Nordea stiller et provokernde spørgsmål i en analyse af de mulige konsekvenser af det amerikanske valg. En konsekvens kan være, at centralbanken reducerer sine opkøb. Men hvad så? Et tidligere medlem af centralbanken siger, at centralbanken snart ikke har mere krudt tilbage, så stimuli må komme fra staten. Får statslige udgifter en langt større rolle fremover, kombineret med flere restriktioner for erhvervslivet? Og hvad med ECB’s udstedelse af grønne obligationer – er det reelt et power-grab fra ECB’s side? Er der ved at blive ændret på nogle fundamentale forhold?

Are markets dumb or not?

Bettors are much more optimistic on Trumps behalf than most PhD modellers. Are markets dumb or not? We will see this week. We favour USD longs into the election with rising restrictions in Europe and a potential scope for lengthy lockdowns.

Are betting markets dumb or not? Or are they perhaps criminally insane? We’ll hopefully find out during the coming week. Perhaps we will know the results already Wednesday morning European time, but the Supreme Court’s decision to allow some/several states to keep counting mail-in ballots for days afterwards means we might not know for sure until late in the week or even the week after.

Even if the Democrats take control of the White House and the whole of Congress, President Trump and Treasury Secretary Mnuchin may have some tricks up their sleeves. If they want to go out with their guns blazing, they might be able to force the Fed to taper its QE program or perhaps pause it by lowering issuance.

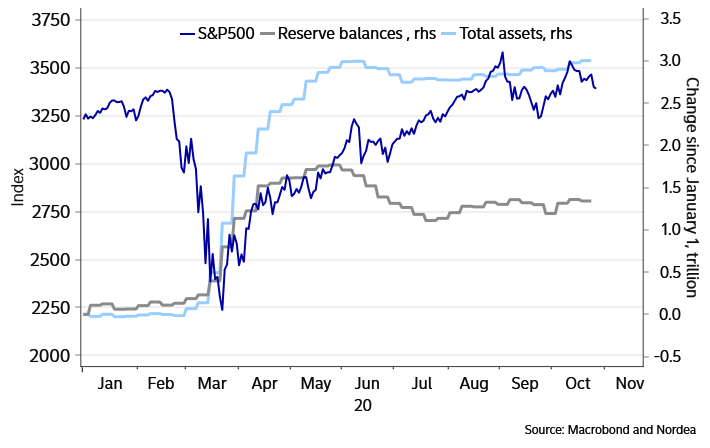

Chart 1. Fed B/S vs S&P500

Such a move would draw down the elevated Treasury’s General Account (TGA) at the Fed, and thus boost bank reserves (excess liquidity). While more liquidity would normally be positive for risky assets, the reduced growth of the Fed’s balance sheet may more than offset this. The S&P500 has been more strongly correlated with the size of the Fed’s balance sheet than with bank reserves this year.

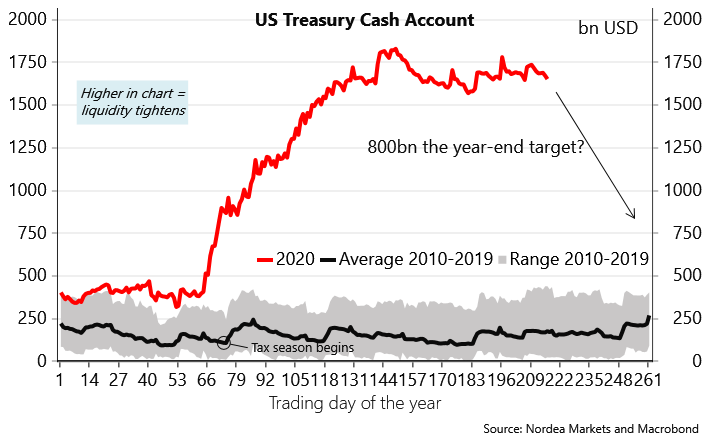

The US Treasury will, hilariously, publish a “non-politized” quarterly refunding forecast just 24 hours ahead of the election. They will likely continue to communicate that the TGA could end the year at just $ 800bn, but that obviously requires a huge fiscal deal or a tin-foil hat scenario with no issuance as described above.

We do not find it likely that a sizeable fiscal deal will be implemented until 2021 almost no matter the scenario that plays out on Tuesday. If the Republicans keep the Senate despite a Biden win, they will have every incentive block everything tea party style until the mid-terms. Then the ball is back in the Fed’s court.

Chart 2. Will the TGA ever come down again?

Speaking of the Fed, ex-Fed Dudley said in an interview recently that “[t]he outlook for the economy is deteriorating”. (A saying involved a fictional character living on London’s Baker Street comes to mind).

He went on to add that the Fed nears the point of being out of firepower and that “America’s future prosperity depends more than ever on the government’s spending plans”. So there we have it: government spending (apparently) holds the key to future prosperity. M.M.T in all but name.

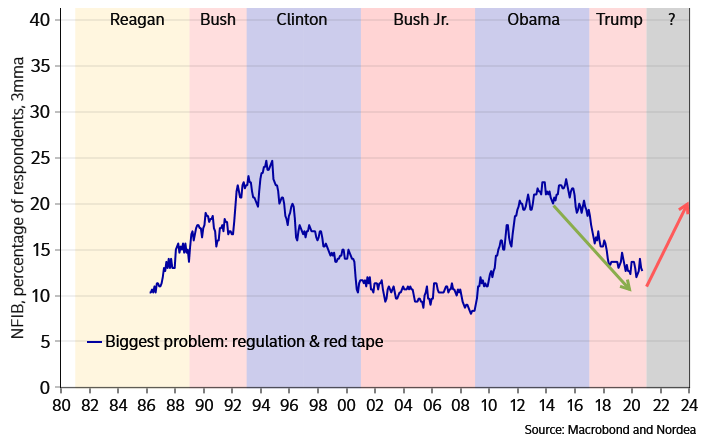

Chart 3. Small businesses became less annoyed by red tape under Trump

We would however argue that government spending could be antithetical to “prosperity”. It is the private sector which holds the key to true growth over the long term. Government spending risks crowding out the private sector and stifle long-term productivity growth.

We think investors pay too little attention to this possibility from a Blue Wave scenario. A Biden win could also be the start of massive re-regulation of the US economy – also a negative for long-term growth.

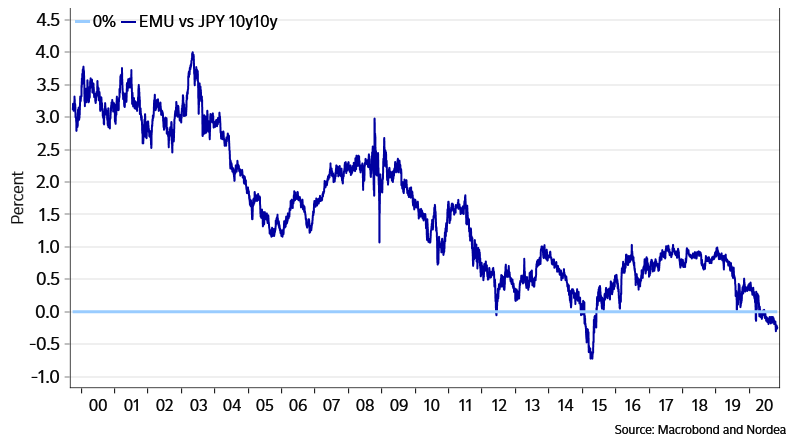

Chart 4. Euro-area fully Japanized

Similar views are prevalent within E[SG]urope, where the fixed income market has become fully Japanized. ECB Lagarde has asked “whether market neutrality should be the actual principle that drives our monetary-policy portfolio management” and Riksbank’s copy-cat Breman wants to “consider sustainability in our purchases of corporate bonds”.

While sustainability is a nice word, these views imply another power grab by central banks – a power grab investors will want to keep front-running.

So far we have mostly talked about the E in ESG, see eg our speculation about climate QE & TLTROs last year and the Green Bubble early this year. Going forward we advise thinking more about the SG parts of ESG.

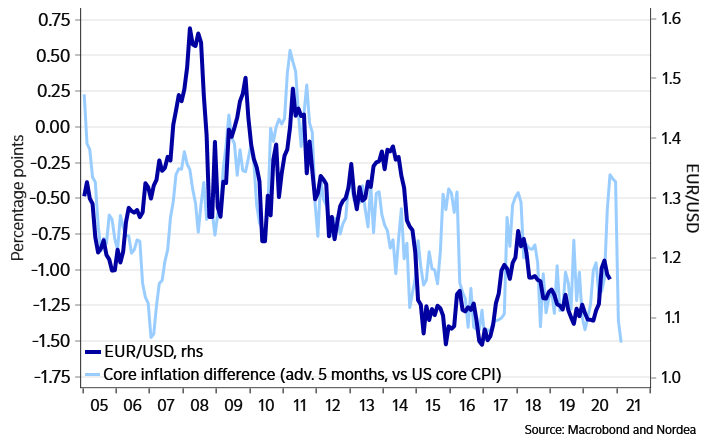

Chart 5. EUR/USD – core inflation spread point south

On the macro front, the recent collapse in Euro-area core inflation continue to point decidedly south for the EUR, as the ECB should be under greater pressure than the Fed to “go big” – e.g. via ESG related purchases or just via adding Fallen Angels to the QE program. This should also keep a lid on relative EUR credit spreads compared to USD spreads, which in turn could richen the USD in the xCcy basis (more negative figures).

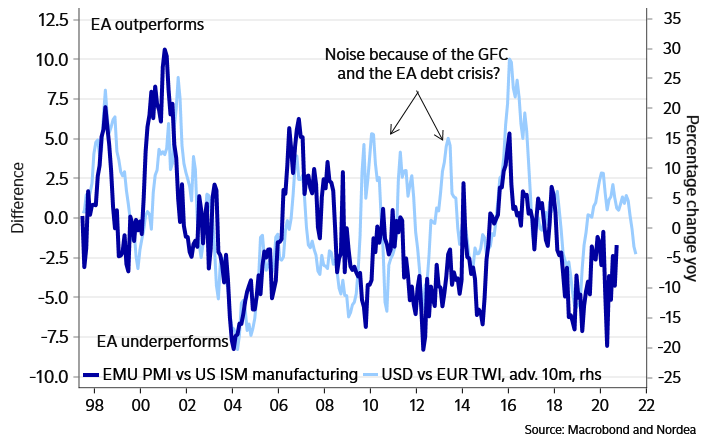

Chart 6. EMU PMI may underperform again in 2021

This year’s rise in the trade-weighted EUR furthermore suggests economic headwinds for the Euro area into the beginning of 2021. Historically, a rise of the EUR (or drop of the USD) predicts relative underperformance in the Euro-area’s manufacturing sentiment. This adds to the pressure on the ECB. Go big or go home in December.