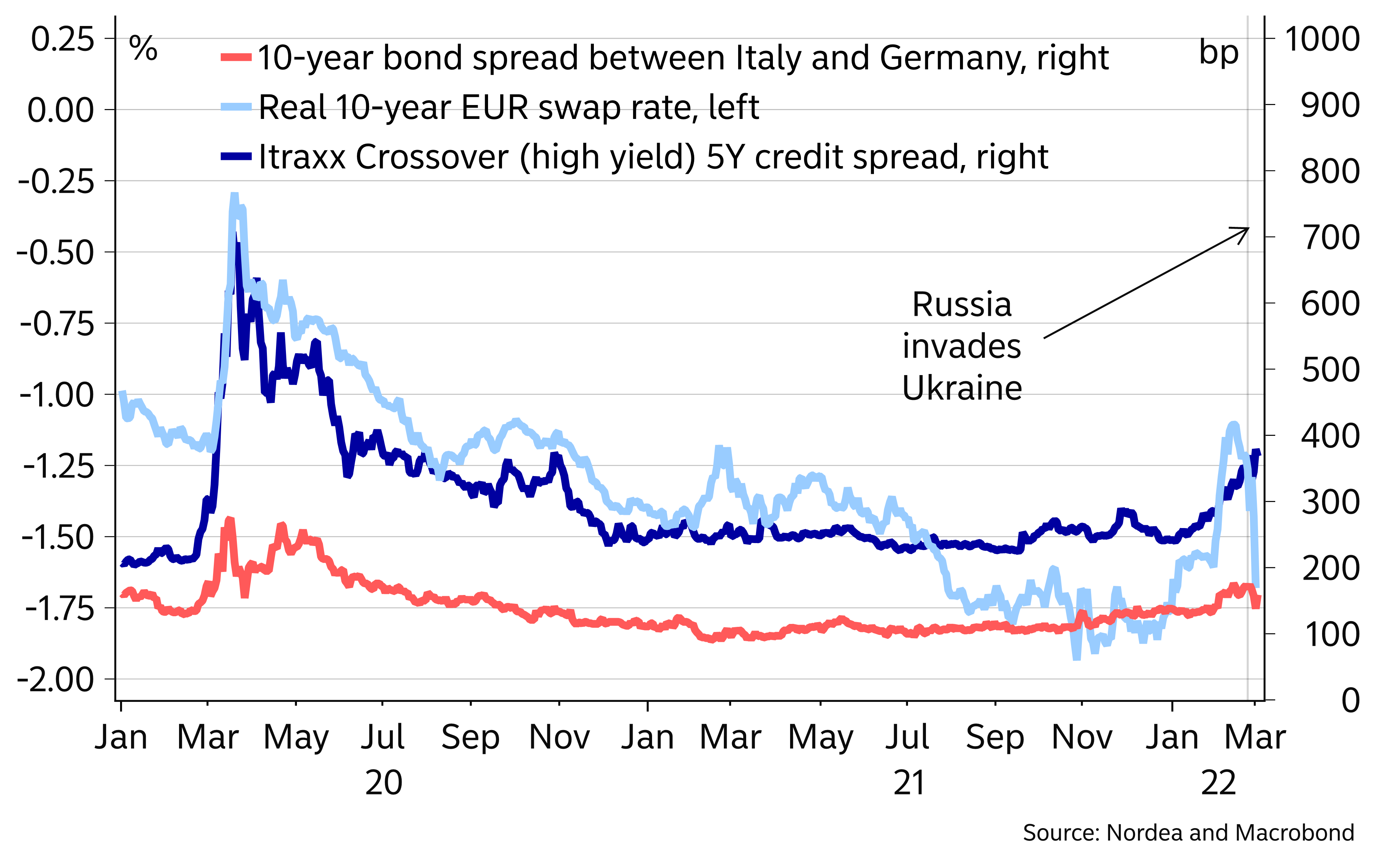

Finally, while financing conditions did tighten in response to the ECB’s earlier signals of tighter policy ahead, they have not really tightened further after the Russian attack.

Against this background, we think the ECB will go for a package of decisions that will leave it as much flexibility as possible regarding the future, including

- Accelerating the tapering of its net asset purchases, so that the net purchases would end during Q3 of this year (compared to the open-ended EUR 20bn pace from Q4 forward, outlined in December) and with that allow the ECB to raise rates already this year, if the data supported that

- Breaking the link between the end of net asset purchases and the start of rate hikes in its forward guidance to signal that rate hikes could be delayed

- Emphasizing flexibility to change the course of the bond purchases and the preparedness of continuing to buy bonds for longer and in bigger size, if financing conditions experienced an unwarranted tightening.

While there has been a lot of volatility, financial markets are still pricing in more than a full 25bp rate hike from the ECB by the end of the year. As things stand now, risks are tilted towards a later start to the hikes. Nevertheless, in our baseline projection we continue to think that the ECB policy rates are heading higher during our forecast horizon and rate hikes could still start already at the December meeting. That of course assumes that the negative impact of the war is rather mild.

Financial markets pricing in higher inflation amidst a deteriorated growth outlook

Euro-area financing conditions not tightened further since the Russian attack

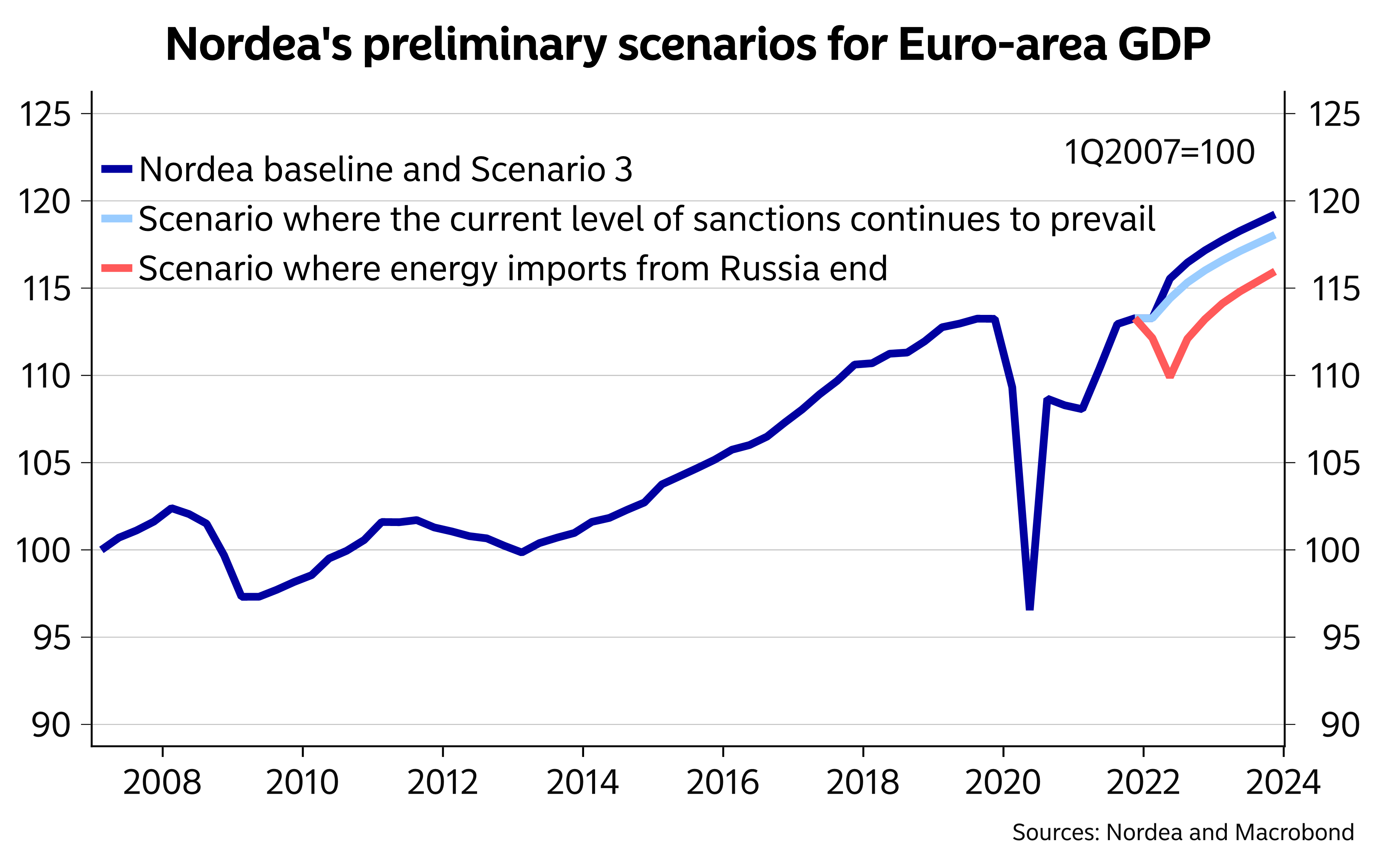

The economic impact of the war is highly uncertain

The ECB staff forecast process will be very different this time, which opens the door for large revisions. Lane said on Wednesday that the schedule for the March staff projections exercise has been revised in order to take into account the implications of the Russian invasion of Ukraine. The revised schedule also means that today’s Eurostat inflation release will be incorporated in the projections that will be considered at next week’s monetary policy meeting.

Different assumptions about the war outcome will lead to very different economic developments

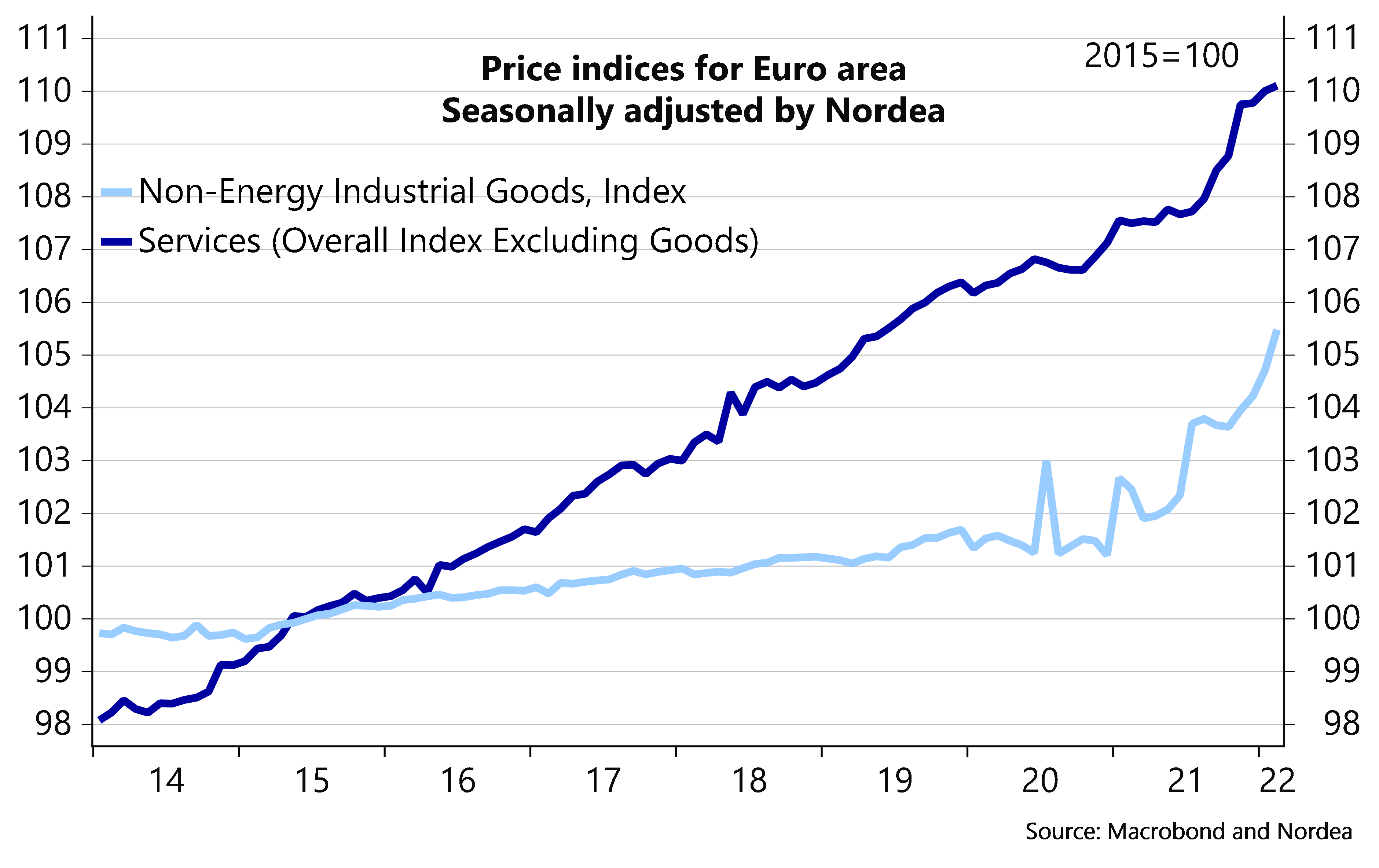

It is clear that the inflation projection will rise significantly in the short-term no matter what kind of growth profile the ECB assumes. Both headline and core inflation have first of all surprised strongly to the upside since the December projections, and the recent rise in energy prices indicate that more is to come. We expect that for 2022, the headline inflation will rise from 3.2% to around 5% and core inflation to rise from 1.9% to around 3%.

In conclusion, we expect the ECB to lift its core inflation projection for 2023 from 1.7% to around 2% but to keep the 1.8% forecast for 2024 nearly unchanged. We do expect the ECB to emphasise the high level of uncertainty around the projection, and this time they probably see risks on both ways.

Goods prices have continued to increase rapidly

Energy prices have risen dramatically

Flexibility and optionality needed more than ever

The monetary policy account from the ECB’s February meeting, released today, emphasized the need for flexibility amidst the ECB’s course towards policy normalization. Unless the ECB is ready to ditch its sequencing, i.e. ending net asset purchases before raising rates, which looks unlikely in light of recent communication, it makes sense to accelerate to tapering of net asset purchases to increase flexibility going forward.