Huspriserne er faldet i Sverige i april i forhold til marts, og faldet ventes at tage til i maj, viser de første tal for prisudviklingen i maj. Nordea venter, at prisfaldet vil fortsætte og blive på 10 pct. indtil slutningen af 2023. Det er bl.a. en konsekvens af rentestigningen. Den svenske Riksbank sætter renterne aggressivt i vejret, vurderer Nordea. Den svenske udvikling indikerer en udvikling, vi så småt ser i andre lande.

Swedish housing market April: The peak is behind us

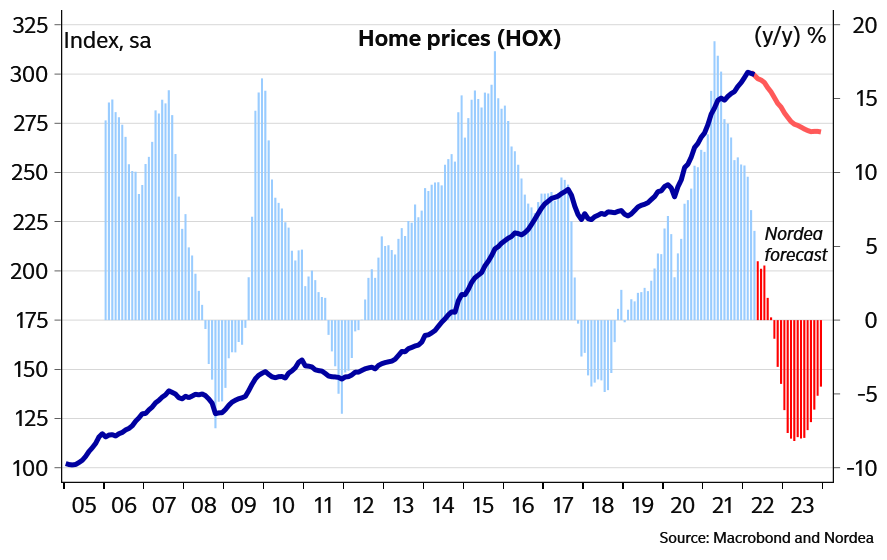

Home prices in Sweden declined in April, supporting our view that the market has peaked and that prices are expected to fall further from here.

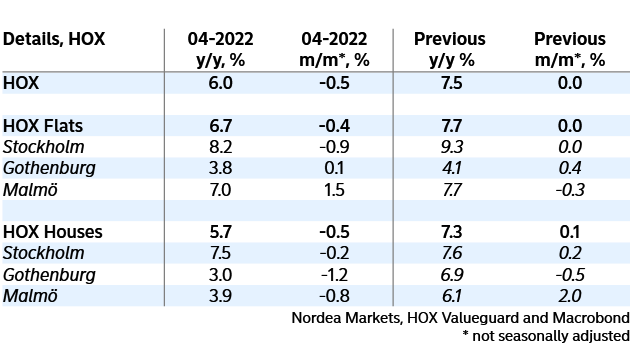

Swedish home prices fell by 0.5% m/m and rose 6.0% y/y in April, in line with our forecast. The decline was broad-based, with apartment and house prices falling by 0.4% and 0.5% on the month respectively. While house prices were down in all of the three largest cities, the decline in apartment prices was mainly due to a decline in Stockholm by 0.9%. Conversely, flat prices were up by a full 1.5% in Malmö. Amongst medium sized cities, both house and apartment prices were down 0.3% on the month.

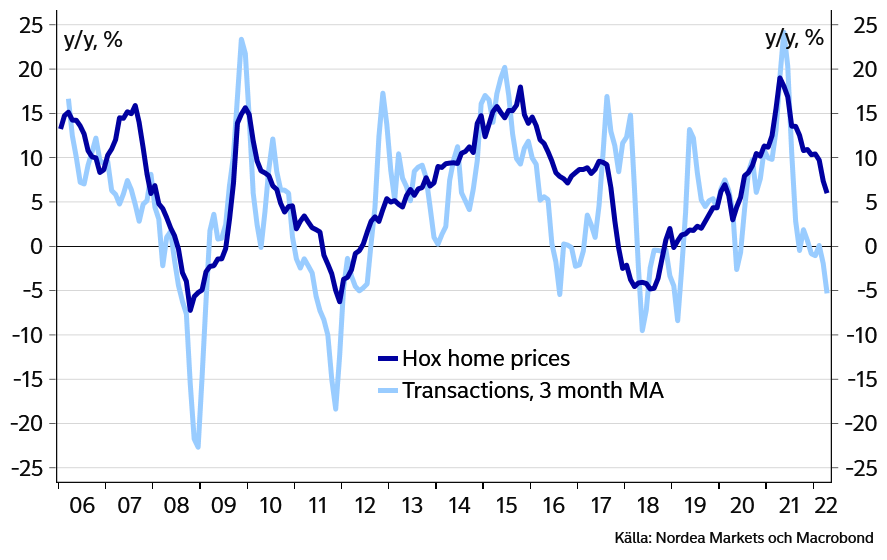

Darker clouds are gathering on the housing market horizon. Transaction volumes are declining quickly and suggest negative price growth ahead (see chart below). Preliminary data points toward prices declining sharply in May. According to HOX Valueguard, apartment prices fell by 1.7% in Stockholm and 1.3% in Gothenburg in the first two weeks of May.

We recently changed our call on the Riksbank and have consequentially revised down our housing market forecast. Interest rates are rising quickly and we now expect the Riksbank to hike the repo rate to 1.5% by year-end. The Riksbank has already hiked by 25bps and interest rate expectations are on the rise. We therefore expect home prices to have peaked. Swedish households are sensitive to higher interest rates and with aggressive Riksbank tightening in the cards, we expect home prices to fall by 10% by the end of 2023.

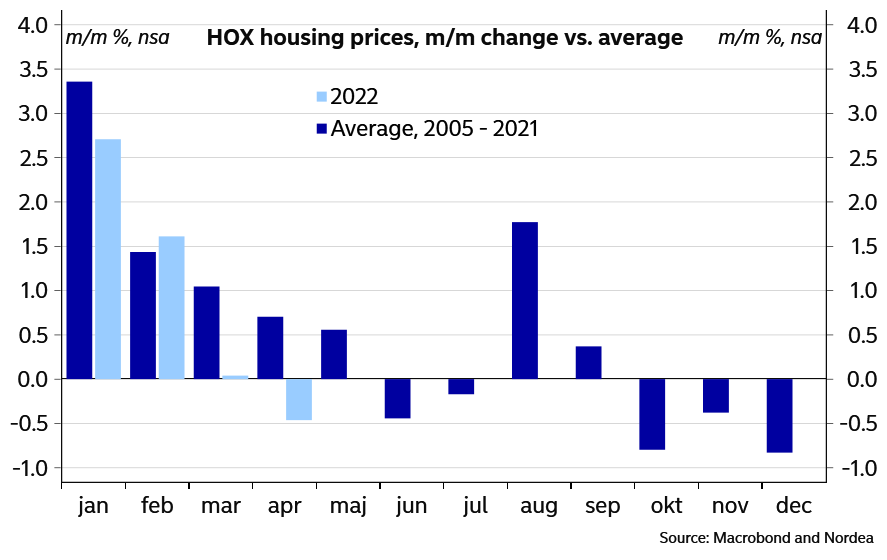

Home prices declined by 0.2% m/m when taking seasonal effects into account. However, the seasonal component for April has been distorted due to last years’ large price swings and adjusted numbers should be interpreted with caution.