Nordea stiller nogle interessante spørgsmål i en analyse af svingede energiproduktion og kraftigt stigende energipriser, når vi bliver afhængige af grøn energi. Er der en back-up, når vinden svigter? F.eks. med atomkraftværker? Hvordan skal stigende priser håndteres på den baggrund – af regeringer og centralbanker? Det er der overhovedet intet svar på – måske kun fra Kina, der fortsat satser på atomkraft. Og så kommer Nordea med et utraditionelt forslag, når det drejer sig om at stimulere økonomien. I stedet for QE, som centralbankerne har brugt de seneste årtier ved at pumpe penge i omløb, især via finanssektoren, så skulle centralbankerne måske lave et folkets QE-program, så de pumper penge direkte til hver eneste forbruger under en krise? Det kan de gøre, når de indfører en digital valuta, hvor alle får en konto i centralbankerne. Det er en idé, som Nordea vil forfølge i den kommende tid.

Green New Deal Stagflation

A big part of the current inflationary spike is driven by political decisions that may prove stagflationary in nature as they don’t improve growth prospects, while they increase cost pressures.

Green New Deal is stagflationary in its nature. Germany is the culprit and they could Scholz things up!

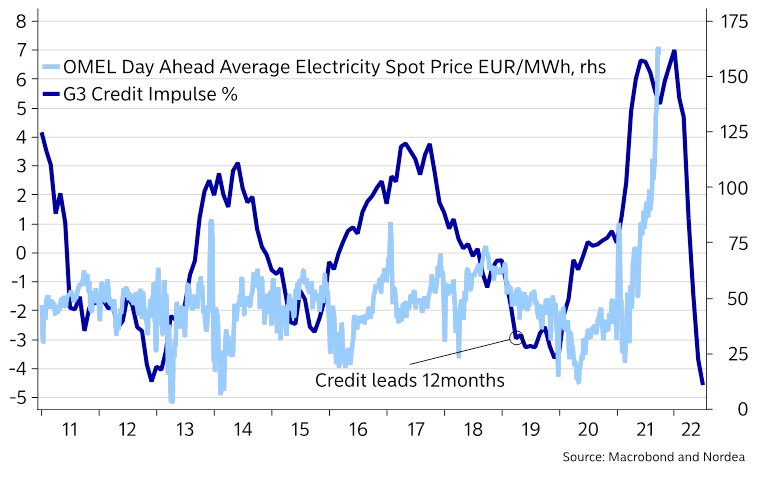

Meanwhile electricity prices continue to surge due to i) a benign summer with low winds, ii) rising natural gas prices and maybe most importantly iii) the removal of well-functioning nuclear capacity in countries such as Sweden and Germany.

This is a friendly reminder of the necessity of a double-infrastructure, the more weather-dependent the electricity production becomes. Nuclear capacity is behind roughly 10% of world electricity production, while wind-and solar energy sources are behind around 8%.

Replacing nuclear plants with solar/wind energy delivers zero bang for the buck carbon-wise but increases the need for a double-infrastructure, which is why natural gas prices are on the rise. This is a stagflationary policy in nature. Meanwhile China tests the first thorium-fuelled nuclear reactor – a striking difference.

It will be tricky to implement the Green New Deal without causing social unrest, and the recent political signals from Italy and Spain also hint that it will become politically opportune to “shield consumers” against rising electricity prices.

Germany on the other hand looks set to “Scholz things up” further on the Green New Deal should opinions polls prove right for the election.

Chart 7. Electricity prices are usually uncorrelated to the credit/economic cycle. The recent surge is politically driven

The worst case is that the ECB and BoE react to the current supply driven price increases with a tighter policy. Christine Lagarde has so far rejected that the ECB can influence energy prices (she is right), while the BoE sounds more and more hawkish in response to bizarre supply side effects on wages and prices in the UK.

What can central banks do, if supply side driven inflation continues to surpass the nominal wage growth (that is more linked to demand driven inflation)? The answer is very little within the current toolbox.

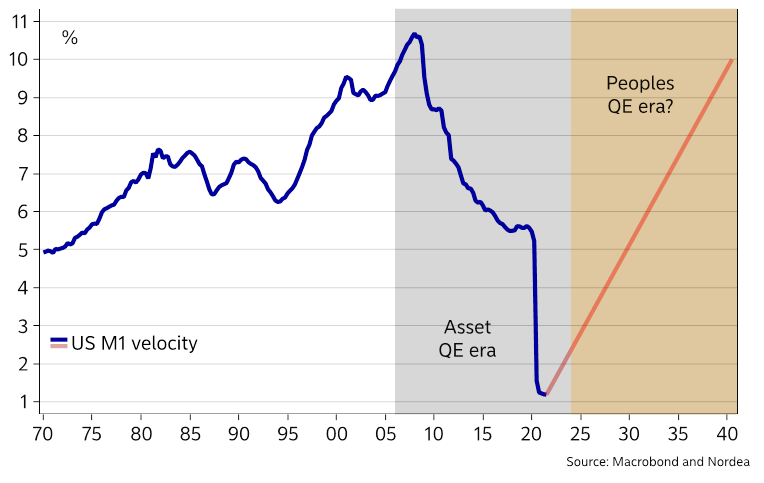

The medium-to-long-term answer could be for central banks to exploit the possibility of doing true People’s QE rather than asset-swap QE. Asset-swap QE is almost per definition structurally disinflationary as it leads to a slowing velocity of the money base. The ultimate receiver of the (non-reserve currency) deposit in asset-swap QE is a financial counterpart of banks with access to the central bank. A pension fund deposit is almost per definition a “zero velocity” deposit.

This could change with a true People’s QE program. When CBDCs are ultimately launched, it will also deliver the infrastructure needed for central banks to perpetually “lend out” digital fiat-reserves to each and every holder of a digital wallet at the central bank every month (read, everyone). It sounds far-fetched yes, but when you allow a central bank a new weapon in the armoury, they tend to utilize it!

We will exploit these differences in depth in a thematic next week. Stay tuned!