De svenske boligpriser faldt i maj med 1,6 pct. Det var på linje med de fleste forventninger. Men Nordea vurderer, at priserne vil falde kraftigt i de kommende måneder. Inden for det seneste år er boligomsætningen faldet med 20 pct. Faldet er dobbelt så stort i storbyerne som i landsgennemsnittet.

Swedish housing market May: Plummeting

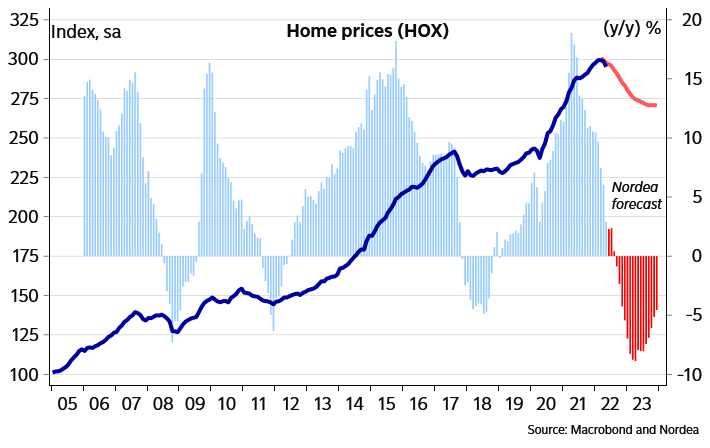

Home prices declined in May by 1.6% m/m. Interest rates are increasing rapidly and households are losing confidence. We expect a continued sharp decline in the coming months and see downside risks to our forecast.

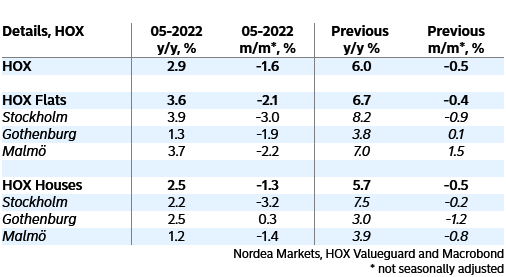

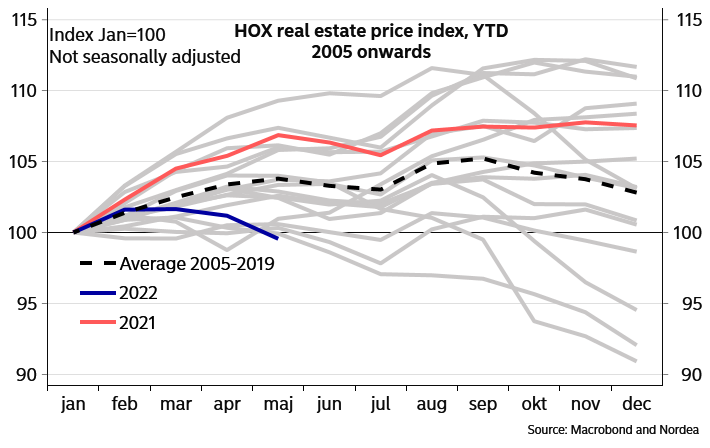

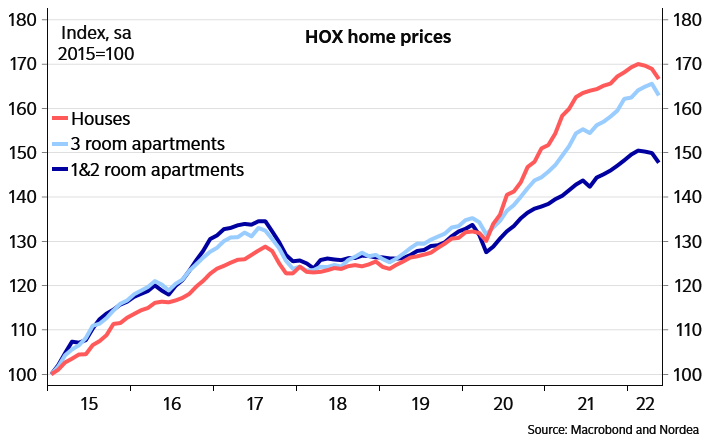

Swedish home prices fell by 1.6% m/m in May (-1.2% seasonally adjusted). The decline was in line with most indicators on the housing market and indicates downside risks to our forecast in the coming months.

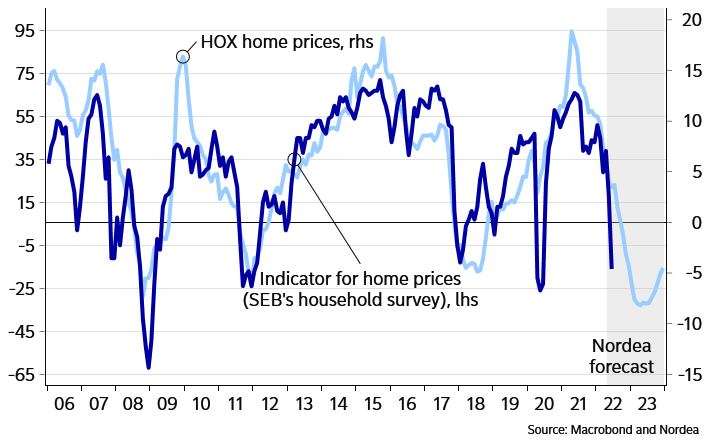

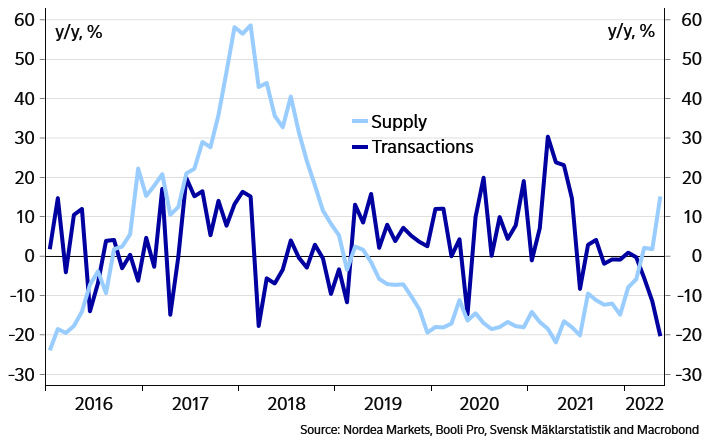

The housing market is showing clear signs of stress. Total transactions decreased by 20% y/y, whilst supply instead was up 20% y/y in May. Furthermore, interest rates have increased faster than most had anticipated and households’ price expectations are plummeting.

The decline is especially pronounced in Stockholm as both apartment and house prices were down by around 3.0% on the month. The decline was broad based over the country, even if house prices in Gothenburg stood out with a small uptick. Preliminary data points toward a worsening market development this month. According to HOX Valueguard, apartment prices fell by 3.3% in Stockholm and 3.9% in Gothenburg in the first two weeks of June.

Today’s report confirms that the dramatic increase in interest rates is causing stress on the housing market. We expect a volatile second half of this year as households continue to adjust to the new interest rate environment. Prices have declined faster than we expected and we see downside risks to our forecast of home prices declining by 10% by the end of 2023.

We expect the Riksbank to hike the repo rate to 1.75% by year-end. Read more here.