Nordea tager en tur horisonten rundt og forsøger at se et billede i et mix af begivenheder: Stigende priser, især energipriser; kinesisk ejendomskrise; lavere tysk vækst; stigende dollar; råvarepriser udvikler sig ude af takt med økonomien. Høvles 1,5-2 procentpoint af væksten i det nye år i USA, Europa og Japan?

Nordea weekly: Please ask the Tsar if stagflation is coming

The energy crisis has left the economic momentum hanging by a thread, and the fate of the Euro area is now in the hands of Putin’s natural gas.

So, what’s going on in markets? Is it all about month-end and quarter-end flows, exacerbated by positioning? Or is it something deeper? For sure, it’s not that difficult to construct an economically bearish narrative nowadays: i) the energy crisis will impact real GDP negatively, ii) the credit cycle is weakening across China/US/EMU (as we have pointed out before), iii) we may finally see negative effects from component shortages, iv) dollar liquidity will dwindle rapidly when the debt ceiling is dealt with, v) and BoE & Fed has turned more hawkish – suggesting they aren’t able or keen to see through the negative impact on growth from higher prices, and vi) there’s also the so-called black-out period for buybacks in place ahead of the Q3 reporting season.

Chart 1. The drawdown in the TGA has added ~1400bn of dollar liquidity ytd – expect a turn-around

We thus have plenty of things to worry about, and perhaps that has been a driver behind the recent pick-up in vol. Or perhaps most or all of “it” can be explained by month-end and quarter-end flows, which seems to be how most of our clients are leaning. Alas, it’s also the case that a high “wall of worry” can be construed as risk-bullish as these fears seldom materialise…

We find it unlikely that we will be faced with a material correction on index levels with the current amount of monthly QE still in place. Rather, we expect asset allocation trends to turn “anti-cyclical” soon. A material credit deceleration (as we see currently) that is paired with continued monetary easing (as we see currently as well) is most likely to create more orderly asset allocation shifts from value back to growth stocks, with moves out of EM and highly cyclical commodities/stocks, at least if the global supply dearth ends (Global: How to position for a weaker credit impulse?). This is usually a USD positive scenario as well.

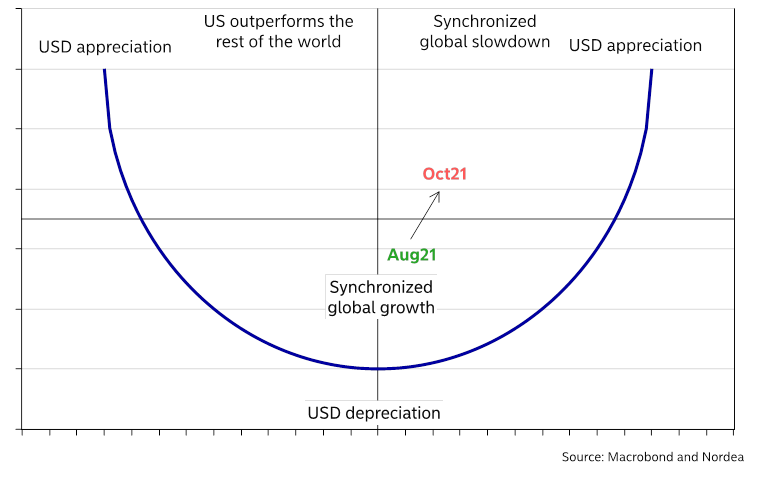

Chart 2. Perhaps we are moving in the dollar smile… USD positive!

As for the dollar, it may simply be that market participants have started to bet that we’re leaving the quadrants with “synchronized global growth”, which typically leave the dollar somewhat vulnerable. Instead, the energy crisis and so on could mean we are moving towards a global synchronized slowdown, which typically coincides with a stronger greenback (at least vs “riskier” currencies”).

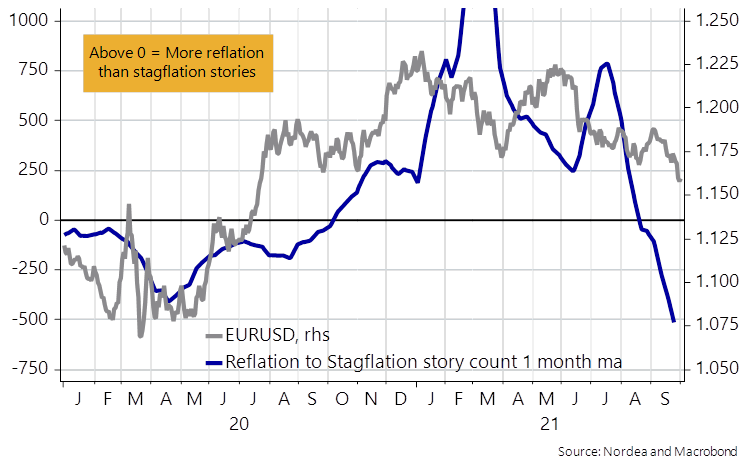

The stagflation story count has at the same time overtaken the reflation story count, which is usually also USD positive unless it can be construed as a contrarian signal as in February and March of 2021. We though remain in fairly “neutral” territory in the reflation to stagflation indicator in a longer perspective, which could not be said about the reflationary high five festival during the early spring of 2021.

Chart 3. The reflation to stagflation indicator hints of a lower EURUSD reading

Moreover, the German economy stands to lose out versus USA due to the real estate credit contraction in China, which usually takes EUR/USD lower with a time-lag. Evergrande fears are even likely to resurface during this week as a Jumbo Fortune Enteprise note secured by the real estate developer is allegedly due this Sunday.

If Evergrande is not able to pay the principal, it will leave the CCP only five days to officially come up with a nationalization plan, otherwise the (already well-known) default is a reality. We ultimately put our trust in Xi, but we don’t buy the current “non-credit-based” growth plan of the CCP. They will have to reopen the credit tabs as soon as Evergrande is effectively quasi-nationalized, with PBoC easing action as part of the plan (CNH negative).

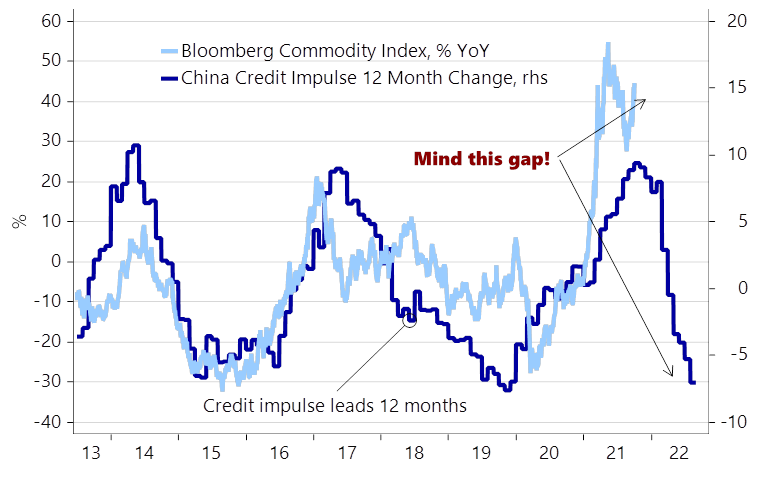

Chart 4. China’s credit slowdown continues to pose downside risks to the EA

The energy crisis has already overtaken Evergrande as the hottest (or should we say coldest) topic among our talking partners. Last week, we dusted off an old supply vs. demand driven price change methodology showcasing that the oil price had almost only risen due to supply side constraints this year. We find that this holds for most of the commodity space with natural gas as the potential extreme now.

The price increases in the BBG commodity index are completely out of whack with the global cycle due to political programs such as Zero Covid and New Green Deals. It is tempting to add short exposure to the commodity sector, but it requires a decent set of cojones to do that already now. We find other anti-cyclical bets (such as being long USD) more attractive from a risk/reward perspective.

Chart 5. Mind the massive gap between the business cycle and commodity prices

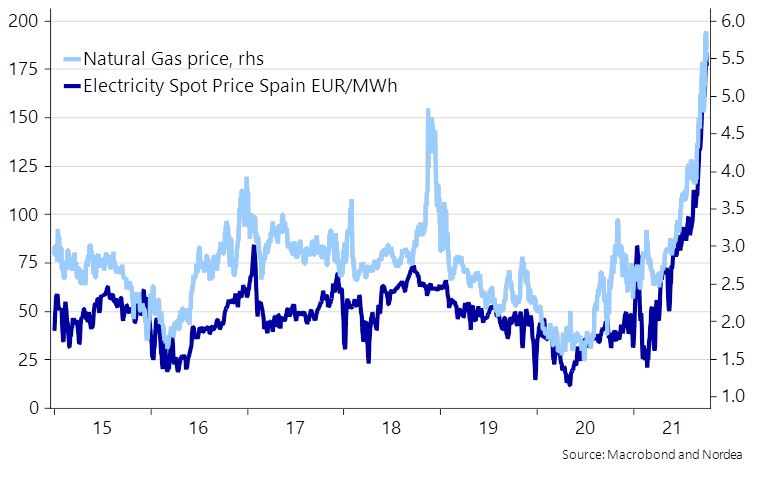

European energy policy is effectively in the hands of Putin due to 1) a 30-40% weaker wind-season, 2) closures of functioning nuclear capacity and 3) already weak natural gas inventories. Even the Green Eurocrats likely pray for a warm winter across Europe as a colder than usual winter would send European electricity prices even further up into the stratosphere. Whether for example Spain, Germany and similar countries are about to enter a period of marked stagflationary vibes is now solely in the hands of the Tsar, similar to what was the case with the Muftis in the 1970s.

We decide to hedge against a Russian winter in Europe by selling CNH/RUB (approx 4% annualized carry) around 11.30 with a spot-target of 10.4230 and a S/L at 11.8760.

Chart 6. Natural gas versus the spot electricity price in Spain… Putin decides!

How big of an effect should we expect on 2022 growth prospects from already observed price increases in energy? We constructed an energy input index for both the Euro area and the US. If we allow the regression on GDP to run only since the shale-boom, the model is roughly undecided on whether a higher energy price basket is good or bad for the US economy, while it is a CLEAR negative for the Euro area no matter the calculation horizon.

Bidens “build back better” policy might now allow a renewed shale-boom in the US, why we suspect that the energy price sensitivity has increased across the pond again. The bottom-line is that the Euro area is likely to be the most sensitive (not least to Natural Gas) and we should expect at least 1.5-2%-points to be shaved of 2022 growth prospects within the G3+ countries (Japan, Euro area and US) just due to the recent price moves in Energy.