Nordea kaster sig ud i den langsigtede prognose og vurderer, at der er risiko for, at dollaren gradvist svækkes i de kommende ti år og kan ende med 1.60 dollar over for euroen i 2030. Det kan også styrke den kinesiske valutas rolle.

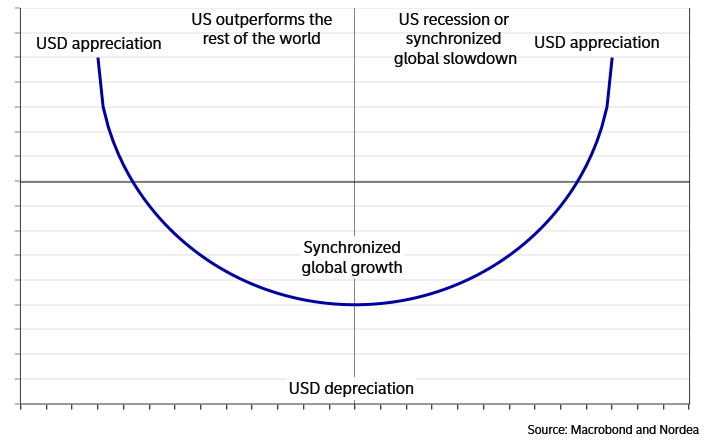

The dollar smile and its future

In this esoteric piece, we take a look at the potential very long-term drivers of the USD and conclude that the Biden administration may “bananafy” both the Fed and the USD over the coming years, and China may be well-equipped to take advantage of it

The dollar smile is a theory saying that the USD tends to strengthen both when the US economy is very strong but also, counter-intuitively, when the economy is extremely weak (during recessions or during intense risk aversion) in sharp contrast to other currencies.

In our February dollar-o-meter we outlined cyclical drivers that actually look fairly benign for the USD in 2021. This might be good news for the dollar since it would suggest greater chances of a move to the top-left quadrant in the dollar smile.

Chart 1: The current shape of the dollar smile

However, we also argued that the politics parameter was “generally negative for the dollar, especially for the medium and long terms”. Indeed, we can identify four reasons why the dollar smile could move to the dollar’s detriment over the coming decade: i) Biden “bananafying” the Fed, ii) China’s DC/EP and the weaponisation of the dollar, iii) energy politics under the Biden/Harris administration, and iv) re-regulation of the economy and tax hikes.

Summing up

To sum up, while we see cyclical tailwinds for the dollar later in 2021, we see several drivers of significant dollar weakness in the very long run, especially if eg more (economically) left-leaning Democrats make further inroads into Congress over the next few election cycles.

The potential for Biden “bananafying” the Fed might even become something of a talking point later this year, as could China’s DC/EP currency ahead of the Winter Olympics of 2022 when wide-scale testing is planned – though we expect neither narrative to significantly dent the dollar just yet.

What’s more, energy politics under the Biden/Harris administration will be worth watching, as would their moves towards dampening America’s animal spirits via increased regulation and greater tax burdens.

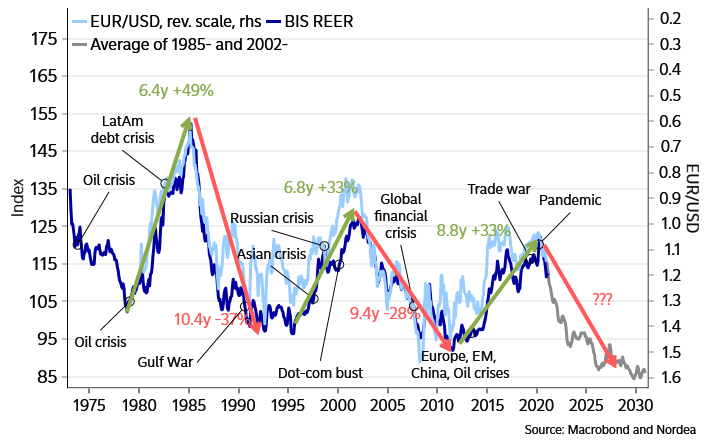

Chart 7: If the dollar is to repeat 1985 & 2002 downtrends, 1.60 in 2030?

In the end, a copy-paste of the larger dollar downtrends which ensued in 1985 and 2002 can’t be ruled out.

Assuming the dollar peaked during the most intense phase of the COVID-19 pandemic – in April 2020 – a new ten-year bear trend could eventually bring EUR/USD to 1.60 when the world leaves the “roaring 20s” to instead enter the next 30s, but we should expect many twists and turns before then. And we must not forget about other central banks and polities …

Is EUR/USD higher or lower in 10 years from now? Good question – our chips are placed on the EUR in this long-run standoff (if the EUR still exists, that is.)