EU-kommissionens forslag om en fond for at genrejse økonomien er intet mindre end en super-boosting af økonomien, vurderer Nordea. Fonden bliver større end det tysk-franske forslag, nemlig på 750 milliarder euro. De 500 milliarder bliver direkte tilskud til de hårdest ramte land. Pengene skal ikke betals tilbage. De 250 milliarder bliver lån – som sparebanden i EU har krævet. Med fonden lægger EU også op til nye indtægtskilder, såsom en CO2-skat.

Uddrag fra Nordea:

Euro area: Turbo-boosting the recovery

The EUR 750bn recovery fund proposal presented by the Commission today could make a difference but still faces obstacles. If passed, it would illustrate a strong commitment to keep the Euro-area and the EU together and support EUR assets.

- The European Commission proposes a package worth EUR 750bn, EUR 500bn in grants and EUR 250bn in loans, financed by bonds issued by the European Union. The repayment period would last until 2058.

- The grants would be targeted towards countries in worst economic difficulties, with e.g. Greece receiving aid worth more than 13% of GDP.

- The plan faces many obstacles, but if passed, it has the potential to significantly boost confidence towards the EU and Euro area.

- The plan aims to increase investments in the future, but at this stage, there are a lot of questions marks related to implementation. Unless the aid comes with strong conditionality, there are clear risks of moral hazard and an eventual loss of confidence towards the EU in a number of countries.

- The proposal comes up with many new sources of revenue, such as a border carbon tax for the EU, to help finance the package, which may also raise objections in a number of countries.

- A convincing recovery plan is positive for the EUR and supports narrowed intra-Euro-area bond spreads.

The European Commission proposed today a EUR 750bn package to support the recovery from the corona crisis, of which EUR 500bn would take the form of grants and EUR 250bn in loans. The Commission’s plans will also include a general increase in the EU budget and follows a string of other support measures decided earlier.

The package would be financed by the bonds issued by the European Union, backed by the EU budget and guarantees from EU member states. The EU has issued bonds before, but with an amount of around EUR 50bn outstanding, the magnitude has been much smaller. At least a part of the bonds would be in the long-end of the yield curve as the Commission proposes that the debt would be paid back only by 2058.

One of the major changes to the earlier EU policies is that the package proposes a number of new own resources, including income from the Emission Trading Scheme (ETS), a Carbon Border Adjustment Mechanism and a new digital tax.

The grants would be targeted towards countries in worst economic difficulties, and the amounts would be significant. Greece would receive support worth more than 13% of its (2019) GDP, Spain for close to 7% and Italy worth around 5% of GDP. Following the aid packages in the form of loans that were used in the Euro-area debt crisis, the Commission’s proposal would take a huge step towards increased solidary within the EU.

If passed, and that remains a big if, the plan has the potential to considerably boost the recovery of the economies worst hit by the crisis, and build confidence that the member countries are committed to supporting the union in times of crisis. Within the Euro area, the plan would also relieve the ECB of some pressure it is facing to keep the Euro area together.

However, the details will make a huge difference and the plan also includes real risks. On what basis will the money be allocated? Will there be conditionality to encourage real economic reforms? Or will this only set a precedent and expectations that the EU will provide support also in future crisis without the need for reforms? How quickly will the funds be in use? Given the seriousness of the crisis, there are good grounds for increased solidarity, but the long-term positive effects will only be achieved with efficient investments. It seems that the money will be distributed mostly though EU programmes without special focus on conditionality. Perceptions of fiscal transfers without conditionality could seriously hurt the popularity of the EU among the net contributor countries.

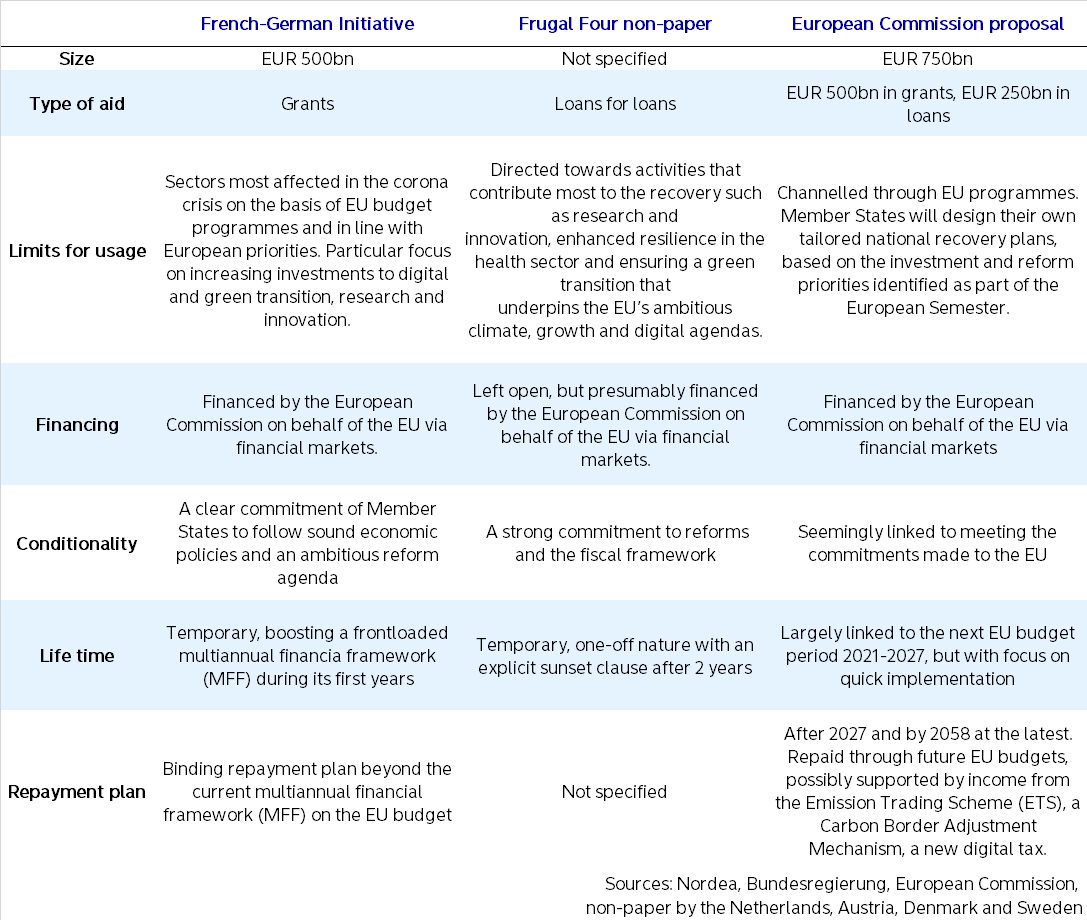

Commission’s recovery plan compared to other recent proposals

Now comes the hard part

The Commission’s package follows the proposal from France and Germany and the counterproposal by the so-called Frugal Four (the Netherlands, Austria, Sweden, Denmark). The Commission idea is close to the Franco-German idea, and having the two largest EU economies on board naturally is an important prerequisite for an eventual agreement, which requires unanimity within EU countries.

The objections of the Frugal Four, who called for a short-term loans-based approach, are sizable and present an obstacle to the passing of the Commission plan, which according to many legal experts is probably again at the very least stretching the EU treaties a lot. Most likely, these four are not the only ones having issues with the plan, so the negotiations ahead will be difficult. Still, the pressure for compromise is large, and there have already been some signs of a willingness to compromise in these countries.

Given the magnitude of the crisis, its type (an external event, for which the most affected countries should not be blamed) and the fact that France and Germany already seem to have reached an agreement support expectations that a deal will finally be reached. However, it is a fair assumption that the eventual compromise will be a watered-down version of today’s blueprint.

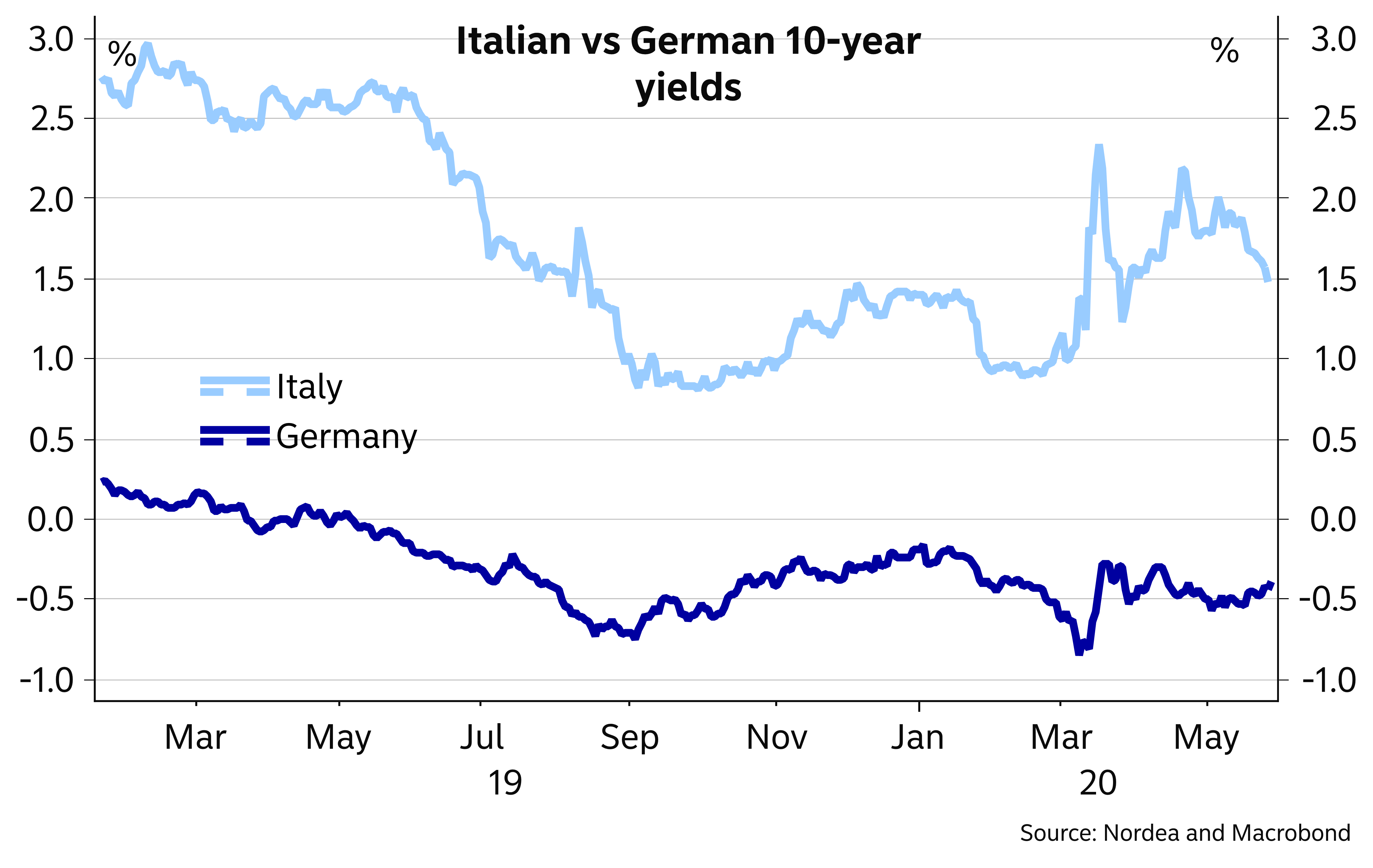

Support for the EUR and Italian bonds

The corona crisis has again revealed the weaknesses of the Euro area and raised even the prospect of the break-up of the currency area. Today’s proposal, if implemented, should decrease the risks regarding the future of the Euro area. It is clearly beneficial for Italian bonds, but is negative for German bonds both via a higher credit risk component, as the EU’s credit status relies heavily on the German credit rating, and via an improved economic outlook. The plans should thus decrease intra-Euro-area bond spreads.

The euro should be supported as well, if the political risks facing the currency are seen to have fallen.

Given the number of open questions and the difficult negotiations ahead, there will most likely be market volatility ahead, as the market reassesses the prospects of a compromise. Assuming an eventual compromise is found, without watering down today’s elements too much, it should support the euro and EUR assets in general in the medium term.