Nordea analyserer inflationstendenserne og debatten om, hvorvidt en højere inflation er vedvarende eller midlertidig. Udviklingen peger i retning af en permanent højere inflation, men der kan også blive store udsving i de kommende år, når energiproduktionen bliver mere svingende med mere grøn energi. Der bliver klare vindere og tabere, og det vil også ses i valutakurserne. Hvis der kommer stagflation, som mange økonomer forventer, og hvis industriproduktionen falder i det nye år, så skal investorerne spænde sikkerhedsselen, lyder advarslen fra Nordea.

Nordea weekly: Is permanent inflation now an alarming consensus?

The transitory vs. permanent inflation debate seems to have come to an end with almost everyone throwing in the transitory towel, but could that be the timing to start debating inflation again? “Permanent” inflation also means volatile inflation.

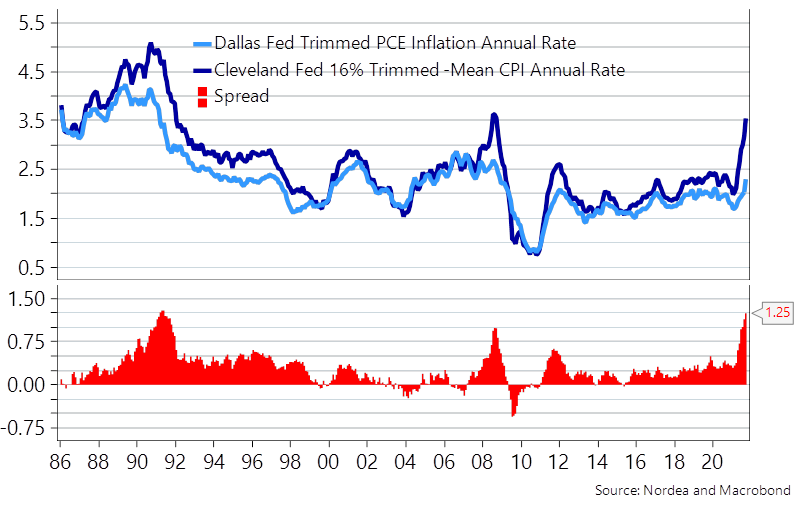

The transitory vs. permanent inflation debate seems to be over as almost all consensus economists except for Christine Lagarde have started to warn against the current inflation pressure. The dark horse in the Fed chairman race, Raphael Bostic, even labelled transitory as a “dirty word” during the week. The sharp rise in the trimmed CPI measures was probably the final nail in the coffin for the transitionistas, even if we find reasons to start doubting the inflation outlook for H2-2022 exactly because of the sharp rise in these trimmed inflation measures.

If average inflation levels have structurally shifted upwards, it likely also means that inflation volatility has shifted markedly upwards. We by the way prefer the word structurally to permanently in this inflation debate, since promising a “permanent” shift is quiet the time-horizon to forecast.

The recent energy price surge is a reminder of how the Green New Deal will continuously add to inflation volatility in the coming years. The more weather dependent an electricity production, the larger the natural volatility in the price. We just as well want to remind you that we can get years of almost “free electricity” (before taxes) in parts of Northern Europe if the windfarms suddenly deliver 2-2.5 std-devs above the expected outcome in sharp contrast to this year.

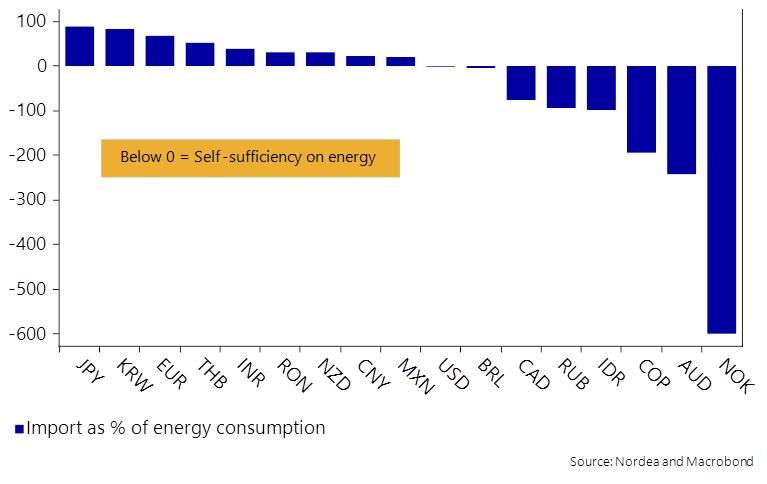

Chart 1. Winners and losers of the energy crisis (the further the right in the chart the better)

We generally find that volatility in GDP and inflation has re-increased with large intra-regional differences. Countries such as Japan, Korea, Germany (Euro zone), Thailand and India will suffer GDP-wise due to high energy prices in to 2022, while inflation will increase. In these regions, we find stagflation-fears warranted. Other countries such as Norway and Australia will rather see a strong GDP growth paired with relatively weak inflation in to 2022 due to a large net export of energy.

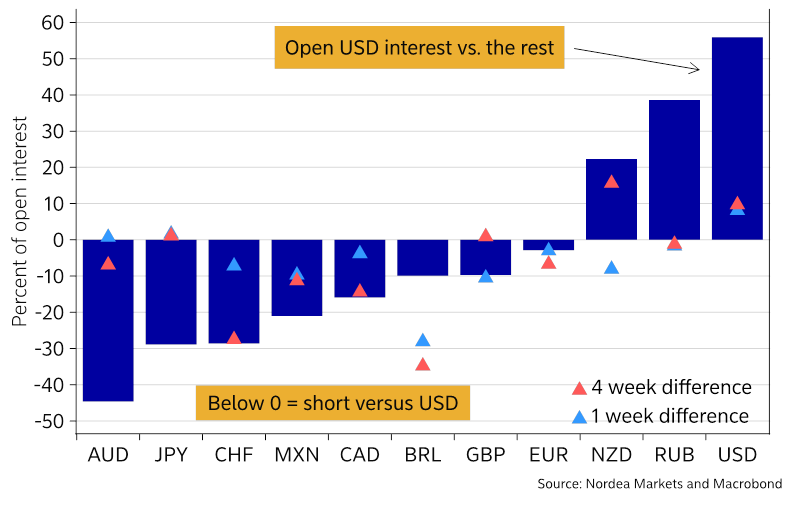

Energy-linked trades have turned popular in recent weeks, and we find that both RUB and NOK positioning is fairly stretched already, while the AUD interestingly remains very “hated” by market participants. This leaves short EUR/AUD (or long AUD/NZD) as an interesting trade still as we are yet to see the full energy-repercussions on German growth. We also remain confident that short CNH/RUB positions will continue to perform as China is also a clear net-importer of energy, while the market is yet to realize that it will have material negative implications for 2022 growth in China.

We generally find that it makes sense to turbo-frontload inflation and rates expectations even more, as 1) wage growth is about to spiral up, 2) China needs to buy (a lot) more natural gas to deliver on air pollution promises ahead of the Winter Olympics in Feb-22 and 3) Energy-inventories look scarily low across the board (maybe except for the US).

Chart 2. Positioning is still super short in AUD, while RUB and NOK have turned popular

Both median- and trimmed CPI measures increased markedly in September, which was construed as the final nail in the coffin for the transitionistas. We concur with such a take-away for the next 2-3 quarters, but we also want to remind you that a sharp rise in trimmed CPI measures is usually a signal of a late-cycle development in inflation. The spread between trimmed CPI and trimmed PCE measures has turned all-time-wide, which is usually something we see 1-3 quarters ahead of the actual peak in inflation.

CPI-weights are updated substantially less frequently than PCE-weights, why the CPI may underestimate the behavioural effects from rising prices currently. Will consumers substitute certain goods in the basket after a rapid price increase or maybe just outright decrease spending? If the latter is the real reason why CPI-PCE spreads have widened materially, then it may be a really bad signal for growth in 2022.

Chart 3. Spreads between CPI and PCE prices have widened to historical highs. A bad sign?

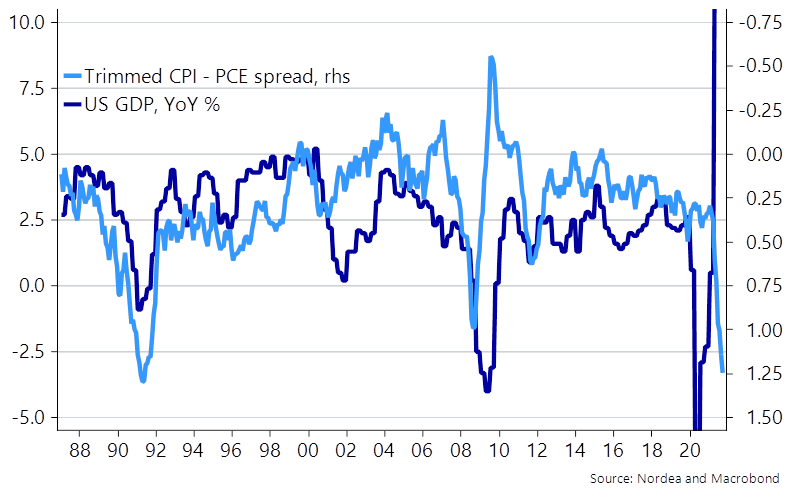

In any case, we remain on watch for 2022 growth since continued high inflation paired with weakening trends in forward-looking indicators is obviously something to worry about. When spreads between trimmed CPI and PCE prices are as elevated as currently, then we have usually been in the middle of a recession already. We most likely aren’t, but there is a clear risk that consumers and manufacturing companies will start behaving differently due to the recent surge in (energy) prices.

Chart 4. With spreads as wide as now between CPI and PCE prices, we have usually been in a recession

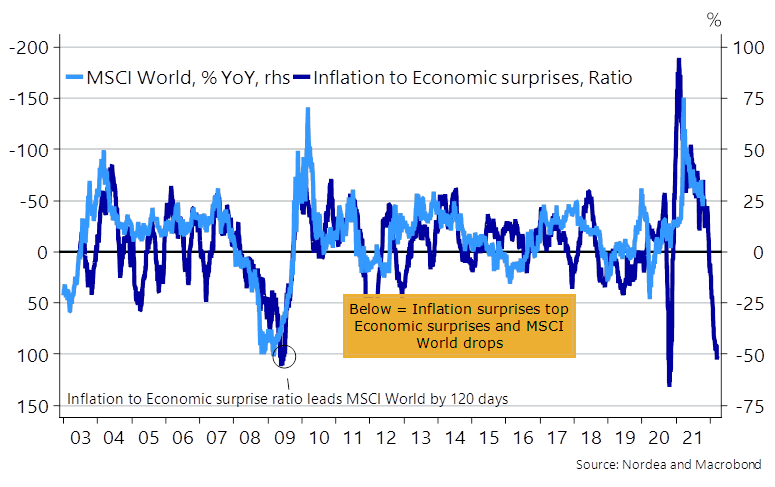

In any case, it can’t be construed as good news that inflation keeps surprising on the upside, while growth prospects keep surprising on the downside. We have basically never seen a material correction in equities with the current amount of monthly support from central bank QE, but if the Fed, BoE and maybe partly the ECB are convinced to take the foot of the pedal due to inflation, then it may be another discussion already during H1-2022.

A Santa Rally in equities is likely (due to oversold conditions and continued QE), but 2022 prospects are muddy as the current strike price of the central bank put is not necessarily going to survive an inflationary regime-shift.

Chart 5. If stagflation fears are as warranted as economic surprise indices hint, then buckle up in 2022

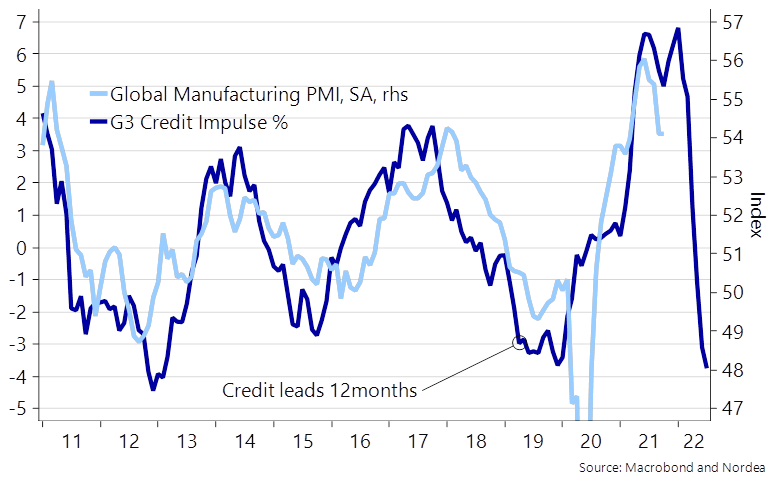

Input prices have been materially on the rise, which will add to an already bleak picture for the cyclical parts of the economy in to 2022. Global manufacturing looks set to slow, if the usual lead/lag patterns related to the global credit impulse hold true again and we are yet to receive new potentially worse credit numbers post the recent energy price squeeze. Anti-cyclical bets (such as being long USD) will become the name of the game in late Q4 and early Q1, if we are right (Global: How to position for a weaker credit impulse?).

Chart 6. A clear manufacturing slowdown in 2022 on the cards?

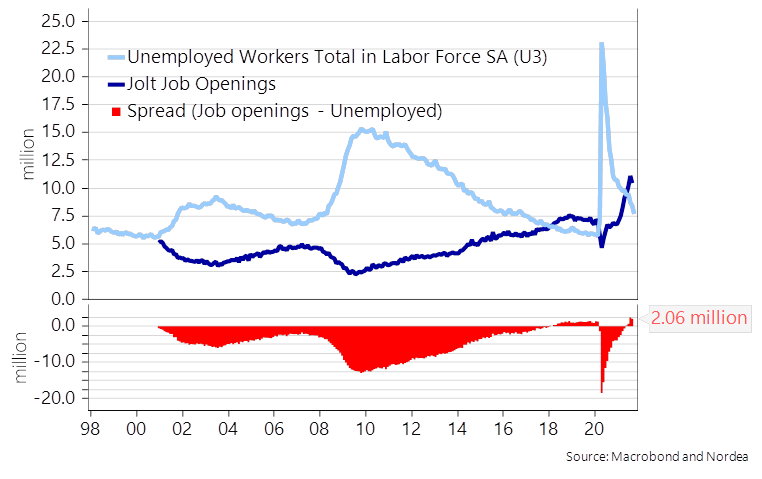

Does this mean that global stagflation fears are warranted? We find (at least) one missing piece in the stagflation puzzle – namely labour markets. All indicators still look sound and job openings are extremely plentiful compared to the number of unemployed. The latter is driven by a combination of a strong comeback for demand paired with a continued surprisingly weak labour market supply.

Boomers who have enjoyed the asset-QE ride, will likely never return to the labour-force or else at least insist to work only from the cottage house in Toscana. Vaccine mandates have likely also limited labour market supply to a surprisingly large extent (The mandates surely cannot increase labour market supply at least). These developments speak in favour of a tight labour market development over the coming quarters. This doesn’t sound overly stagflationary to us, but consumers simply need a substantial pay rise by now to keep confidence elevated as the purchasing power will be otherwise be eradicated too swiftly.

Chart 7. More jobs than unemployed in the US still

The economic repercussions of the energy crisis will be larger in Europe than in the US, and interestingly coalition-talks in Germany are held on the back of the scaringly low natural gas inventories. A coalition with the SPD and the Greens is more likely to increase Germanys already extreme foreign energy-dependency in years of weak wind pressures as further 4-5 GW of nuclear capacity will be closed shortly. Meanwhile, the UK is allegedly going to put nuclear capacity at the heart of their zero-emission strategy. In any case, we expect green assets to see a resurgence ahead of the COP-26 in Glasgow in a few weeks’ time.