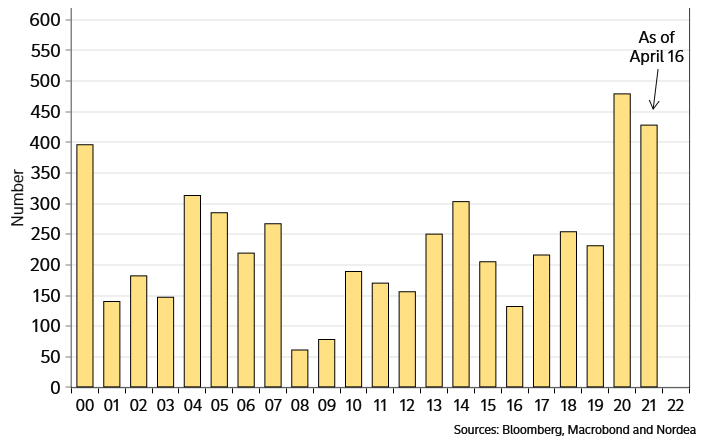

Også Nordea kommer med en risiko-advarsel, og det er et boom i børsnoteringer. Sidste år gik 480 virksomheder på børsen i USA. I år er 426 virksomheder gået på børsen. 2021 kan blive et boom-år, måske med 1600 selskaber på børsen? Det suger kapital væk fra markedet, og på grund af lock-up bestemmmelserne vil der være en begrænset handel i de nye aktier. Men i tredje kvartal kan der komme et brandudsalg, som kan trykke markedet.

Global: could the IPO boom smash risk appetite?

We have earlier written about the “shortage of equity shares” as potential driver of returns, but perhaps it’s time to mull a pending lack of shortage? After the current IPO tsunami, what will happen when insiders get to sell?

Some 18 months ago we were wondering if not a low supply of shares could be a “secret” positive driving force for the stock market, as share buybacks and M&A activity reduced the amount of shares purchasable by the general public (see this article in Swedish here).

However, last year was a bumper year for IPOs in the US. As many as 480 companies were listed on the stock exchange last year, and 2021 has started off way stronger than that – with more than 426 IPOs year to date. If this extreme pace continues throughout the year, as many as ~1,600 companies will be listed this year (are there even that many?).

Chart 1: Last year was a bumper year for IPOs, and 2021 starts even stronger

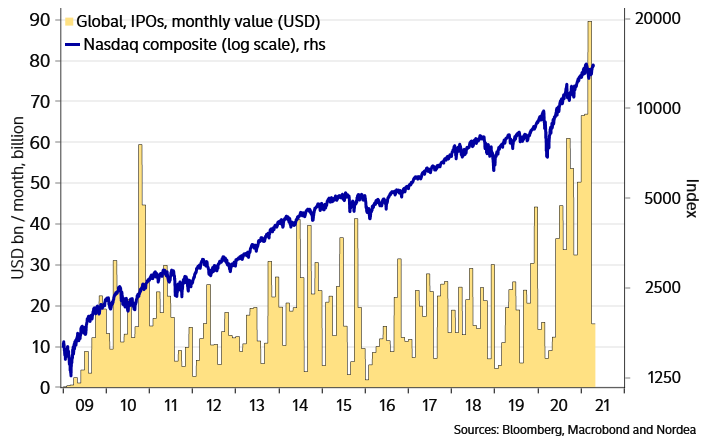

In any case it seems as if 2021 will be an even stronger year than 2020 in terms of IPOs. And it’s not only about the number of IPOs, the value on offer has been surging too – especially since last summer.

Chart 2: A flood of IPOs – especially since the summer of 2020

In light of this IPO tsunami, we may have to ask ourselves if we instead of a shortage of equity assets perhaps will face an abundance of equity assets.

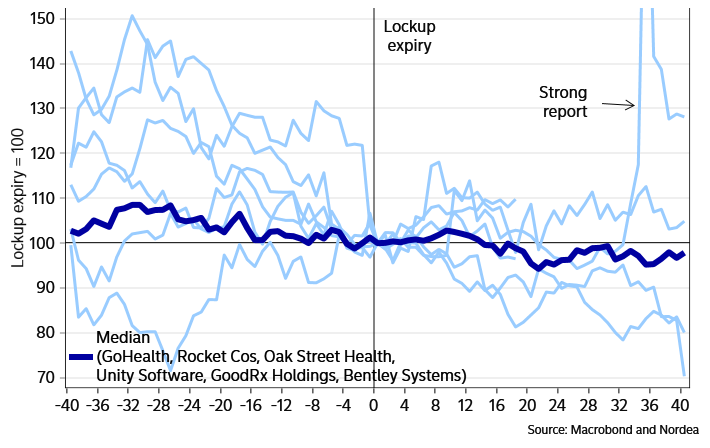

Insiders are typically not allowed to sell shares during the first six months after an IPO. The record-high number of IPOs in February, could thus lead to a rise in supply of shares six months later.

Chart 3: End of lock-up periods may put downward pressure on individual shares

This chart shows price developments for six equities in relation to the Nasdaq composite index, when insiders were allowed to sell their holdings at the beginning of 2021 (we selected for companies with a market cap above USD 5bn at the IPOs, and lock-ups ending year-to-date 2021). Even though extrapolating on the basis of so few observations is fairly dubious, we see that five out of these six companies did tend to underperform before the end of respective lock-up dates.

As insiders will likely buy other assets if/when they sell shares, related effects should not have a negative impact on the broader market. However, with record-many IPOs perhaps the flow effects could rub off also on index levels, or perhaps the price action of certain companies may result in psychological effects?

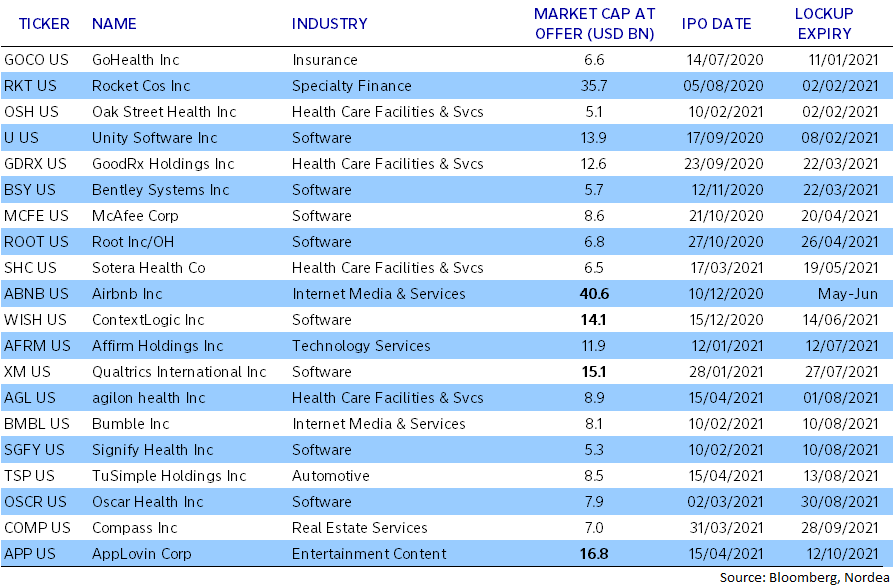

Table 1: Large US IPOs lately

For the well-known company AirBnb, which was listed in December and which is also representing ”the new sharing economy”, as it is commonly called, insiders’ lock-up period will end sometime after its quarterly report is published on 12 May. What will happen then?

Here we are talking about a market cap of more than USD 100bn at present, and a company whose share price could be considered a proxy for the “modern economy” and thus may risk having a wider effect on investor psychology.

Given the recent flood of IPOs, we can also construct a chart showing when respective lock-ups will end. And here we see that a wave of insider selling becomes possible in the third quarter. For instance, on July 7, lock-ups end for 12 companies, of which 11 are now-trendy SPACs(Special Purpose Acquisition Company).

One should ideally calculate marketable dollar amounts when lock-up periods end. However, since this data is cumbersome/tricky to come by, we choose to use market cap at IPO as a dumb proxy. And for what it’s worth, the modest Nasdaq decline in late January and during the second half of March, coincided with the end of two “major” lock-up periods.

The bottom line is that we risk seeing increased selling by insiders later this year, when both the US ISM index and EA/US/world GDP growth has peaked (in yoy terms)…

We are of the view that the stock market usually doesn’t experience a sharp decline as long as profits grow, especially if discount rates remain at today’s historically depressed levels. But perhaps we are underestimating the above-mentioned supply effect as a “secret driving force” which could dent risk sentiment?