Inflationen i Danmark bevæger sig op på et permanent højere niveau, skriver Nordea, der venter en inflation i år og næste år på 1,5 pct. Det er markant over niveauet siden 2013. Det er især fødevarer, brugte biler samt boligomkostninger, der driver inflationen i vejret.

A higher plateau for Danish inflation

In July Danish inflation was at 1.6% y/y. This was the third consecutive month with markedly higher inflation. In our view, the recent increase reflects a more permanent upward shift in Danish inflation.

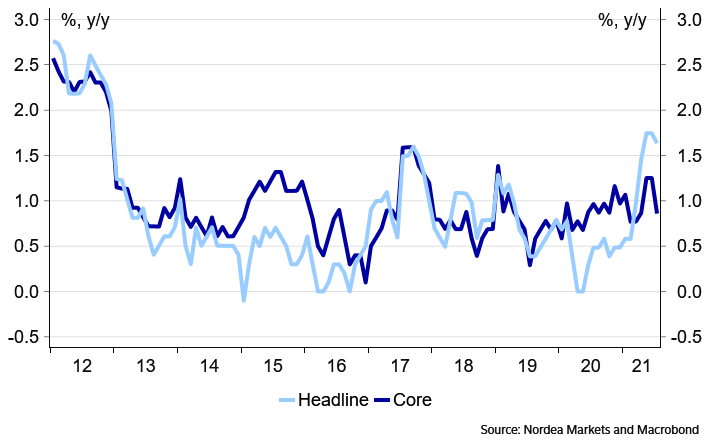

Measured year-over-year the Danish headline CPI increased by 1.6% in July. This was slightly lower compared to both May and June when annual inflation was at 1.7% – the highest since 2012. Core inflation, excluding energy and non-processed food, was at 0.9% in July, down from 1.3% in the previous month.

Chart 1: Headline and core inflation

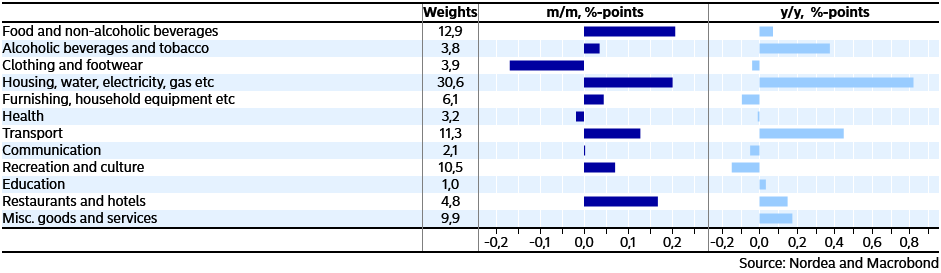

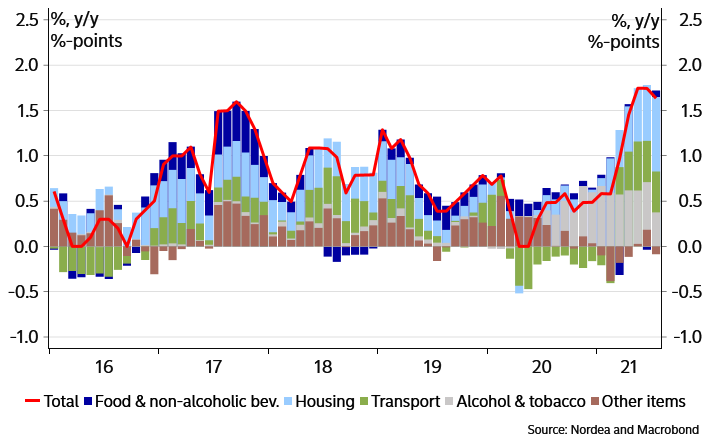

In July the annual change in the consumer price index was mainly lifted by the effects of higher rents for housing in combination with higher prices of electricity. This caused housing to make a significant positive contribution to the annual inflation numbers in July of a total of +0.80% point. In addition, the significant increase in oil prices caused transport to add 0.40% point to the annual change.

On the other hand, the base effects from last year’s large tax increase on tobacco started to fade away in July with a contribution of 0.36% point compared to 0.48% point in June. The effect of the tax increase will most likely disappear completely around October but will reappear from the beginning of 2022 when new increases in taxes on tobacco will be implemented.

It should also be noted that prices of package holidays made a negative contribution of 0.28% point. According to Statistics Denmark this negative effect can to a large extent be explained by the fact that the weight of package holidays in the consumer price index has been reduced markedly in 2021 due to Covid-19.

Table 1: Contribution to headline inflation in July, m/m and y/y

Chart 2: Housing, Transport and Tobacco are pushing headline inflation higher

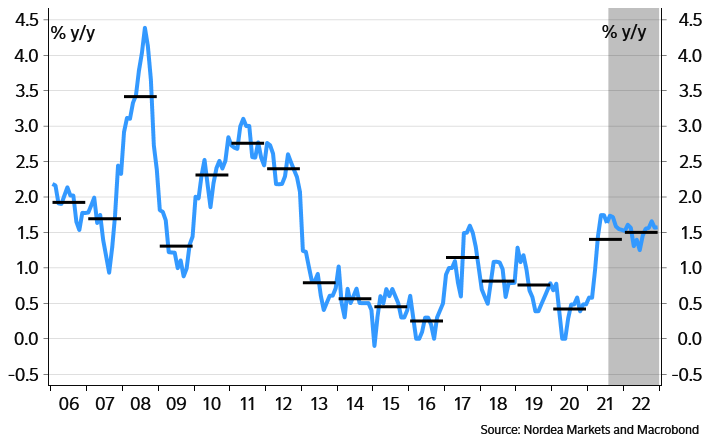

Higher inflation is here to stay

Looking forward, we expect Danish inflation to stay at elevated levels during the rest of the year. This is expected even though base effects from last year’s large tax increase on tobacco will gradually fade away in the second half of the year.

Instead, this is expected to be replaced by higher prices of especially food. Global food prices have increased sharply over the past year. Historically this has been a very good leading indicator for the development in Danish food prices, which together with non-alcoholic beverages account for almost 13% of the consumer price index. Due to this we expect higher food prices to contribute around 0.5% point later this year.

Also higher prices of used cars are expected to make a significant contribution to higher annual inflation numbers in coming months. According to statistics from Bilbasen.dk, average prices of used cars have increased by 12% over the past year. For some reason this price increase is still not included in the official price index for used cars from Statistics Denmark.

Lastly, we expect Housing to continue to make a significant contribution. Until February 2022 rents for housing will contribute 0.29% point to the annual inflation numbers. We expect this to increase in coming years both due to mortgage rates and a higher increase in the net price index, which is used for adjustments in rents in parts of the private market for housing rents.

In total we expect an average inflation rate in both 2021 and 2022 of close to 1.5%. In a long-term perspective this is still a relatively low level but compared to the period from 2013 to 2020 it marks a higher plateau for Danish inflation.

Chart 3: Nordea forecast for headline inflation