Nordea har analyseret den overraskende udmelding fra ECB i sidste uge. Høgene i ECB-rådet har vist deres ansigt. Selv om der ikke kommer en rentestigning før sidst på året, så vil høgene i rådet presse på for at begynde afviklingen af opkøbsprogrammet allerede i næste måned. Grunden til den nye kurs er, at inflationen har overrasket hver eneste måned det seneste halve år.

Permanent upward surprises

The ECB found its inner hawk and joined many other central banks in hinting at tightening ahead. We note that the inflation outlook remains very uncertain but conclude that market pricing has become too aggressive.

“There was unanimous concern around the table of the Governing Council about inflation numbers.” – Christine Lagarde, ECB President.

Back in December the ECB was adamant that rate hikes would not be this year’s business. A couple of inflation surprises later the tone had changed materially. At this week’s meeting, ECB President Lagarde talked about inflation risks now being to the upside, about unanimous concern about recent inflation numbers, how the situation had changed and how the ECB was getting much closer to its inflation target. The message was full of hawkish remarks.

The hawkish references did not stop there. After the meeting, there were stories circulating, based on anonymous ECB sources, saying that a sizeable minority wanted to dial back stimulus already at this week’s meeting, and a decision in March now looked likely, barring a big drop in inflation.

The market went bananas, and e.g. the 5-year German benchmark yield jumped by more than 10bp to see its second biggest daily increase in more than five years. The market is now pricing in around 50bp of higher overnight rates by the end of the year.

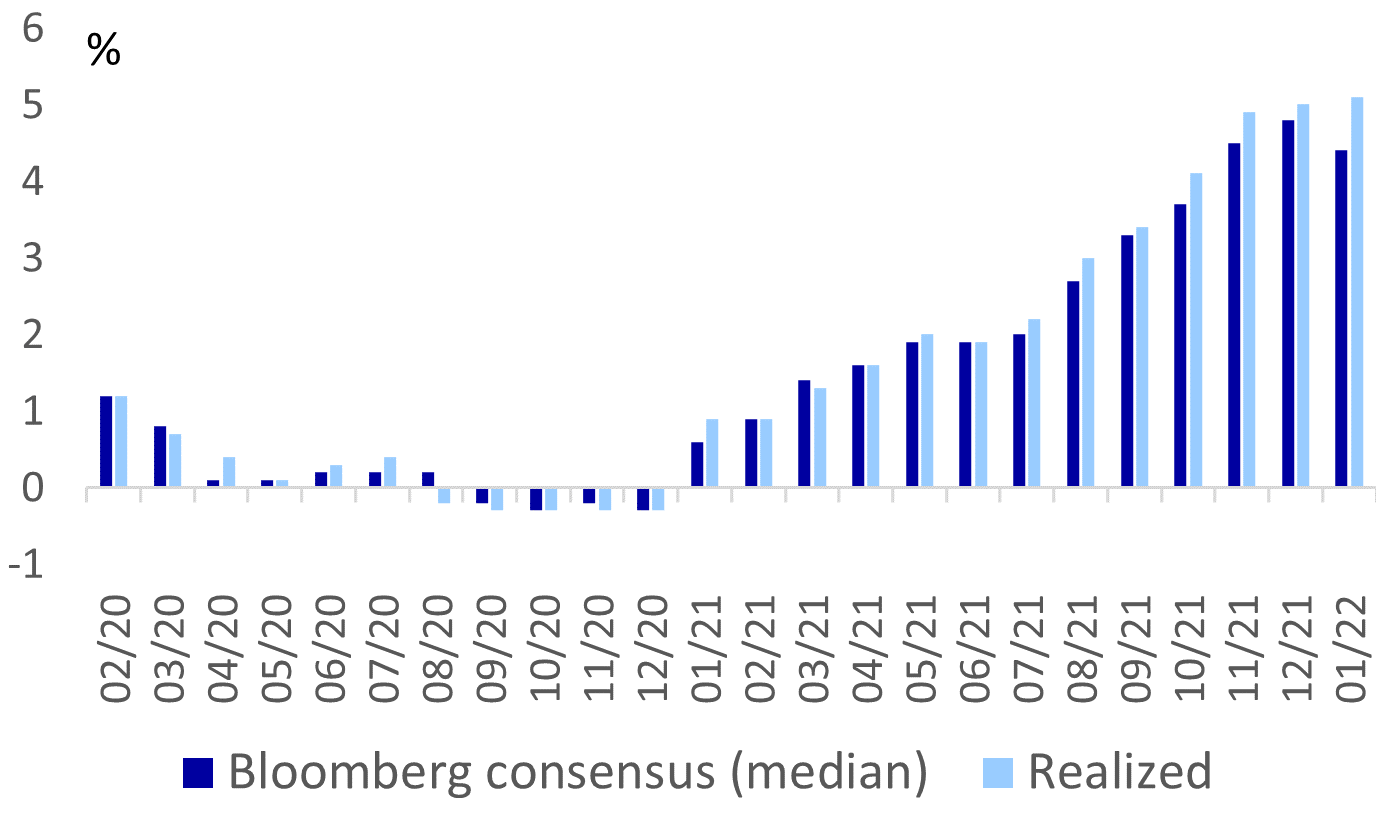

We want to take the ECB’s signals seriously. Euro-area headline inflation releases have now surprised to the upside seven times in a row, and the ECB had to constantly revise its inflation forecasts higher last year – and will likely have to do the same again in March. It is thus no wonder that many central bankers are becoming worried.

Chart 1: Euro-area inflation numbers constantly surprised to the upside

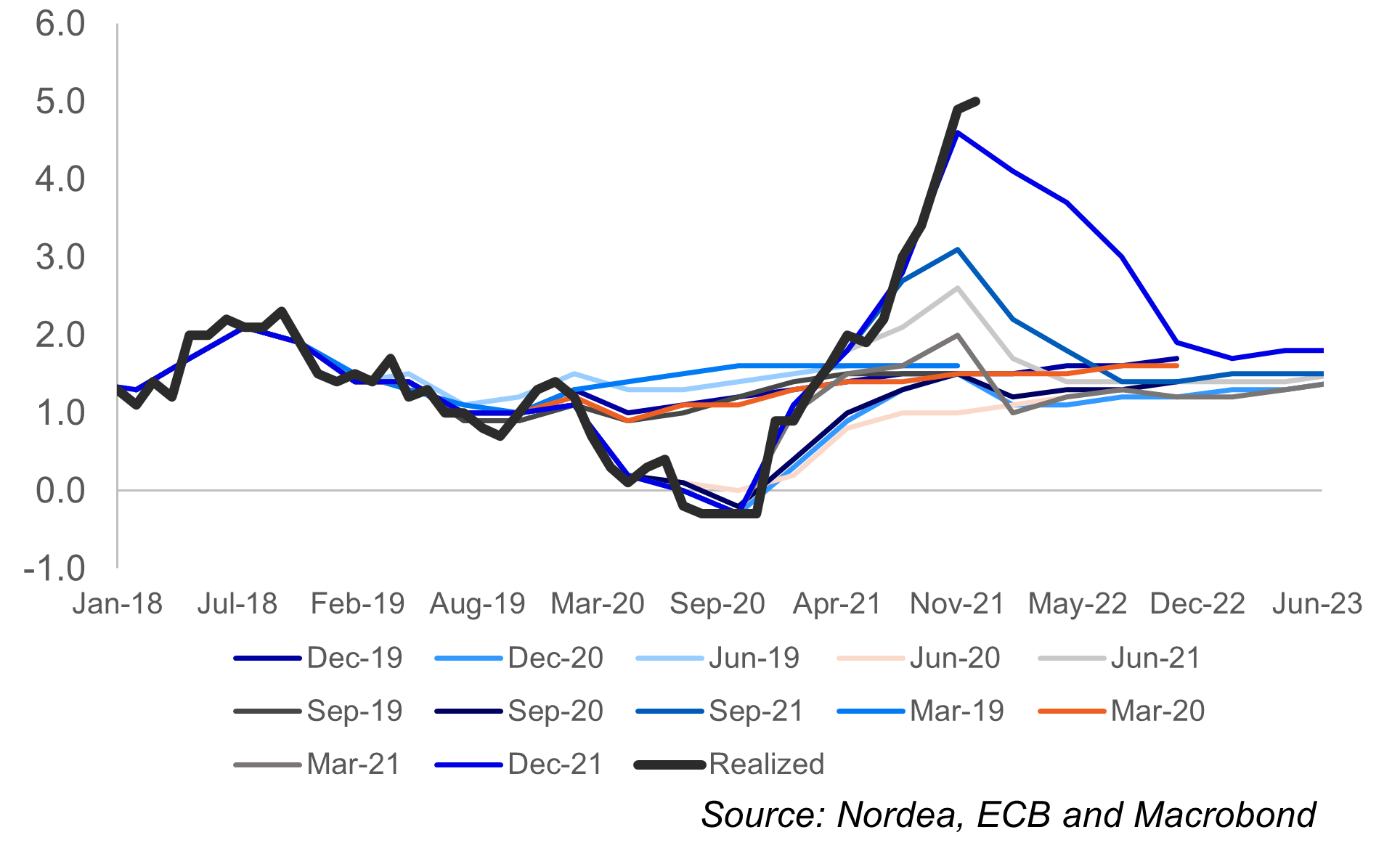

Chart 2: The ECB has had to revise its inflation forecasts higher time and again lately

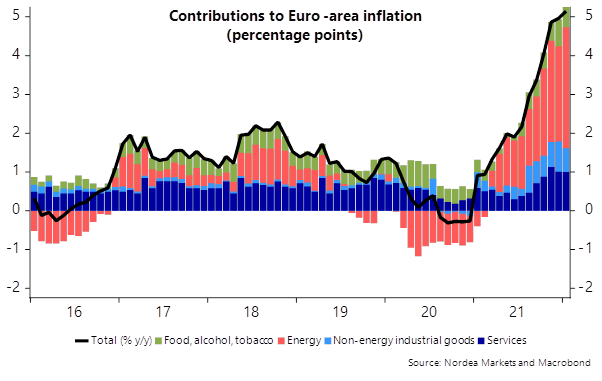

Nevertheless, there are also good reasons to doubt the current aggressive market pricing. More than half of the recent annual 5.1% headline inflation is still accounted for by higher energy prices.

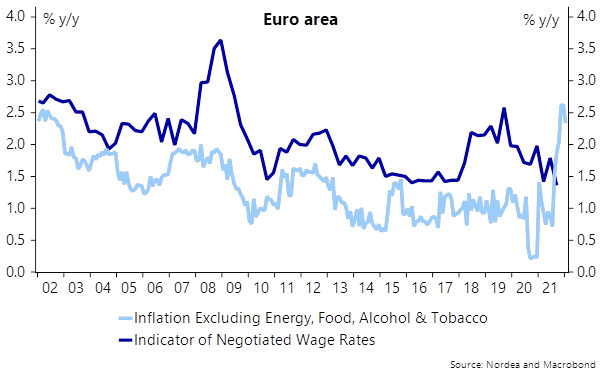

True, core inflation pressures are becoming more broad-based, but overall wage growth remains muted andit will take more time for the picture on wage growth to become clearer. It is also true that the longer headline inflation stays at high levels, the larger the risk that it will spill over to wage growth, so the ECB is right to be concerned.

Chart 3: More than half of high Euro-area inflation due to energy

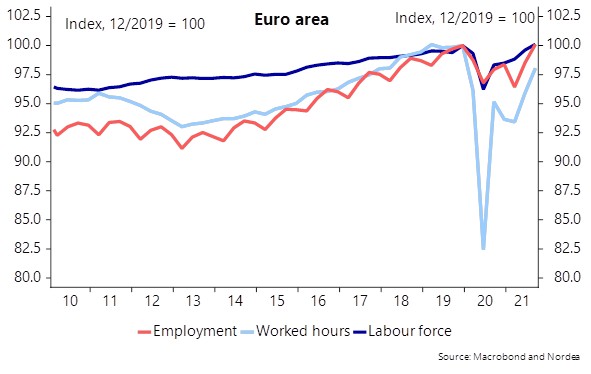

The inflation outlook is currently very uncertain. Several measures of labour market tightness indicate a tight market. The unemployment rate hit new record lows in January and the level of employment has reached pre-pandemic levels. However, hours worked have recovered more slowly, as many have still continued to work shorter hours, and point to still spare capacity in the labour market.

We do expect wage growth to pick up, but argue it will take more than a few months for the upward trends in wage growth really to be seen.

Chart 4: Employment rebounded faster than hours worked

Chart 5: Wage growth looking modest for now

The ECB also holds onto its sequencing, meaning it will not raise rates until it has ended its net asset purchases. The current path implies an end to net purchases around the end of this year, at the earliest, so for rate hikes to come into play this year, the ECB needs to speed up the pace of its asset purchase tapering. This is likely to be on the table at the March meeting.

Finally, the ECB’s strategy review emphasised the need for especially persistent monetary policy measures and the central bank has been keen to make changes to its policy only gradually. It is thus unlikely to rush into tightening steps.

Finally, it is understandable that many in the Governing Council are getting impatient and want to gain more flexibility for the ECB to tighten policy faster, if needed. From that perspective, deciding to taper the bond purchases faster, say by late summer/early autumn would make sense as the ECB would then be freer to raise rates sooner, if needed.

Especially as there seems to be growing doubts within the Governing Council towards continuing the bond purchases longer, a consensus on such a step could be found already at the March meeting.

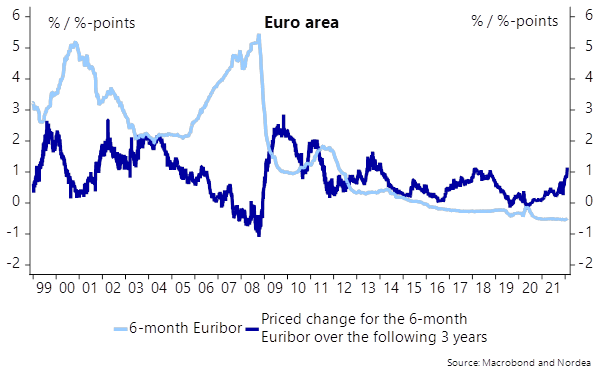

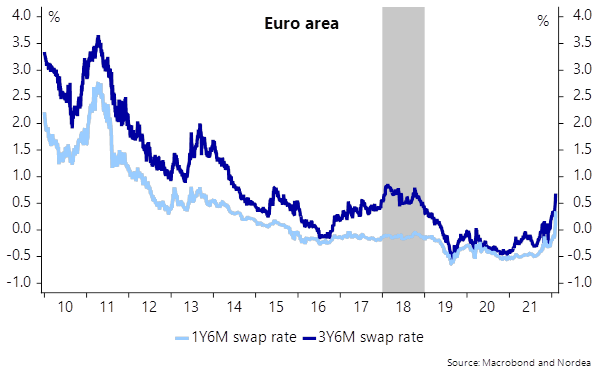

Looking at the ECB pricing longer out, the market is pricing in slightly more than 100bp of higher short rates (6-month Euribor) over the course of the following three years. This is almost exactly as much as the pricing was at its highest in 2018. At that time, no rate hikes actually materialised, but that period could offer some reference to the current episode, suggesting the market could struggle to price in much more, at least before the ECB was actually raising rates.

The big difference this time is that at that time, the market was pricing in virtually no change on a 1-year horizon, while this time most of the priced in moves take place already on a 1-year horizon.

Chart 6: Market pricing in roughly as much tightening as at its highest in 2018

Chart 7: Unlike in 2018, this time the pricing is driven by moves within a 1-year horizon

To conclude, after this week’s comments, one should not exclude the chance of rate hikes as early as this year. However, we find it more likely that rate hikes will start later than the market is currently pricing in as it will still take time to get a better picture of wage dynamics. In the meantime, the ECB can buy itself additional flexibility by deciding to taper its bond purchases faster at the March meeting.

We do see the ECB heading towards rate hikes and continue to see longer bond yields creep further up in the coming years, but the curve may struggle to steepen much further. We still expect the Fed to be more hawkish than the ECB this year, and EUR/USD is unlikely to have seen its bottom yet.