United Kingdom – så længe det holder – har gjort en forrygende indsats mod coronaen, og det har hjulpet det britiske pund, mener Nordea, men det har også overskygget den dramatiske nedgang i samhandelen mellem UK og EU, og det overskygger, at der forstår vanskelige forhandlinger om servicesektoren, herunder om Londons position som et finanscenter.

Uddrag fra Nordea:

Brexit: What’s next for the EU/UK relationship?

We keep liking the GBP as a result of a successful vaccine roll-out but medium-term perspectives remain unclear due to the second round of Brexit negotiations on Services.

The Christmas miracle

On the 24th of December, in the manner of a true Christmas miracle, a “deal”, namely the “EU-UK Trade and Cooperation Agreement” (TCA), was reached between the UK and the EU. The agreement that has been in place since 1st of January provided a solution to the major deadlocks in fishing rights, ensuring a level playing field on goods without quotas and tariffs.

Between then and now, it has become quite clear that the deal struck is not finalized as both the EU and UK has been flexing muscles: big banking London is in a limbo and vaccines produced on EU soil sought to be kept from entering UK via Northern Ireland amidst EU vaccine supply bottlenecks (although, the EU quickly backtracked) . Lastly, the European Commission is preparing to take legal action against the British government, as the UK has failed to keep promises the island of Ireland free of border checkpoints.

Meanwhile, the Bank of England cautiously increases optimism with inflation expected to return to target and GDP developments better than anticipated. Albeit with tail risks of Brexit 2.0 negotiations and covid-19 are diminishing, unusual uncertainty remains, meaning that BoE are neither closing the door on tightening nor loosening in the near term.

So what was agreed upon and what are the implications?

Most importantly, the agreement preserves a tariff- and quota-free exchange of most goods. While a definite positive, this is not a frictionless agreement as prevalent in the inner market, as EU and UK goods exchanged will be exposed to customs, regulatory checks and rules of origin regulation. Customs are instated at the borders and Rules of Origin means that goods imported from for example India, cannot be resold into the EU tariff-free. This ensures that outside produce will not be introduced into the EU-sphere through eased agreements with the UK. It also means that minimum requirements are implemented on various groups of goods, determining how much of a UK good must be made in the UK before it can enter EU tariff-free.

“What about services?”, you might ask. As introduced above, especially the financial services industry in the UK is suffering under the lack of financial services passporting. ICAP, the world’s largest interdealer broker, said that it was unable to service some EU clients because it had not finished relocating staff to Paris. The EU is pulling what has previously been sourced to the UK back to the EU, and a potential large scale relocation of the industry will have a definitive impact on the UK economy.

In January, the stark effect of this shift poised Amsterdam to dethrone London on basis of share trading volumes. Services are generally going to be impacted in businesses that may have a cross border offering such as architecture or accounting firms. Such cross border activity will face restrictions on their right to access to the EU markets and qualifications will no longer automatically be recognized in the EU.

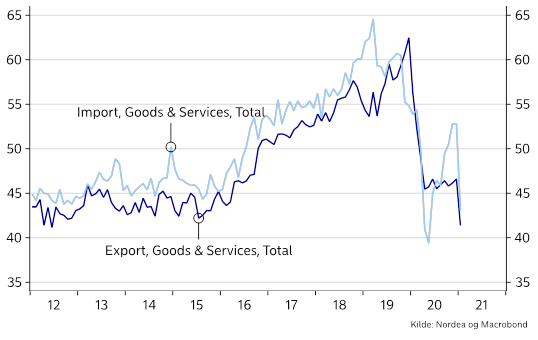

All in all, there’s reasons to be a little bit pessimistic on goods trade with EU because of the significant layer of red tape, that will no doubt dampen trade between the two parties. Already in January, we saw that UK exports to the EU fell 41% compared to the December, and imports from EU fell 29%. However, it may be that the initial reaction to restrictions on trade are stronger than they will be in the longer run as companies acclimatize to the new reality.

Services are more of a fickle pickle; the UK has been the clear entry hub for financial services in- and out of the EU and the EU’s pull on financial services passporting rules is going to have definite impact on the UK economy as a whole. At some 7% of the UK economic output, the financial services sector is not insignificant. Both parties are impacted negatively by Brexit, however, it does appear that the UK has the short end of the stick.

Chart 1: UK total Imports and Exports see a drastic decline post Brexit effectuation

Another important part of the agreement is the agreement on a level playing field. It has been agreed to treat the current regulations (in e.g. environmental protection or workers’ rights) as a shared baseline. However, In the manner of this agreement, both the EU and UK are free to diverge on various standards. However, if either side believes that a divergence of standards distorts trade, tariffs may be imposed.

In the near future, what needs to be resolved is mostly related to the services sector, and especially the London status as an European financial hub. The EU/UK talks on the finance sector started in January and no real outlay of future relationship has been established yet with a self-imposed deadline in march for a memorandum of understanding (yet we know how deadlines in the Brexit negotiations have worked out thus far).

Brexit test #1: UK vs. EU 1-0 in the vaccine roll-out.

It goes without saying, that the larger downside risks have largely been overshadowed by government’s handling of the Coronavirus. While there was initially a lot of (fair) global scepticism on the accord of the UK handling of the virus, credit must be given where credit is due – in the latter months they have done well to contain the B.1.1.7 mutation and nailed the subsequent roll-out of vaccines.

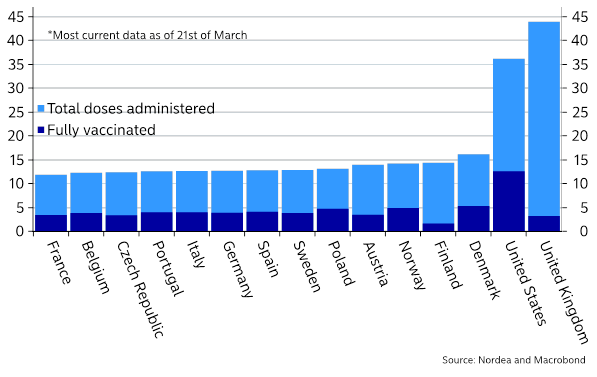

Chart 2: UK is the leader of the western vaccine race

At the moment of writing, the UK has administered doses corresponding to ~45% of the British population – on the contrary, the EU aggregates somewhere around 13%. The British result is down to efficient delivery of vaccines, and postponing the second shot (i.e. serving less-than-full protection in a broad part of the population as quickly as possible). Based on an analysis from Oxford, researchers find that the vaccine was 76% effective at preventing symptomatic illnesses up to three months after first dose. At this point, with current knowledge, it is hard to argue against this approach.

UK vs. EU 1-0 in the vaccine roll-out.

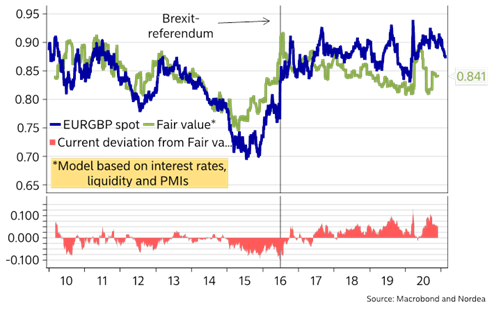

Chart 3: The GBP still looks relatively cheap

The UK is by the way the very clear front-runner in the entire Western vaccine race, which is a reason why the GBP has had such a fantastic 2021 so far. The removal of the no-deal Brexit tail risk risks also compounded the pound rebound early 2021. Going forward, we assume that the GBP optimism continues due to a successful vaccine roll-out in the UK.

As the risks fade further, we expect the pound to diminish the valuation differential to our model-based fair value and look for levels around 0.83-0.84 in EUR/GBP.