Nordea indtager et langt mere positivt syn end hidtil på inflationsudviklingen i euro-zonen. I en ny prognose vurderer Nordea, at den nuværende høje inflation er midlertidig, og at den begynder at falde i begyndelsen af det nye år, fordi Nord Stream 2 sender gas gennem rørene under Østersøen. Forsyningsproblemerne vil også mindskes, selv om der også er usikre faktorer, såsom den kinesiske vækst og stigende lønudgifter.

Euro-area inflation: Waiting for the second-round effects

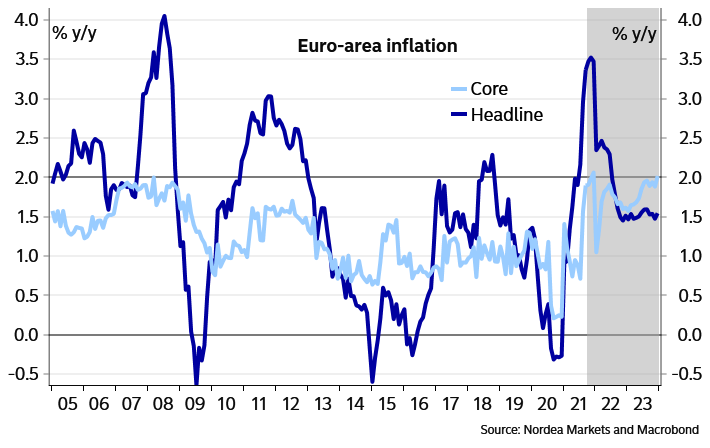

There are signals that Euro area could exit the pre-pandemic regime with very low inflation if economic recovery continues to be robust. In our new forecast, core inflation approaches the ECB target at the end of 2023.

Euro-area inflation outlook at the moment is extremely interesting, but also very uncertain. The big question is whether we will go back to the pre-pandemic regime with very low inflation after the energy prices normalise or whether we will see a more fundamental regime shift towards permanently higher inflation numbers.

We take a slightly positive view on that question in our new Euro-area inflation forecast and foresee core inflation accelerating by end-2023 to close to the ECB’s 2% target. The main arguments for this regime shift are first of all the recent rise in inflation expectations probably partly boosted by the currently high energy prices and global supply chain problems, loose monetary and fiscal policies and the strong economic recovery which has tightened the labour market situation faster than expected.

Our view on Euro-area inflation in a nutshell:

- Headline inflation will peak in the coming months but is then expected to decline substantially in the winter months when Nord Stream 2 starts to operate, easing the pressure on energy prices.

- In 2022, core inflation will remain volatile due to temporary reasons and base effects but the broadly-based inflationary pressures will remain rather weak in most Euro-area economies.

- However, we expect that challenges in the global supply chains, robust labour market recovery coupled with the temporarily high headline inflation numbers and higher inflation expectations will imply higher wage growth from 2022 onwards. This will start to drive up Euro-area core inflation permanently towards the ECB target in the latter half of 2023.

- Risks to this forecast are balanced. First, global price pressures could persist longer than expected and may combined with relatively loose fiscal policy drive up core inflation further than in our forecast. On the other hand, we see some downside risks accumulating globally and weaker real economic developments for example in China could dampen the recovery and price outlook also in the Euro area.

- Regarding the ECB monetary policy, in our baseline we do not have any rate hikes until the end of 2023 and we consider the current market pricing a bit too aggressive. However, our now somewhat more positive view on inflation can of course open a door to a rate hike already in 2023.

Our new core inflation forecast foresees a gradual rise towards the end of the forecast horizon

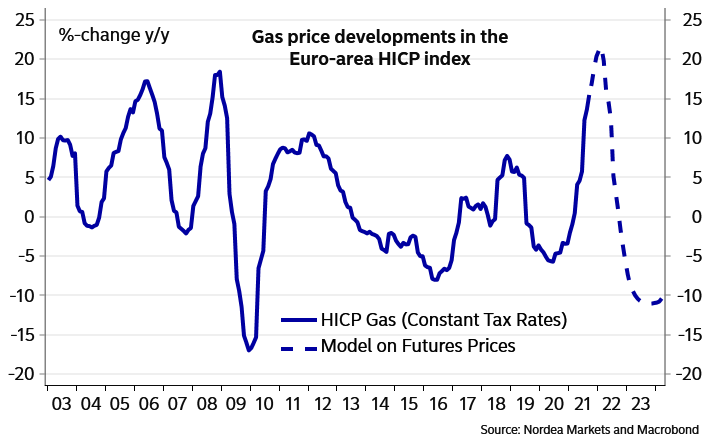

Nord Stream 2 is expected to normalise energy prices in Europe

Euro-area headline inflation continues to be dominated in the coming months by the high energy prices which we expect to peak in the winter and then to start contributing negatively to inflation numbers in the latter part of 2022.

Our view is based on the expectation that most of the turbulence in the European energy market caused by multiple simultaneous factors (e.g. global factors, low gas inventories, swiftly recovering demand and challenges in wind power generation) will disappear after the Nord Stream 2 gas pipeline starts to operate. That will likely happen in February. Until then, prices could remain at very high levels especially if it turns out to be a cold winter. This scenario also seems to be the market consensus at the moment.

Thus, high energy prices imply significant contributions to inflation prints until mid-22 when the contribution turns slightly negative. However, the size of the pass-through of energy prices to the HICP index is difficult to estimate not only due to different price formation dynamics in Euro-area countries but also due to a number of political initiatives that aim to decrease the upside pressure on consumer prices that many countries are now experiencing.

On top of the direct impact, higher production costs are likely to have a positive effect also on consumer prices. A recent survey by Dansk Industri reveals that about half of the respondent Danish companies have not hedged against increasing energy costs at all and about one-third of those said that they were raising end-prices to maintain margins at previous levels. We may extrapolate this onto Euro-area economies and expect that at least some of the unhedged costs are passed on to consumers.

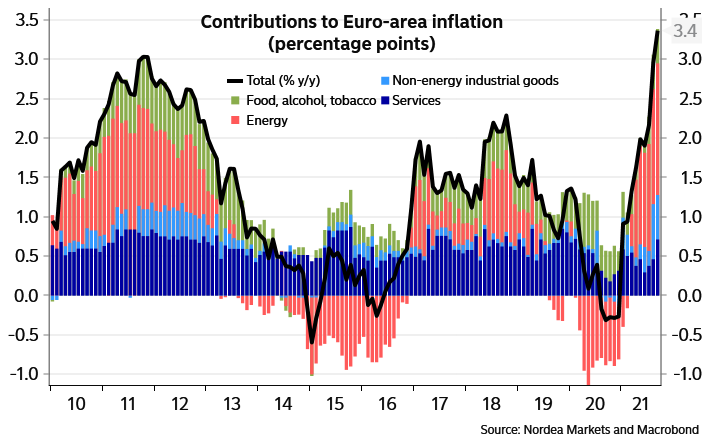

While changes in oil prices have traditionally had the largest impact among the energy components on Euro-area consumer price inflation, at the moment also the dramatic increases in prices of gas, coal and finally electricity boost HICP inflation significantly. In September, the energy component contributed 1.6 % points to Euro-area inflation and we expect this to rise further in October.

We expect the contribution of gas to the HICP index to turn negative in H2 2022

Energy contributed almost 50% of Euro-area inflation in September

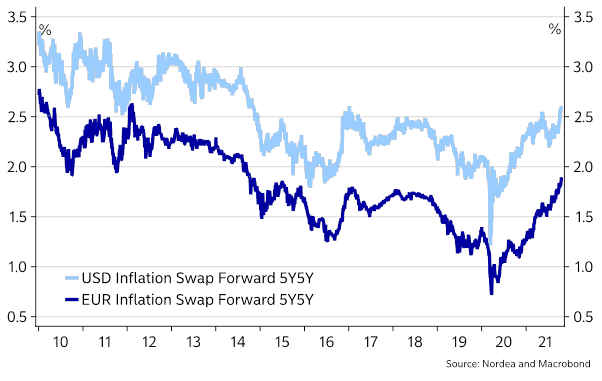

Inflation expectations are re-anchoring

The current transitory vs persistent debate around inflation is borderline imbecilic. There are obviously transitory as well as persistent elements to the current inflation as well as to the inflation outlook. On top of the high headline numbers, active fiscal policy in combination with the central banks’ change of strategy to re-anchor inflation expectations are two structural changes that may have helped lift inflation expectations substantially.

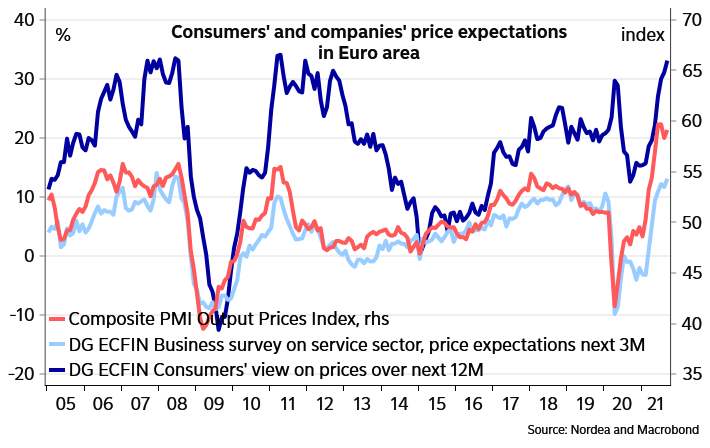

The higher inflation expectations, which are now prevailing in the financial markets but have also gathered pace among companies and consumers, have the potential to lift nominal wage growth and hence make inflation more likely to remain around the inflation target in a kind of “positive” second-round effect. Thus, we see the recent development in wider set of inflation expectations as one of the key topics when considering our new inflation forecast profile.

Market-based inflation expectations have increased close to the ECB target

Also companies and consumers expect higher prices in the coming months

We expect wage growth to accelerate from 2022 onwards

So far, broadly-based inflationary pressures have been limited in all other large Euro-area economies except Germany where we see wider signals of rising prices on top of what the base effect from the VAT reduction would suggest (here our latest note on Euro-area inflation). In other large economies, goods price inflation (excluding energy and food) has been dominated by international and temporary factors, and service inflation has been slow due to weak economic activity. The rise in service sector inflation in Italy and France were mainly due to either higher energy prices or the changes in weights in the consumer basket in the beginning of 2021 which caused some seasonal volatility in the price index (see the last chapter of this note).

Thus, it is probably Germany where we expect to see the possible-second round effects from currently higher inflation numbers materialising first. Robust economic recovery (excl. supply-related problems in manufacturing), tight labour market and the possibly loose fiscal policy by the next government are factors that could intensify the wage negotiations in the future. However, the most recent news from the on-going wage negotiations for public sector and construction workers and the already finalised round with train drivers do not indicate that the shift to higher wage increases would happen very quickly as annual wage increases in both cases hover at around 2.5%. News from Spain and France indicate slightly increasing cost pressures stemming from higher increases (2-3% in annual terms) in minimum wages but in otherwise cost pressure so far seems to be well under control.

The level of the Euro-area labour market tightness is obviously extremely difficult to estimate at the moment, especially given that the various compensation schemes have distorted the overall picture and resulted for example in a much smaller increase in the unemployment rate than in the US during the pandemic. We think that there is still free capacity available in most Euro-area countries’ labour market but if rapid recovery continues the lack of capable labour will become a more common phenomenon instead of being concentrated on certain sectors. One factor tightening the labour market probably is good economic development in the Central European EU countries which implies high wage increases in those economies and less incentives for their citizens to return to work in Western Europe after the pandemic. That phenomenon was present e.g. in Germany already during the years prior to pandemic.

Just like the ECB we also continue to monitor closely wage developments and possible second-round effects from the currently high inflation and rising inflation expectation in order to see possible signs of sustainably higher wage and price pressures in the Euro area. Although there is a lot of uncertainty partly due to very low core inflation numbers since the Euro crisis, we think that If economic recovery continues and the labour market continues to tighten, we might return to the Phillip’s curve, with wage growth gradually being passed through to consumer prices. This could imply higher wages from 2022 onwards and with one year delay permanently higher core inflation from 2023 onwards.