De høje huspriser i industrilandene begynder åbenbart at få effekt på valget af boliger. Svenskerne begynder tilsyneladende at flytte i mindre boliger. Det ses i en kraftig stigning i prisen på små lejligheder. De havde den største månedlige stigning i februar siden 2016, mens der var fald i prisen på store lejligheder. Nordea ser tegn på, at huspriserne generelt vil stige mindre i de kommende måneder. Det skyldes en stigning i leveomkostningerne samt forventning om en højere rente.

Swedish housing market: The resurrection of small apartments

Home prices saw another strong month in February, but signs are mounting that the housing market could be losing steam in the coming months. Small apartment prices had the strongest month in over 5 years.

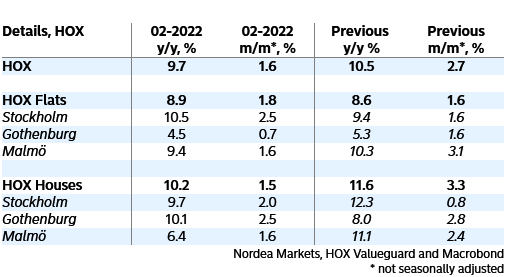

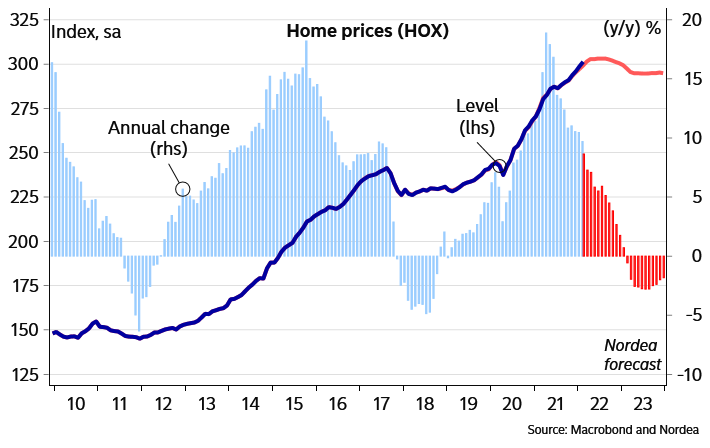

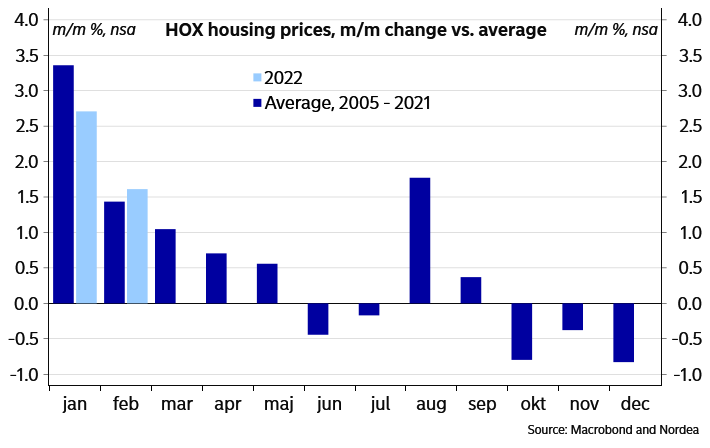

Swedish home prices increased by 9.7% y/y and 1.6% m/m%. The figure is slightly stronger than usual for the season and was also stronger than our forecast. Taking seasonal effects into account, prices were up by 0.8% on the month.

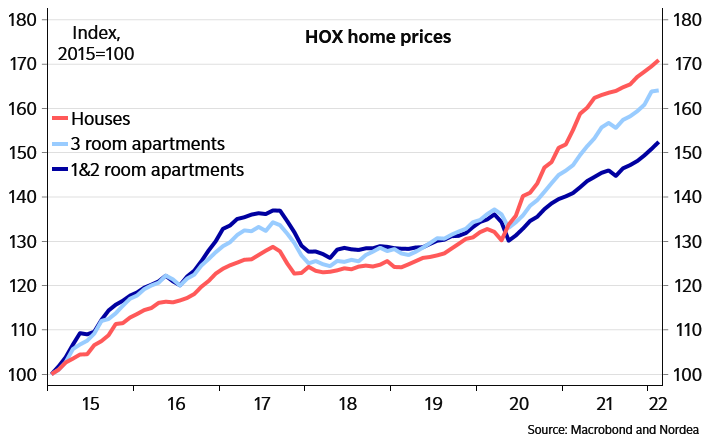

Apartment prices, which have lagged house prices during the pandemic price rally, have clearly taken over as the main driver of price growth this year. We might be seeing the start of normalizing housing preferences, as prices for smaller apartments stood out with the largest monthly gain since August 2016 (2.4%). Conversely, larger apartment prices slowed down in February (chart 3). As house prices continued to slow down in most cities, prices were up by a full 2.5 percent in Gothenburg.

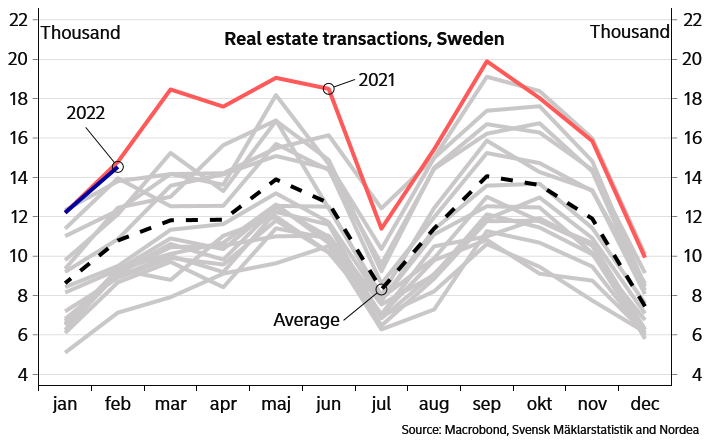

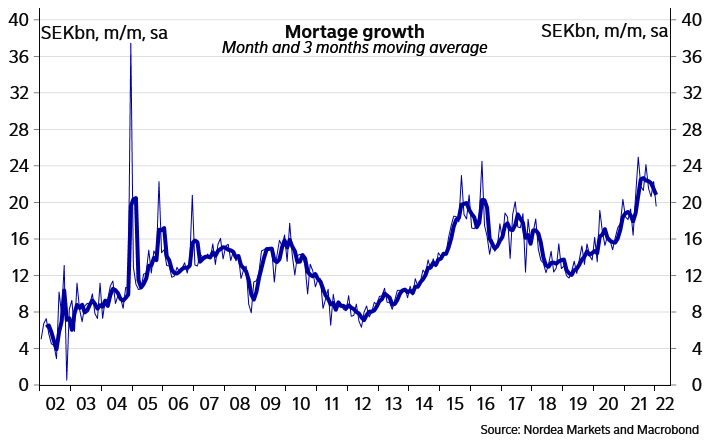

Transactions on both the housing- and apartment markets remain elevated and have started this year by tracking the record levels seen in 2021. However, mortgage growth has clearly reached its peak and has been edging lower since last fall, albeit at high levels (charts 4 & 5).

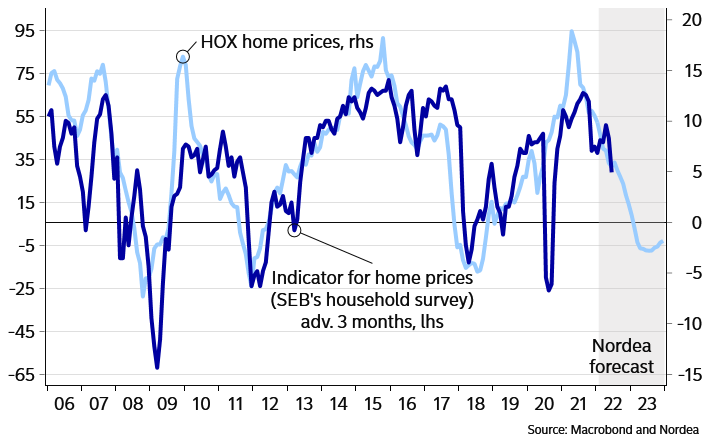

Despite the strong February figure, signs are mounting that the housing market might be losing steam. Home price expectations dropped markedly in March to the lowest level since July 2020, which signals a further moderation of price growth in the coming months (chart 6). It should be noted that the survey was conducted in the first week of February, i.e. before the invasion of Ukraine as well as surging electricity prices and last month’s inflation print. As living costs are on the rise and interest rate expectations continue to rise swiftly, risks of a more rapid slowdown on the housing market are clearly on the rise.

According to HOX Valueguard, price growth has slowed down in both Stockholm and Gothenburg in the first two weeks of March.