Nordea analyserer ECB’s egen rapport fra ECB-rådets møde i december og hæfter sig ved, at høgene i ECB-rådet træder kraftigere frem og lægger begrænsninger på, hvad ECB kan gøre. Høgene vil begrænse yderligere lempelser. Derfor er der ikke udsigt til nye opkøbsprogrammer foreløbig. Nordea mener, at det kan føre en en svag stigning i renterne.

ECB Watch: Not anything goes

ECB monetary policy account strengthened the picture that while the ECB stands ready to do more, the hawks are putting limits to what the central bank can agree on. Such a stance also leaves some room for yields and spreads to increase.

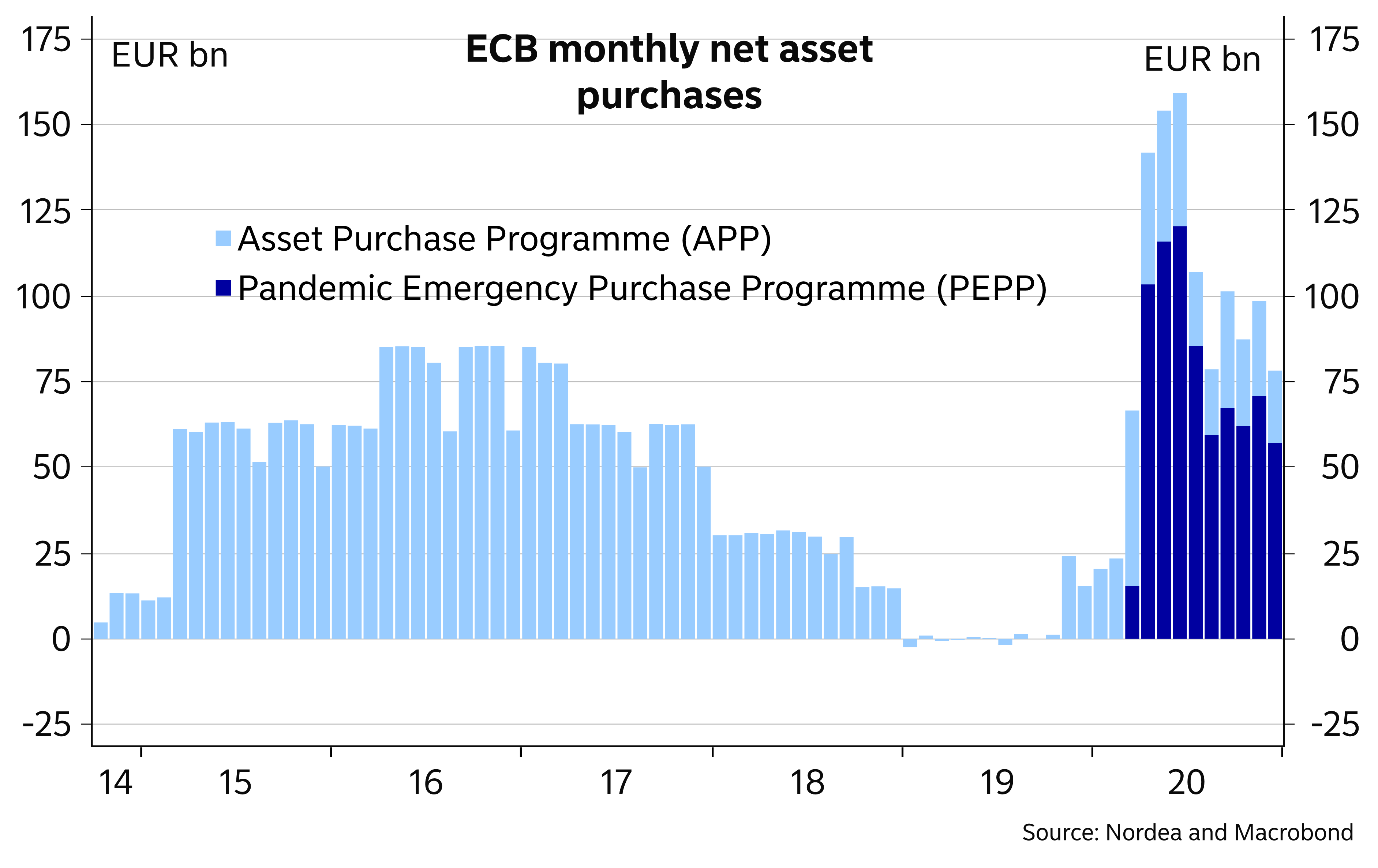

The ECB delivered another sizable easing package in December, including a EUR 500bn expansion in the Pandemic Emergency Purchase Programme (PEPP) and an extension in its duration to at least the end of March 2022. The monetary policy account from the meeting confirmed that the ECB is quite happy with the current level of financing conditions and does not actively seek to push yields or spreads lower.

We do not expect a further expansion of the PEPP. Purchases will likely be sizable still in the first half of this year, when bond issuance needs are large, but the peak pace of the purchases is likely already behind and the pace will gradually fall.

The decisions were not unanimous, and the reservations of the more hawkish members of the Governing Council will limit the scale and scope of further measures, including the terms of the PEPP.

Since the ECB has not set any purchase pace targets for the PEPP, it can allow the pace to fall relatively silently without having to make an explicit decision at a monetary policy meeting. This could make the ECB’s exit strategy somewhat easier.

Preserving a tightening of financing conditions is probably a relative concept, meaning the ECB would tolerate a gradual rise in longer bond yields, if they reflected a rebounding economy and higher inflation expectations. In other words, we see some upside potential in bond yields and spreads amidst firmer signs of a recovery.

We do not expect the ECB’s policy to be on autopilot going forward. While no bigger decisions are probably needed in the first meetings of the year, the terms of the Targeted Longer-Term Refinancing Operations (TLTROs) will probably be eased further later this year, while the tiering multiplier could be raised.

Further, the ECB’s strategy review will be an important exercise, which should be concluded during the second half of this year. We do not expect the ECB to cut its deposit rate further.

Peak bond purchases already behind