Nu kommer også den europæiske centralbank, ECB, på banen med en stramning af pengepolitikken, og det vil ske tidligere end hidtil antaget, skriver Nordea på baggrund af de seneste referater fra ECB’s rådsmøde. Høgene har fået overtaget i ECB-rådet, vurderer Nordea, der mener, at ECB vil begynde at reducere sine obligationsopkøb i juni, og måske allerede melder det ud i næste uge, og at der kommer hurtigere rentestigninger end hidtil ventet. Inflationen i eurozonen steg til 7,5 pct. i marts, og ECB’s egne økonomer har konstant ligget bagefter i vurderingen af prisudviklingen i de seneste to år. Det svækker ECB’s troværdighed, skriver Nordea. Derfor er selv nogle af rådsmedlemmerne begyndt at tvivle på ECB’s egne prognoser.

ECB Watch: Normalisation plans intact

The ECB is between a rock and a hard place, but we judge the more hawkish tones are prevailing for now. Still, the next actual monetary policy decisions are more likely in June than already next week. The chances of earlier rate hikes have risen.

- Another big upward surprise in Euro-area inflation adds pressure on the ECB, even if downside risks for the economy have risen at the same time.

- We think the ECB will decide on the end date for net asset purchases only at the June meeting, but the decision could be taken already at next week’s meeting.

- Markets continue to price in a more aggressive rate path than we think is warranted based on the ECB’s signals.

- ECB monetary policy account suggests the more hawkish tones within the ECB have gained the upper hand.

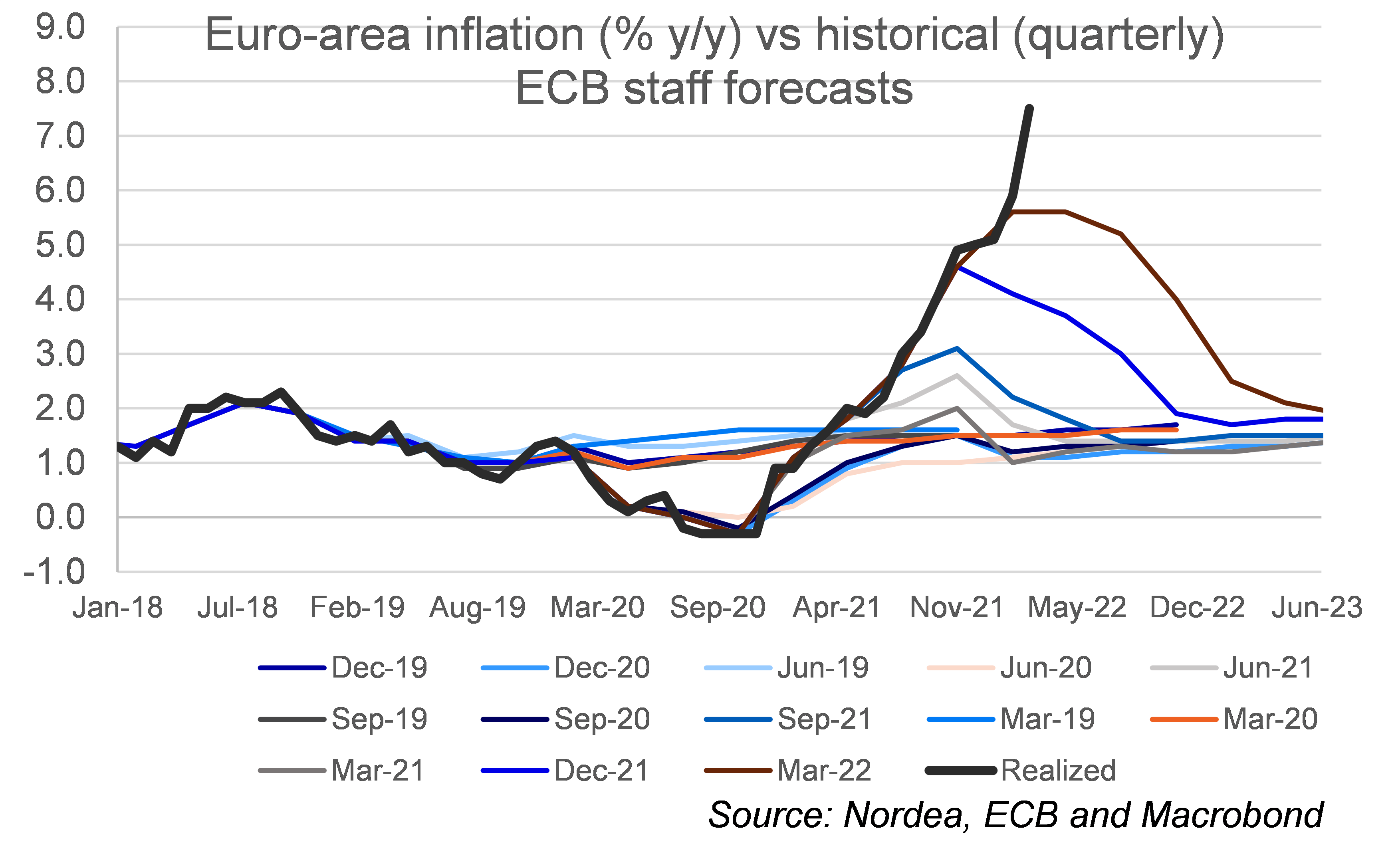

After Euro-area inflation printed at 7.5% y/y in March, the ECB’s latest inflation forecasts again look almost embarrassing compared to the reality – something that has been the norm lately, when comparing realized inflation to the ECB’s forecasts. The ECB naturally targets inflation in the medium-term, so high spot inflation now, especially driven by energy and food prices, should not make the central bank tighten policy.

However, the constant underestimation of inflation over the past two years is a burden on the credibility of the ECB, especially as the ECB staff forecasts have adamantly insisted inflation would be close to the 2% target at the end of the forecast horizon.

No wonder then that several Governing Council members have also started to doubt the accuracy of the forecasts, and have argued they should be only one input in the ECB’s decision making. So even if the ECB remains far from convinced that also underlying inflation pressures are building for good, the pressure to do something on the exceptionally easy monetary policy stance is growing.

The ECB’s inflation forecasts continue to be severely biased to the downside

The other side of the coin is of course the considerable uncertainty about the economic outlook due to the Russian attack and high energy prices. The ECB’s March forecasts took a rather optimistic stance, but it is not difficult to envision more severe downside scenarios. The more dovish ECB members have been emphasizing that it would be wrong for the ECB to try to bring energy-induced inflation down with tighter policy, when inflation expectations remained contained, especially in an uncertain economic environment.

Nevertheless, the ECB remains on a firm course towards normalisation of its monetary policy, but whether it will again accelerate the pace of its steps in that process is the main question at the ECB meeting on 14 April. Our best guess is that the ECB will continue to signal the end of net bond purchases in Q3, and will make the more detailed decision in the June meeting, when it again has new forecasts to aid in that decision making.

It is quite telling that not even the ECB hawks have called for more than to take the deposit rate to zero by the end of the year, i.e. two 25bp rate hikes. Bundesbank President Nagel, for example, suggested interest rates could rise soon, but even he said that the ECB will take the next decisions in June. There should thus be no great rush to take further decisions already next week.

Nevertheless, given that the ECB has surprised hawkishly in each of the past few meetings, we see a risk that the central bank will make a decision to end net purchases by the end of June already at next week’s meeting, or at least give strong indications that it is tilted in that direction. While the economic outlook remains uncertain, the pressure on the inflation front has increased, favouring even more flexibility to act already during the summer, if signs of rising wages become stronger.

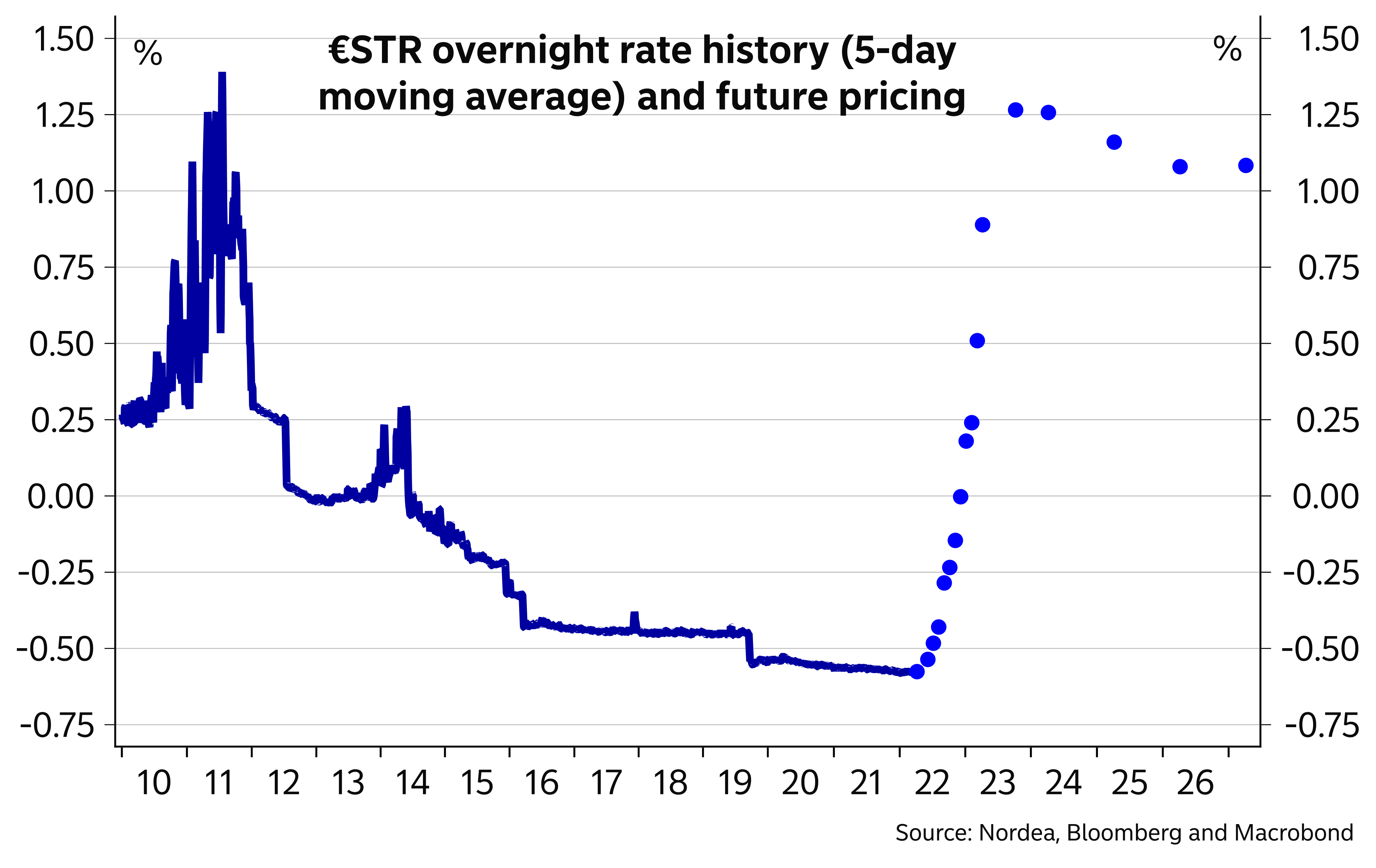

Financial markets continue to price in a faster pace of rate increases than the ECB has been signalling. The market is currently pricing in a total of around 65bp of increases in overnight rates by the end of the year, i.e. around two and a half 25bp rate hikes. 15bp is in prices already for the ECB July meeting. We think such pricing is on the excessive side, but given the markets tendency to interpret recent ECB signals in a hawkish light, such pricing may not correct any time soon. It is also worth remembering that in the past few ECB meetings, it is the central bank that has converged towards the market pricing at the time rather than the other way around.

Markets expect short rates to rise to positive territory by the end of the year

Hawks have gained the upper hand

Unsurprisingly, also the monetary policy account from the March meeting revealed clear differences in opinion between the more dovish and hawkish Governing Council members amidst great uncertainty.

The more hawkish members clearly doubted the ability of the ECB’s models to forecast inflation longer out, and saw a credibility problem in continuing to forecast inflation to recede relatively quickly even after persistent upward surprises. Some would have preferred to set a firm date on ending the net asset purchases, which would not be conditional on the evolving outlook.

The more dovish members, in turn, found it plausible that economic developments could turn out to be clearly weaker than the ECB’s downside risks scenarios suggested, and pointed out that in the absence of the currently high inflation, more easing could actually be warranted.

It was also clearly argued that the three requirements in the ECB’s forward guidance on starting rate hikes were already met or being close to being met, though the doves reminded that those requirements were a necessary but not a sufficient conditions for starting to raise rates.

Overall, we think the somewhat more hawkish Governing Council members have gained the upper hand within the ECB, and will continue to push for further normalization steps in the June meeting. We think this will entail a decision to end net asset purchases already at the end July, which would open the door for the possibility to raise rates in September. Our baseline remains a first hike only in December, but risks of a hike already in September have risen considerably.