Nordea venter en kraftig fremgang på Emerging Markets og forudser en kurs på 1,25 for EUR/USD. Nordea ser dog også dårlige tegn, f.eks. den kraftige stigning i den amerikanske arbejdsløshed, og der er forventninger om særdeles kraftige stigninger i olieprisen, og det vil også skubbe obligationsrenterne opad.

There are decades where nothing happens; and there are weeks where decades happen

Who expected the IMF would be quoting Lenin? 2020 has been a bizarre year in many ways and most people anticipate that 2021 will be marvelous in comparison. We remain EM bullish and find that the ECB has paved the way for 1.25 levels in EUR/USD.

If you want to receive a copy of FX weekly directly in your inbox, you can sign up via this link.

Quote of the week

“There are decades where nothing happens; and there are weeks where decades happen”–Vladimir Ilyich Lenin.

ECB QE was PEPPed up without any real threat of rate cuts (good news for EUR bulls), the two parties in the Brexit negotiations now hold a no deal as base case (time to buy GBP again?) and EM bets keep performing in an anticipation of a marvellous 2021. We have talked over and over about the potential melt-up in risk assets in 2021 due to too much money chasing too few assets post the pandemic.

It arguably feels like we are already in 2021 when watching price action but who knows whether 2021 will be a boring risk-on year given how much bizarreness we have experienced just during 2020? We take profit on our EUR/GBP longs and keep our EM bullishness intact.

Chart 1. Could risk assets melt up due to a scarcity of risk assets?

Who expected the IMF would be quoting Lenin?

Who, in 2019, predicted international travel would soon require a “health passport”? That WTI oil prices were going to trade below zero? That social media would censor the US President? That (economically) more successful EU countries would give allowances to less successful ones?

That the US was going to see substantial riots for several months? That the Lone Star State were going to sue other states after the US election? That Germany would suspend part of its constitution with a new infection law? That the Riksbank would start buying covered bonds? Or that the IMF(!) would quote Vladimir Ilyich Lenin?

And what happened to all populist movements (Hong Kong, Yellow vests, Catalonia) and to the populists (BoJo, Trump, Salvini)? Perhaps 2021 could provide plenty of surprises (or disappointments) and well, and perhaps Lenin was right in that IMF quote: “there are decades where nothing happens; and there are weeks where decades happen”…

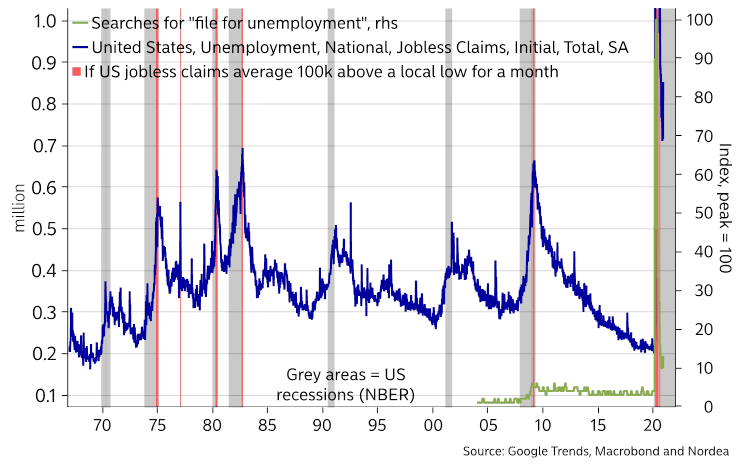

Chart 2. How about some joblessness as a Christmas present?

Turning to more normal stuff, US jobless claims skyrocketed this week, sending a gloomy labour market signal. Jobless claims jumped 137k over the week. This is not good news. Whenever jobless claims jump 100k or more from local lows, the US is often in, or about, to enter a recession. Recent development in google searches “file for unemployment” is also signalling near-term labour market weakness. Christmas is not only cancelled because of authorities’ responses to the virus, quite a few US citizens may get redundancy notices in their Christmas stockings as well.

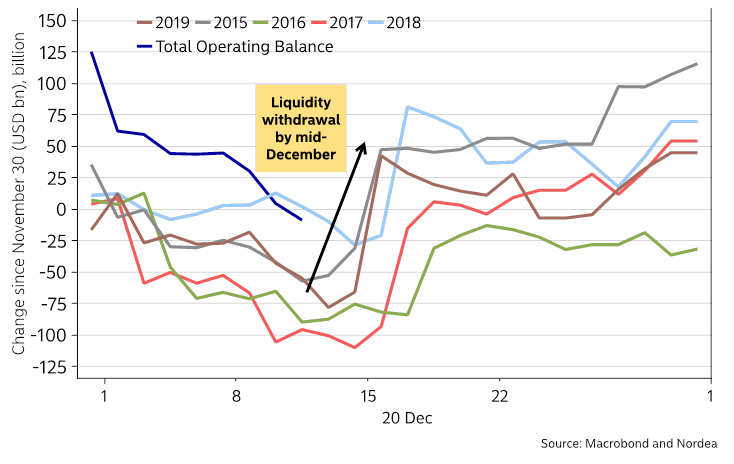

Chart 3. TGA to rise in the coming week, which will sterilise liquidity

Perhaps more interesting from the market’s perspective is the seasonality in the Treasury’s TGA account. The Treasury usually receives tax receipts around the middle of December, which reduces the amount of excess liquidity by an equal amount. This is chump change, but nevertheless constitutes a short-term negative (for the EUR/USD) around the same time as the Fed’s next meeting (December 16).

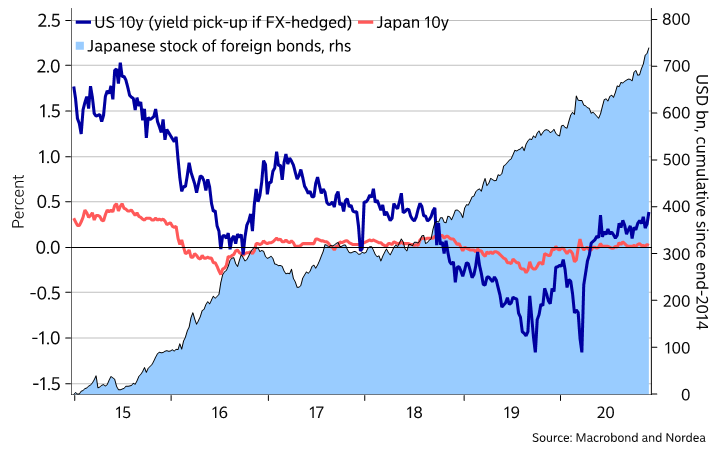

Chart 4. US 10y yield highest since summer of 2018 when adjusting for a 3m FX hedge

If we get a speed bump for the consensus view of a higher EUR/USD and a glorious 2021, then a speed bump may be possible for duration sellers as well? Here we note that, seen from Japanese shores and adjusted for the cost of FX hedging, the yield of a US 10y Treasury bond is the highest since the summer of 2018 – perhaps this can help keep the yield capped for the near term. Brexit risks also suggest as much. Recent flow data also suggest that Japanese fixed income investors have looked mainly towards US and Australia recently.

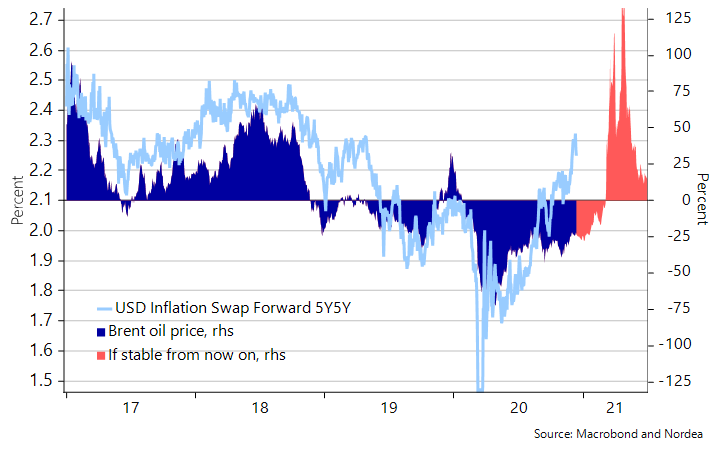

Chart 5. Oil price base effects will send inflation skywards next spring – good news for term premiums

But then again, seeing as 2021 is likely to be glorious once we’re all jabbed. One has to keep in mind that term premiums remain extremely depressed. And base effects from oil prices will send inflation skywards in spring time. WTI oil prices will rise 145% YoY in April and Brent oil prices will rise by 86% assuming prices as today’s levels. Such base effects usually boost inflation expectations and can also have a positive effect on term premiums – i.e. bad news for bonds.

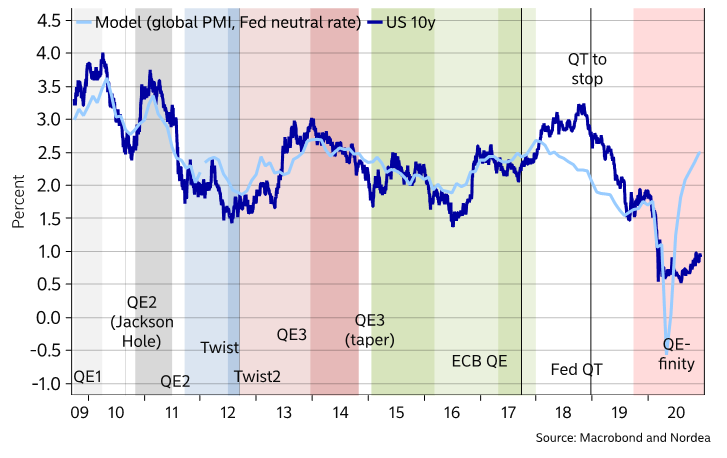

Chart 6. US 10y model suggests 2.5% as “fair value” currently

For the medium term, our models also imply plenty of downside to US fixed income from here on, with a regression of the 10y yield based on global PMI and the Fed’s idea of the neutral nominal rate landing at 2.5% rather than levels below 1%.

And this is before mentioning the risks of a regime change away from the rather deflationary 2009-2020 era. While not as risky as debt jubilees or debt cancellation (both of which has been discussed in 2020), the more central banks monetize government’s fiscal spending, the greater the risk of eroded confidence in fiat money. This effect need not be that visible in nominal fixed income assets, as central banks are sure to prevent a too big sell-off (via QE, YCC or other forms of financial repression).

The costs are thus more likely to be real than nominal. Promethean PhDs have given fire to our policy makers, and we fear this won’t end well. On that note, Mary Shelley had “The Modern Prometheus” as the subtitle of her Frankenstein novel, so perhaps we should be talking less about zombie companies (& households) and more about Frankenstein monsters? At least if, or when, Silicon Valley’s AI priests succeed in creating “life”? Which may not be such a good idea either.

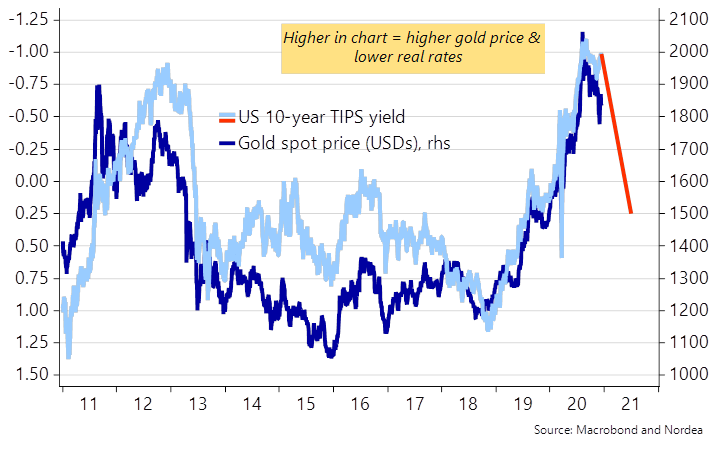

The question is if the shiny metal, which is a crowded long trade for very good reasons, can continue to shine if term-premiums are “allowed” to increase during 2021. Usually real yields go up, when nominal bond yields rise. Gold currently looks a tad cheap compared to real yields, but the gold bug crowd is BIG and already long (>70 % of open interest)!

Chart 7. Will the gold crowd receive a term-premium scare in 2021? (model on real rates if 10yr bond yields go to 2.5%)

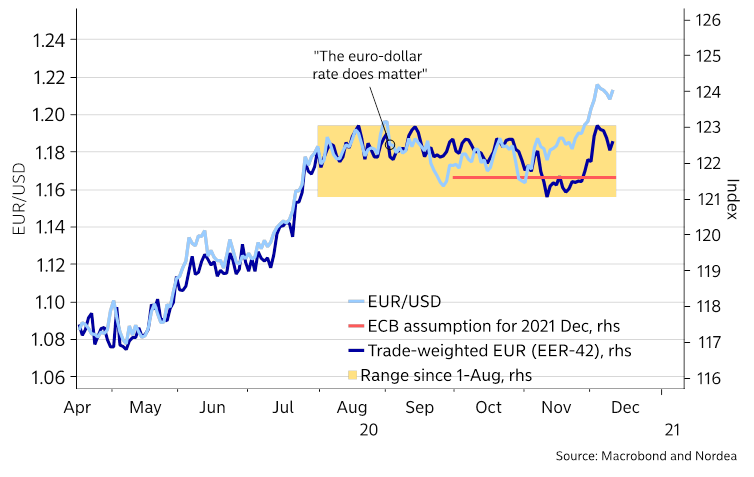

The ECB refrained from rattling the EUR bull cage as the deposit rate cut remains a tail scenario for the policy makers. The trade-weighted EUR has roughly traded sideways since August, which is probably comforting for the Gandalf’s within the ECB. As long as EM trades perform, then EUR/USD can also slowly climb higher.

Chart 8. The trade weighted EUR has roughly range-traded since august despite a spike in EUR/USD

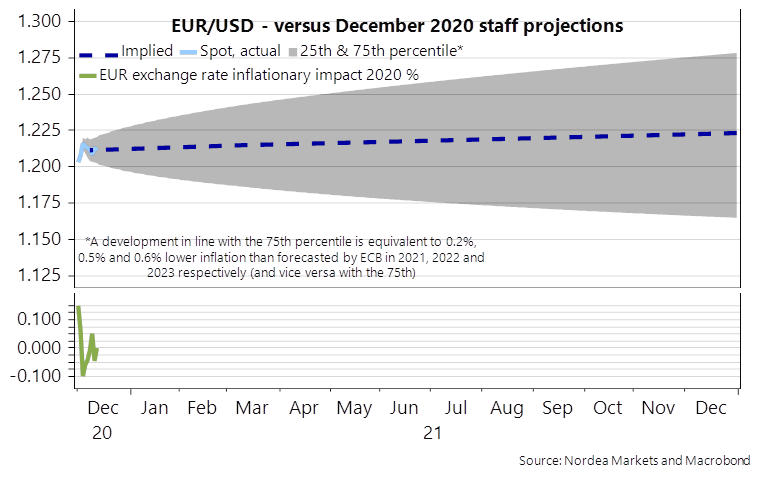

The ECB inflation staff projections treat FX very mechanically. A development in line with the 75th percentile in a ”risk cone” around the implied EUR/USD forward equals a 0.2%, 0.5% and 0.6% downwards revision of 2021,2022 and 2023 in forecasts. It also means that EUR/USD can move to 1.25 or thereabout during the spring without any repercussions should inflation surprise by 0.2%-points compared to the current staff projection. Not an impossible scenario given how inflation dovish even the ECB staff has become.

Chart 9. EUR/USD effect on ECB staff projections. 1.25 is OK if inflation surprises by 0.2%-points

BoJo and Von Der Leeyen suddenly sound like ”no-dealers” in the media, which is probably the best possible signal you can get that neither has any intention of actually allowing a cliff-edge scenario to unfold from 1st of January. Is it not classic public relation tactics to tell the public that there is a clear risk that everything will fall apart unless a prolongation is agreed upon?

We take profit in long EUR/GBP bets and are comfortable being short the pair from levels just south of 0.93 in anticipation of another last-minute prolongation. For those who hope for a big trade deal, a prolongation may be the worst-case scenario since there are no incentives for any of the parties to break the stalemate unless an external trigger-move is introduced to the game. A cliff-edge no deal would be exactly such a scenario. A prolongation will just lead to more of the same.