Væksten i den finske økonomi fortsatte i tredje kvartal med 0,9 pct. på kvartalsbasis. Udsigterne for 2022 er gode, men den nye coronabølge, flaskehalse samt en stramning af arbejdsmarkedet udgør dog en risiko. Alligevel forudser Nordea, at Finland bliver et af de lande, der får den bedste udvikling efter pandemien – med vækstrater i de kommende år, der svarer til perioden før pandemien.

Finland Macro: The broad-based economic recovery continues in Finland

The economic recovery continued in the third quarter with GDP growing by 0.9% q/q. Growth prospects for 2022 remain strong, but a new coronavirus wave, supply chain bottlenecks and a tightening labour market are creating risks for growth.

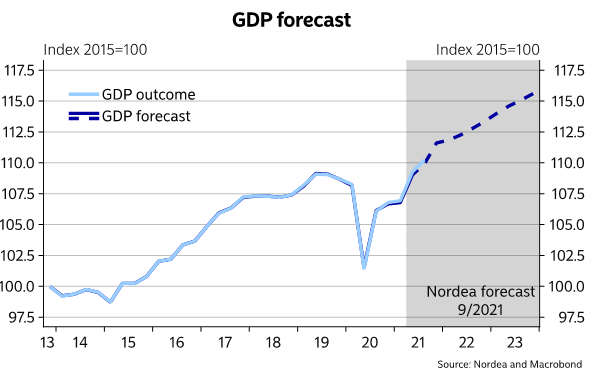

The economic recovery continued in the third quarter with GDP growing by 0.9% q/q and 4% y/y according to preliminary estimates from Statistics Finland. This outcome is in line with Nordea’s 3.5% GDP growth forecast for 2021. Growth prospects for 2022 remain strong, but a new coronavirus wave, supply chain bottlenecks and a tightening labour market are creating risks for growth going forward.

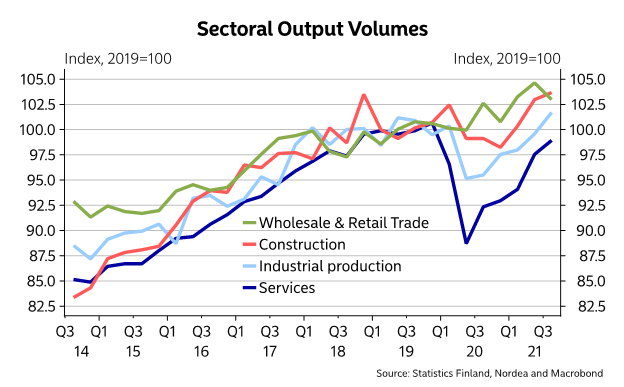

Growth was broad-based across sectors. Industrial production is benefiting from surging global demand, and thick order books bode well for production also next year. Supply chain bottlenecks have hindered production less than in many other countries, but lack of sufficient production capacity and materials are likely to hold back growth in coming months.

The service sector continues to recover as pent-up demand is released. While consumption is redirected more towards services, the retail sector is losing steam. The number of Covid-19 cases is increasing despite a relatively high vaccination coverage. New restrictions for public events were imposed this week and more restrictions are likely to follow soon, which could dampen the services sector’s recovery in the last quarter.

Construction sector still fuelled by strong housing demand. The number of unsold new flats is at a record-low level. Housing starts have seen a steady increase over the past year and construction activity is likely to stay at a high level also next year. Office and commercial construction is still lagging behind.

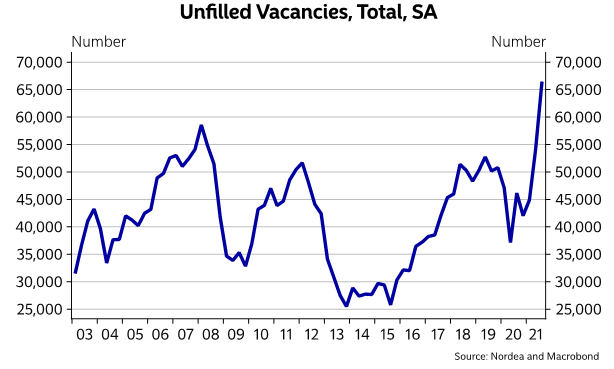

The fast recovery has created bottlenecks in the labour market as the number of open vacancies has increased swiftly. Already, two thirds of the vacancies seem hard to fill. At the same time, the unemployment rate remains above the pre-covid level.