For første gang siden 2018 blev inflationen i Europa på 2 pct. – i maj. Nordea mener, den vil falde en smule de kommende måneder, men så vil den stige senere på året til over 2 pct. Kerneinflationen i de store lande er dog mindre. Derimod er der stigninger i servicesektoren i Tyskland. Nordea tror ikke, at ECB ændrer sit opkøbsprogram foreløbig.

Euro-area Inflation Flash: Transitory… for now

Inflation hit 2.0% in May for the first time since 2018 and will most likely be even higher towards the end of the year. ECB staff inflation projections are unlikely to change much and “transitory” is likely to remain the ECB’s narrative for now.

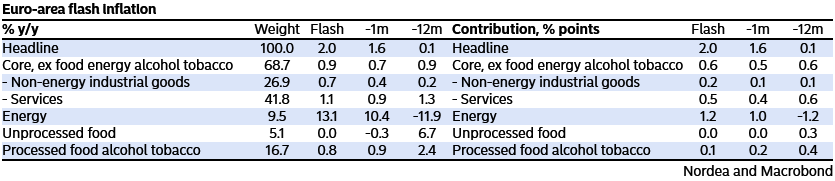

Euro-area flash inflation hit 2.0% y/y in May – due largely to base effects from the low energy prices a year ago.

Core inflation, which excludes prices of food, energy, alcohol and tobacco, increased to 0.9% y/y in May from 0.7% y/y in April due to modest increases in both core goods prices and services prices.

Chart 1. May flash HICP inflation

This inflation print – although high – is unlikely to change the staff inflation projections that will be discussed at next week’s ECB meeting and is unlikely to change the ECB’s “transitory”-narrative. Core inflation remains stubbornly low.

May is likely to be the peak for now. The next couple of months are likely to be lower before somewhat higher numbers are likely towards the end of the year due mainly to base effects from last year’s temporary German VAT cut.

Given the amount of dovish ECB talk that has hit the wires during the recent two weeks, next week’s meeting seems too early for tapering discussions and too early to reduce the pace of PEPP purchases more than what market conditions warrant.

Wider price pressures remain moderate in all big countries

The flash inflation data provides only a very limited amount of detailed information on each country’s price developments but it points to a direction that the core inflation seems to be sluggish in most Euro-area countries and energy was driving the increases in headline inflation in all countries.

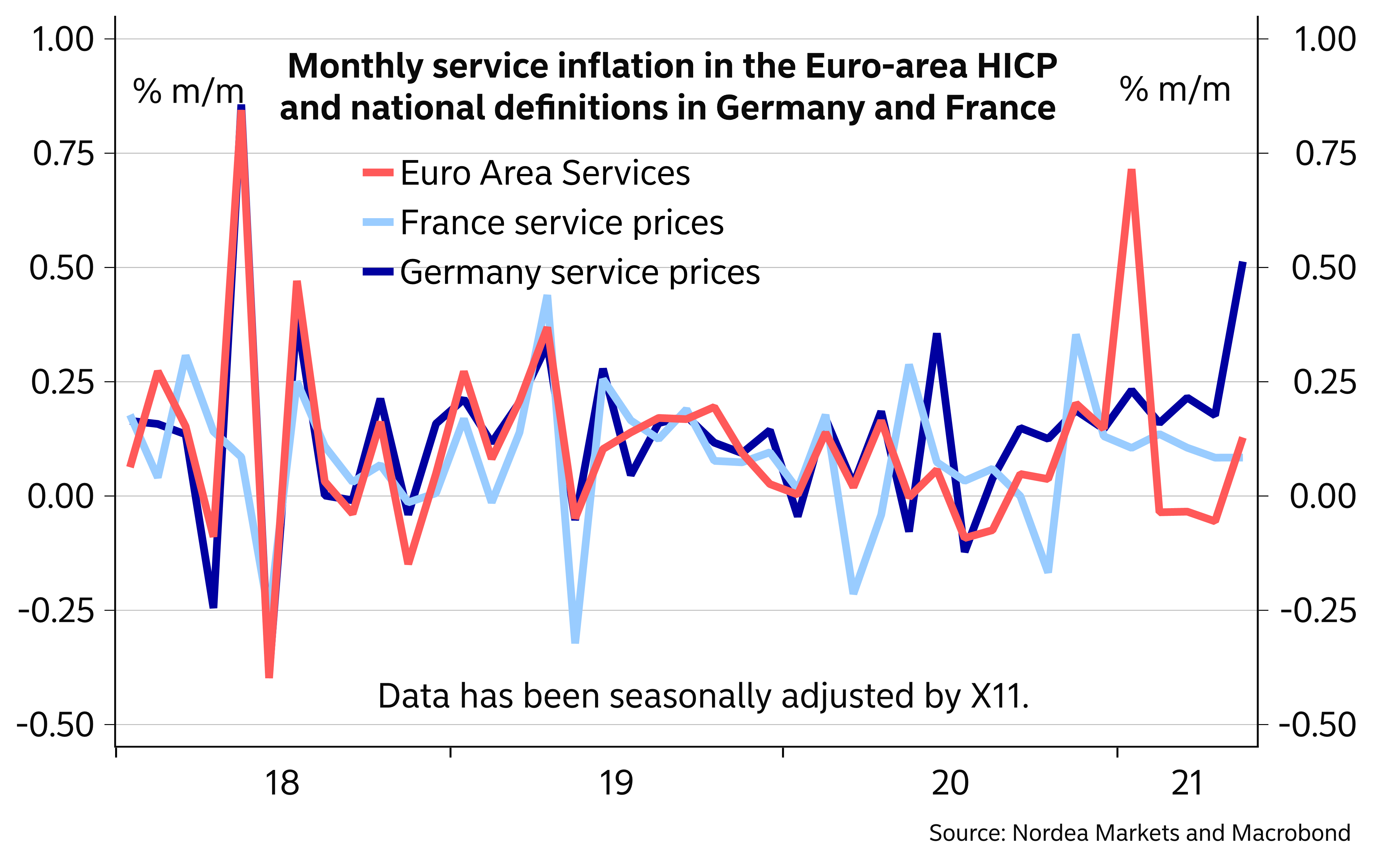

Out of the big economies, the HICP core inflation slowed down to 0.1% in Italy and in France, available information both on services and manufactured products showed very modest inflation in monthly terms and core inflation very likely kept hovering at around 1%.

The only signs of higher core inflation came from Germany where service price inflation (based on the national data) accelerated from 1.6% to 2.2%.

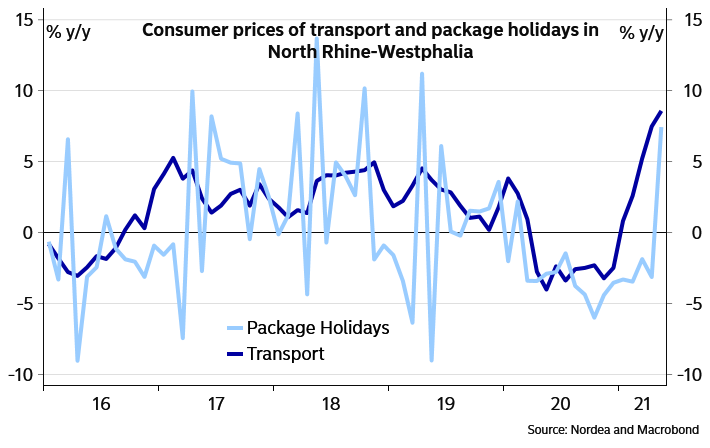

Based on the regional data, it seems that the rise was mainly due to higher inflation in transport and package holidays which both are typically volatile and especially the transport prices were probably at least partly driven by the higher fuel prices. Otherwise, the regional data showed very gradual price developments among services in Germany.