Nordea hæfter sig ved den holistiske tilgang, som ECB-chefen Lagarde havde til pengepolitikken på ECB’s første pressemøde i år. Hun udtrykte sig forsigtigt og lagde vægt på, at ECB ser “hele kompasset rundt”, dvs. ser på finansieringsbehovene for såvel private husholdninger som banker og stater. Der er ikke udsigt til nogen ændring af pengepolitikken, og der er ikke udsigt til flere obligationsopkøb. Men Nordea vurderer dog, at der er udsigt til svage rentestigninger, og at ECB vil acceptere det.

ECB Watch: Holistic compass

Lagarde was balancing her comments carefully today and did not give any new guidance on where the ECB is heading. We think the ECB will gradually scale down the pace of its bond purchases, which leaves some room for higher yields and spreads.

- No changes to policies from the ECB and balanced comments from Lagarde.

- Minor tweaks in the statement suggest more openness to scale bond purchases either way and fewer worries about FX developments.

- The ECB defines favourable financing conditions holistically and does not target any specific yield or spread levels.

- We expect the ECB to gradually scale down the pace of its purchases, opening more room for gradual upward moves in yields and spreads.

The ECB kept its monetary policy stance unchanged Thursday and Christine Lagarde tried to balance her comments as carefully as possible. This probably reflects both the uncertainty regarding the future as well as the differences of opinions within the Governing Council. Nothing is off the table and the Governing Council continues to stand ready to adjust all of its instruments.

There were a few minor tweaks here and there, though. The ECB emphasized that the Pandemic Emergency Purchase Programme (PEPP) could be adjusted both ways. Lagarde has said the exact same thing before, but this time it was lifted already to the monetary policy statement, which is not totally insignificant.

If favourable financing conditions can be maintained with asset purchase flows that do not exhaust the envelope over the net purchase horizon of the PEPP, the envelope need not be used in full. Equally, the envelope can be recalibrated if required to maintain favourable financing conditions to help counter the negative pandemic shock to the path of inflation.

In the press conference, Lagarde pointed out that the word equally meant that while it was possible that the full envelope would not need to be used, it was equally possible that the programme would need to be calibrated upwards.

Second, references to the exchange rate were dropped from the statement but included in the introductory statement, suggesting worries about rapid EUR strengthening had eased somewhat.

The big message remained that the ECB still sees that its December projections remain largely valid, as they assumed only gradually progressing vaccinations and lockdowns continuing throughout Q1. Risks remained tilted to the downside, but had become less pronounced. Lagarde listed both positives and negatives since the December meeting.

The positives included

- vaccinations had started, albeit with some difficulties

- agreement was found on Brexit

- European leaders had reached complete agreement on the Next Generation EU, i.e. the recovery fund, which means more fiscal stimulus will come

- manufacturing was clearly on a recovery path

- uncertainty related to the US election results had been removed.

The negatives, on the other hand, included

- pandemic had worsened in many countries, lockdowns had been tightened and extended

- activity likely declined in Q4 last year

- inflation numbers remained extremely weak, and domestic price pressures remained subdued.

Understandably, a lot of focus was on how the ECB defined favourable financing conditions, as preserving such conditions is now the key part of the ECB’s guidance. Lagarde explained that the ECB is taking a holistic approach on defining financing conditions, one that covers households, companies and sovereigns, credit conditions, bank lending conditions, corporate and sovereign bond yields.

She added that favourable financing conditions were the compass, while countering the downward impact on the path of inflation was the anchor. In other words, she wanted to play down suggestions that the ECB was targeting any specific level of yields or spreads, but was taking a much broader view, which in turn leaves the central bank with much more flexibility in how it scales its bond purchases.

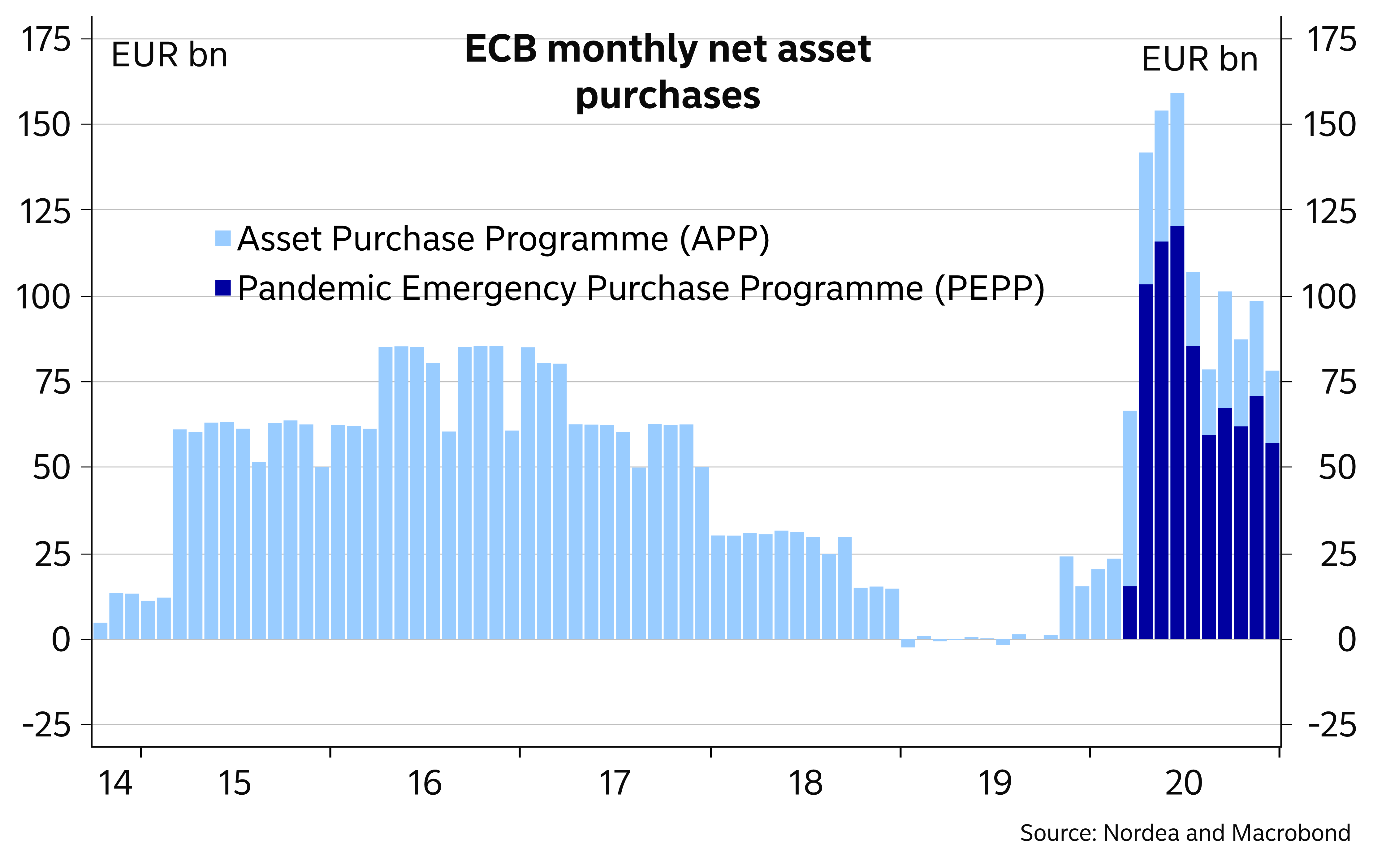

We do not expect the ECB to expand the PEPP further. Purchases will likely be sizable still in the first half of this year, when bond issuance needs are large and as the ECB seeks to further strengthen credibility that its flexible approach to the purchases did not mean it would be about to let yields rise. The peak pace of the purchases is already clearly behind and the pace will gradually fall.

Pace of bond purchases already fallen clearly

Pace of purchases to gradually fall

The end of net PEPP purchases does not mean the end of net purchases altogether. The Asset Purchase Programme (APP) also continues at a monthly volume of EUR 20bn, and we expect the ECB to move at least some of the flexibility of the PEPP into the APP later this year, when it concludes its strategy review. The ECB could then continue net asset purchases also beyond March 2022, but the focus will shift back to the APP.

The falling pace of purchases will reflect the proceeding economic recovery but also a compromise between the more dovish and hawkish members of the Governing Council, with the latter group actively reminding that the PEPP needs to be only a temporary tool. Since the ECB has not set any purchase pace targets for the PEPP, it can allow the pace to fall relatively silently without having to make an explicit decision at a monetary policy meeting. This could make the ECB’s exit strategy somewhat easier.

As Lagarde made clear, preserving easy financing conditions is a broader concept and likely also a relative one. This probably means that the ECB will tolerate a gradual rise in longer bond yields, if they reflected a rebounding economy and higher inflation expectations. We see some upside potential in bond yields and spreads and a slightly steeper curve amidst firmer signs of a recovery.

Bond yields edged slightly higher today in response to Lagarde’s message, but the moves were not huge.