Inflationen i eurozonen satte i november ny rekord – med 4,9 pct. Kerneinflationen blev på 2,6 pct., og det var også rekord. Den seneste tids høje energipriser er den vigtigste årsag til den høje inflation. Det er i høj grad Tyskland, der har drevet inflationen i vejret, da kerneinflationen er langt lavere i Sydeuropa. Hvis energipriserne falder, er det muligt, at kerneinflationen vil falde en smule næste år. ECB venter en lavere inflation.

Euro area inflation: record-high, again

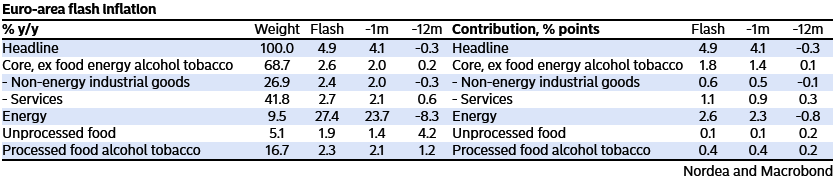

Euro-area inflation hit another record-high in November at 4.9% y/y. Core inflation also hit record-highs at 2.6% y/y. Energy prices remain the largest contributor to headline inflation, but underlying price pressures are clearly building.

Euro-area inflation hit another record-high in November at 4.9% y/y, up from the previously tied record at 4.1% y/y in October. Euro-inflation data dates back to 1999, while German national data showed the highest inflation rate since 1992!

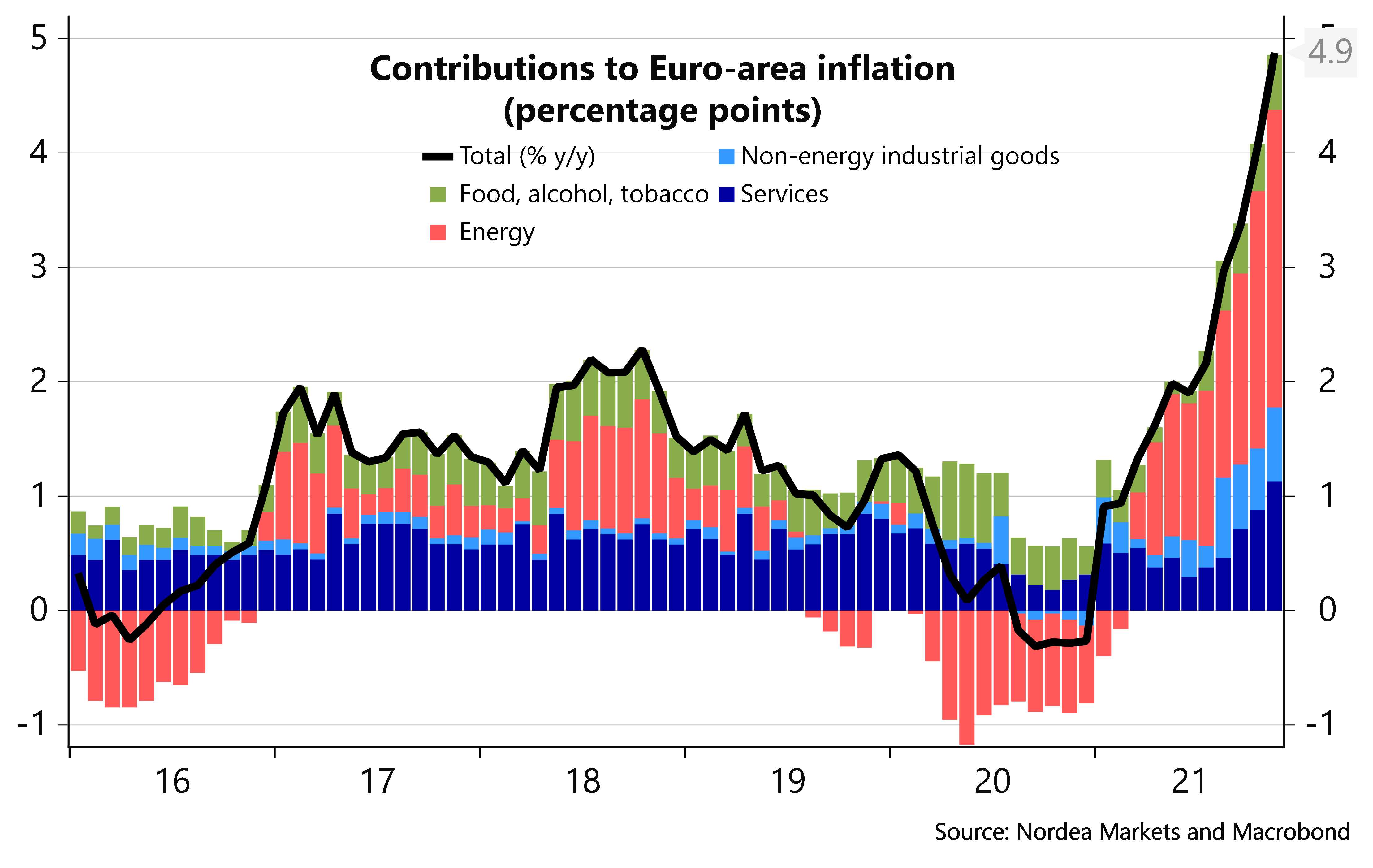

Energy prices remain the largest contributor. Thus, of the 4.9% y/y headline inflation, 2.6% points stem from energy prices and another 0.4% points stem from food prices. With HICP inflation ex energy at 2.3% y/y (4.9% – 2.6%), headline inflation would be close to he ECB target in a year’s time if energy prices were to remain at current levels.

In other words, the ECB still has a valid claim that inflation is likely to be lower next year. Concerns over the higher energy prices relate more to the potential adverse growth impact as well as potential second-round effects from higher expected future inflation to higher wage growth than to overshooting the inflation target.

However, core inflation is also on the rise and stood at 2.6% y/y in November, up from 2.1% y/y in October and the highest level since data was released in Dec 2001. Part of the high core is base effects from last year’s temporary German VAT cut and part is supply disruptions and tighter labour markets. The latter parts point to core inflation not much below the ECB’s (headline) inflation target next year. Indeed, both service price inflation and Non-Energy Industrial Goods (NEIG) price inflation are above 2% and rising.

Waiting for the second round effects in Germany

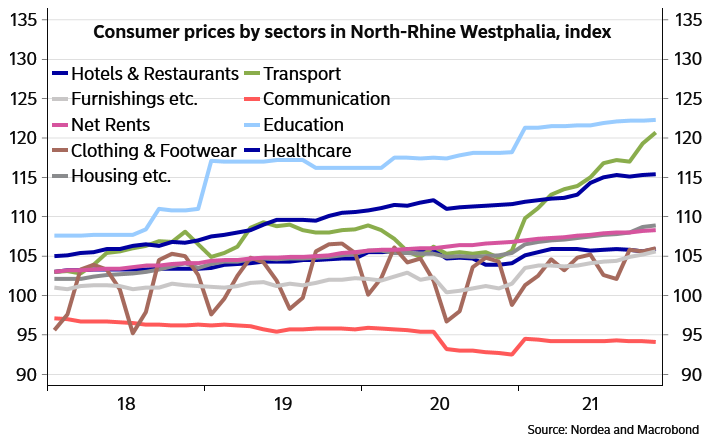

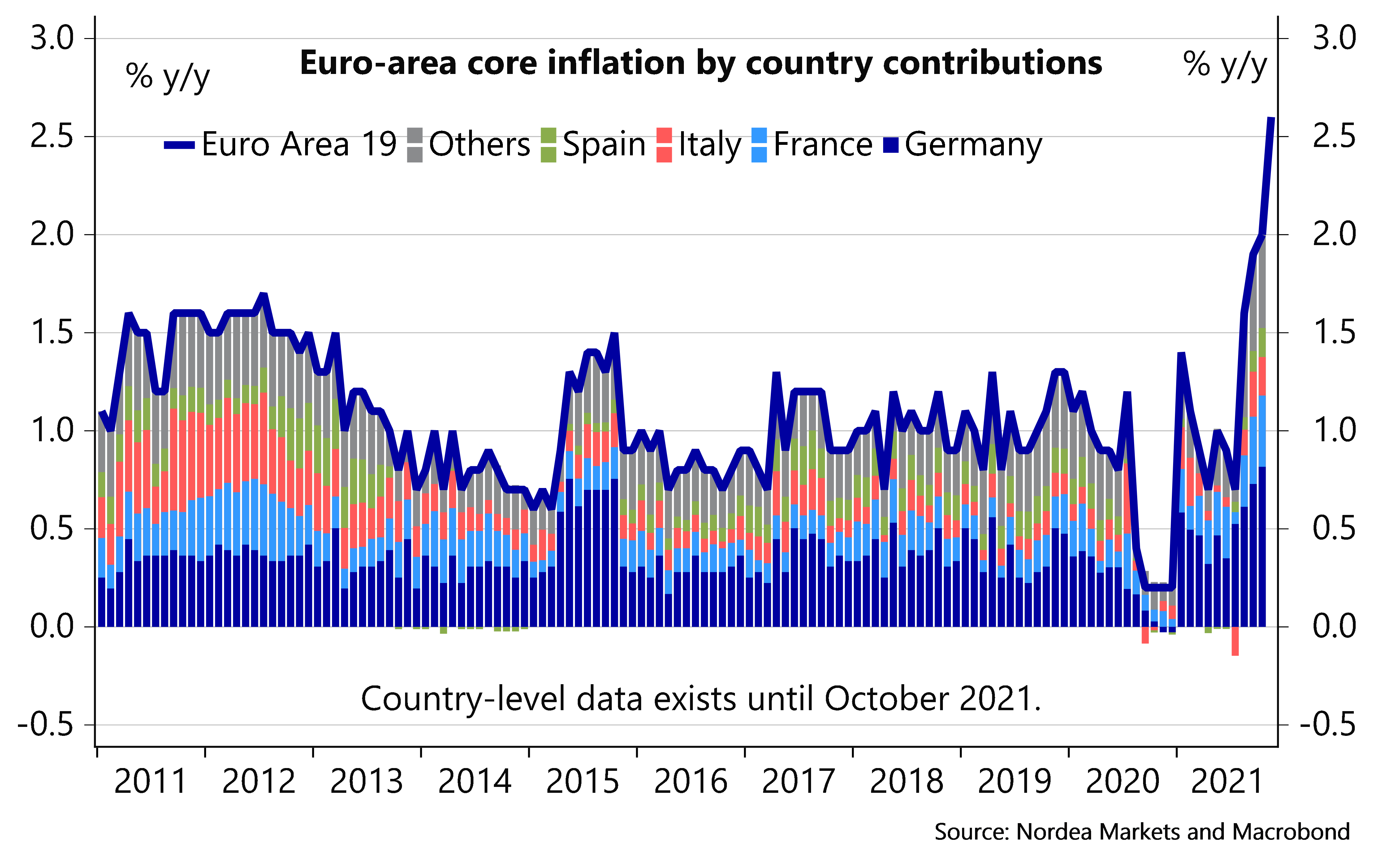

By looking at the country and sectoral level data, we continue to think that the price pressures are still rather specific and concentrated on certain sectors while wider and more general upside pressures in consumer prices are much weaker than what the headline numbers show.

In Germany, where inflation has for long been the highest, the base effect from the VAT cut, energy-intensive prices as well as shifts in the seasonal patterns among package holidays and clothing have been the factors driving up core inflation. Based on the state-level data, that seemed to be the case also in November as the price increases in most sectors continued to be modest.

Regarding the second-round effects stemming from Germany’s exceptionally high headline inflation, the publics sector reached yesterday a new wage which implies a tax-free payment of €1,300 at the beginning of 2022 and a wage increase of 2.8%. The deal runs for 24 months and we do not see the new agreement as a sign of a wage spiral in Germany.

Price increases in most sectors have remained modest in Germany’s largest state

In Southern Europe, general price pressures accumulating slowly

Energy continued to be the main driver of headline inflation also in the other bit Euro-area countries. However, the period of very low core inflation is clearly behind as the prices are correcting to a more normal levels.

In France, HICP inflation accelerated slightly to 3.4%. Preliminary data on core inflation showed a modest increase as service price inflation rose from 1.8% to 1.9% and the prices of manufactured products increased 0.8% y/y (0.3% in October).

In Italy, core inflation increased to 1.4% from 1.1%. The statistical authorities listed the prices of transport services to have increased by 3.6% being one of the key drivers behind the development.

In Spain, underlying inflation has been climbing up and was already 1.7% in November. However, based on the preliminary data it seems that that was at least partly due to the base effect: prices were at very low level in November in 2020 in many service sectors. However, most details are still missing regarding the Spanish data.